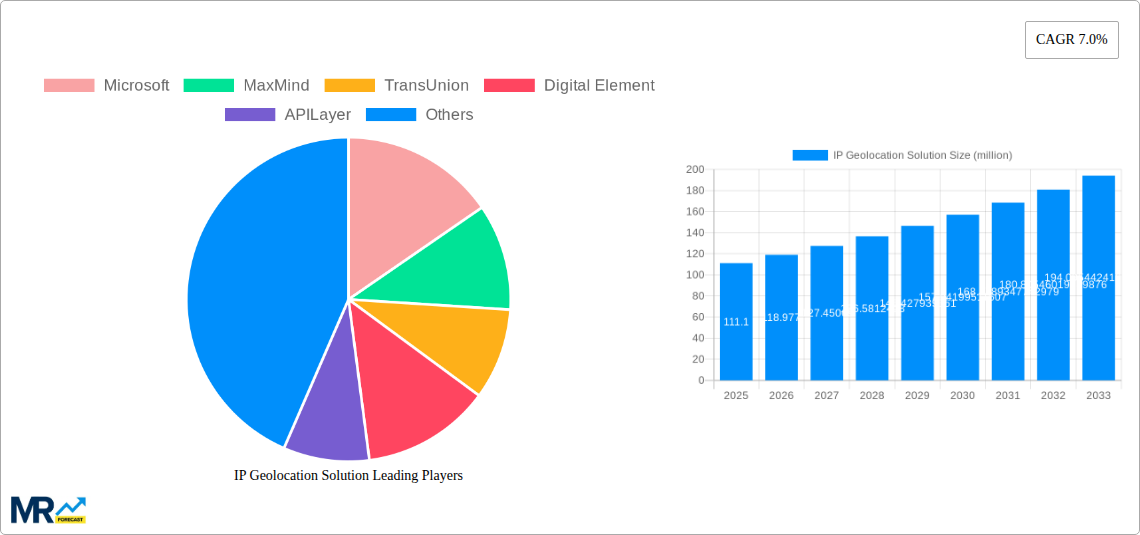

1. What is the projected Compound Annual Growth Rate (CAGR) of the IP Geolocation Solution?

The projected CAGR is approximately 7.0%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

IP Geolocation Solution

IP Geolocation SolutionIP Geolocation Solution by Type (Location Management, Security, Traffic Analysis), by Application (Financial Use, Electronic Business Use, Internet and Media Use, Social and Gaming Use, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global IP Geolocation Solution market is poised for substantial growth, projected to reach an estimated USD 111.1 million in 2025. This expansion is fueled by a healthy Compound Annual Growth Rate (CAGR) of 7.0%, indicating a consistent upward trajectory throughout the forecast period of 2025-2033. The increasing reliance on precise location data across various industries serves as a primary driver. Businesses are leveraging IP geolocation for enhanced cybersecurity measures, enabling them to detect and mitigate fraudulent activities and unauthorized access by pinpointing the geographical origin of IP addresses. Furthermore, the demand for personalized user experiences, targeted marketing campaigns, and optimized content delivery is significantly boosting the adoption of these solutions. The ability to understand user locations allows for tailored website content, localized advertising, and improved customer service, all contributing to higher engagement and conversion rates.

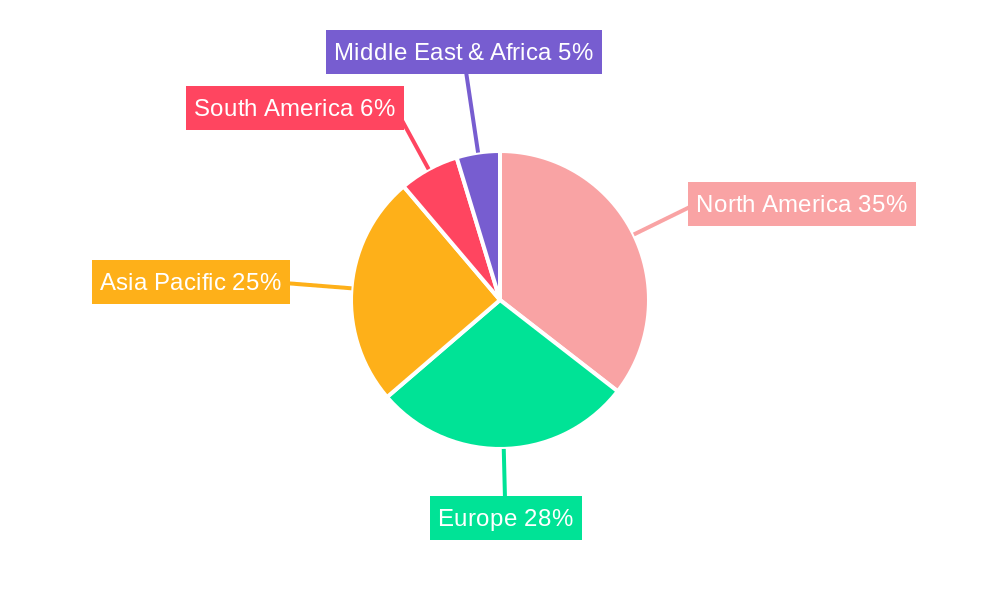

The market is segmented across key functionalities, with Location Management, Security, and Traffic Analysis emerging as crucial areas. In terms of application, the Financial Use, Electronic Business Use, and Internet and Media Use sectors are expected to be the dominant contributors to market revenue. The growing volume of online transactions, e-commerce activities, and digital content consumption necessitates robust IP geolocation capabilities to ensure security and compliance. Geographically, North America and Asia Pacific are anticipated to lead the market due to their advanced technological infrastructure and high adoption rates of digital services. However, Europe also represents a significant market, driven by stringent data privacy regulations that encourage the use of accurate geolocation for compliance purposes. Emerging economies within these regions are also presenting lucrative opportunities for market players.

This comprehensive report delves into the dynamic landscape of IP Geolocation Solutions, forecasting its trajectory from 2019 to 2033, with a specific focus on the base year of 2025. The market, valued in the millions, is poised for substantial growth driven by an increasing demand for precise location data across various industries. This analysis will dissect the underlying trends, propelling forces, challenges, and pivotal players shaping this vital sector. With a deep dive into key regions and segments, coupled with a thorough examination of recent developments, this report offers an unparalleled perspective for stakeholders seeking to navigate and capitalize on the evolving IP Geolocation Solutions market.

XXX The IP Geolocation Solution market is experiencing a significant surge, projected to witness robust expansion over the study period of 2019-2033. The base year of 2025 alone is anticipated to see market valuations reaching several tens of millions, a testament to the escalating integration of location-aware technologies across global business operations. The market's growth is intrinsically linked to the ever-increasing volume of internet traffic and the proliferation of connected devices, creating an insatiable demand for accurate and granular IP address intelligence. Key trends include the evolution from basic country-level geolocation to highly precise city, postal code, and even latitude/longitude data, enabling more refined targeting and personalized user experiences. Furthermore, the burgeoning cybersecurity landscape is driving significant adoption, as organizations leverage IP geolocation for threat detection, fraud prevention, and compliance with regional data regulations. The rise of edge computing and the Internet of Things (IoT) further amplifies the need for real-time location insights, pushing the boundaries of traditional geolocation capabilities. The market is also witnessing a shift towards cloud-based solutions, offering scalability, accessibility, and cost-effectiveness for businesses of all sizes. The integration of machine learning and AI is enhancing the accuracy and predictive capabilities of these solutions, allowing for more sophisticated use cases in areas such as ad targeting optimization and customer segmentation. The increasing complexity of internet infrastructure and the dynamic nature of IP address assignments necessitate continuous innovation and sophisticated data acquisition techniques. Over the forecast period of 2025-2033, we anticipate sustained double-digit growth, driven by these intertwined technological advancements and the ever-expanding digital economy. The historical period of 2019-2024 laid the foundation for this growth, characterized by early adoption in e-commerce and digital advertising, but the coming years promise a much broader and deeper integration across all sectors.

The IP Geolocation Solution market is experiencing an unprecedented surge, propelled by a confluence of powerful forces that are fundamentally reshaping how businesses interact with their online environments. At the forefront of this movement is the escalating global adoption of e-commerce and digital advertising, where precise location data is paramount for targeted marketing campaigns, personalized customer experiences, and effective fraud detection. Companies are increasingly leveraging IP geolocation to understand their audience demographics, optimize ad spend, and prevent fraudulent transactions, contributing to market valuations in the millions. The growing emphasis on cybersecurity and risk management further amplifies this demand. Organizations across all sectors are deploying IP geolocation solutions to identify and mitigate cyber threats, track malicious IP addresses, and ensure compliance with increasingly stringent data privacy regulations, such as GDPR and CCPA. This need for enhanced security, coupled with the desire to improve user experience through localized content and services, creates a compelling business case for robust geolocation capabilities. The proliferation of mobile devices and the burgeoning Internet of Things (IoT) ecosystem are also significant drivers. As more devices connect to the internet, the need for real-time location awareness becomes critical for applications ranging from fleet management and logistics to smart city initiatives and connected home devices. This expanding digital footprint necessitates more sophisticated and accurate IP geolocation services, pushing the market towards higher levels of precision and real-time responsiveness.

Despite its robust growth trajectory, the IP Geolocation Solution market faces several inherent challenges and restraints that could temper its full potential. One of the primary hurdles is the inherent inaccuracy and dynamic nature of IP address assignments. Internet Service Providers (ISPs) frequently reallocate IP address blocks, and the use of VPNs and proxies can obfuscate a user's true location, leading to potential data discrepancies. Achieving pinpoint accuracy down to the street level remains a complex technical challenge. Furthermore, evolving data privacy regulations across different jurisdictions pose significant compliance hurdles. Companies must navigate a patchwork of laws governing the collection, storage, and use of location data, which can add complexity and cost to solution implementation. The increasing sophistication of cyber threats, including the use of advanced cloaking techniques and botnets, requires continuous innovation and investment in detection and mitigation strategies, potentially impacting the cost-effectiveness of existing solutions. Another restraint is the potential for data fatigue and information overload. As the volume of data generated by IP geolocation solutions grows, businesses may struggle to effectively analyze and derive actionable insights, leading to underutilization of the technology. The competitive landscape, while fostering innovation, also presents a challenge for smaller players to gain market share against established giants with extensive data resources and established client bases. Lastly, the upfront investment required for implementing and integrating advanced IP geolocation solutions, particularly for smaller enterprises, can be a significant barrier to adoption.

The IP Geolocation Solution market is poised for significant dominance in both specific regions and particular market segments, driven by distinct economic, technological, and regulatory factors.

Key Regions/Countries Poised for Dominance:

North America: This region, encompassing the United States and Canada, is a perennial leader in technology adoption and digital innovation. With a highly developed internet infrastructure, a mature e-commerce ecosystem, and a significant concentration of major technology companies, North America is expected to continue its reign. The presence of leading players like Microsoft, MaxMind, and TransUnion, alongside numerous innovative startups, fuels a competitive and rapidly evolving market. The region’s strong focus on cybersecurity, driven by a high volume of online transactions and a proactive stance on threat mitigation, makes accurate IP geolocation solutions indispensable. The sheer volume of internet users and the advanced digital advertising landscape further solidify its position, leading to market valuations in the tens of millions within this region alone. The regulatory environment, while evolving, generally supports the use of location data for business intelligence and security purposes.

Europe: Driven by the European Union's commitment to digital transformation and the implementation of stringent data privacy regulations like GDPR, Europe presents a unique and substantial market. While GDPR necessitates careful handling of personal data, it also underscores the importance of accurate geolocation for consent management and compliance. Countries like the United Kingdom, Germany, and France, with their robust economies and advanced digital infrastructure, are key contributors. The growth in e-commerce, online media consumption, and the increasing focus on localized services across various European nations are significant growth drivers. Companies here are leveraging IP geolocation for everything from content personalization to ensuring regulatory adherence, contributing to market growth in the millions.

Asia-Pacific: This region is emerging as a powerhouse, particularly driven by the rapid digitalization of economies like China, India, South Korea, and Japan. The sheer scale of the internet user base in countries like China, with giants like Tencent, Baidu, Alibaba, and Huawei innovating in this space, represents a massive opportunity. The burgeoning e-commerce sector, the rapid adoption of mobile technologies, and the increasing demand for digital entertainment are creating immense traction for IP geolocation solutions. While regulatory landscapes can be diverse, the overarching trend is towards greater data utilization for business growth and security. The presence of regional players like NAVER Cloud, Beijing Tiantexin Technology, and Ipplus360 alongside global providers, signifies a vibrant and competitive market, with significant investment in the millions.

Dominating Segments:

Security: This segment is unequivocally a primary driver and will continue to dominate the IP Geolocation Solution market. The ever-escalating threat landscape, characterized by sophisticated cyberattacks, fraud, and data breaches, makes accurate IP geolocation an essential tool for defense. Businesses across all industries, from financial institutions to e-commerce platforms and government agencies, rely heavily on this technology for:

Electronic Business Use (E-commerce): The foundation of modern e-commerce is built upon understanding and serving customers effectively, and IP geolocation is central to this. This segment utilizes IP geolocation for:

Internet and Media Use: The online content and media industry is heavily reliant on IP geolocation for audience engagement and revenue generation. This includes:

The IP Geolocation Solution industry is experiencing accelerated growth due to several powerful catalysts. The relentless expansion of the digital economy, particularly the surge in e-commerce and online services, necessitates precise location understanding for targeted marketing and fraud prevention. Furthermore, the increasing global focus on cybersecurity and risk management is driving demand for IP geolocation as a critical tool for threat detection, access control, and compliance with data privacy regulations. The burgeoning Internet of Things (IoT) ecosystem, with its vast network of connected devices, is also creating new use cases and demanding real-time location intelligence.

This report provides an exhaustive analysis of the IP Geolocation Solution market, spanning the historical period of 2019-2024 and extending through a detailed forecast to 2033, with a dedicated focus on the base year of 2025. The market, valued in the millions, is meticulously segmented by Type, Application, and industry developments. It dissects the intricate trends, driving forces, and challenges that shape this dynamic sector. Furthermore, the report identifies key regions and countries poised for market dominance and highlights the most impactful market segments, particularly focusing on Security and Electronic Business Use. Comprehensive profiles of leading industry players, including Microsoft, MaxMind, and TransUnion, are provided, alongside a timeline of significant developments and innovations. This in-depth coverage ensures stakeholders gain a holistic understanding of the market's current state and future potential.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.0% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.0%.

Key companies in the market include Microsoft, MaxMind, TransUnion, Digital Element, APILayer, Hexasoft Development, El Toro, WhoisXML API, Melissa, IPligence, NAVER Cloud, Beijing Tiantexin Technology, Ipplus360, Tencent, Baidu, Alibaba, Huawei, .

The market segments include Type, Application.

The market size is estimated to be USD 111.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "IP Geolocation Solution," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the IP Geolocation Solution, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.