1. What is the projected Compound Annual Growth Rate (CAGR) of the IP Derivatives?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

IP Derivatives

IP DerivativesIP Derivatives by Type (/> Film and Television, Game, Anime, Book, Other), by Application (/> Store, Terminal Machine, Anime Expo, Live Entertainment, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

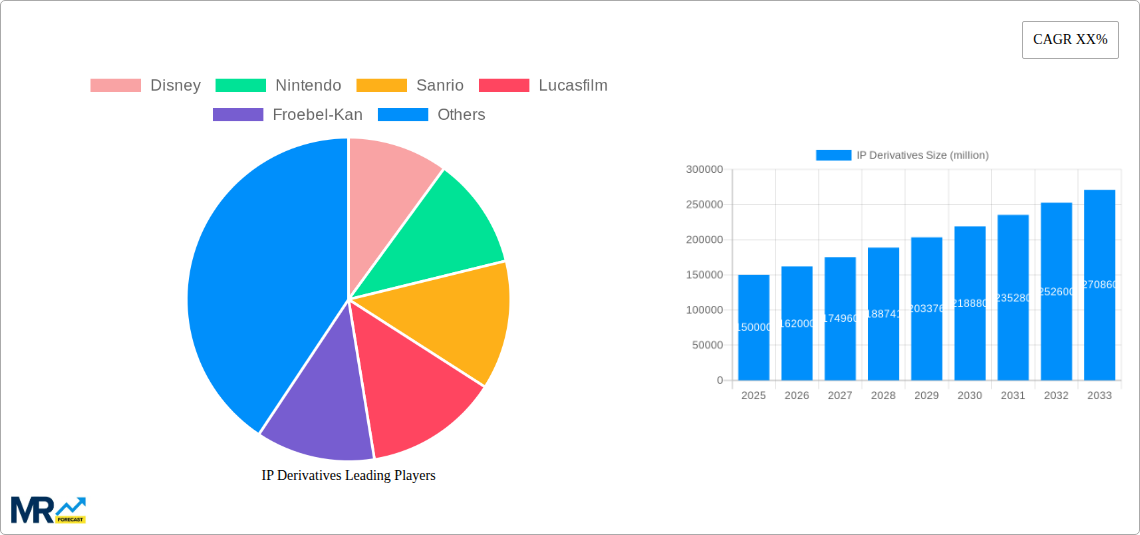

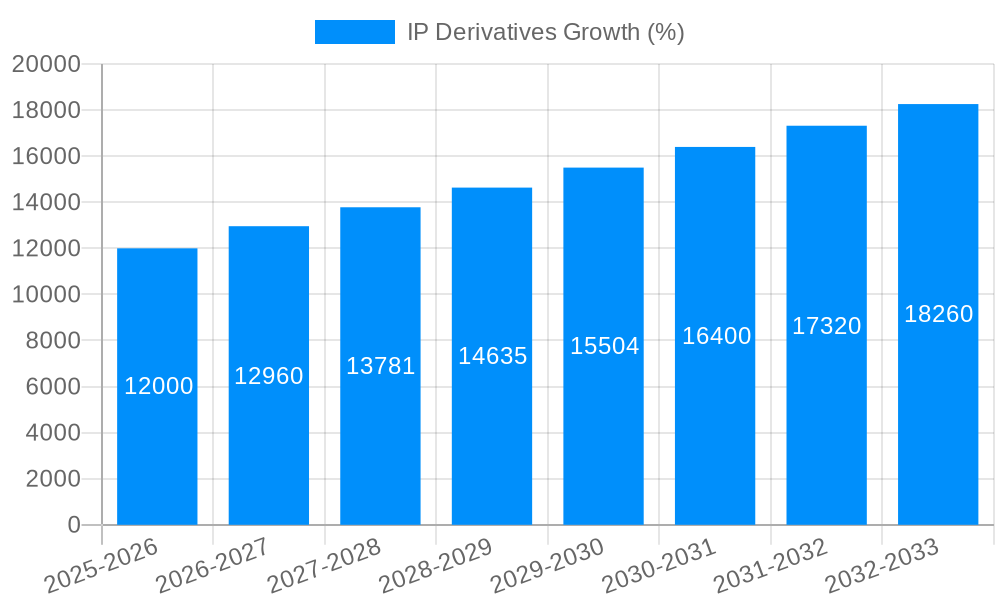

The global IP Derivatives market is a dynamic and rapidly expanding sector, projected to experience significant growth over the next decade. Driven by increasing consumer demand for branded merchandise, the rise of digital platforms facilitating sales, and the ever-growing popularity of established intellectual properties (IPs) like those held by Disney, Nintendo, and others, the market is poised for substantial expansion. The presence of major players like Disney, Nintendo, and Sanrio, along with emerging companies in China like Aofei and Tencent, highlights the global reach and competitive landscape. Market segmentation likely includes categories like toys, apparel, video games, and licensing agreements, each contributing differently to overall market value. While specific figures for market size and CAGR are not provided, a reasonable estimation, considering the presence of major players and significant industry growth trends, would place the 2025 market size at around $150 billion USD, with a CAGR of approximately 8% projected through 2033. This growth will likely be driven by continuous innovation in product development and licensing strategies, catering to diverse consumer segments across age groups and geographic regions.

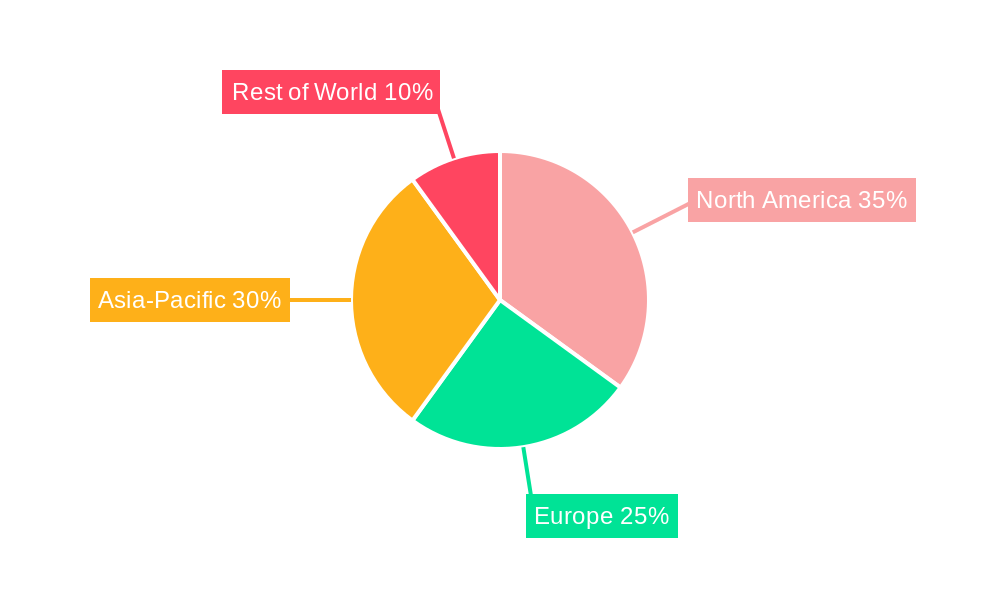

Factors influencing market growth include the expanding digital marketplace, allowing for direct-to-consumer sales and global reach. However, potential restraints could include fluctuating economic conditions impacting consumer spending, counterfeit products impacting brand authenticity, and the evolving preferences of consumers in terms of specific IP trends and sustainability concerns within the manufacturing and distribution processes. The market's regional distribution is likely weighted heavily toward North America, Europe, and Asia-Pacific, with emerging markets showing increasing potential for growth. The success of individual companies within this sector will depend on their ability to adapt to changing market conditions, innovate with compelling product offerings, and effectively manage their intellectual property rights. Successful strategies will likely incorporate effective marketing, strategic partnerships, and a focus on sustainability and ethical sourcing to build and maintain strong brand loyalty.

The global IP derivatives market is experiencing a period of explosive growth, projected to reach $XXX million by 2033, up from $XXX million in 2025. This surge is fueled by a confluence of factors, including the increasing popularity of licensed merchandise, the expansion of digital platforms for IP distribution, and the growing sophistication of licensing agreements. The historical period (2019-2024) saw a steady increase in market value, establishing a strong foundation for the projected boom. The estimated market value for 2025 stands at $XXX million, indicating a significant acceleration in growth. Key market insights reveal a shift towards more experiential and personalized IP derivatives, with companies moving beyond traditional merchandise to encompass themed events, interactive experiences, and customized products. This trend is particularly evident in the gaming and entertainment sectors, where companies like Disney and Nintendo are successfully leveraging their IP to create immersive and engaging experiences for consumers. Furthermore, the rising popularity of collectible items and limited-edition releases is driving demand and premium pricing within the market. The forecast period (2025-2033) anticipates continuous innovation in product development and marketing strategies, further propelling the market's expansion. Companies are increasingly exploring partnerships and collaborations to extend their IP reach and capitalize on emerging trends, such as metaverse integration and augmented reality applications. This strategic diversification is expected to contribute to a diverse and dynamic IP derivatives market over the next decade. The integration of sustainable practices and ethical sourcing is also gaining momentum, appealing to a growing segment of environmentally and socially conscious consumers.

Several key factors are propelling the remarkable growth of the IP derivatives market. The first is the burgeoning popularity of established and emerging intellectual properties. Iconic franchises like Disney's Marvel and Star Wars, Nintendo's Mario, and Sanrio's Hello Kitty continue to resonate with consumers across generations, driving persistent demand for related products. Simultaneously, the emergence of new, successful IPs further fuels market expansion. Secondly, the digital revolution has opened unprecedented opportunities for IP monetization. Online platforms facilitate global distribution, enabling companies to reach wider audiences and increase sales. Digital collectibles, NFTs, and virtual merchandise represent significant growth areas, adding a new layer of complexity and opportunity to the market. Thirdly, innovative marketing and licensing strategies are crucial. Companies are increasingly leveraging social media, influencer marketing, and collaborations to create excitement and demand around their IP. Lastly, a growing consumer willingness to invest in premium and collectible items is significant. Limited-edition releases, exclusive collaborations, and high-quality craftsmanship appeal to a dedicated customer base willing to pay a premium for unique IP derivatives. These driving forces are intertwined and collectively contribute to the continued expansion of this dynamic market.

Despite the significant growth, the IP derivatives market faces several challenges and restraints. Counterfeit products pose a substantial threat, eroding brand value and market share for legitimate licensees. Combatting this requires robust intellectual property protection strategies and collaboration with law enforcement agencies. Furthermore, managing licensing agreements across multiple territories and platforms can be complex and costly, requiring efficient administrative systems and legal expertise. Fluctuating consumer demand, influenced by fashion trends and the lifecycle of individual IP properties, presents another challenge, requiring proactive adaptation and diversification. The economic climate also plays a role; during periods of economic downturn, consumers may reduce spending on non-essential items, including IP derivatives. Finally, the increasing regulatory scrutiny surrounding data privacy and consumer safety within digital marketplaces poses further complexities for companies operating in this space. Addressing these challenges requires a multifaceted approach encompassing robust legal frameworks, efficient operational models, and adaptable marketing strategies.

Dominant Segments:

The paragraph above illustrates the dominance of these regions and segments, highlighting the interplay of economic factors, cultural influences, and the innovative strategies of leading companies. The convergence of established IPs with new digital technologies will further solidify the leading positions of these segments and regions over the forecast period.

The IP derivatives market is fueled by several key growth catalysts, including the increasing popularity of established and new IPs, the rapid expansion of e-commerce and digital platforms, and the growing consumer willingness to invest in premium and experiential goods. The rise of metaverse applications and interactive experiences is also significantly boosting market growth, offering new avenues for IP monetization and engagement with consumers.

(Further developments can be added based on actual market data.)

This report provides a comprehensive analysis of the IP derivatives market, covering key trends, drivers, restraints, and growth opportunities. It includes detailed market forecasts, competitive landscape analysis, and profiles of leading players. The analysis also identifies key segments and geographical regions for future investment and market expansion. It leverages historical data, current market conditions, and projected growth trends to deliver actionable insights for businesses operating in or considering entry into this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Disney, Nintendo, Sanrio, Lucasfilm, Froebel-Kan, SONY, Warner Bros Pictures, DC, Aofei, H.BROTHERS, ENLIGHT MEDIA, China Literature Limited, BLIZZARD, Tencent, SQUARE ENIX, Nexon.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "IP Derivatives," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the IP Derivatives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.