1. What is the projected Compound Annual Growth Rate (CAGR) of the IoT Fleet Management?

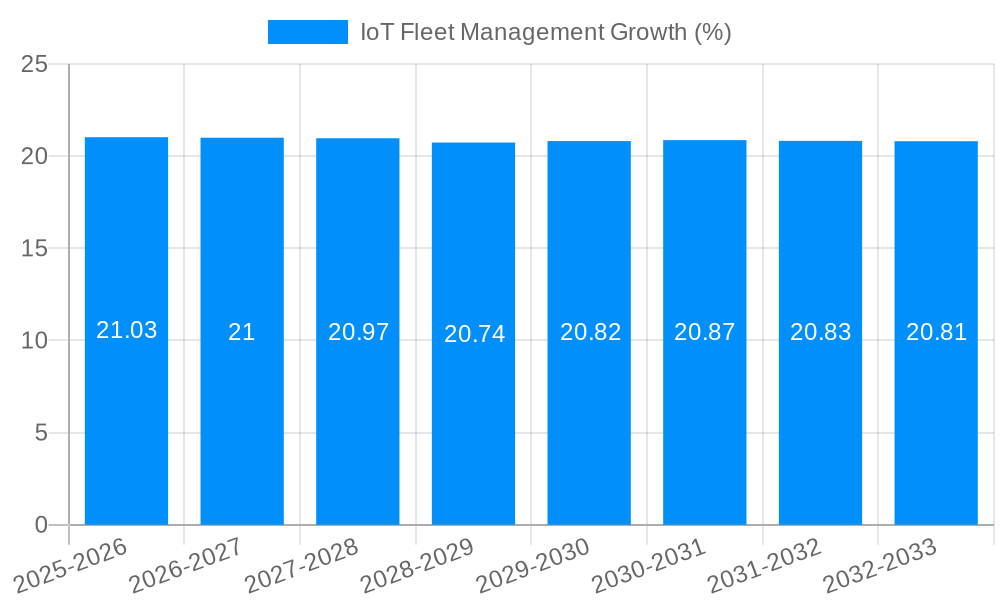

The projected CAGR is approximately 20.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

IoT Fleet Management

IoT Fleet ManagementIoT Fleet Management by Type (Passenger Vehicles, Commercial Vehicles), by Application (Routing Management, Tracking and Monitoring, Fuel Management, Remote Diagnostics, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

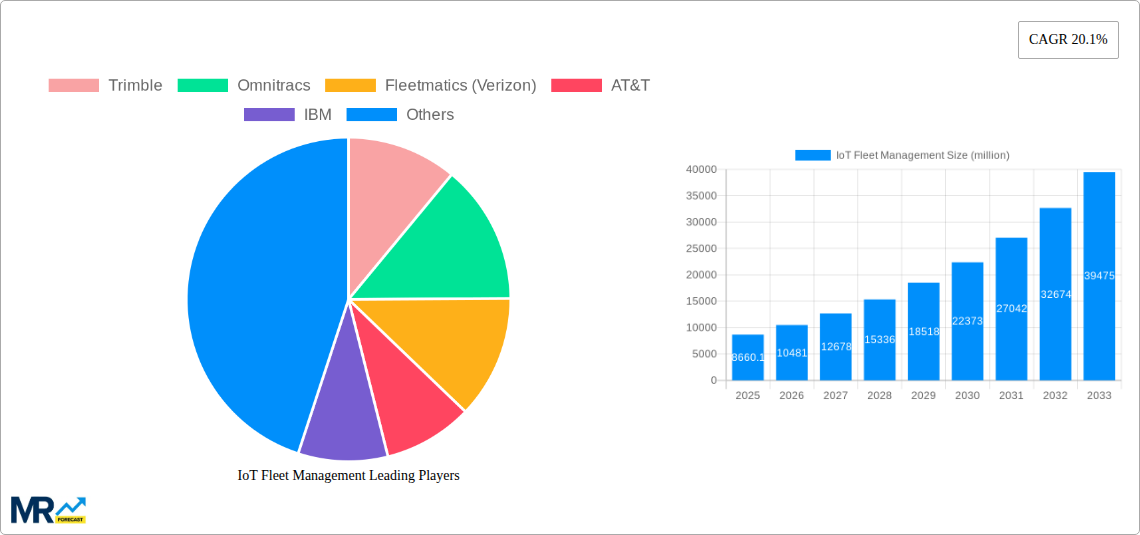

The global IoT Fleet Management market is poised for substantial expansion, projected to reach a valuation of $8,660.1 million in 2025. This robust growth is underpinned by a remarkable Compound Annual Growth Rate (CAGR) of 20.1%, indicating a dynamic and rapidly evolving landscape over the forecast period of 2025-2033. The primary drivers fueling this surge include the escalating demand for enhanced operational efficiency, stringent regulatory compliance mandates regarding vehicle emissions and safety, and the continuous innovation in telematics and sensor technology. Companies are increasingly leveraging IoT solutions to gain real-time insights into vehicle performance, driver behavior, and asset location, thereby optimizing routes, reducing fuel consumption, and minimizing downtime. This strategic adoption is critical for managing complex logistics operations and improving overall fleet productivity.

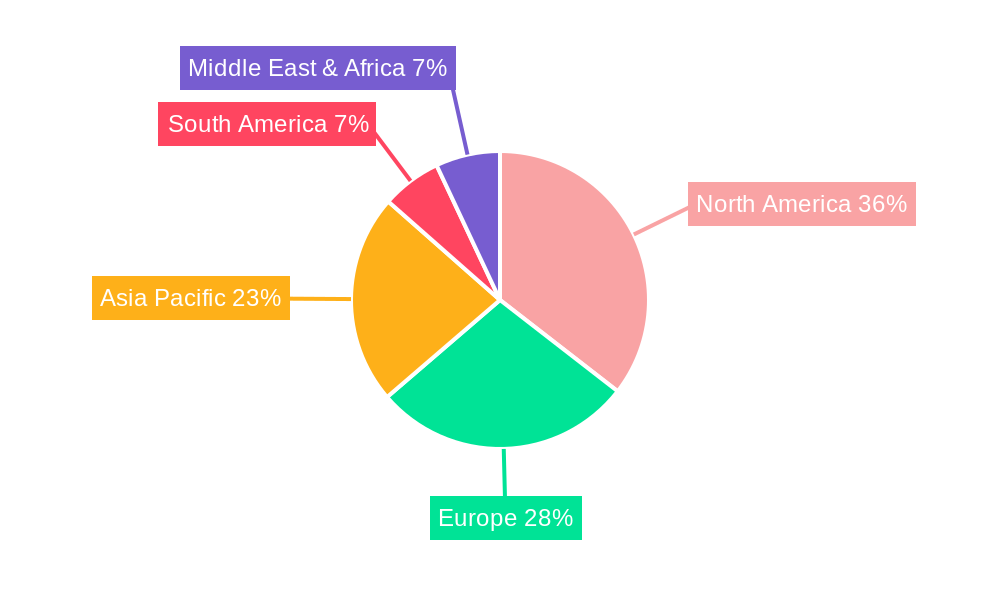

The market segmentation reveals a significant focus on Passenger Vehicles and Commercial Vehicles, with applications spanning Routing Management, Tracking and Monitoring, Fuel Management, and Remote Diagnostics. The increasing complexity of supply chains and the growing e-commerce sector are accelerating the need for advanced tracking and routing solutions. Furthermore, the emphasis on cost reduction and sustainability is driving the adoption of fuel management and remote diagnostics technologies. Key industry players such as Trimble, Omnitracs, and Fleetmatics (Verizon) are at the forefront, developing and deploying sophisticated IoT platforms that offer comprehensive fleet management capabilities. Geographically, North America is expected to maintain a dominant position, driven by its early adoption of technology and a well-established logistics infrastructure. However, the Asia Pacific region is anticipated to exhibit the fastest growth due to rapid industrialization, increasing vehicle penetration, and government initiatives promoting smart city development and digitized logistics.

This comprehensive report delves into the dynamic and rapidly evolving landscape of the IoT Fleet Management market. Spanning the study period of 2019-2033, with a detailed analysis of the historical period (2019-2024), a robust base year of 2025, and an estimated year also of 2025, followed by a forward-looking forecast period of 2025-2033, this report provides invaluable insights for stakeholders. The market is projected to witness significant growth, with the number of connected IoT fleet management devices expected to reach 250 million units by 2025 and surpass 700 million units by 2033. The report meticulously dissects key trends, driving forces, challenges, and dominant market segments, offering a strategic roadmap for navigating this burgeoning sector.

XXX The Internet of Things (IoT) is revolutionizing the way fleets are managed, transforming operational efficiency, cost reduction, and safety across various industries. The core of this transformation lies in the ubiquitous deployment of connected devices that collect, transmit, and analyze vast amounts of data in real-time. One of the most prominent trends is the escalating adoption of predictive maintenance powered by IoT sensors. Instead of reacting to breakdowns, fleets are increasingly moving towards anticipating them. By continuously monitoring critical components such as engine health, tire pressure, and battery status, organizations can schedule maintenance proactively, minimizing downtime and preventing costly repairs. This shift from reactive to proactive maintenance is not only cost-effective but also significantly enhances vehicle longevity and operational reliability. Furthermore, the integration of AI and machine learning algorithms with IoT data is unlocking deeper analytical capabilities. These advanced technologies are enabling sophisticated route optimization, not just based on traffic but also on factors like driver behavior, cargo weight, and even weather patterns. This leads to substantial savings in fuel consumption and reduced delivery times. The demand for enhanced driver safety and compliance is another significant trend. IoT solutions are providing real-time driver behavior monitoring, including speeding, harsh braking, and fatigue detection, which are crucial for accident prevention and adherence to regulatory mandates. The proliferation of telematics devices, coupled with cloud-based platforms, is creating a unified ecosystem for fleet managers to oversee their entire operations from a single dashboard, providing unparalleled visibility and control. The convergence of IoT with 5G technology is set to further accelerate these trends, enabling faster data transmission and more responsive real-time analytics, paving the way for autonomous and highly optimized fleet operations in the coming years. The focus is shifting from mere tracking to intelligent decision-making, where data becomes the driving force behind every operational choice, ensuring a more efficient, sustainable, and secure future for fleet management. The increasing emphasis on sustainability and environmental regulations is also driving the adoption of IoT solutions for monitoring emissions and optimizing fuel efficiency, a critical aspect for businesses looking to reduce their carbon footprint and comply with global environmental standards.

The exponential growth of the IoT Fleet Management market is being propelled by a confluence of powerful forces. Foremost among these is the unyielding pursuit of operational efficiency and cost reduction by businesses across all sectors. In today's competitive landscape, minimizing operational expenses is paramount, and IoT solutions directly address this by optimizing fuel consumption through intelligent routing and driver behavior monitoring, reducing maintenance costs through predictive analytics, and minimizing downtime by preventing unexpected vehicle failures. The increasing stringent regulatory environment globally, particularly concerning emissions, safety, and driver working hours, is another significant propellant. IoT devices provide the granular data necessary for companies to demonstrate compliance and avoid costly penalties. Furthermore, the growing awareness and demand for enhanced safety for both drivers and the public are fueling the adoption of IoT-enabled safety features, such as collision avoidance systems, driver fatigue monitoring, and real-time incident alerts. The rapid advancements in IoT hardware and software, coupled with the decreasing cost of sensors and connectivity solutions, have made these technologies more accessible and attractive to a wider range of businesses, including small and medium-sized enterprises. The burgeoning adoption of cloud computing and big data analytics further amplifies the value proposition of IoT in fleet management, enabling sophisticated data processing and actionable insights that were previously unattainable.

Despite its robust growth trajectory, the IoT Fleet Management market faces several inherent challenges and restraints that can impede its widespread adoption. A primary concern is the initial investment cost associated with deploying IoT hardware, software, and the necessary infrastructure for data management and analysis. For many small to medium-sized businesses, this upfront expenditure can be a significant barrier. Another crucial challenge is data security and privacy. The vast amounts of sensitive data collected by IoT devices, including driver behavior and location information, are attractive targets for cyberattacks. Ensuring robust data protection measures and compliance with evolving privacy regulations (like GDPR) is paramount and can be complex to implement effectively. Integration complexities with existing legacy systems and IT infrastructure pose another hurdle. Many organizations operate with diverse and often outdated systems, and seamlessly integrating new IoT solutions can be a time-consuming and technically demanding process. Furthermore, the lack of standardization across different IoT platforms and protocols can lead to interoperability issues, making it difficult for businesses to choose solutions that can scale and adapt to future needs. Technical expertise and skilled workforce are also in short supply. Effectively managing, analyzing, and acting upon the data generated by IoT devices requires specialized skills in data science, analytics, and IT, which can be difficult to find and retain. Finally, driver resistance to constant monitoring and the perception of intrusive surveillance can also be a restraint, necessitating careful change management and transparent communication about the benefits of IoT solutions.

The Commercial Vehicles segment is poised to dominate the IoT Fleet Management market due to its inherent need for operational efficiency, regulatory compliance, and cost optimization. Commercial fleets, encompassing trucks, vans, buses, and specialized vehicles, are characterized by high utilization rates, extensive daily mileage, and stringent operational requirements. The economic imperative to minimize fuel costs, reduce maintenance expenses, and ensure timely deliveries makes IoT solutions indispensable.

Commercial Vehicles: This segment is the primary revenue driver. The sheer volume of commercial vehicles operating globally, coupled with their critical role in supply chains and logistics, naturally positions them as the leading adopters of IoT fleet management technologies. The need for real-time tracking, route optimization to improve delivery times and reduce mileage, and comprehensive fuel management to control a significant operational cost makes IoT solutions a non-negotiable investment for this segment. For instance, a logistics company operating a fleet of 100,000 commercial vehicles can achieve substantial savings through optimized routing, potentially reducing fuel expenditure by 5-10% per vehicle, translating to millions of dollars in savings annually. Predictive maintenance enabled by IoT sensors can prevent costly breakdowns, extending vehicle lifespan and reducing unscheduled downtime, which in itself can cost businesses hundreds of thousands to millions in lost revenue and repair costs per incident.

North America: This region is expected to lead the market due to a mature telematics infrastructure, high adoption rates of advanced technologies, and a strong emphasis on regulatory compliance and safety. The presence of major logistics hubs and a high density of commercial vehicle operations further solidify its dominance. The market size in North America is projected to reach $15 billion by 2025, driven by significant investments from large fleet operators and government initiatives promoting smart transportation. The rapid integration of AI and cloud-based solutions in this region contributes to its leading position, with companies actively leveraging data analytics for strategic decision-making. The adoption of advanced safety features, such as electronic logging devices (ELDs) and driver behavior monitoring systems, is also high in North America, further boosting the market.

Application Dominance: Tracking and Monitoring & Routing Management: Within the application landscape, Tracking and Monitoring and Routing Management are expected to be the most significant contributors to market revenue. Real-time tracking and monitoring provide the foundational visibility into fleet operations, enabling managers to know the precise location, status, and performance of each vehicle. This forms the basis for almost all other fleet management functions. Complementing this, sophisticated Routing Management solutions leverage this tracking data, coupled with external factors like traffic conditions and delivery schedules, to optimize routes. This directly translates to reduced travel time, lower fuel consumption, and improved customer satisfaction through more predictable delivery windows. The combined adoption of these two applications is projected to account for over 60% of the total IoT fleet management market share by 2025, as businesses prioritize the most direct paths to cost savings and operational efficiency. The continuous improvement and refinement of these applications, driven by advancements in AI and real-time data processing, will ensure their continued dominance.

The IoT Fleet Management industry is being significantly propelled by several key growth catalysts. The increasing global focus on sustainability and environmental regulations is driving the demand for solutions that optimize fuel efficiency and reduce emissions. Furthermore, the continuous advancements in sensor technology, connectivity options (like 5G), and data analytics platforms are making IoT solutions more powerful, accessible, and cost-effective. The growing need for enhanced driver safety and compliance with evolving safety standards is also a major catalyst, as businesses seek to mitigate risks and protect their employees.

This report offers a comprehensive and in-depth analysis of the IoT Fleet Management market, providing crucial information for strategic decision-making. It covers market size estimations in millions of units, detailed trend analysis, and an examination of the critical driving forces and challenges that shape the industry. With a meticulous breakdown of dominant regions and segments, including Commercial Vehicles and applications like Tracking and Monitoring and Routing Management, the report offers actionable insights. Furthermore, it identifies key growth catalysts and profiles the leading players in the market, alongside a timeline of significant historical and projected developments. This extensive coverage ensures that stakeholders are equipped with the knowledge to navigate the evolving IoT Fleet Management landscape effectively and capitalize on future opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 20.1%.

Key companies in the market include Trimble, Omnitracs, Fleetmatics (Verizon), AT&T, IBM, Teletrac Navman, TomTom, Oracle, Intel, Cisco Systems, Sierra Wireless, .

The market segments include Type, Application.

The market size is estimated to be USD 8660.1 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "IoT Fleet Management," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the IoT Fleet Management, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.