1. What is the projected Compound Annual Growth Rate (CAGR) of the Internet Advertising?

The projected CAGR is approximately 13%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Internet Advertising

Internet AdvertisingInternet Advertising by Type (E-commerce Ads, Social Platform Ads, Short Video Ads, Search Engine Ads, Others), by Application (Food and Beverage, Auto Industry, Healthcare, Consumer Good, Travel, Education, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

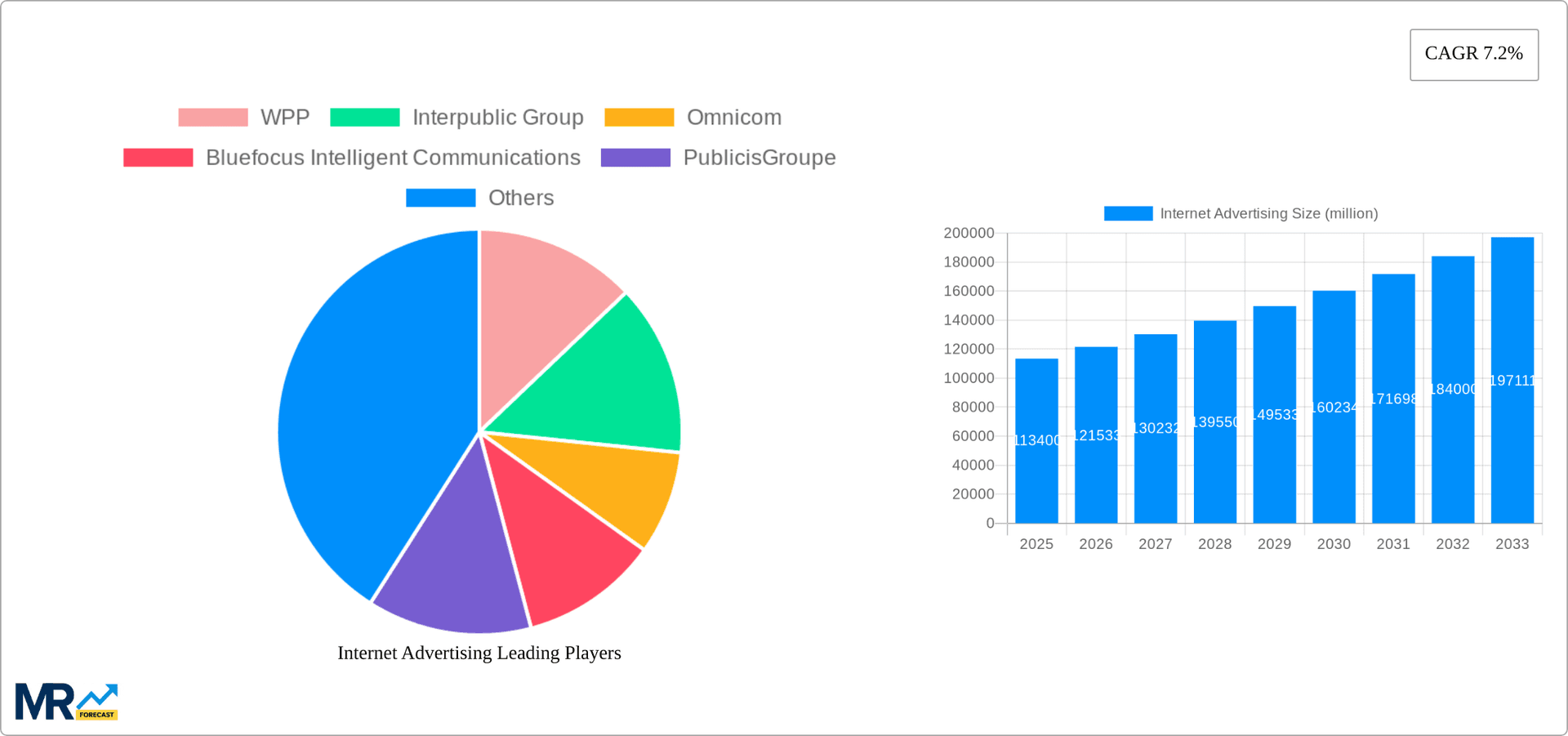

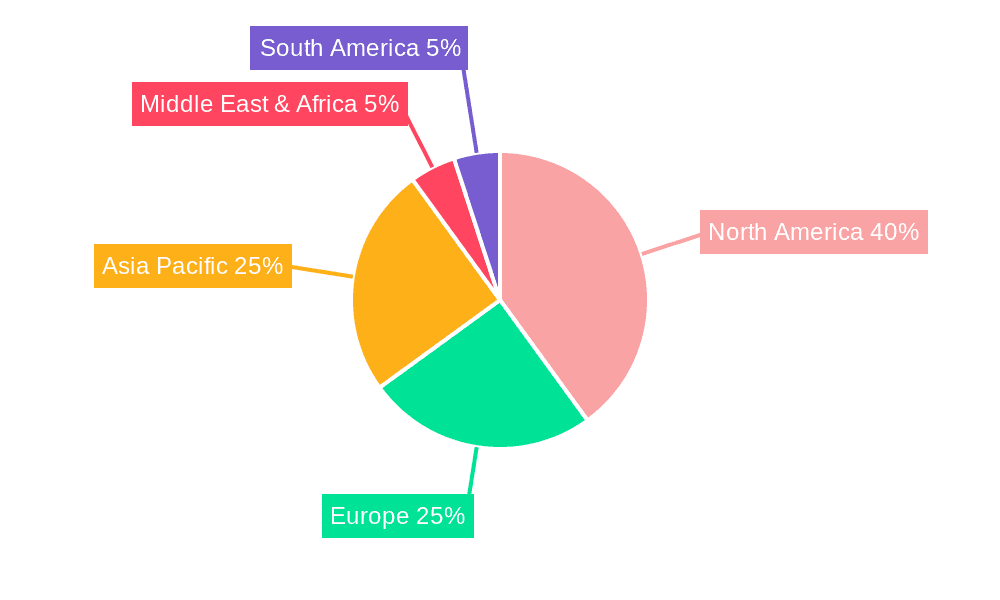

The global internet advertising market, valued at $499.95 billion in 2025, is projected to experience significant expansion. Driven by increasing digital platform adoption and a growing preference for targeted campaigns, the market is forecast to achieve a Compound Annual Growth Rate (CAGR) of 13% between 2025 and 2033. Key growth catalysts include widespread smartphone penetration, the escalating use of social media and e-commerce, and the advancement of programmatic advertising technologies enabling precise targeting. The market is segmented by advertising type (e-commerce, social media, short video, search engine, and others) and application (food & beverage, automotive, healthcare, consumer goods, travel, education, and others), highlighting its diverse deployment avenues. While specific segment contributions are not detailed, e-commerce and social media advertising are anticipated to lead due to their pervasive influence on consumer behavior. Geographically, North America and Asia-Pacific are expected to dominate, driven by high internet penetration and digital advertising adoption. Emerging markets present substantial growth opportunities. The competitive landscape features global leaders such as WPP, Interpublic Group, and Omnicom, alongside rapidly expanding regional players, particularly in Asia. Future market trajectory will be shaped by technological innovation, evolving data privacy regulations, and shifting consumer consumption patterns.

The competitive environment is dynamic, with established multinational agencies like WPP, Omnicom, and Publicis Groupe coexisting with agile, digitally native firms such as Hylink Digital Solution and Simei Media. Success hinges on adapting to emerging technological trends, including AI-powered advertising, and leveraging data analytics for enhanced campaign performance. Regulatory scrutiny regarding data privacy and consumer protection will necessitate ethical and transparent advertising practices. Long-term success will favor organizations demonstrating both scale and specialized expertise across digital platforms, coupled with a strong commitment to data security and user privacy. Growth within specific application segments will be influenced by evolving consumer trends and digital adoption rates in sectors like healthcare, education, and finance.

The global internet advertising market exhibited robust growth between 2019 and 2024, exceeding $XXX billion in 2024. This expansion is projected to continue, reaching $YYY billion by 2025 and surging to an estimated $ZZZ billion by 2033. Key market insights reveal a shift towards a more diversified advertising landscape. While traditional forms like search engine ads remain significant, the explosive growth of short-video platforms and the increasing sophistication of e-commerce advertising are reshaping the industry. The influence of social media marketing continues to be a dominant force, with targeted campaigns driving significant returns on investment (ROI) for advertisers. However, the rise of ad blockers and increasing consumer concerns regarding data privacy present ongoing challenges. Furthermore, the market is experiencing a heightened focus on programmatic advertising, allowing for greater automation and efficiency in ad buying and placement. This trend necessitates a deeper understanding of audience segmentation and data analytics to maximize campaign effectiveness. The increasing use of artificial intelligence (AI) and machine learning (ML) in targeting, optimization, and fraud detection is also impacting the landscape significantly, leading to more refined and results-driven strategies. The future of internet advertising appears dynamic, with a strong focus on mobile-first approaches, personalized experiences, and a constant need for adaptation to evolving technological advancements and consumer preferences. The convergence of online and offline advertising strategies is further blurring lines, creating new opportunities for integrated marketing campaigns. The competition among advertising agencies and technology platforms is intensifying, resulting in continuous innovation in tools, platforms, and strategies.

Several factors fuel the impressive growth trajectory of the internet advertising market. The proliferation of internet and mobile devices worldwide provides a vast and expanding audience for advertisers. Increased internet penetration, particularly in developing economies, significantly expands the potential reach of digital advertising campaigns. The rise of social media platforms has created new avenues for targeted advertising, enabling businesses to connect with specific demographics and interest groups with unprecedented precision. The continuous development of sophisticated advertising technologies, including programmatic advertising and AI-powered targeting, enhances campaign effectiveness and ROI. The ability to measure and track campaign performance in real-time offers valuable data for continuous optimization and improvement. E-commerce's explosive growth necessitates robust advertising strategies to attract and convert online shoppers, driving significant demand for online advertising solutions. Furthermore, the increasing preference for video content, especially short-form videos, has created a lucrative market for short-video advertising, further propelling market growth. The shift from traditional media to digital platforms by businesses seeking to reach wider and more engaged audiences is also a major driving force. This transition is driven by the cost-effectiveness and measurable results offered by digital advertising compared to traditional methods.

Despite the significant growth, the internet advertising market faces substantial challenges. Increasing concerns regarding data privacy and the ethical implications of targeted advertising are prompting stricter regulations and impacting advertising strategies. The prevalence of ad blockers significantly reduces ad viewability and reach, requiring advertisers to adopt more sophisticated techniques to circumvent these technological barriers. The rising cost of advertising inventory on prime digital platforms can limit smaller businesses' participation. Furthermore, the complexity of the digital advertising ecosystem, involving multiple intermediaries and technologies, necessitates specialized expertise and can increase operational costs. Measuring the true impact of internet advertising campaigns, particularly concerning brand awareness and long-term customer loyalty, remains a challenge. Fraudulent activities, such as ad-click fraud and fake engagement metrics, continue to impact the credibility and ROI of online advertising campaigns. Maintaining brand safety in a constantly evolving digital landscape is crucial and remains an ongoing challenge, requiring sophisticated content filtering and monitoring techniques. Lastly, maintaining consumer trust in an environment where privacy concerns are paramount is crucial for the long-term sustainability of the internet advertising industry.

The Asia-Pacific region is expected to dominate the internet advertising market throughout the forecast period (2025-2033), driven by the region's massive and rapidly growing internet user base, coupled with increasing smartphone penetration and rising disposable incomes. Within the Asia-Pacific region, China and India stand out as key drivers of market expansion.

E-commerce Ads: This segment is expected to maintain significant growth due to the booming e-commerce sector in the Asia-Pacific region, especially in China and India, where online shopping has become mainstream. The increasing adoption of mobile commerce further fuels this growth, creating opportunities for highly targeted advertising.

Social Platform Ads: Social media usage remains incredibly high across the Asia-Pacific region. Platforms like WeChat in China and various other platforms across the region present lucrative avenues for targeted advertising campaigns, driving considerable investment in this segment.

Short Video Ads: The phenomenal popularity of short-video platforms like TikTok and YouTube Shorts in Asia-Pacific is fostering explosive growth in this segment. The highly engaging nature of short-form videos makes them a highly effective advertising medium.

Consumer Goods Segment: This segment will experience significant growth due to the increasing purchasing power in developing economies within the Asia-Pacific region, boosting demand for consumer goods and creating a large pool of potential customers.

In summary, the combination of high internet penetration, burgeoning e-commerce, and the prevalent use of social media and short-video platforms in Asia-Pacific, specifically targeting the ever-expanding consumer goods market, positions this region and these segments as the dominant forces in the global internet advertising market. The diverse range of platforms and highly engaged user bases create ideal conditions for profitable advertising campaigns.

The internet advertising industry's growth is catalyzed by several key factors: continuous technological advancements in targeting and measurement; the increasing sophistication of programmatic advertising; the rise of innovative advertising formats such as interactive ads and augmented reality (AR) experiences; and the growing integration of online and offline advertising strategies. These factors contribute to a more effective and efficient advertising landscape, driving greater investment and fostering continued expansion.

This report provides a comprehensive overview of the internet advertising market, analyzing historical trends, current market dynamics, and future growth projections. It identifies key market drivers, challenges, and growth catalysts, providing valuable insights into the dominant regions, segments, and leading players within the industry. The report also offers an in-depth examination of significant developments shaping the sector, ultimately offering a robust framework for informed decision-making and strategic planning in this ever-evolving landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 13%.

Key companies in the market include WPP, Interpublic Group, Omnicom, Bluefocus Intelligent Communications, PublicisGroupe, Liou Group Digital Technology, Dentsu Inc, Hakuhodo, Guangdong Advertising, Havas Group (Vivendi), Hylink Digital Solution, Inly Media, ADK Holdings Inc. (Bain Capital), Simei Media, Beijing Pairui Weixing Advertisin, Guangdong Insight Brand Marketing, Three's Company Media, Fs Development Investment Holdings, Guangdong Guangzhou Daily Media, .

The market segments include Type, Application.

The market size is estimated to be USD 499.95 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Internet Advertising," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Internet Advertising, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.