1. What is the projected Compound Annual Growth Rate (CAGR) of the Internet Advertising?

The projected CAGR is approximately 13%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Internet Advertising

Internet AdvertisingInternet Advertising by Type (E-commerce Ads, Social Platform Ads, Short Video Ads, Search Engine Ads, Others), by Application (Food and Beverage, Auto Industry, Healthcare, Consumer Good, Travel, Education, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global internet advertising market, valued at $499.95 billion in the 2025 base year, is projected for significant expansion, exhibiting a Compound Annual Growth Rate (CAGR) of 13%. Key growth drivers include the escalating global penetration of smartphones and internet access, leading to increased ad impressions and user engagement. Advancements in sophisticated targeting technologies enable advertisers to precisely reach specific demographics and user interests, acting as a major catalyst. The rising popularity of video content, especially short-form formats on platforms such as TikTok and Instagram Reels, is creating new advertising opportunities and contributing to market growth. Furthermore, enhanced reliance on data analytics for measuring and optimizing campaign performance boosts effectiveness and return on investment, incentivizing further investment in online advertising.

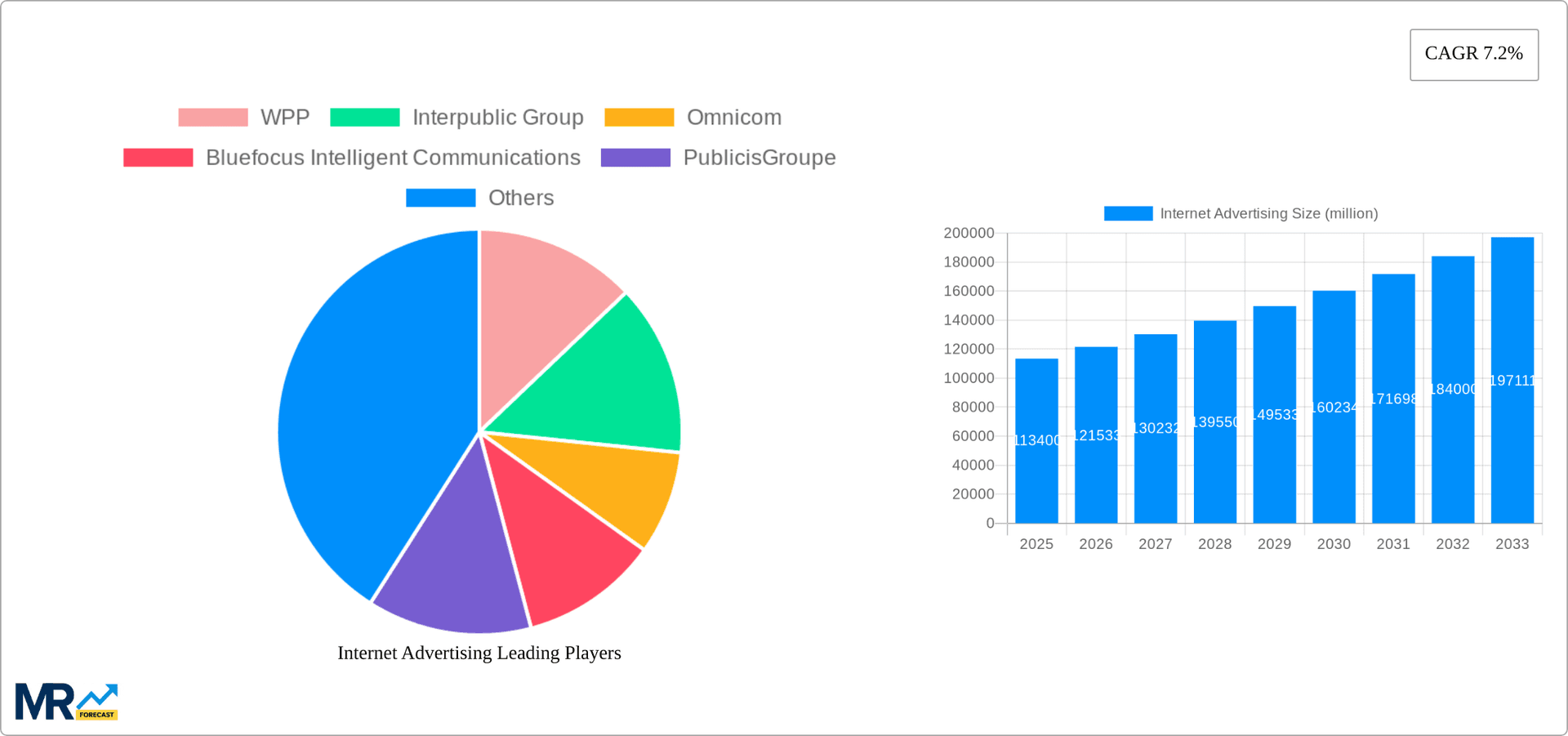

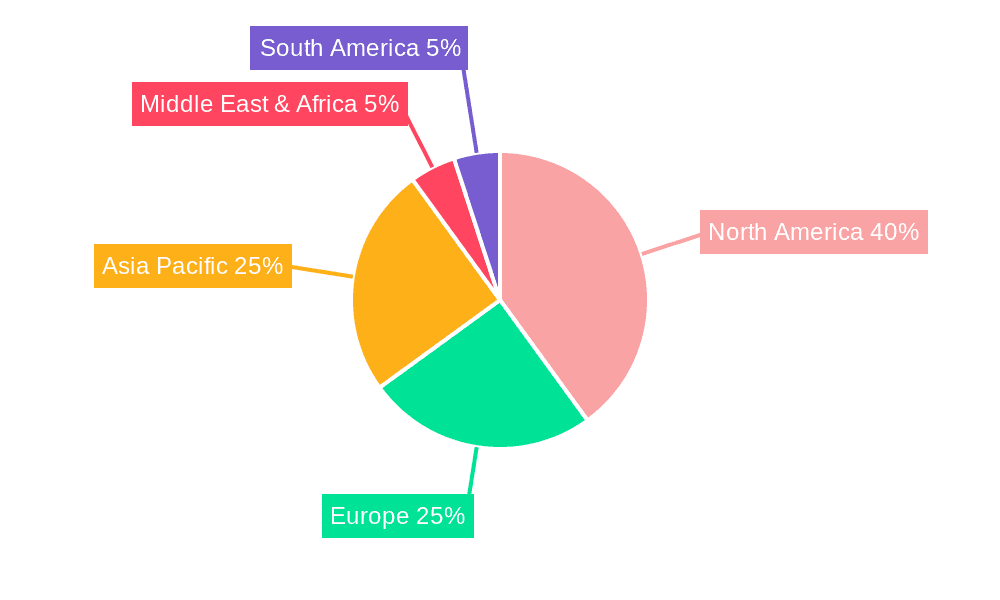

The internet advertising market exhibits substantial segmentation. Dominant segments include e-commerce ads, social platform ads, and short-video ads, reflecting the contemporary digital landscape. The application segment encompasses a wide array of industries utilizing online advertising, such as food and beverage, automotive, healthcare, consumer goods, travel, and education. While North America and Europe currently command significant market share, the Asia-Pacific region, particularly China and India, is anticipated to experience substantial growth driven by rapidly expanding internet penetration and rising disposable incomes. The competitive landscape is intense, featuring global leaders like WPP, Omnicom, and Publicis Groupe alongside numerous regional competitors. Challenges such as data privacy concerns, ad fraud, and the evolving regulatory environment require effective navigation for sustainable growth. The long-term outlook remains optimistic, with the internet advertising market poised for continuous evolution and expanded reach.

The global internet advertising market exhibited robust growth between 2019 and 2024, exceeding $XXX billion in 2024. This upward trajectory is projected to continue throughout the forecast period (2025-2033), reaching an estimated $XXX billion by 2025 and surpassing $XXX billion by 2033. Key market insights reveal a significant shift towards mobile advertising, driven by the increasing penetration of smartphones and mobile internet usage worldwide. The dominance of social media platforms as advertising channels continues to grow, with platforms like Facebook, Instagram, and TikTok capturing significant market share. Simultaneously, the rise of programmatic advertising and the utilization of sophisticated data analytics are enabling more targeted and efficient ad campaigns, optimizing return on investment (ROI) for businesses. The e-commerce sector's burgeoning growth is intrinsically linked to internet advertising's expansion, as online retailers increasingly leverage targeted ads to reach potential customers. Furthermore, the increasing sophistication of ad formats, such as interactive video ads and augmented reality experiences, is enhancing user engagement and campaign effectiveness. The continuous evolution of consumer preferences, technological advancements, and emerging advertising technologies all contribute to the dynamic and ever-changing nature of the internet advertising landscape. This complex interplay necessitates a flexible and adaptive approach from advertisers to maintain competitiveness and maximize returns within this rapidly expanding market. The increasing focus on data privacy regulations and the associated implications for targeted advertising present both challenges and opportunities for companies operating within this sector. Finally, the competitive landscape is characterized by both established giants and emerging players, resulting in a constant struggle for market share and innovation.

Several factors fuel the growth of internet advertising. The exponential rise in internet and mobile device usage globally forms the bedrock of this expansion. More people accessing the internet means a larger potential audience for advertisers. This is further amplified by the increasing sophistication of targeting capabilities. Advertisers can now reach highly specific demographics and interest groups with unprecedented precision, maximizing campaign effectiveness and minimizing wasted ad spend. The shift towards mobile-first consumption is another significant driver. As a larger portion of internet usage shifts to mobile devices, advertisers are increasingly focusing their efforts on optimizing their campaigns for mobile platforms. The proliferation of social media platforms provides another crucial avenue for internet advertising. These platforms offer vast, engaged audiences, allowing for creative and highly targeted advertising strategies. Furthermore, the rise of e-commerce has created a symbiotic relationship with internet advertising. Online retailers rely heavily on advertising to drive traffic to their websites and boost sales. The continuous evolution of ad technologies and data analytics empowers advertisers with more effective campaign management and measurement tools, allowing for real-time optimization and performance monitoring. Finally, the expanding availability of data and the development of advanced analytical tools are continuously refining targeting and measurement strategies, further contributing to market growth.

Despite the significant growth, the internet advertising market faces substantial challenges. Increasing concerns about data privacy and the implementation of stricter regulations, such as GDPR and CCPA, impose limitations on data collection and targeting practices, affecting the effectiveness of personalized advertising. Ad blocking software continues to pose a significant hurdle, reducing the reach of online advertisements. The escalating costs of advertising on popular platforms and the ever-increasing competition for audience attention further constrain market growth. Measuring the true return on investment (ROI) from advertising campaigns remains a challenge, particularly in complex, multi-channel strategies. Furthermore, the prevalence of ad fraud and the difficulty in combating it significantly impact advertising spend efficiency and trust. The dynamic and constantly evolving nature of the digital landscape necessitates continuous adaptation and investment in new technologies and strategies, which represents a significant ongoing expense for advertisers. Finally, brand safety and the risk of associating with inappropriate or controversial content present a persistent challenge for brands investing in internet advertising.

The North American and Asian markets are projected to dominate the global internet advertising landscape during the forecast period. Within these regions, specific countries such as the United States, China, and Japan will likely exhibit the most significant growth due to their large and digitally engaged populations and high levels of internet penetration.

E-commerce Ads: This segment is poised for substantial growth, driven by the explosive growth of online shopping. The convenience and reach of online marketplaces are fueling the demand for targeted advertising campaigns aimed at converting online browsers into buyers. This segment is expected to be a primary growth driver across all regions.

Social Platform Ads: Social media platforms remain dominant advertising channels, particularly given their effective targeting capabilities and high user engagement. The continuous innovation of advertising formats and the expansion of features on these platforms will sustain the growth of this segment.

In summary: The combination of a large and digitally active population, a thriving e-commerce sector, and the dominance of social media platforms positions North America and Asia, particularly the United States, China, and Japan, as key regions for internet advertising growth. Within the various advertising types, e-commerce and social platform ads are likely to be the dominant segments, reflecting the current trends in consumer behavior and technological advancement. Both these segments are likely to see higher growth rates than other segments in the coming decade. The focus on mobile advertising and evolving advertising formats further reinforces their position as dominant drivers of market expansion.

Several factors are catalyzing growth in the internet advertising industry. These include the continued proliferation of smartphones and mobile internet access, expanding e-commerce adoption rates, the ongoing development of innovative ad formats, and improvements in data analytics capabilities, all combining to create a more effective and targeted advertising environment. Increased investment in programmatic advertising and the rising popularity of video ads further fuel this expansion.

This report provides a comprehensive overview of the internet advertising market, analyzing historical trends, current market dynamics, and future projections. It identifies key drivers, challenges, and growth opportunities, providing valuable insights for businesses operating within this dynamic sector and those considering market entry. The report offers a detailed examination of leading players, segment trends, and regional variations, enabling informed strategic decision-making within the internet advertising industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 13%.

Key companies in the market include WPP, Interpublic Group, Omnicom, Bluefocus Intelligent Communications, PublicisGroupe, Liou Group Digital Technology, Dentsu Inc, Hakuhodo, Guangdong Advertising, Havas Group (Vivendi), Hylink Digital Solution, Inly Media, ADK Holdings Inc. (Bain Capital), Simei Media, Beijing Pairui Weixing Advertisin, Guangdong Insight Brand Marketing, Three's Company Media, Fs Development Investment Holdings, Guangdong Guangzhou Daily Media, .

The market segments include Type, Application.

The market size is estimated to be USD 499.95 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Internet Advertising," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Internet Advertising, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.