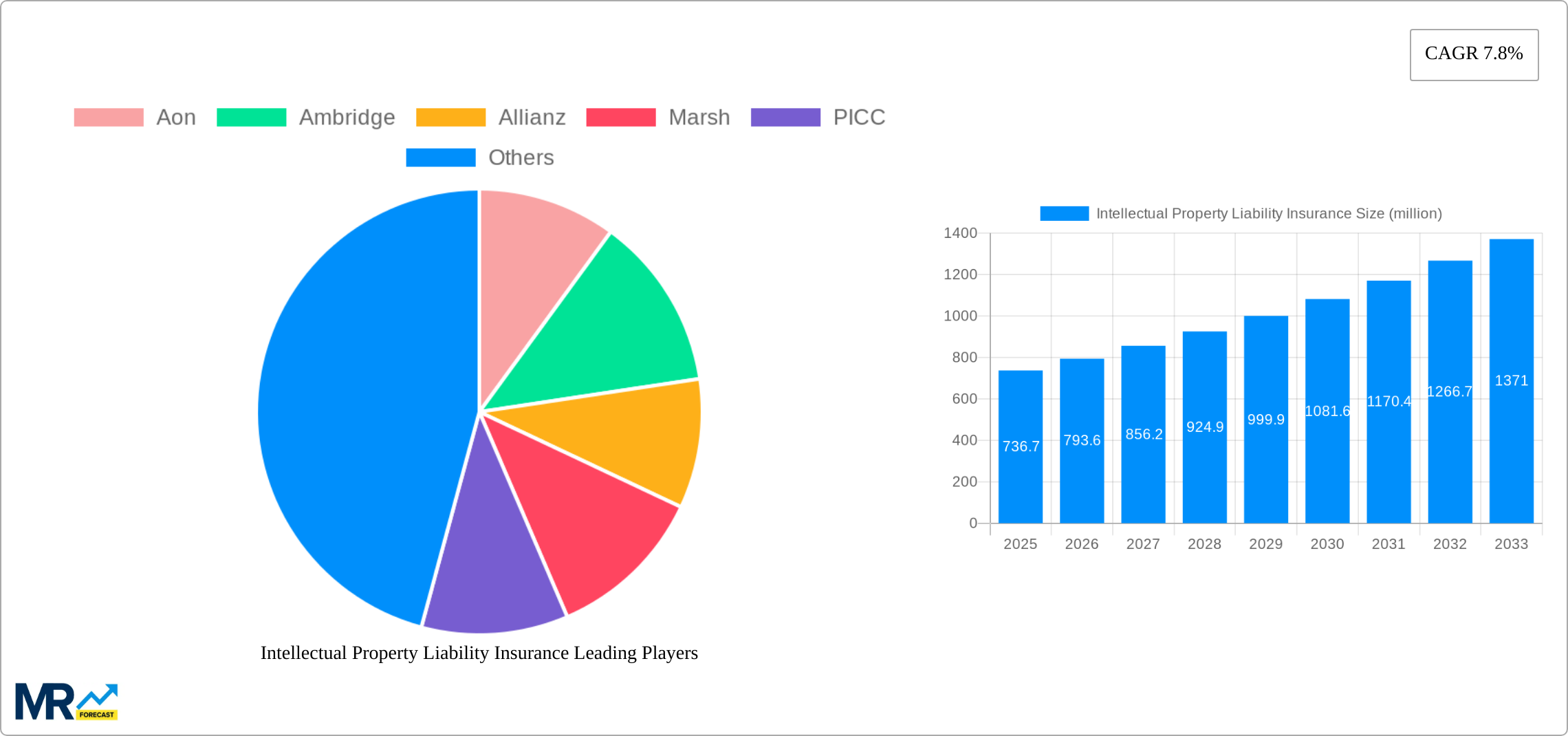

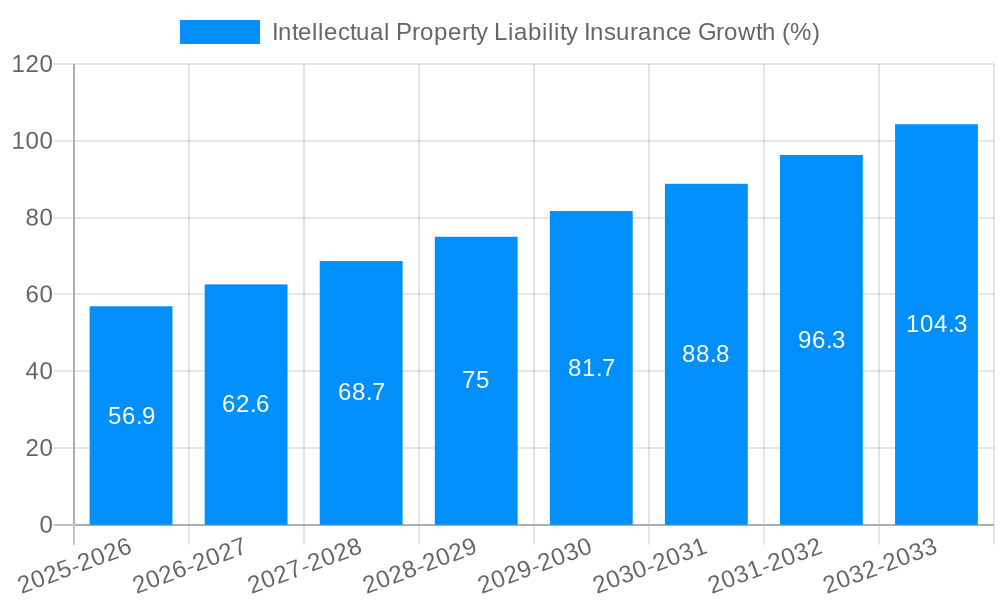

1. What is the projected Compound Annual Growth Rate (CAGR) of the Intellectual Property Liability Insurance?

The projected CAGR is approximately 7.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Intellectual Property Liability Insurance

Intellectual Property Liability InsuranceIntellectual Property Liability Insurance by Type (Corporate Intellectual Property Liability Insurance, Personal Intellectual Property Liability Insurance), by Application (Copyright, Patents, Trademarks, Design Rights, Trade Secrets), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

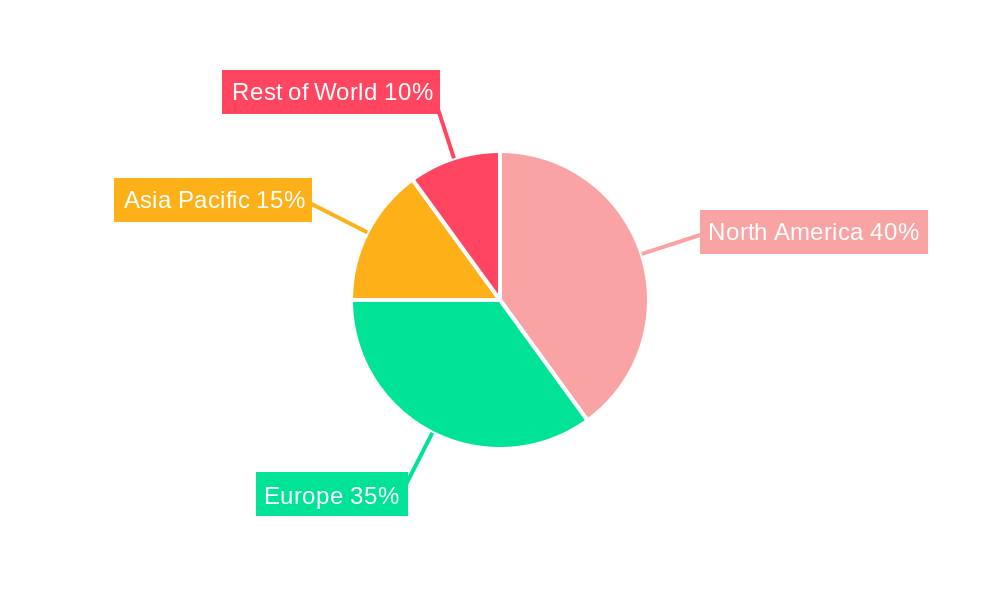

The Intellectual Property (IP) Liability Insurance market, valued at $736.7 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 7.8% from 2025 to 2033. This surge is driven by several factors. The increasing prevalence of intellectual property disputes across various sectors, particularly in technology, pharmaceuticals, and creative industries, necessitates comprehensive risk management strategies. Companies are increasingly recognizing the significant financial repercussions of IP infringement lawsuits, leading to a greater demand for insurance coverage that protects against potential losses. Furthermore, the rising complexity of intellectual property rights, coupled with globalization and cross-border collaborations, fuels the growth of this market. The market segmentation reveals a strong demand for both Corporate and Personal IP Liability insurance, with Copyright and Patent protection constituting the largest segments. This is understandable given the high value and strategic importance of these IP assets. The geographical spread reveals significant market potential across North America and Europe, with Asia-Pacific showing considerable promise due to rapid economic growth and expanding technological sectors.

The competitive landscape comprises both global insurance giants like Aon, Allianz, and Marsh, as well as specialized firms like Founder Shield focusing on niche IP insurance products. This competition fosters innovation and product diversification, leading to tailored solutions for various business sizes and IP types. The presence of prominent players in both developed and emerging markets ensures broader market penetration and increased awareness of IP risk mitigation strategies. While regulatory changes and the evolving nature of IP itself pose certain challenges, the long-term prospects for the IP Liability Insurance market remain positive, driven by the continued rise in IP disputes and the growing awareness of the importance of protecting intangible assets. The market's growth trajectory indicates significant opportunities for insurers to expand their offerings and capitalize on the growing need for reliable IP protection.

The global Intellectual Property (IP) Liability Insurance market is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. The study period from 2019 to 2033 reveals a consistent upward trajectory, with the base year of 2025 serving as a crucial benchmark. The increasing awareness of IP risks across various industries, coupled with the rising value of intangible assets, is a primary driver. Companies are increasingly recognizing the potential for significant financial losses stemming from IP infringement lawsuits, leading to a heightened demand for comprehensive insurance coverage. This trend is particularly pronounced in sectors with high levels of innovation and competition, such as technology, pharmaceuticals, and fashion. The market is also witnessing diversification in policy offerings, with insurers developing specialized products tailored to specific industry needs and IP types (patents, trademarks, copyrights, etc.). Furthermore, technological advancements, particularly in areas like AI and data analytics, are impacting the underwriting process, allowing for more accurate risk assessment and pricing. The historical period (2019-2024) showed a steady increase in market size paving the way for substantial growth in the forecast period (2025-2033). The estimated year (2025) data indicates a significant market value, with projections suggesting continued exponential growth driven by factors detailed below. The expansion is not solely concentrated in developed economies but is also witnessed in emerging markets with developing IP protection frameworks and growing businesses. The complexities surrounding global IP rights and cross-border litigation are fueling the demand for robust insurance solutions offering protection against potential legal challenges.

Several key factors are propelling the growth of the Intellectual Property Liability Insurance market. The escalating value of intangible assets, such as patents, trademarks, and copyrights, represents a significant financial risk for businesses. A single successful infringement lawsuit can result in millions of dollars in damages, legal fees, and lost revenue, making insurance a critical risk mitigation strategy. The increasing globalization of businesses and the interconnectedness of global supply chains have expanded the potential for IP infringement across geographical boundaries. This necessitates the need for insurance coverage that provides protection in multiple jurisdictions. Moreover, stringent IP laws and increased enforcement actions by regulatory bodies worldwide are adding to the perceived risk for businesses. Companies are thus proactively seeking insurance to safeguard against potential penalties and legal costs. The rising awareness of IP risks among businesses, driven by successful litigation against major corporations, is also contributing to market growth. Educational initiatives by insurance providers and industry associations have also played a role in educating businesses about the importance of IP protection and the role of insurance in mitigating those risks. Finally, the development of innovative insurance products, such as those offering tailored coverage for specific IP types or industries, further enhances market appeal and expands the pool of potential customers.

Despite the significant growth potential, the Intellectual Property Liability Insurance market faces several challenges. The complexity of IP law and the varied interpretations across different jurisdictions pose significant underwriting challenges for insurers. Accurate risk assessment and pricing of IP liability insurance policies remain a major hurdle, requiring sophisticated methodologies and expertise in both insurance and intellectual property law. This complexity can lead to higher premiums, potentially making insurance unaffordable for smaller companies or start-ups. The lack of standardized definitions and classifications of IP assets across various countries and industries further complicates the process of assessing risks. Furthermore, the increasing frequency and severity of IP infringement lawsuits, especially in rapidly evolving sectors like technology, add uncertainty to the market. Predicting the outcomes of IP litigation is inherently difficult, increasing the financial risk for insurers. In addition, the difficulty in establishing clear causal links between insured events and the resulting financial losses can result in disputes between insurers and policyholders, leading to complications in the claims process. The relatively nascent nature of the market in some regions also limits market penetration and potential for growth. Finally, maintaining competitive pricing while ensuring sufficient reserves to cover potential payouts requires a delicate balance for insurance providers.

The Corporate Intellectual Property Liability Insurance segment is poised to dominate the market over the forecast period. This is largely due to the significantly higher value of intellectual property held by large corporations, and their increased susceptibility to costly infringement lawsuits.

North America and Europe are expected to be the leading regions due to strong IP protection frameworks, established insurance markets, and a high concentration of innovative companies in various industries.

Asia-Pacific is anticipated to show significant growth, fuelled by increasing industrialization, technological advancements, and the rise of innovative companies, particularly in China and India. However, inconsistencies in IP enforcement across the region and a relatively lower awareness of the benefits of this insurance may initially limit growth.

The Patents application segment shows high potential owing to the substantial investment in R&D activities by corporations across various sectors. A patent infringement lawsuit can have devastating financial implications, making patent liability insurance a critical need.

Growth within the Patents segment is linked to the continuous innovations in industries such as pharmaceuticals, technology, and engineering where patent protection is crucial. The high cost associated with defending or prosecuting patent infringement litigation ensures strong market potential.

The Trademarks segment will also witness steady growth, driven by the increasing brand awareness and consumer protection efforts of businesses across sectors. The need to safeguard brand reputation and market share against counterfeit goods or trademark infringement will drive demand.

The Copyright segment is expected to see considerable growth, driven by the digital revolution and the expanding reach of creative content. Protection of software, literary works, and multimedia content against unauthorized replication is a crucial factor boosting market demand.

The continued evolution of new technologies, such as Artificial Intelligence and the Metaverse, will lead to the development of new IP rights and protection mechanisms, further fueling demand for specialized insurance products. The increasing complexity of IP rights, coupled with escalating legal fees associated with IP litigation, will continue to reinforce the significance of IP liability insurance across all sectors and geographical regions.

The burgeoning digital economy, with its inherent risks relating to data breaches, software piracy, and online copyright infringement, is a major catalyst for market growth. Increased awareness among businesses about the potential financial consequences of IP disputes, coupled with more stringent enforcement of IP rights by governments, is further driving demand for comprehensive protection. The innovation in insurance products, tailored to the specific needs of various industries and IP types, enhances market appeal and facilitates broader adoption.

The Intellectual Property Liability Insurance market is poised for substantial growth, driven by several converging factors. These include the increasing value of intangible assets, the rising frequency and cost of IP disputes, and the escalating awareness of IP risks among businesses. The market's expansion is further facilitated by innovative insurance product offerings and technological advancements in risk assessment. The report provides comprehensive insights into market trends, drivers, challenges, and key players, offering valuable information for businesses and investors alike.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.8%.

Key companies in the market include Aon, Ambridge, Allianz, Marsh, PICC, Ping An Insurance, China Pacific Insurance, The Hartford, CMI, CFC, Gallagher, Founder Shield, .

The market segments include Type, Application.

The market size is estimated to be USD 736.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Intellectual Property Liability Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Intellectual Property Liability Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.