1. What is the projected Compound Annual Growth Rate (CAGR) of the Integrated Outage Management System?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Integrated Outage Management System

Integrated Outage Management SystemIntegrated Outage Management System by Type (/> Software System, Communication System), by Application (/> Private Utility, Public Utility), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

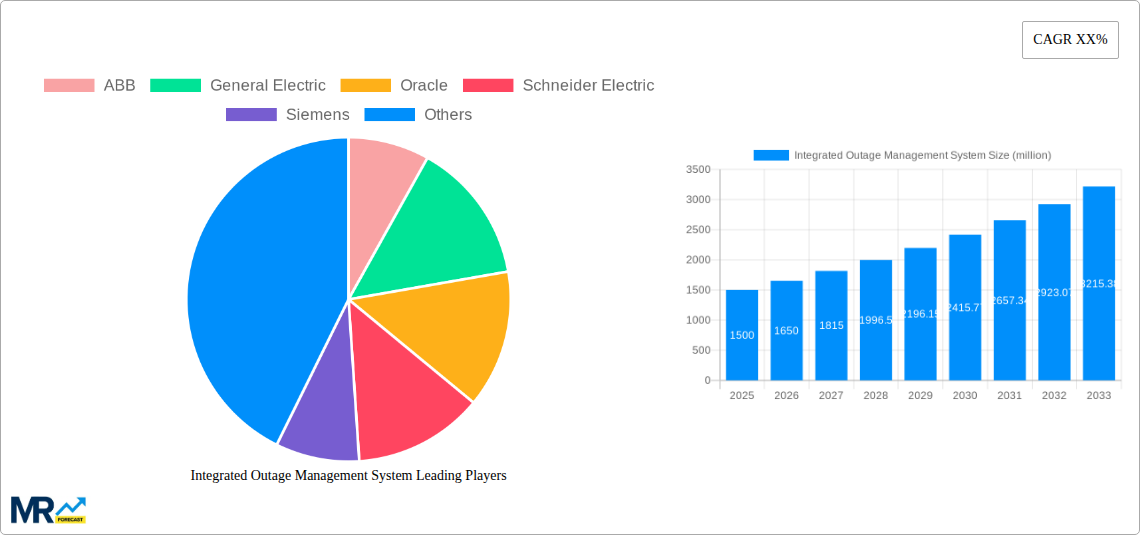

The global Integrated Outage Management System (OMS) market is poised for substantial growth, projected to reach an estimated USD XXXX million by 2033, driven by a Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is primarily fueled by the increasing complexity of power grids, the rising demand for reliable electricity supply, and the growing adoption of smart grid technologies. Utilities are investing heavily in advanced OMS to enhance operational efficiency, minimize downtime, and improve customer satisfaction. Key drivers include the need for proactive fault detection, rapid restoration of services, and better management of distributed energy resources (DERs) integrated into the grid. The market is witnessing a significant shift towards sophisticated software systems that offer predictive analytics, real-time monitoring, and seamless integration with other utility management platforms like SCADA and GIS.

The market segmentation reveals a strong preference for advanced software systems over traditional communication systems, highlighting the evolution towards intelligent and automated solutions. Both private and public utilities are recognizing the indispensable role of OMS in maintaining grid stability and resilience, particularly in the face of an aging infrastructure and an increasing frequency of extreme weather events. However, certain restraints, such as the high initial implementation costs and the need for skilled personnel to manage and operate these complex systems, could pose challenges. Despite these hurdles, the continuous innovation in AI and IoT integration, coupled with supportive government initiatives promoting grid modernization, is expected to sustain the robust growth trajectory of the Integrated Outage Management System market globally, with a strong presence of key players like Siemens, GE, and Schneider Electric.

Here's a comprehensive report description for an Integrated Outage Management System (OMS) market study, incorporating your specified details:

This report provides an in-depth analysis of the global Integrated Outage Management System (OMS) market, offering insights into its evolution, key drivers, challenges, and future trajectory. The study encompasses a detailed examination of market trends, segmentation by type and application, and regional dynamics, with a particular focus on the period from 2019 to 2033. The Base Year for the analysis is 2025, with forecasts extending through 2033. The Study Period covers 2019-2033, including the Historical Period of 2019-2024. The market is projected to witness substantial growth, with the global market size estimated to reach $8.5 million in 2025 and is expected to expand to $18.2 million by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of approximately 9.8% during the Forecast Period of 2025-2033.

The Integrated Outage Management System (OMS) market is currently experiencing a profound transformation, driven by the increasing complexity of power grids and the imperative for enhanced reliability and customer satisfaction. A key trend observed is the pervasive adoption of advanced digital technologies, including Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT), which are fundamentally reshaping how utilities detect, predict, and respond to power outages. These technologies are empowering OMS to move beyond reactive incident management to a more proactive and predictive approach, allowing for the identification of potential issues before they escalate into widespread disruptions. The integration of smart grid infrastructure, such as smart meters and advanced sensors, provides real-time data streams that feed directly into OMS platforms, enabling faster and more accurate outage localization and restoration. Furthermore, there is a significant trend towards cloud-based OMS solutions, offering scalability, flexibility, and reduced upfront capital expenditure for utilities. This shift enables seamless updates, remote access, and easier integration with other utility systems, thereby optimizing operational efficiency. The growing emphasis on cybersecurity is also a critical trend, as OMS platforms, being central to grid operations, are increasingly targeted. Therefore, vendors are investing heavily in robust security measures to protect sensitive data and ensure system integrity. The demand for mobile workforce management capabilities within OMS is also on the rise, facilitating efficient dispatch and real-time communication with field crews, thereby accelerating restoration efforts. The increasing regulatory pressures and stringent performance standards for utility service reliability are further compelling utilities to invest in sophisticated OMS. The convergence of OMS with Distribution Management Systems (DMS) and Supervisory Control and Data Acquisition (SCADA) systems is another important development, creating a more unified and intelligent operational environment. This integration allows for a holistic view of grid operations, enabling better decision-making during both normal operations and emergency situations. The focus on customer engagement is also intensifying, with OMS playing a crucial role in providing timely and accurate outage information to affected consumers through various channels, enhancing transparency and trust.

The growth of the Integrated Outage Management System (OMS) market is propelled by a confluence of critical factors that are reshaping the utility landscape. Foremost among these is the escalating demand for improved grid reliability and resilience. Aging infrastructure in many regions, coupled with the increasing frequency and severity of extreme weather events, necessitates sophisticated systems capable of minimizing downtime and ensuring uninterrupted power supply. Utilities are under immense pressure from regulatory bodies and consumers alike to maintain high service standards, making OMS a crucial investment for operational excellence. The rapid advancement of smart grid technologies serves as another significant driver. The proliferation of smart meters, sensors, and advanced communication networks generates vast amounts of real-time data, which are indispensable for the accurate detection, analysis, and resolution of outages. This data empowers OMS to perform predictive diagnostics and optimize restoration efforts. Furthermore, the ongoing digital transformation within the utility sector, characterized by the adoption of cloud computing, AI, and IoT, is creating new opportunities for enhanced OMS functionalities. These technologies enable greater automation, improved analytics, and more agile response capabilities. The increasing focus on customer experience is also a key propellant. In an era of heightened consumer expectations, utilities are leveraging OMS to provide proactive communication about outages, estimated restoration times, and service updates, thereby fostering greater customer satisfaction and loyalty. Economic factors, such as the potential for reduced operational costs through efficient outage management and minimized revenue losses due to downtime, also encourage investment in these advanced systems.

Despite the promising growth prospects, the Integrated Outage Management System (OMS) market faces several significant challenges and restraints that could impede its widespread adoption and expansion. A primary hurdle is the substantial upfront investment required for the implementation of sophisticated OMS solutions. Utilities, particularly smaller public entities, often grapple with budget constraints, making the acquisition of advanced software and hardware a considerable financial undertaking. The complexity of integrating new OMS with existing legacy systems can also be a major bottleneck. Many utilities operate with outdated infrastructure and disparate IT systems, leading to compatibility issues and costly integration efforts. This lack of interoperability can hinder the seamless flow of data and compromise the effectiveness of the OMS. Another significant challenge is the cybersecurity threat landscape. As OMS becomes increasingly interconnected and reliant on digital data, it becomes a more attractive target for cyberattacks. Ensuring the robust security of these critical systems requires continuous vigilance and substantial investment in advanced cybersecurity measures, which can be a daunting task for many organizations. The scarcity of skilled personnel with expertise in advanced OMS technologies, including data analytics and cybersecurity, also presents a restraint. Utilities often struggle to find and retain qualified professionals capable of effectively managing and leveraging these complex systems. Furthermore, resistance to change within utility organizations can slow down the adoption of new technologies. Traditional operational mindsets and established workflows can create inertia, making it difficult to implement the radical shifts in processes that an advanced OMS often necessitates. Finally, the standardization of data formats and communication protocols across different vendors and regions remains an ongoing challenge, which can complicate interoperability and system-wide deployment.

The global Integrated Outage Management System (OMS) market is characterized by distinct regional and segmental dominance, driven by a combination of technological adoption, regulatory frameworks, and infrastructure maturity.

Dominant Segments:

Type: Software System: The Software System segment is poised to dominate the OMS market. This is attributed to the increasing demand for advanced functionalities like AI-driven prediction, real-time analytics, and sophisticated visualization tools. The shift towards cloud-based OMS also significantly boosts this segment, offering scalability and flexibility that on-premise solutions cannot match. Vendors like ABB, Siemens, and Oracle are heavily investing in their software capabilities, offering comprehensive solutions that cater to the evolving needs of utilities. The continuous development of sophisticated algorithms for outage detection, localization, and restoration planning is a key factor in its leading position. The market for specialized software modules, such as SCADA integration, customer notification systems, and field crew management, also contributes significantly to the dominance of the software segment.

Application: Private Utility: The Private Utility segment is expected to be a major driver of market growth and dominance. Private utilities, often driven by profit motives and a stronger emphasis on customer satisfaction and operational efficiency, are more inclined to invest in cutting-edge OMS technologies to minimize revenue losses due to outages and enhance their brand reputation. They tend to have greater financial flexibility and a quicker decision-making process for adopting new technologies compared to some public entities. Companies like General Electric and Schneider Electric often find fertile ground in the private utility sector due to their ability to offer integrated solutions that deliver tangible ROI. The competitive landscape among private utilities further fuels the adoption of advanced OMS to maintain a competitive edge in service delivery.

Dominant Regions:

North America: North America, particularly the United States and Canada, is projected to be a dominant region in the OMS market. This is driven by several factors including:

Europe: Europe is another key region demonstrating strong market growth and dominance. This is fueled by:

Other regions like Asia-Pacific are also witnessing substantial growth, driven by rapid urbanization, increasing energy demand, and government initiatives for smart city development. However, North America and Europe are expected to retain their leadership positions throughout the forecast period due to their mature markets and proactive adoption of advanced technologies.

The Integrated Outage Management System (OMS) industry is experiencing accelerated growth due to several key catalysts. The escalating frequency and intensity of extreme weather events worldwide are compelling utilities to invest in more robust and responsive outage management capabilities to minimize downtime and ensure grid stability. Furthermore, the increasing penetration of distributed energy resources (DERs) and the complexity they introduce to grid management necessitate advanced OMS for real-time visibility and control. Government initiatives and regulations aimed at improving grid reliability and security are also significant growth drivers, pushing utilities to adopt state-of-the-art solutions. The continuous advancements in AI and IoT technologies are enabling more predictive and proactive outage management, enhancing operational efficiency and reducing restoration times, thereby acting as a major catalyst for market expansion.

The global Integrated Outage Management System (OMS) market is characterized by the presence of several prominent players, including:

This comprehensive report on the Integrated Outage Management System (OMS) market offers a detailed exploration of market dynamics, technological trends, and future outlook. The report provides granular insights into market segmentation by type and application, alongside an in-depth analysis of regional market sizes and growth opportunities. It delves into the strategic initiatives and recent developments undertaken by key industry players, offering valuable intelligence for stakeholders. Furthermore, the report scrutinizes the driving forces, challenges, and restraints impacting market growth, providing a balanced perspective on the industry's trajectory. With an extensive study period from 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report aims to equip businesses with the knowledge needed to navigate the evolving OMS landscape. The market is projected to witness significant growth, with an estimated global market size of $8.5 million in 2025 and an expansion to $18.2 million by 2033.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include ABB, General Electric, Oracle, Schneider Electric, Siemens, CGI Group, Advanced Control Systems, Futura Systems, Intergraph, Milsoft Utility Solutions, Survalent Technology, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Integrated Outage Management System," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Integrated Outage Management System, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.