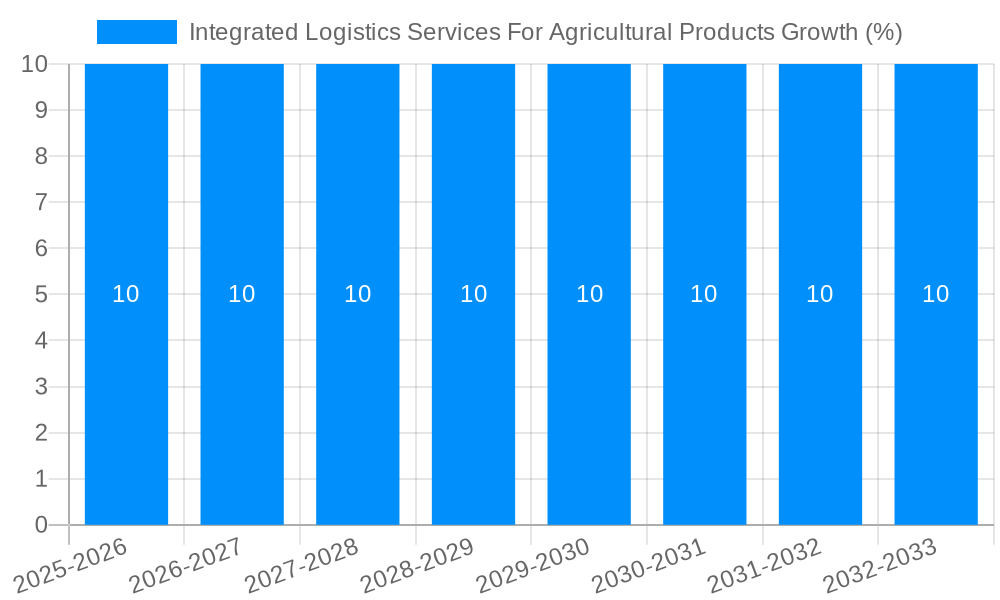

1. What is the projected Compound Annual Growth Rate (CAGR) of the Integrated Logistics Services For Agricultural Products?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Integrated Logistics Services For Agricultural Products

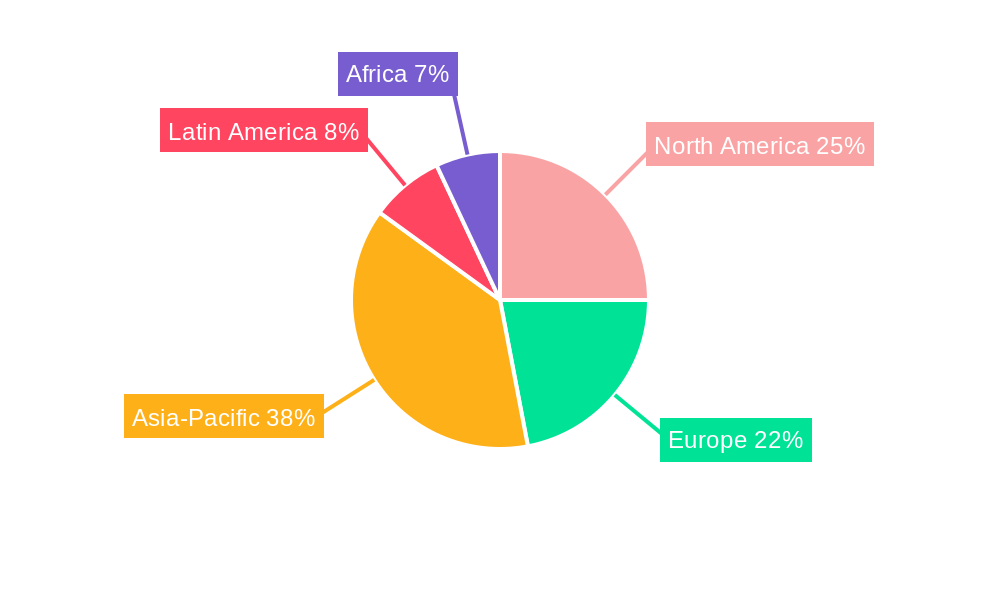

Integrated Logistics Services For Agricultural ProductsIntegrated Logistics Services For Agricultural Products by Type (Shipping Agent, Shipping Agency, Warehousing Services, Shipment Service), by Application (Feed Processing, Food Trade, Aquaculture, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

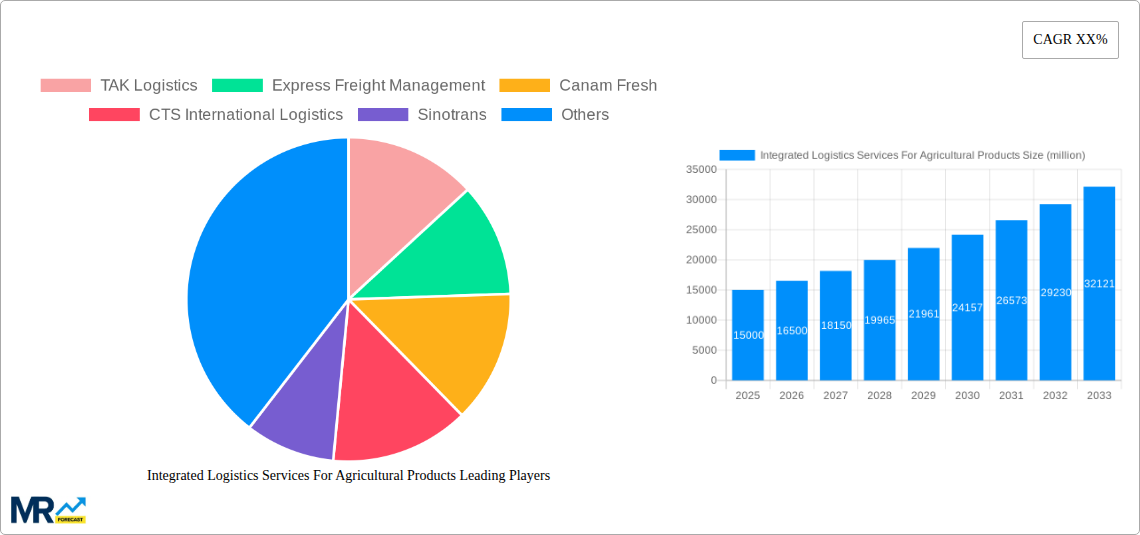

The Integrated Logistics Services for Agricultural Products market is poised for significant expansion, projected to reach a substantial market size of approximately $350 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7%. This impressive growth is primarily fueled by escalating global demand for agricultural produce, a direct consequence of a burgeoning world population and increasing disposable incomes. The imperative to minimize post-harvest losses, a perennial challenge in the agricultural sector, further drives the adoption of integrated logistics solutions that encompass efficient warehousing, optimized shipping, and seamless cold chain management. Furthermore, the growing emphasis on food safety and traceability, coupled with the liberalization of trade policies in many regions, is creating a more conducive environment for sophisticated logistics operations, thereby stimulating market advancement.

Key trends shaping this dynamic market include the increasing adoption of advanced technologies like IoT for real-time tracking and monitoring of shipments, AI-powered route optimization, and blockchain for enhanced transparency and security throughout the supply chain. The burgeoning food trade and the growing aquaculture sector are emerging as particularly strong application segments, demanding specialized handling and timely delivery. While the market exhibits strong growth potential, certain restraints such as the high initial investment required for infrastructure development, particularly for cold storage facilities, and the complexities associated with international trade regulations and customs procedures, need to be addressed. Nevertheless, the continuous innovation in logistics solutions and the strategic partnerships being forged by leading companies like TAK Logistics, Express Freight Management, and Sinotrans are expected to mitigate these challenges and propel the market towards sustained and profitable growth across all regions.

This report delves into the dynamic and evolving landscape of Integrated Logistics Services for Agricultural Products. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025, this analysis provides in-depth insights into market trends, driving forces, challenges, and growth catalysts. The historical period (2019-2024) sets the foundation for understanding past performance, while the estimated year (2025) and forecast period (2025-2033) offer projections and strategic foresight. Our rigorous research methodology, encompassing both qualitative and quantitative analysis, ensures a robust understanding of the market's potential, estimated to reach billions in value.

XXX - The integrated logistics services sector for agricultural products is experiencing a significant evolutionary phase, marked by a confluence of technological advancements and increasing global demand for food security. The core trend revolves around the transition from fragmented, standalone logistics functions to seamless, end-to-end solutions that manage the entire agricultural supply chain. This integration is driven by the critical need to minimize post-harvest losses, a perennial challenge in the agricultural domain, which currently accounts for billions in lost potential revenue. Furthermore, the escalating consumer demand for fresh, traceable, and sustainably sourced produce is pushing logistics providers to adopt more sophisticated tracking and temperature-controlled solutions. The rise of e-commerce in the food sector, further amplified by global events, has also necessitated faster, more agile, and digitally-enabled logistics networks capable of handling smaller, more frequent deliveries. Smart warehousing, equipped with AI-powered inventory management and automated handling systems, is becoming a cornerstone, optimizing space utilization and reducing operational costs, projected to impact the warehousing segment significantly in the coming years. Cold chain logistics, in particular, is witnessing substantial investment as perishable goods require stringent temperature control throughout transit and storage, a critical factor for products in the Food Trade and Aquaculture segments. The implementation of IoT sensors for real-time monitoring of temperature, humidity, and location is no longer a luxury but a necessity, fostering greater transparency and accountability. Supply chain visibility, powered by blockchain technology and advanced analytics, is emerging as a key differentiator, enabling stakeholders to track products from farm to fork, thereby enhancing food safety and consumer confidence. The industry is also observing a growing emphasis on sustainability, with logistics providers exploring eco-friendly transportation methods and optimized routing to reduce carbon footprints, aligning with global environmental initiatives and influencing the Shipping Agent and Shipment Service segments. The integration of these diverse elements is crucial for unlocking the full economic potential of the agricultural sector, moving it from its current billion-dollar valuation to even greater heights.

The integrated logistics services for agricultural products market is being propelled by a powerful confluence of factors, primarily driven by the global imperative for enhanced food security and the burgeoning demand for efficient supply chains. The increasing global population, projected to further strain existing food production capacities, necessitates optimized logistics to minimize wastage and ensure timely delivery of essential commodities. Furthermore, the growing sophistication of consumer preferences, with an emphasis on quality, safety, and traceability, compels stakeholders to invest in integrated solutions that can provide end-to-end visibility and control over the supply chain. Technological advancements play a pivotal role, with the adoption of IoT, AI, and blockchain revolutionizing how agricultural products are stored, transported, and tracked. These technologies enable real-time monitoring, predictive analytics for demand forecasting, and automated processes, all contributing to greater efficiency and cost-effectiveness. Industry developments such as the expansion of international trade agreements and the rise of specialized agricultural products also fuel the demand for integrated logistics that can handle complex global movements and stringent regulatory requirements. The transformation of agricultural practices, moving towards more specialized and higher-value crops, further necessitates tailored logistics solutions.

Despite the promising growth trajectory, the integrated logistics services for agricultural products sector faces several significant challenges and restraints. One of the most pervasive issues is the inherent perishability of many agricultural commodities, requiring specialized handling, storage, and transportation that can be costly and complex to manage effectively across vast distances. The lack of standardized infrastructure, particularly in developing regions, coupled with inadequate cold chain facilities, poses a substantial hurdle to efficient logistics operations, impacting segments like Warehousing Services. Fluctuations in commodity prices and seasonal variations in supply and demand create significant forecasting difficulties, leading to potential overstocking or shortages that disrupt supply chains and impact profitability. Stringent and often fragmented regulatory frameworks across different countries, concerning food safety, import/export procedures, and phytosanitary measures, add layers of complexity and can lead to delays and increased costs. The high capital investment required for specialized equipment, such as refrigerated trucks and advanced warehousing systems, can be a deterrent for smaller players, limiting market entry. Furthermore, the reliance on manual processes in certain parts of the supply chain, coupled with a shortage of skilled labor proficient in logistics technology, can hinder the adoption of integrated and automated solutions. Cybersecurity threats targeting digital logistics platforms also represent a growing concern, necessitating robust security measures to protect sensitive data and operational integrity. The potential for disruptions due to natural disasters, geopolitical instability, and pandemics further adds to the inherent risks within the agricultural logistics ecosystem.

The Food Trade segment, within the broader context of integrated logistics services for agricultural products, is poised to be a significant dominator of the market, driven by robust global demand and evolving consumer behavior. This dominance is particularly pronounced in regions with well-established trade infrastructures and significant agricultural production.

While other segments like Warehousing Services and Application segments like Feed Processing will witness substantial growth, the interconnectedness of global food demand, the sheer scale of trade, and the strategic positioning of the Asia Pacific region, particularly China, make the Food Trade segment, amplified by the regional strengths, the undeniable dominator in the integrated logistics services for agricultural products market.

Several key catalysts are igniting growth in the integrated logistics services for agricultural products industry. The escalating global demand for food, driven by population growth and rising incomes, is a fundamental driver. Furthermore, an increasing focus on reducing post-harvest losses through efficient supply chain management is creating significant opportunities. Technological advancements, including the adoption of AI, IoT, and blockchain for enhanced tracking, temperature control, and inventory management, are revolutionizing operations and improving efficiency. The expansion of e-commerce for food products also necessitates more agile and responsive logistics networks.

This report offers an unparalleled and comprehensive analysis of the integrated logistics services for agricultural products market. It goes beyond surface-level data to provide deep dives into critical market dynamics, including a thorough examination of industry trends, the underlying forces driving market expansion, and the significant challenges and restraints that stakeholders must navigate. The report meticulously identifies and elaborates on the key regions and dominant market segments, offering strategic insights into areas of highest growth potential. With projections extending to 2033, this research equips businesses with the foresight needed to make informed strategic decisions and capitalize on emerging opportunities within this vital sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TAK Logistics, Express Freight Management, Canam Fresh, CTS International Logistics, Sinotrans, Circle Logistics, Beidahuang Logistics, China Grains & Logistics, Weishida Cold Chain Logistics Research, Co-Op Cold Chain And Logistics, Zhongwuchu International Freight Forwarding.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Integrated Logistics Services For Agricultural Products," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Integrated Logistics Services For Agricultural Products, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.