1. What is the projected Compound Annual Growth Rate (CAGR) of the Insurance for Musicians and Instruments?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Insurance for Musicians and Instruments

Insurance for Musicians and InstrumentsInsurance for Musicians and Instruments by Type (Instruments Insurance, Musicians Insurance), by Application (Individual, Group), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

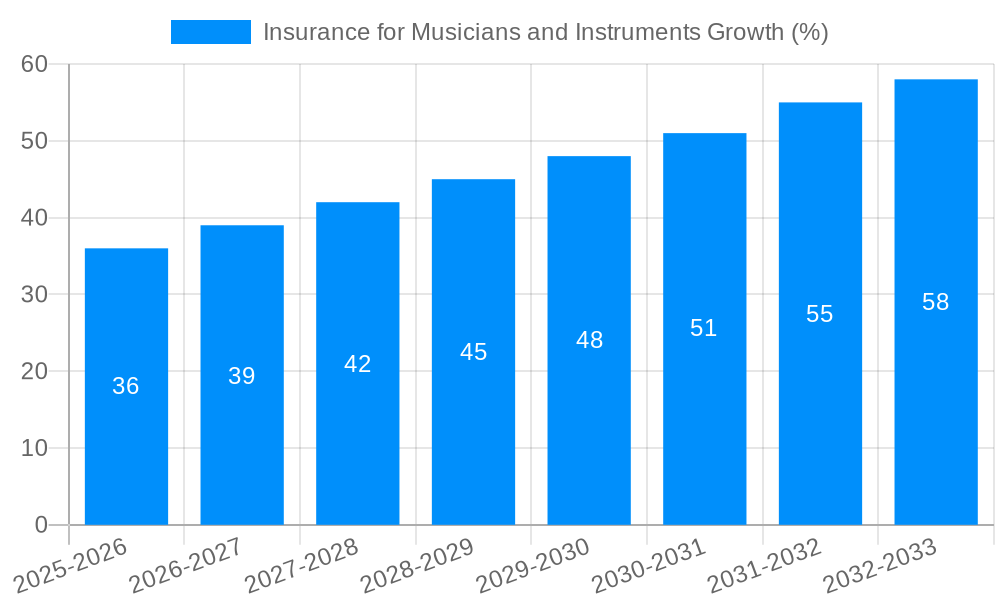

The market for insurance for musicians and musical instruments is experiencing significant growth, driven by increasing awareness of the risks associated with instrument damage, theft, and musician liability. The rising popularity of music as a profession and hobby, coupled with the increasing value of high-end instruments, fuels demand for specialized insurance solutions. This market, estimated at $500 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033, reaching an estimated $950 million by 2033. Key drivers include the expansion of the gig economy, a growing number of professional musicians relying on their instruments for income, and enhanced awareness of the financial implications of instrument loss or damage. Trends show a shift towards online platforms offering streamlined insurance processes and customized coverage options, catering to the diverse needs of individual musicians and bands.

Despite this growth, the market faces certain restraints. These include the relatively low awareness of dedicated musician's insurance among amateur musicians and the challenge of accurately assessing the value of unique or vintage instruments for insurance purposes. Market segmentation reflects variations in coverage based on instrument type (e.g., stringed, wind, percussion), musician status (amateur vs. professional), and geographical location. Leading companies operating in this niche market include Aon Plc, AXA Insurance Ltd., and Allianz Insurance plc, among others, reflecting a competitive landscape with opportunities for both established players and specialized insurance providers. Future growth will likely depend on innovation in risk assessment methodologies, the development of tailored insurance products, and effective marketing campaigns to reach a wider audience of musicians.

The insurance market for musicians and their instruments is experiencing significant growth, projected to reach multi-million dollar valuations by 2033. This burgeoning sector reflects a confluence of factors, including the rising professionalization of the music industry, increased touring and performance activity, and a growing awareness among musicians of the risks associated with instrument damage, loss, and liability. The historical period (2019-2024) saw a steady increase in demand, driven partly by the increasing value of vintage and high-end instruments. The estimated market value for 2025 is already substantial, exceeding expectations set in previous years. This upward trend is expected to continue throughout the forecast period (2025-2033), propelled by technological advancements, such as improved instrument tracking systems and online insurance platforms, offering greater convenience and accessibility. Furthermore, the increasing number of musicians relying on their instruments as their primary income source further underscores the need for comprehensive insurance coverage. The market is witnessing a diversification of policy offerings, moving beyond basic damage coverage to incorporate liability protection, loss of income, and even medical expenses related to performance injuries. This evolution indicates a sophisticated understanding of the unique needs and risks faced by musicians across various genres and career stages. The market is also seeing a growing demand for specialized insurance catered towards specific instruments, like high-value violins or delicate keyboards. Competition is increasing, with both established insurance providers and niche companies entering the market, resulting in greater innovation and competitive pricing. Overall, the trend points to a robust and expanding market with a bright future for both insurers and musicians.

Several key factors contribute to the growth of the insurance market for musicians and instruments. Firstly, the increasing professionalization of the music industry means more musicians rely on their instruments as their primary source of income. This dependency highlights the critical need for robust insurance to mitigate financial losses from instrument damage, theft, or loss. Secondly, the rise of gig economy platforms and increased touring activity expose musicians to a higher risk of accidents, instrument damage, and liability claims. The need for comprehensive protection encompassing these scenarios is driving demand. Thirdly, the growing value of vintage and high-end instruments further intensifies the need for specialized insurance coverage that accounts for their elevated worth. Furthermore, improved awareness among musicians regarding the benefits of insurance and the availability of tailored policies are playing a significant role. The increasing accessibility of online insurance platforms and the development of user-friendly policies have simplified the purchasing process. Finally, the proactive involvement of industry associations and music schools in educating musicians about insurance options and the potential risks associated with their profession is further driving market expansion. These factors collectively contribute to a robust and expanding market.

Despite the significant growth potential, the insurance market for musicians and instruments faces certain challenges. One major hurdle is the difficulty in accurately assessing the risk associated with individual musicians and instruments. The variability in performance locations, transportation methods, and instrument types makes risk assessment complex. This can lead to higher premiums or limited coverage options for some musicians. Another significant challenge is the lack of standardized valuation methods for musical instruments, particularly unique or antique instruments. Establishing a fair and consistent valuation system is crucial for accurate claims settlement. Furthermore, the prevalence of fraud and the challenge of verifying instrument ownership and authenticity pose difficulties for insurers. The relatively high cost of insurance can be a barrier for entry for many musicians, particularly those starting their careers or working on limited budgets. Finally, a lack of widespread awareness among musicians about the availability and benefits of specialized insurance remains a challenge. Effective marketing and educational initiatives are needed to reach a wider audience and demystify the insurance process. Overcoming these challenges is crucial for sustainable growth in this market.

The market for insurance for musicians and instruments shows strong growth potential across various regions and segments. While precise market share data is proprietary to individual insurance companies, several trends point towards key areas:

North America (USA and Canada): The large and established music industry in North America, coupled with a high concentration of professional musicians, positions it as a key market. The developed insurance sector and a strong understanding of risk management contribute to its dominance. The presence of many major insurance companies and a high level of awareness among musicians significantly contributes to market penetration.

Europe (UK, Germany, France): Europe also boasts a rich musical heritage and a significant number of professional musicians, supporting market expansion within this region. The growing popularity of online insurance platforms provides easier access to policies. Different European countries possess unique regulatory environments and cultural nuances impacting policy design and market dynamics. Nevertheless, consistent growth is projected across most of Western Europe.

Asia (Japan, South Korea): While comparatively smaller, the growth of the Asian market is notable, spurred by the increasing number of professional musicians and expanding music industries in key Asian countries. Technological advancements are streamlining insurance access.

High-Value Instrument Segment: The segment focusing on high-value instruments (e.g., violins, pianos, vintage guitars) commands premium pricing and significant market attention due to the substantial financial risk involved. Specialized insurance products tailored to these instruments address a distinct market need.

Professional Musicians Segment: Professional musicians, whether solo performers or part of bands and orchestras, represent a key segment due to their higher dependence on their instruments for livelihood. This sector is more likely to invest in comprehensive coverage including liability and income protection.

In summary, while North America currently leads, other regions and segments are demonstrating significant growth potential and future dominance is likely to be diversified.

Several factors are accelerating growth. The rising professionalization of the music industry and the increasing use of online platforms for bookings and payments are creating a more interconnected and transparent market, driving the need for insurance. Improved awareness of the risks involved in owning and using high-value instruments is also pushing musicians toward securing suitable protection. The development of innovative insurance products, tailored specifically to musicians’ needs, along with technological advancements that simplify the buying process, are acting as significant growth catalysts.

The market for insurance for musicians and instruments is experiencing a period of rapid growth, driven by increased professionalization within the music industry, greater awareness of risks, and the introduction of innovative insurance products and technologies. The market is poised for continued expansion, with key opportunities existing in high-value instrument segments and geographically within regions with strong music industries. The competitive landscape is dynamic, with both established players and new entrants driving innovation and diversification of offerings.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Aon Plc, AXA Insurance Ltd., Assetsure, Aston Lark., Anderson Musical Instrument Insurance Solutions, LLC, Allianz Insurance plc, Benzinga, Bajaj Finance Limited, EBM, Erie Indemnity Co., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Insurance for Musicians and Instruments," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Insurance for Musicians and Instruments, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.