1. What is the projected Compound Annual Growth Rate (CAGR) of the Inflight Shopping?

The projected CAGR is approximately 4.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Inflight Shopping

Inflight ShoppingInflight Shopping by Type (Full Service, Low Cost), by Application (Adults, Children), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

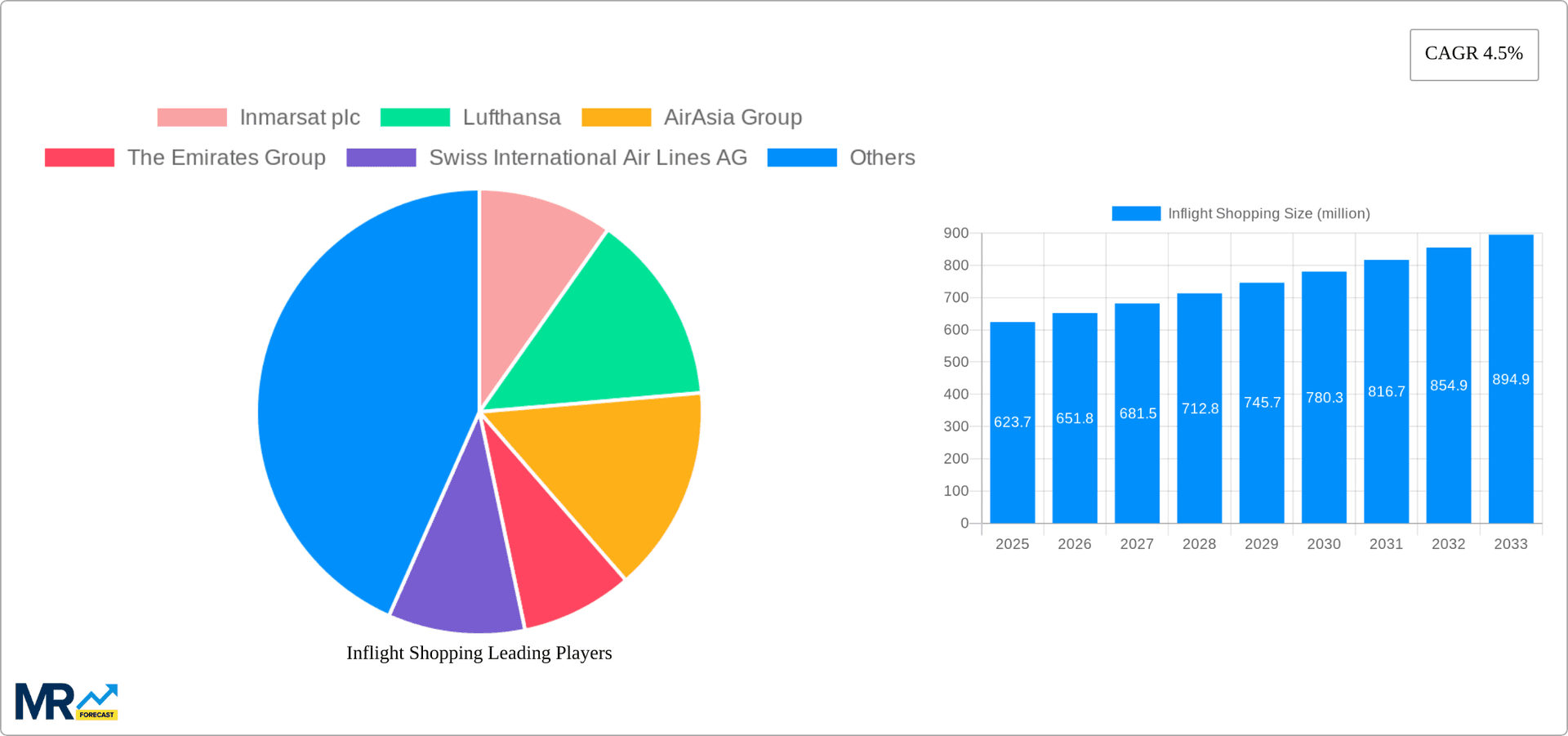

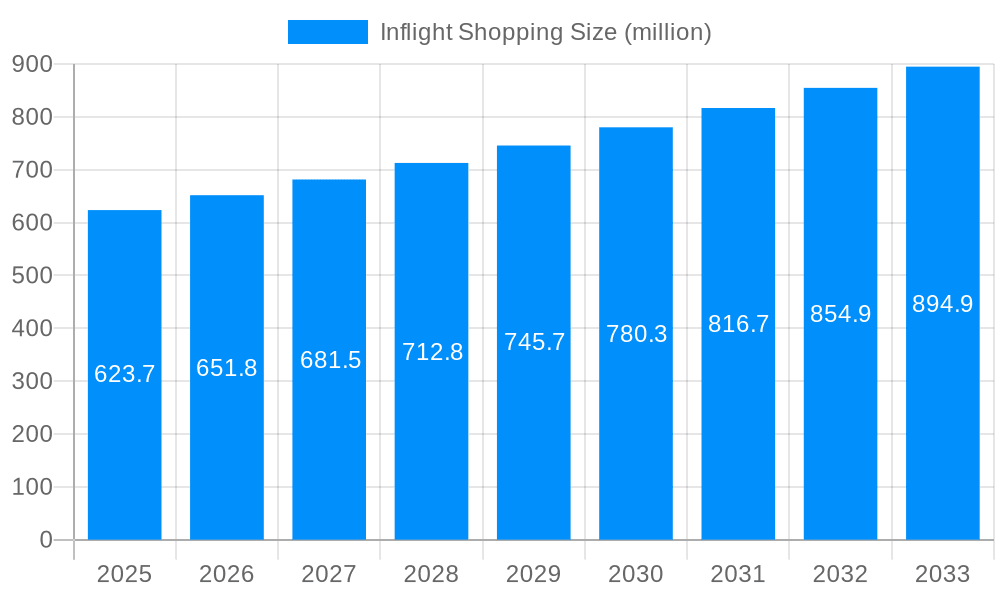

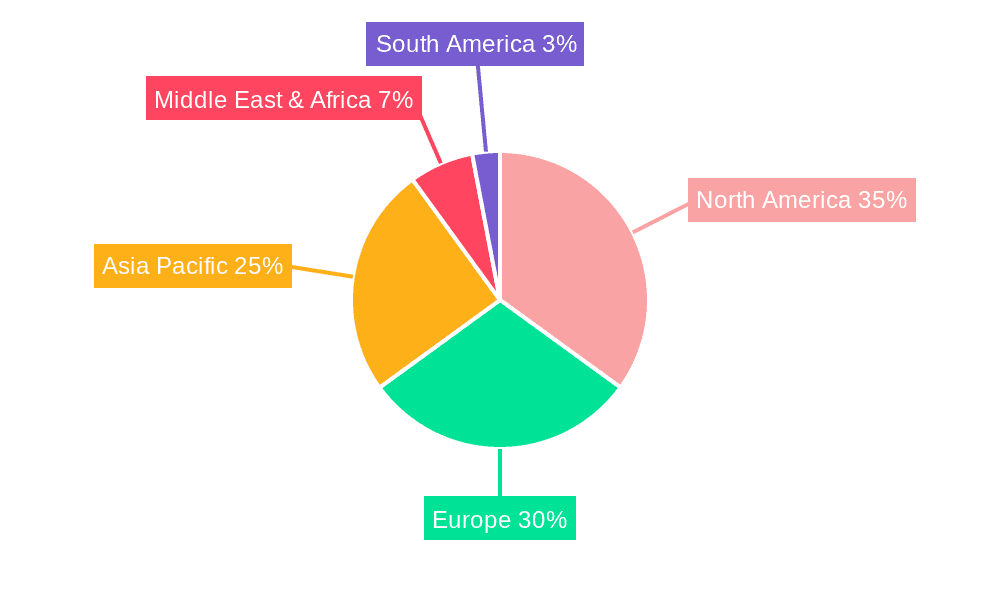

The inflight shopping market, valued at $623.7 million in 2025, is projected to experience robust growth, driven by several key factors. The increasing number of air travelers, coupled with a rising disposable income among passengers, fuels demand for convenient in-flight purchases. The expansion of e-commerce platforms and mobile payment options within the airline industry further enhances the accessibility and appeal of inflight shopping. Furthermore, airlines are continuously innovating their offerings, introducing personalized experiences and curated product selections tailored to passenger preferences, leading to increased conversion rates. This trend towards enhanced customer experience and personalized offerings, alongside the adoption of advanced technology like in-seat entertainment systems integrated with shopping platforms, promises significant market expansion. The market segmentation, encompassing full-service and low-cost carriers catering to adult and children's preferences, allows for targeted marketing strategies and customized product portfolios, maximizing revenue generation across different passenger demographics. The competitive landscape, with established players like Inmarsat, Lufthansa, and AirAsia, alongside emerging startups, indicates a dynamic and evolving market poised for significant growth in the coming years. Regional variations will likely persist, with North America and Europe maintaining leading positions due to high air passenger traffic and established infrastructure. However, rapid growth is anticipated in the Asia-Pacific region driven by the burgeoning middle class and increasing air travel within the region.

The projected Compound Annual Growth Rate (CAGR) of 4.5% indicates a steady and sustained expansion of the inflight shopping market from 2025 to 2033. This growth trajectory is expected to be influenced by factors such as technological advancements in in-flight connectivity, enabling smoother and more efficient transactions, alongside an increasing focus on sustainability and ethical sourcing of products. Airlines are adapting their strategies to meet evolving consumer preferences, offering a wider range of products including duty-free goods, personalized amenities, and even virtual reality experiences linked to purchases. This holistic approach, combining convenience with innovative offerings, positions the inflight shopping market for significant long-term success. Addressing challenges, such as fluctuating fuel costs impacting airline profitability and the influence of economic downturns on consumer spending, will remain crucial for sustaining this growth. Nonetheless, the overall outlook for the inflight shopping market is positive, with substantial opportunities for expansion and innovation.

The inflight shopping market, valued at several billion units in 2024, is poised for significant expansion throughout the forecast period (2025-2033). This growth is driven by a confluence of factors, including the increasing number of air travelers globally, the evolving preferences of passengers towards convenience and personalized experiences, and the innovative strategies employed by airlines and inflight retailers. The historical period (2019-2024) witnessed fluctuating trends influenced by global events such as the COVID-19 pandemic, which temporarily disrupted air travel and inflight shopping activities. However, the market is showing strong signs of recovery and exceeding pre-pandemic levels in many regions. The base year (2025) serves as a pivotal point, marking the beginning of a period of robust growth fueled by technological advancements, targeted marketing campaigns, and a wider range of high-quality products offered onboard. The shift towards digitalization is noteworthy, with mobile ordering and contactless payment systems becoming increasingly prevalent, enhancing the overall passenger experience and driving sales. The estimated year (2025) projects substantial market value growth compared to previous years. This is largely attributable to an anticipated increase in passenger numbers, particularly in the Asia-Pacific and Middle East regions, which are anticipated to demonstrate strong demand for inflight retail offerings. Analysis of data from 2019-2024 indicates strong regional variations in market performance, highlighting the need for airlines and retailers to tailor their strategies to specific regional consumer preferences and cultural norms. The study period (2019-2033) provides a comprehensive overview of market dynamics, allowing for informed forecasting and strategic planning by key stakeholders in the inflight shopping industry. The forecast period highlights potential for significant market expansion driven by technological advancements, personalized marketing, and sustainable practices.

Several key factors are propelling the growth of the inflight shopping market. Firstly, the steadily increasing number of air passengers worldwide fuels demand. As more people travel by air, the potential customer base for inflight shopping expands proportionately. Secondly, the rise of e-commerce and digital technologies is transforming the inflight shopping experience. Mobile ordering, personalized recommendations, and seamless payment systems enhance convenience for passengers, leading to increased sales. Thirdly, airlines are actively investing in enhancing their inflight shopping offerings. This includes expanding product ranges, introducing premium brands, and partnering with prominent retailers to offer passengers a more compelling shopping experience. Fourthly, innovative marketing strategies, including targeted advertising and loyalty programs, are effective in stimulating inflight purchases. Airlines and retailers are employing data-driven approaches to better understand passenger preferences and tailor their offerings accordingly. Finally, the growing focus on personalization in the travel and retail sectors is driving inflight shopping growth. Passengers value experiences tailored to their individual needs and preferences, and this trend is positively impacting inflight sales.

Despite the positive growth trajectory, the inflight shopping sector faces several challenges. Fluctuations in air travel due to economic downturns or unforeseen global events, such as pandemics, significantly impact sales. Maintaining a diverse and appealing product range while managing inventory and logistics in the unique environment of an aircraft presents logistical complexities and adds to operational costs. Competition from other in-flight services and entertainment options for passengers can divert attention from shopping. Security regulations and limitations on the types of goods that can be sold onboard affect product selection and profitability. Moreover, passenger concerns about pricing, limited product selection, and payment processing issues can deter purchases. Finally, achieving cost-effective distribution and managing supply chain complexities within the confines of the aviation industry pose ongoing challenges for retailers.

The full-service airline segment is expected to dominate the inflight shopping market. This is largely due to the fact that full-service airlines typically cater to a higher-spending passenger demographic, which tends to be more open to inflight purchases.

The adult segment represents a significantly larger market than the children's segment. Adults represent a larger percentage of air travelers and generally possess higher disposable incomes. Marketing strategies tailored to adults' preferences and purchasing power are more widely implemented by airlines and retailers.

The inflight shopping industry is experiencing growth fueled by several factors. Technological advancements, such as mobile ordering and contactless payments, enhance convenience and drive sales. Strategic partnerships between airlines and retailers expand product variety and improve brand perception. Effective marketing campaigns, including personalized recommendations, targeted advertisements, and loyalty programs, stimulate purchases and boost revenue. A growing emphasis on providing a personalized and enhanced passenger experience also creates more positive shopping environments.

This report provides a comprehensive analysis of the inflight shopping market, covering historical data, current trends, and future projections. It identifies key growth drivers, challenges, and opportunities, focusing on leading players and regional variations. This in-depth study provides valuable insights for airlines, retailers, and investors seeking to understand and participate in this dynamic market segment. The report's detailed segmentation and forecasting allow for informed strategic decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 4.5%.

Key companies in the market include Inmarsat plc, Lufthansa, AirAsia Group, The Emirates Group, Swiss International Air Lines AG, Thomas Cook Airlines Ltd., Singapore Airlines Limited, EasyJet Airline Company Limited, .

The market segments include Type, Application.

The market size is estimated to be USD 623.7 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Inflight Shopping," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Inflight Shopping, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.