1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Energy Audit Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Industrial Energy Audit Service

Industrial Energy Audit ServiceIndustrial Energy Audit Service by Type (Planning and Organization, On-site Diagnosis, Current Situation and Energy Saving Analysis), by Application (Industrial Enterprises, Public Institutions, State Administration), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

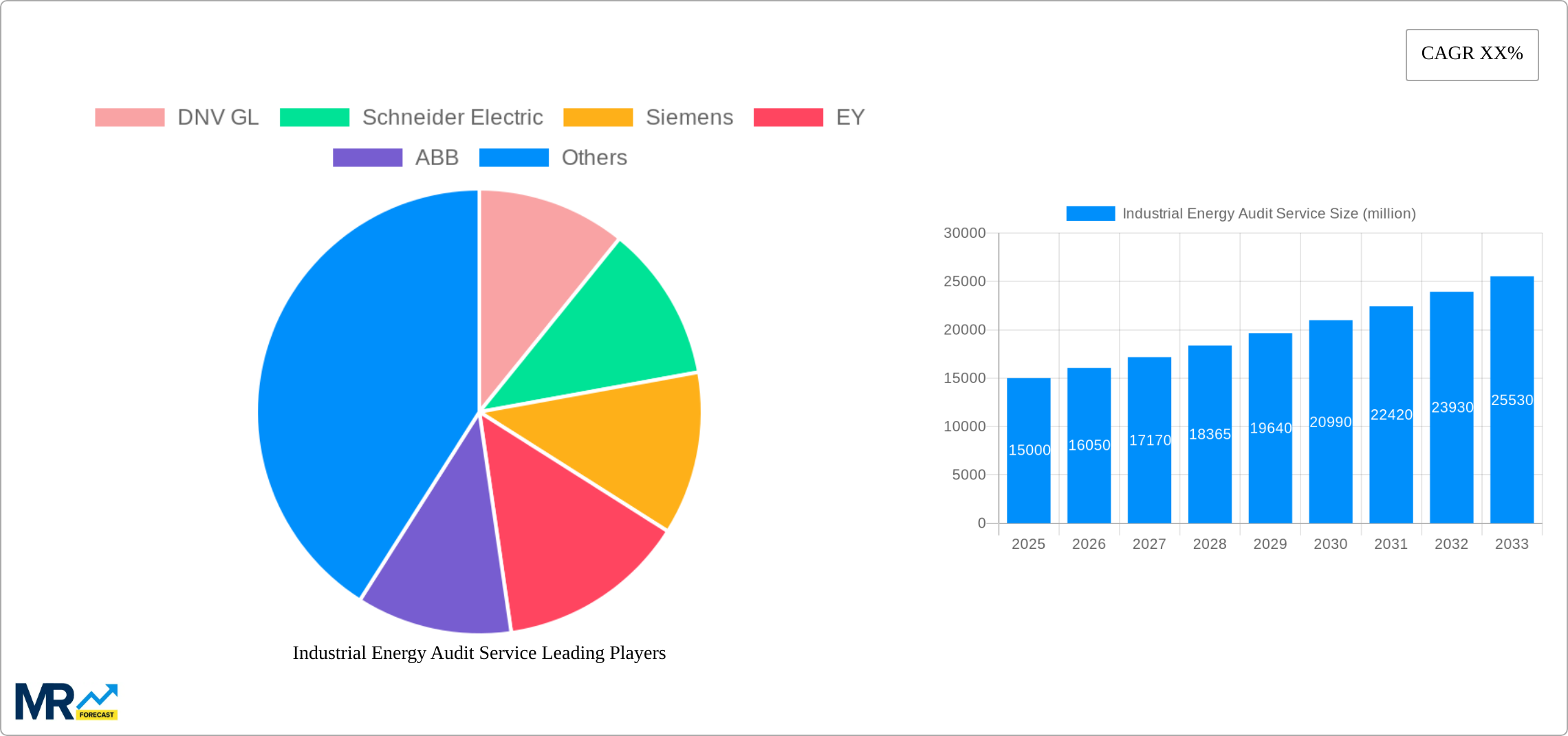

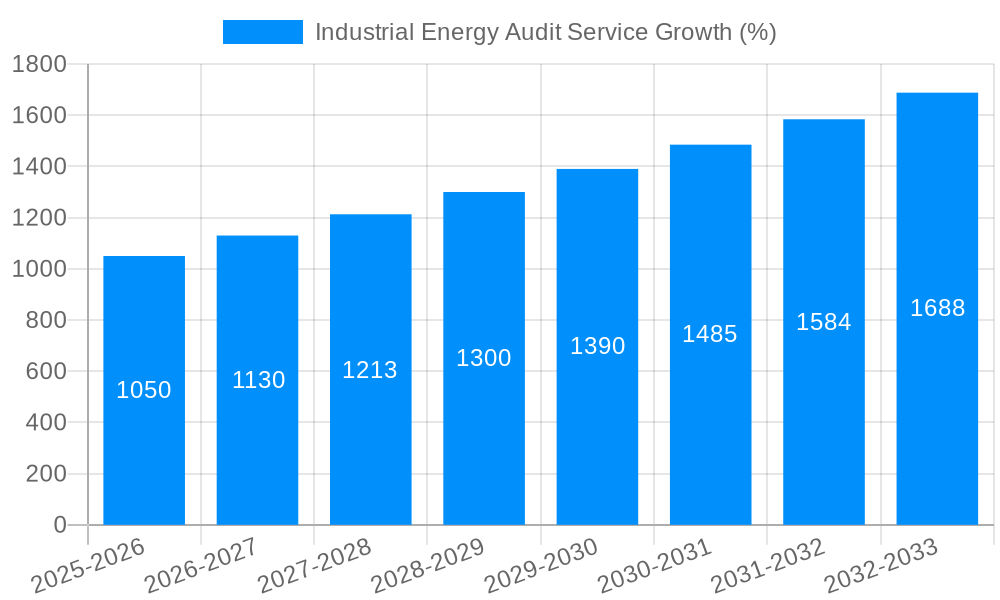

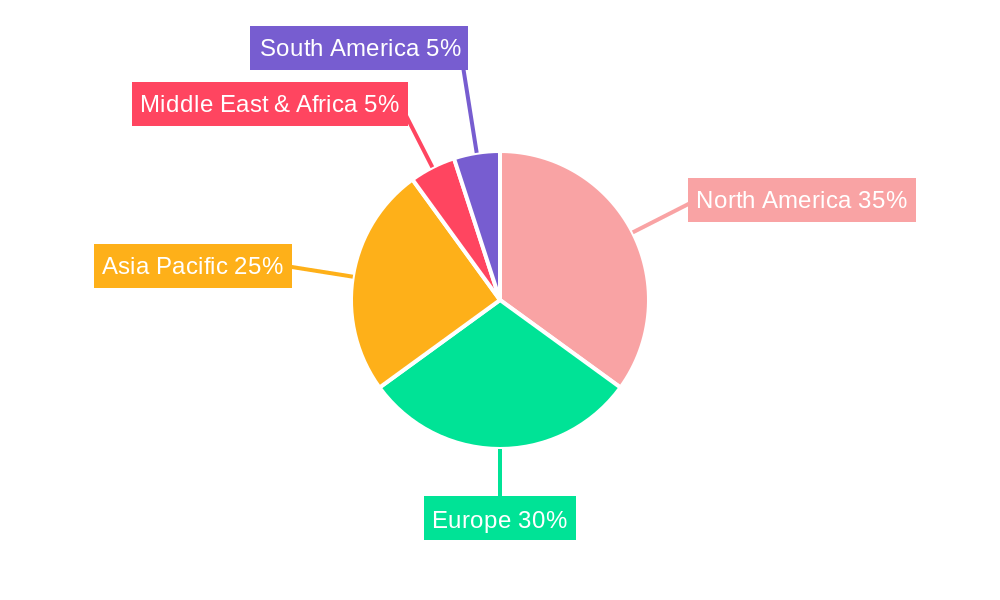

The Industrial Energy Audit Service market is experiencing robust growth, driven by increasing energy costs, stringent environmental regulations, and the growing adoption of Industry 4.0 technologies. The market, currently valued at approximately $15 billion (estimated based on typical market sizes for related services and provided context), is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7% over the forecast period (2025-2033). Key drivers include government initiatives promoting energy efficiency, rising awareness of carbon footprint reduction among industrial enterprises, and the increasing availability of sophisticated energy audit technologies. Significant market segments include planning and organizational services, on-site diagnostics, and current situation/energy-saving analysis, with industrial enterprises, public institutions, and state administrations representing the major application areas. North America and Europe currently hold the largest market share, but significant growth potential exists in the Asia-Pacific region, fueled by rapid industrialization and increasing energy consumption in countries like China and India.

The competitive landscape is characterized by a mix of large multinational consulting firms like DNV GL, Siemens, and EY, alongside specialized energy audit providers. The market is witnessing increasing consolidation through mergers and acquisitions, as companies strive to expand their service offerings and geographical reach. The key restraints include the high initial investment costs associated with energy audits, a lack of skilled professionals, and challenges in accessing reliable data for accurate assessments. However, advancements in data analytics, the development of user-friendly energy management software, and increasing government subsidies are mitigating these constraints, further propelling market expansion. Over the forecast period, the market is expected to witness significant innovation in energy audit methodologies, the increasing integration of AI and machine learning for more precise assessments, and the rise of energy performance contracting models.

The industrial energy audit service market is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. Driven by increasing energy costs, stringent environmental regulations, and a global push for sustainability, businesses across various sectors are increasingly investing in energy efficiency improvements. The market's historical period (2019-2024) witnessed a steady rise in demand, with significant acceleration anticipated during the forecast period (2025-2033). The base year 2025 provides a crucial benchmark to understand the current market dynamics and project future growth. Key market insights reveal a shift towards comprehensive, data-driven audits that not only identify energy waste but also offer tailored solutions for optimization. This includes integrating advanced technologies like IoT sensors, AI-powered analytics, and building information modeling (BIM) to enhance accuracy and efficiency. Furthermore, the market is witnessing a growing demand for specialized audits tailored to specific industrial sectors, considering their unique energy consumption patterns and operational requirements. The increasing awareness of carbon footprint reduction among industrial enterprises and public institutions is also a key driver of market expansion. The rise of energy performance contracting (EPC) models, where service providers finance energy efficiency upgrades and share in the subsequent savings, further fuels market growth. This collaborative approach reduces the financial burden on companies while ensuring tangible energy efficiency gains. Competition among service providers is intensifying, leading to innovative service offerings and competitive pricing. The overall market trend indicates a strong positive trajectory with substantial potential for growth in the coming years, driven by a confluence of economic, environmental, and technological factors.

Several factors are significantly driving the growth of the industrial energy audit service market. Firstly, the ever-increasing cost of energy is compelling industries to actively seek ways to reduce consumption. This financial incentive is a major driver, pushing businesses to invest in comprehensive audits to identify and address energy inefficiencies. Secondly, stricter environmental regulations and growing carbon emission reduction targets are placing immense pressure on industries to improve their environmental performance. Energy audits are becoming essential for compliance and demonstrating corporate social responsibility. Thirdly, technological advancements are continuously enhancing the effectiveness and accuracy of energy audits. The integration of advanced technologies like AI and IoT is enabling more detailed analysis, identification of previously undetectable energy losses, and the development of more precise optimization strategies. Finally, the emergence of energy performance contracting (EPC) models is further stimulating market growth by mitigating financial risks for businesses and facilitating greater adoption of energy efficiency measures. This innovative financing method allows companies to implement improvements without significant upfront investment, sharing the long-term savings with the service providers.

Despite the significant growth potential, the industrial energy audit service market faces certain challenges. The high initial cost of conducting comprehensive audits can be a deterrent for smaller companies with limited budgets. Finding and retaining qualified energy auditors with expertise in various industrial processes and technologies is another hurdle. The complexity of industrial energy systems often necessitates specialized knowledge and advanced analytical tools, making it difficult to ensure consistent quality of service across all providers. Furthermore, securing accurate and reliable data for the audit process can be challenging, particularly in older facilities with outdated or incomplete records. Data privacy concerns and the security of sensitive operational information must also be carefully managed. Finally, the need to establish standardized methodologies and reporting frameworks to ensure consistency and comparability of audit results across different providers is an ongoing challenge for market development and acceptance. Addressing these challenges through collaborations between industry stakeholders, standardization initiatives, and investment in training programs is vital for the sustainable growth of the market.

The industrial energy audit service market is geographically diverse, with significant growth projected across various regions. However, North America and Europe are anticipated to dominate the market, driven by stringent environmental regulations, robust industrial infrastructure, and increased awareness of energy efficiency. Within these regions, certain segments exhibit higher growth potential.

Industrial Enterprises: This segment constitutes the largest share of the market due to the significant energy consumption in industrial processes. Manufacturing, chemical processing, and food production are among the key sub-sectors driving demand. The focus here is on identifying and improving energy efficiency in machinery, HVAC systems, and process optimization.

Planning and Organization: This segment is crucial in setting the stage for successful energy audits. Proper planning, data collection strategies, and project management are critical to maximizing the impact and return on investment. The growing complexity of energy audits is increasing the demand for experienced professionals in this area. This is leading to greater specialization and the adoption of advanced project management tools and techniques.

Current Situation and Energy Saving Analysis: This segment involves detailed analysis of energy consumption data, identification of energy waste areas, and quantification of potential savings. The increasing availability of data analytics tools and the adoption of sophisticated modeling techniques are driving growth in this area. Companies are increasingly looking for actionable insights and detailed recommendations to improve their energy performance.

On-site Diagnosis: This segment involves physical inspections of industrial facilities to identify potential energy inefficiencies. This hands-on approach is essential for accurate assessment and effective identification of energy waste sources which are not always apparent from data analysis alone. The advancements in non-invasive inspection technologies and the availability of qualified technicians are increasing the precision and efficiency of on-site diagnosis, which, in turn, contributes to market growth.

In summary, the combination of the strong regulatory environment, focus on sustainability, and the growing needs for efficient operational processes will drive the substantial growth of the industrial energy audit service industry in North America and Europe. The segments focused on efficient planning, detailed analysis, and on-site diagnosis are particularly poised for significant expansion. The demand from industrial enterprises will continue to be a cornerstone of market growth.

The industrial energy audit service industry is experiencing rapid growth spurred by several key catalysts. Government incentives and subsidies for energy efficiency improvements are significantly lowering the financial barriers for companies to undertake audits. Simultaneously, the rising awareness among corporations of their environmental responsibility and the positive impact of energy efficiency on their bottom line are driving increased demand for professional audit services. Moreover, technological advancements, such as the Internet of Things (IoT) and artificial intelligence (AI), offer more efficient and accurate energy analysis, leading to further market expansion.

This report provides a comprehensive overview of the industrial energy audit service market, encompassing historical data, current market dynamics, and future projections. The analysis delves into key market trends, driving factors, challenges, and competitive landscape. Detailed segment-wise analysis across geography and application offers valuable insights into the market's growth potential. The report further identifies key players and their strategic initiatives. This information equips businesses and investors with the knowledge needed to make informed decisions in this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include DNV GL, Schneider Electric, Siemens, EY, ABB, Bureau Veritas, KPMG, SGS, Trinity Consultants, Inc., Tate Engineering, Inc., McGill Hose & Coupling, Inc., Dynamic Commissioning Solutions, Inc. (DCSi), .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Industrial Energy Audit Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Industrial Energy Audit Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.