1. What is the projected Compound Annual Growth Rate (CAGR) of the In-Flight Wi-Fi?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

In-Flight Wi-Fi

In-Flight Wi-FiIn-Flight Wi-Fi by Application (/> Narrow Body Aircraft, Wide Body Aircraft, Very Large Aircraft, Business Jet), by Type (/> Hardware, Service), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

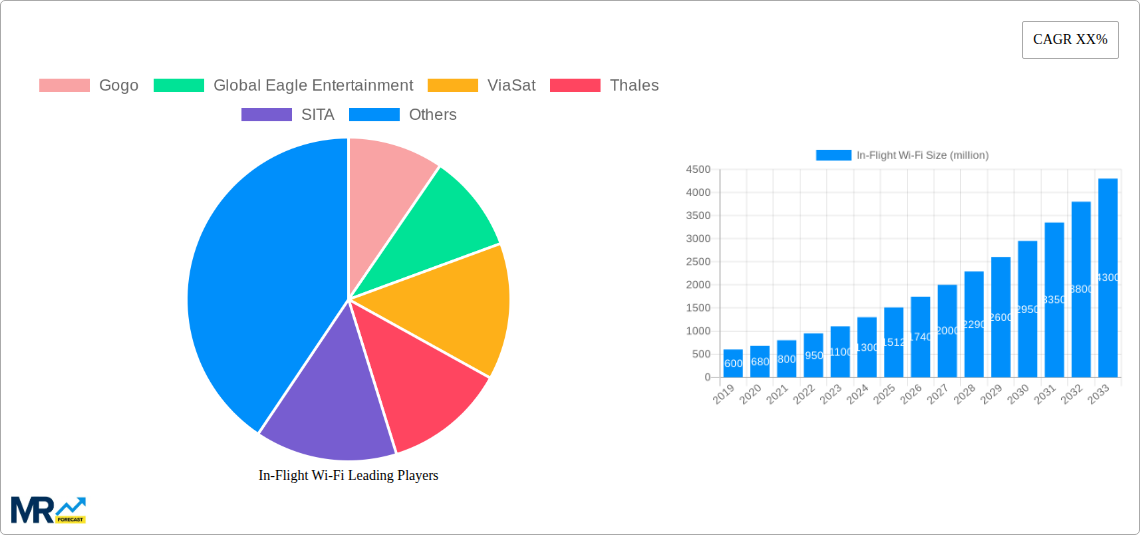

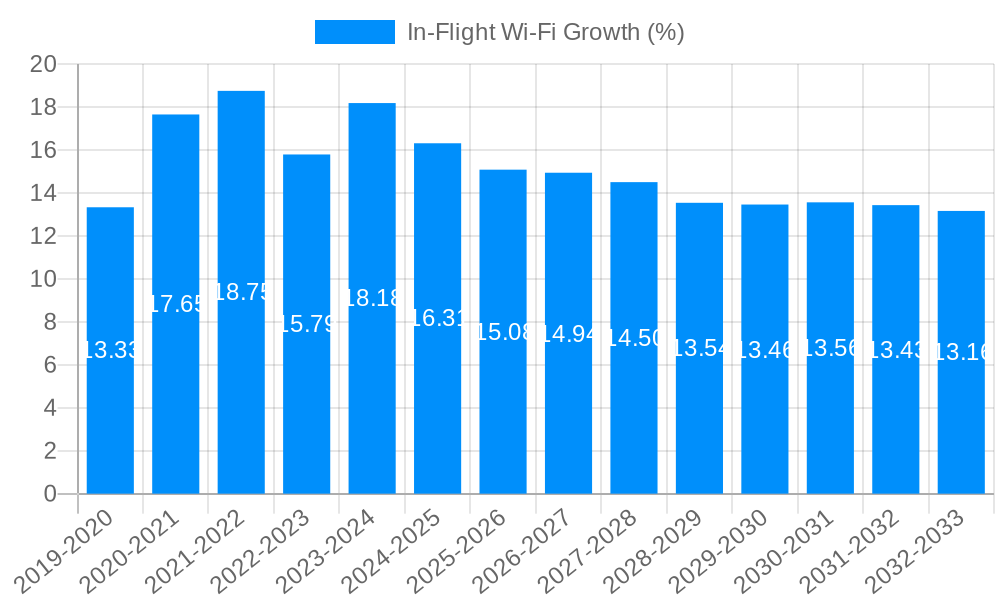

The In-Flight Wi-Fi market is poised for significant expansion, projected to reach a substantial market size of $1512 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 15%. This robust growth is primarily fueled by escalating passenger demand for seamless connectivity during flights, transforming the in-flight experience from a luxury to an expectation. Airlines are actively investing in upgrading their connectivity infrastructure to retain and attract customers, leading to increased adoption of advanced satellite and air-to-ground (ATG) solutions. The increasing penetration of personal electronic devices onboard and the growing reliance on cloud-based services for entertainment, productivity, and communication are further accelerating market momentum. This dynamic environment presents a lucrative opportunity for technology providers and service operators to innovate and cater to the evolving needs of air travelers.

The market segmentation reveals a strong emphasis on both Hardware and Service segments, indicating a balanced growth trajectory driven by the installation of new systems and the ongoing provision of connectivity services. Within applications, Narrow Body Aircraft, Wide Body Aircraft, and Business Jets are the primary beneficiaries of in-flight Wi-Fi deployment, reflecting the high volume of travel on these aircraft types. Key market drivers include the expansion of low-cost carriers seeking to differentiate through connectivity offerings, the integration of sophisticated entertainment systems, and the growing need for real-time operational data transmission for airlines. However, challenges such as the high cost of installation and maintenance, regulatory hurdles, and the complexity of managing bandwidth effectively continue to present restraints, necessitating continuous innovation and strategic partnerships within the industry to ensure sustained and profitable growth in the In-Flight Wi-Fi sector.

This comprehensive report delves into the dynamic and rapidly evolving In-Flight Wi-Fi market, providing an in-depth analysis of its current landscape and future trajectory. Spanning the historical period of 2019-2024 and extending through an extensive forecast period of 2025-2033, with a base year of 2025, this study offers critical insights into market trends, driving forces, challenges, and growth opportunities. The report quantifies market values in the millions, offering a robust understanding of economic performance and investment potential.

The In-Flight Wi-Fi market is experiencing a period of unprecedented growth and innovation, driven by escalating passenger expectations and airlines' strategic imperative to enhance the onboard experience. During the study period of 2019-2033, we anticipate a significant expansion of connectivity services across all aircraft segments. The historical period (2019-2024) witnessed a foundational shift from basic internet access to more robust and reliable connectivity, often tiered with varying speeds and data allowances. Looking ahead to the forecast period (2025-2033), passenger demand for seamless, high-speed internet capable of supporting multiple devices, video streaming, and real-time communication will become the industry standard. This trend is particularly pronounced in the narrow-body aircraft segment, which constitutes the largest portion of global fleets, as airlines increasingly equip these aircraft with advanced Wi-Fi solutions to meet the needs of both leisure and business travelers. The base year of 2025 marks a crucial juncture where subscription-based models are expected to mature, alongside a growing adoption of free, albeit potentially bandwidth-limited, Wi-Fi offerings designed to drive passenger satisfaction and ancillary revenue. Furthermore, the integration of Wi-Fi with other onboard entertainment and service platforms will become more sophisticated, transforming the cabin experience into a connected ecosystem. The market will also see a gradual improvement in the capacity and reliability of satellite-based solutions, particularly for long-haul and wide-body aircraft, enabling a more consistent and high-quality connection across vast geographical distances. The increasing commoditization of basic connectivity is also likely to fuel a competitive landscape where differentiation will come from superior speed, innovative service offerings, and seamless integration with passenger applications. The overall trend points towards a future where In-Flight Wi-Fi is not just a luxury but an essential component of air travel, directly influencing passenger choice and airline competitiveness, with market values projected to reach several hundred million dollars by 2025 and continue their upward trajectory. The increasing adoption of 5G technology in ground infrastructure and its eventual integration into airborne systems will further revolutionize the speed and capacity of in-flight connectivity in the later years of the forecast period.

The expansion of the In-Flight Wi-Fi market is fueled by a confluence of powerful driving forces, each contributing to its robust growth trajectory. Foremost among these is the rapidly evolving passenger expectation for connectivity, mirroring their in-flight experience on the ground. As the world becomes increasingly interconnected, travelers, whether for business or leisure, demand seamless access to the internet to stay productive, entertained, and connected with loved ones. This fundamental shift in consumer behavior is compelling airlines to prioritize Wi-Fi as a key differentiator. Furthermore, airlines are strategically leveraging In-Flight Wi-Fi as a significant revenue generation opportunity. Beyond basic internet access, advanced connectivity enables the sale of premium services such as high-definition video streaming, gaming, and e-commerce platforms, directly contributing to ancillary revenue streams. The evolution of hardware and service providers has also been instrumental. Significant advancements in satellite technology, including the development of High Throughput Satellites (HTS), coupled with the increasing availability of robust antenna technologies, have dramatically improved the speed, reliability, and capacity of In-Flight Wi-Fi, making it a viable and attractive offering. Industry developments such as the growing ecosystem of content providers and application developers who are tailoring their services for the onboard environment further enhance the value proposition for passengers. The competitive landscape among In-Flight Wi-Fi providers also drives innovation and cost-effectiveness, pushing for more advanced solutions at competitive price points. The study period of 2019-2033, with a base year of 2025, highlights how these forces are collectively shaping a market poised for substantial growth, with estimated market values in the hundreds of millions. The increasing adoption of the modularity in Wi-Fi hardware, allowing for easier upgrades and integration of new technologies, also plays a crucial role in sustaining this growth by reducing the long-term costs for airlines.

Despite its promising growth, the In-Flight Wi-Fi market is not without its significant challenges and restraints, which can impede its full potential. A primary hurdle remains the substantial capital investment required for airlines to equip their fleets with the necessary hardware, including antennas, modems, and cabin infrastructure. The cost of installation, ongoing maintenance, and technology upgrades can be prohibitive, particularly for smaller carriers or those operating older fleets. Furthermore, the complexity of integrating new Wi-Fi systems with existing aircraft avionics and IT infrastructure presents technical and operational challenges. Regulatory approvals and certification processes can be time-consuming and add to the overall project timeline and cost. Spectrum availability and potential interference issues, especially for air-to-ground solutions, can also impact service reliability and performance. Cybersecurity threats are another growing concern, as connected aircraft present a larger attack surface for malicious actors. Ensuring robust data protection and privacy for passengers is paramount and requires significant investment in security measures. The continuous evolution of technology also presents a challenge, as airlines must constantly consider the obsolescence of current systems and plan for future upgrades, leading to a perpetual investment cycle. The operational demands of maintaining a consistent and high-quality connection across diverse flight paths, altitudes, and weather conditions remain a technical challenge. Competition among service providers, while beneficial in driving innovation, can also lead to price wars that may impact profitability for some players. The study period of 2019-2033 and the base year of 2025 indicate that these challenges, while present, are being actively addressed through technological advancements and strategic partnerships, but they will continue to shape the market's development and growth, with market values in the millions needing careful consideration of these factors. The ongoing evolution of air traffic management systems and their potential interplay with future wireless communication technologies also presents a dynamic challenge that requires continuous adaptation and collaboration.

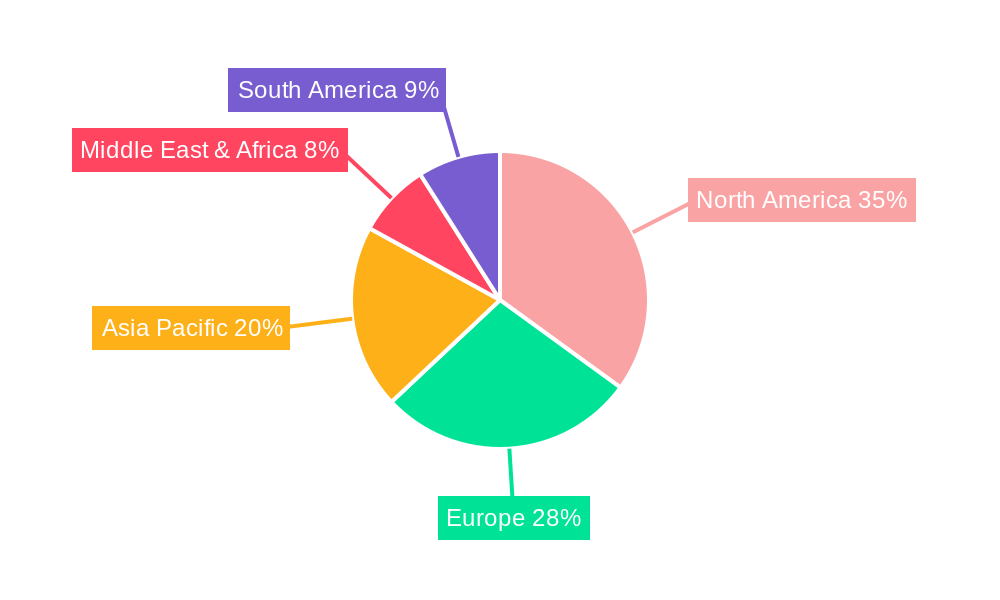

The In-Flight Wi-Fi market is poised for significant regional and segment-specific dominance, with several key players and areas expected to lead the charge.

North America is anticipated to remain a dominant region, driven by a mature aviation market with a high propensity for technological adoption. Airlines in this region have historically been early adopters of new passenger amenities, and the demand for In-Flight Wi-Fi is exceptionally strong. The presence of major network providers and a dense route network further bolsters this dominance.

Asia-Pacific is emerging as a rapid growth area. The burgeoning middle class, increasing air travel frequency, and the rapid expansion of airline fleets across countries like China, India, and Southeast Asian nations are creating a vast untapped market. Airlines in this region are increasingly investing in connectivity to cater to a digitally savvy population.

Europe represents a well-established market with a strong emphasis on passenger experience and a commitment to technological advancement. The fragmented nature of European aviation, with numerous carriers, creates a competitive environment where Wi-Fi becomes a crucial differentiator.

In terms of segments, the Narrow Body Aircraft application is expected to be a significant contributor to market dominance. Narrow-body aircraft constitute the largest portion of global airline fleets and are extensively used for short-to-medium haul routes, where passengers increasingly expect connectivity for productivity and entertainment. The increasing retrofitting of existing narrow-body fleets with advanced Wi-Fi solutions, coupled with the integration of these systems in new aircraft deliveries, will ensure its leading position. The market for Hardware components, including advanced antennas, modems, and cabin routers, will also witness substantial growth as airlines invest in upgrading their infrastructure to support higher bandwidth and more reliable connections. Companies like Gogo, Global Eagle Entertainment, ViaSat, and Panasonic are at the forefront of providing these critical hardware solutions.

The Service segment, encompassing the provision of internet connectivity, content delivery, and associated support, will also play a pivotal role in market dominance. As airlines move towards offering more sophisticated and personalized onboard digital experiences, the demand for comprehensive service packages will surge. This includes the development of value-added services such as live television streaming, e-commerce integration, and personalized entertainment portals. The focus on recurring revenue through subscription models and data packages will further cement the importance of the service aspect.

The Business Jet segment, while smaller in terms of volume compared to commercial aviation, is expected to exhibit high growth rates and significant market value due to the premium services and customized solutions demanded by high-net-worth individuals and corporate clients. These customers often require the highest levels of connectivity and performance, driving the adoption of cutting-edge technologies.

The study period of 2019-2033, with a base year of 2025, forecasts that North America will maintain its leadership, while the Asia-Pacific region will witness the most substantial percentage growth. The Narrow Body Aircraft segment, propelled by its sheer fleet size and evolving passenger expectations, will dominate in terms of overall market volume. The Hardware and Service segments will experience parallel growth as providers offer integrated solutions to meet the demands of a connected aviation ecosystem, with projected market values in the millions for each of these key areas. The interplay between these regions and segments will define the competitive landscape and investment opportunities within the In-Flight Wi-Fi industry.

Several key growth catalysts are accelerating the In-Flight Wi-Fi industry. The escalating demand for seamless, high-speed internet by passengers, mirroring their ground-based experience, is a primary driver. Airlines are increasingly viewing Wi-Fi as a crucial differentiator and a tool for enhancing passenger satisfaction and loyalty. Furthermore, the evolution of satellite technology, particularly the advent of High Throughput Satellites (HTS) and advanced antenna systems, has significantly improved the speed, reliability, and capacity of in-flight connectivity. This technological advancement has made robust Wi-Fi a more feasible and cost-effective offering for a wider range of aircraft. The growing ancillary revenue opportunities, enabled by premium connectivity services such as video streaming and e-commerce, are also a strong catalyst for airlines to invest in and promote Wi-Fi services.

This comprehensive report offers an exhaustive analysis of the In-Flight Wi-Fi market, covering the study period of 2019-2033 with a base year of 2025. It provides detailed market sizing, segmentation, and competitive landscape analysis, including projected market values in the millions for various segments and regions. The report delves into the intricate trends, driving forces, and challenges shaping the industry. It identifies key regions and countries poised for market dominance, along with specific application and type segments that will lead growth. Furthermore, it highlights crucial growth catalysts and significant past and future developments. This report is designed to equip stakeholders with the in-depth knowledge and actionable insights needed to navigate this dynamic market and capitalize on emerging opportunities.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Gogo, Global Eagle Entertainment, ViaSat, Thales, SITA, Panasonic, Honeywell, ThinKom Solutions, Kymeta, EchoStar.

The market segments include Application, Type.

The market size is estimated to be USD 1512 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "In-Flight Wi-Fi," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the In-Flight Wi-Fi, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.