1. What is the projected Compound Annual Growth Rate (CAGR) of the Identity Resolution Software?

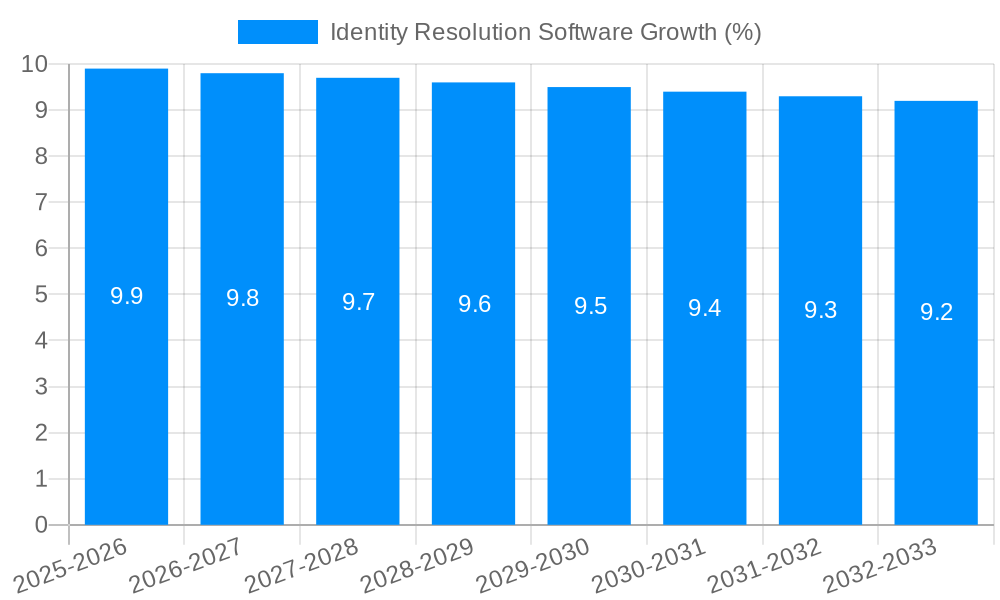

The projected CAGR is approximately 9.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Identity Resolution Software

Identity Resolution SoftwareIdentity Resolution Software by Type (Cloud Based, Web Based), by Application (Large Enterprises, SMEs), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

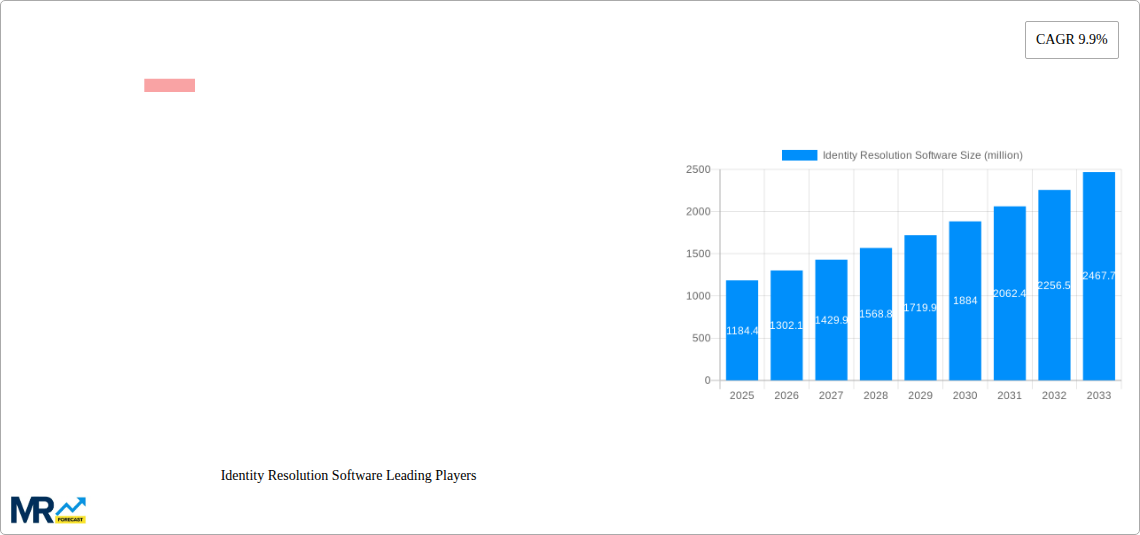

The Identity Resolution Software market is poised for substantial growth, with a current market size of $1184.4 million and a projected Compound Annual Growth Rate (CAGR) of 9.9% from 2025 to 2033. This robust expansion is primarily driven by the escalating need for businesses to create a unified and accurate view of their customers across various touchpoints. In an increasingly fragmented digital landscape, organizations are leveraging identity resolution solutions to overcome data silos, enhance customer understanding, and deliver personalized experiences. This capability is critical for effective marketing, improved customer service, fraud prevention, and compliance with evolving data privacy regulations. The demand for sophisticated identity resolution is further fueled by the proliferation of connected devices and digital interactions, making it imperative for companies to accurately track and manage individual identities for strategic decision-making.

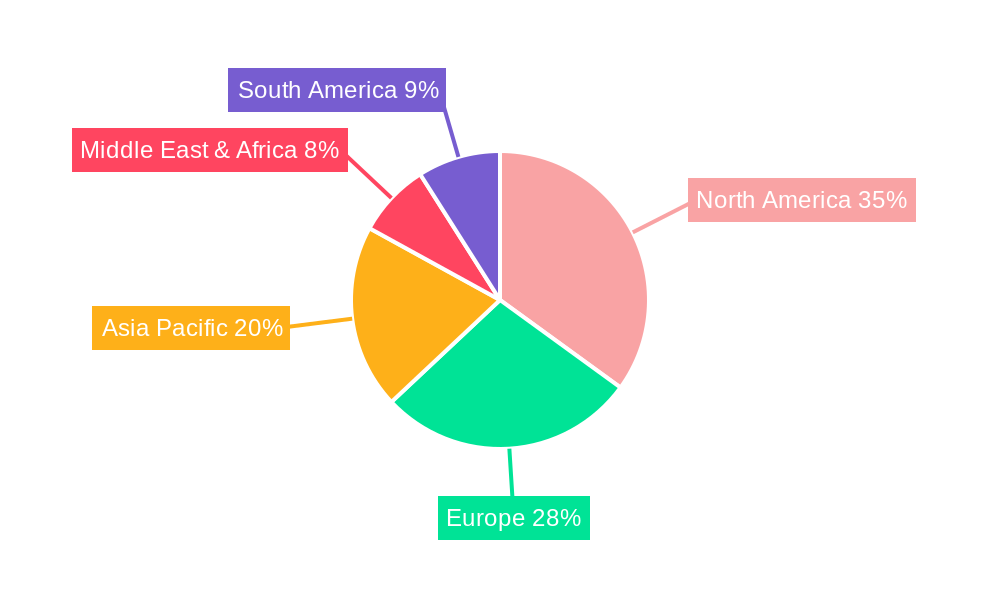

The market is segmented into Cloud Based and Web Based deployment types, with Large Enterprises and Small and Medium-sized Enterprises (SMEs) representing key application segments. While large enterprises have been early adopters due to their complex data infrastructures and significant customer bases, SMEs are increasingly recognizing the value of identity resolution for competitive advantage. The growth trajectory is supported by key trends such as the rise of first-party data strategies, the integration of AI and machine learning for enhanced accuracy, and the growing emphasis on data privacy and consent management. However, challenges such as data quality concerns, integration complexities with legacy systems, and the high cost of advanced solutions can act as restraints. Despite these, the overarching benefits of improved customer insights, operational efficiency, and enhanced marketing ROI are expected to propel the market forward, with significant opportunities anticipated in North America and Europe, followed by the Asia Pacific region.

This comprehensive report delves into the dynamic and rapidly evolving Identity Resolution Software market, offering a detailed analysis from the historical period of 2019-2024 through to an extensive forecast period of 2025-2033. With the Base Year set at 2025, the report leverages current market conditions to project future trajectories, providing invaluable insights for stakeholders. The global market for Identity Resolution Software is projected to reach a significant valuation, with estimates suggesting a market size in the tens of millions for the base year of 2025, and a substantial projected growth to hundreds of millions by the end of the forecast period in 2033.

The report examines the market across various segmentation strategies, including deployment types such as Cloud Based and Web Based solutions, and application segments targeting Large Enterprises and SMEs. Industry developments are meticulously tracked to understand the evolving landscape of customer data management and privacy. Key market players like Informatica, Signal, LiveRamp, Wunderkind (BounceX), Zeta Global, Neustar, Throtle, NetOwl, FullContact, Criteo, Zeotap, Infutor, FICO, Tapad, and Amperity are analyzed for their market share, strategies, and product offerings.

The Identity Resolution Software market is undergoing a profound transformation driven by an increasing emphasis on data privacy, regulatory compliance, and the burgeoning need for a unified customer view across an ever-fragmenting digital ecosystem. In the historical period of 2019-2024, the market witnessed steady growth as organizations began to grapple with the complexities of disparate data sources and the challenges of accurately identifying and understanding their customers. The widespread adoption of cloud-based solutions has been a defining trend, offering scalability, flexibility, and cost-effectiveness for businesses of all sizes. This shift has enabled smaller enterprises to access sophisticated identity resolution capabilities previously only available to large corporations. Furthermore, the increasing demand for real-time data processing and intelligent decision-making has spurred advancements in machine learning and AI capabilities within these platforms, allowing for more accurate and timely identity linkages. The rising scrutiny surrounding data privacy, particularly with regulations like GDPR and CCPA coming into effect, has also significantly influenced market trends. Companies are now prioritizing solutions that not only provide a robust customer profile but also ensure compliance with stringent data protection laws, leading to a demand for transparent and auditable resolution processes. The proliferation of connected devices and the subsequent explosion of data points have further amplified the need for sophisticated identity resolution to stitch together these diverse touchpoints into a cohesive customer journey. As we move into the forecast period of 2025-2033, we anticipate a continued acceleration of these trends. The market will likely see further consolidation as larger players acquire innovative startups and a greater focus on explainable AI and ethical data usage will emerge. The integration of identity resolution with other MarTech and AdTech solutions will become more seamless, creating end-to-end customer data platforms that empower businesses with unparalleled insights and activation capabilities. The ability to resolve identities accurately and ethically will transition from a competitive advantage to a fundamental requirement for business success in the digital age. The market is poised for substantial growth, fueled by these ongoing technological advancements and evolving market demands, indicating a strong and sustained upward trajectory.

Several potent forces are propelling the growth of the Identity Resolution Software market, fundamentally reshaping how businesses engage with their customers. At its core, the relentless pursuit of a true, 360-degree view of the customer stands as a primary driver. In an era characterized by omnichannel interactions, understanding a customer's journey across websites, mobile apps, social media, in-store visits, and customer service touchpoints is no longer a luxury but a necessity. Identity resolution software bridges the gaps between these disparate data siloes, enabling businesses to consolidate information from various sources and construct a unified, deterministic or probabilistic profile for each individual. This granular understanding empowers organizations to personalize marketing campaigns, enhance customer service, optimize product development, and improve overall customer experience, leading to increased loyalty and higher lifetime value. The burgeoning growth of e-commerce and digital advertising further exacerbates this need. As businesses invest more heavily in online channels, the ability to accurately identify and track potential customers through the marketing funnel becomes critical for optimizing ad spend, measuring campaign effectiveness, and preventing fraud. The increasing complexity of the digital advertising ecosystem, with its multitude of platforms and identifiers, necessitates sophisticated identity resolution to ensure ads reach the right audience and to avoid costly misallocations of marketing budgets. Moreover, the ever-evolving regulatory landscape surrounding data privacy, including legislation like GDPR and CCPA, is a significant catalyst. Companies are under immense pressure to obtain explicit consent for data collection and usage, and to provide individuals with control over their personal information. Identity resolution software plays a crucial role in enabling compliance by helping organizations understand what data they hold on individuals, where it came from, and how it can be used, thereby mitigating the risk of hefty fines and reputational damage.

Despite its immense potential, the Identity Resolution Software market faces several significant challenges and restraints that can temper its growth trajectory. Foremost among these is the escalating concern over data privacy and security. As more personal data is collected and processed, the risk of data breaches and misuse becomes a paramount concern for both consumers and businesses. Stringent regulations like GDPR and CCPA, while driving adoption, also impose significant compliance burdens and can limit the types of data that can be collected and linked, thereby impacting the accuracy and comprehensiveness of identity resolution. Building trust with consumers in how their data is used is a continuous challenge, and any perceived violations can lead to a significant backlash. Another substantial hurdle is the inherent complexity of data itself. Customer data is often fragmented, inconsistent, and resides in diverse formats across numerous systems, making the process of accurate matching and linking a technically demanding task. Ensuring high match accuracy and minimizing false positives and negatives requires sophisticated algorithms, robust data cleansing processes, and continuous model refinement. The evolving nature of digital identifiers, such as the deprecation of third-party cookies, presents an ongoing challenge, forcing identity resolution providers to develop alternative strategies for identity linkage, often relying on first-party data and probabilistic matching techniques. Furthermore, the significant cost associated with implementing and maintaining robust identity resolution solutions can be a deterrent, particularly for small and medium-sized enterprises (SMEs) with limited budgets. This includes the cost of software licenses, integration, data storage, and the need for skilled personnel to manage the systems. The competitive landscape, with numerous vendors vying for market share, can also create confusion for buyers, making it difficult to differentiate between offerings and select the most suitable solution. Finally, the ethical considerations surrounding data usage and the potential for misuse of comprehensive customer profiles, such as for discriminatory practices, remain a critical concern that needs careful consideration and robust governance frameworks.

Cloud Based solutions are poised to dominate the Identity Resolution Software market, driven by their inherent scalability, flexibility, and cost-effectiveness, particularly benefiting Large Enterprises.

The Identity Resolution Software market is experiencing a significant shift towards Cloud Based solutions, which are projected to dominate the market throughout the study period (2019-2033). This dominance is rooted in several key advantages that align perfectly with the evolving needs of modern businesses. For Large Enterprises, the ability to scale their identity resolution infrastructure seamlessly without significant upfront capital investment in hardware is a critical draw. Cloud platforms offer on-demand resources, allowing them to handle massive datasets and fluctuating workloads with ease. This agility is crucial for enterprises operating in dynamic markets and dealing with vast volumes of customer interactions. The inherent security measures offered by reputable cloud providers, coupled with the vendor's responsibility for maintenance and updates, also alleviate significant IT burdens for large organizations. Furthermore, cloud-based identity resolution solutions often facilitate quicker integration with other cloud-native MarTech and AdTech stacks, creating a more cohesive and efficient data ecosystem. The access to advanced analytics, AI, and machine learning capabilities, which are often continuously updated and refined on cloud platforms, provides enterprises with a competitive edge in understanding and engaging with their customers.

While Cloud Based solutions are ascendant, Web Based solutions will continue to play a vital role, especially for SMEs. The accessibility and ease of use of web-based platforms make them an attractive option for smaller businesses that may not have dedicated IT departments or the resources to manage complex on-premise systems. These solutions offer a straightforward entry point into identity resolution, allowing SMEs to leverage their first-party data more effectively and gain valuable customer insights without an overwhelming technical commitment. The lower barrier to entry in terms of cost and implementation makes web-based identity resolution a crucial enabler for smaller businesses looking to compete in an increasingly data-driven landscape.

In terms of application, Large Enterprises will continue to be the primary segment driving revenue and innovation. Their substantial data volumes, complex operational needs, and higher propensity to invest in advanced technologies make them early adopters and key influencers in the identity resolution space. The demand from large enterprises for sophisticated capabilities such as advanced probabilistic matching, real-time data synchronization, and robust data governance solutions will shape the product development roadmap of many vendors. However, the growth potential within the SMEs segment should not be underestimated. As cloud and web-based solutions become more affordable and user-friendly, an increasing number of SMEs will adopt identity resolution to enhance their customer engagement strategies, personalize marketing efforts, and improve their understanding of their customer base. This expansion into the SME market represents a significant growth opportunity for vendors that can offer tailored solutions and competitive pricing. The synergy between these segments and deployment types underscores the comprehensive and expanding reach of identity resolution software across the entire business spectrum.

The Identity Resolution Software industry is being propelled by several key growth catalysts. The increasing demand for personalized customer experiences is paramount, as businesses strive to engage customers with tailored offers and relevant content across all touchpoints. Secondly, the burgeoning digital transformation across industries necessitates a unified view of the customer to effectively navigate complex customer journeys. Furthermore, the growing emphasis on data privacy regulations is paradoxically driving adoption, as companies seek robust solutions to ensure compliance and build trust. The proliferation of connected devices and the subsequent explosion of data sources create an undeniable need for accurate identity stitching.

This report provides an exhaustive examination of the Identity Resolution Software market, offering a deep dive into its multifaceted landscape. It meticulously details market size and growth projections, presenting a detailed forecast from 2025-2033, with a base year of 2025. The report scrutinizes key market trends, including the pervasive shift towards cloud-based solutions and the impact of evolving data privacy regulations. It delves into the core drivers propelling this growth, such as the imperative for personalized customer experiences and the need for a unified customer view across an omnichannel environment. Simultaneously, it addresses the inherent challenges and restraints, including data privacy concerns, data complexity, and implementation costs, offering a balanced perspective on the market's dynamics. The report highlights dominant segments and regions, providing strategic insights for market players. Furthermore, it identifies key growth catalysts and showcases the leading companies actively shaping the industry, along with significant recent developments. This comprehensive analysis ensures stakeholders are equipped with the knowledge to navigate this dynamic market effectively.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.9% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 9.9%.

Key companies in the market include Informatica, Signal, LiveRamp, Wunderkind (BounceX), Zeta Global, Neustar, Throtle, NetOwl, FullContact, Criteo, Zeotap, Infutor, FICO, Tapad, Amperity, .

The market segments include Type, Application.

The market size is estimated to be USD 1184.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Identity Resolution Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Identity Resolution Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.