1. What is the projected Compound Annual Growth Rate (CAGR) of the Home Security Solutions?

The projected CAGR is approximately 7.5%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Home Security Solutions

Home Security SolutionsHome Security Solutions by Type (Video Surveillance Systems, Alarm Systems, Access Control Systems, Others), by Application (Individual Users, Building Contractors), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

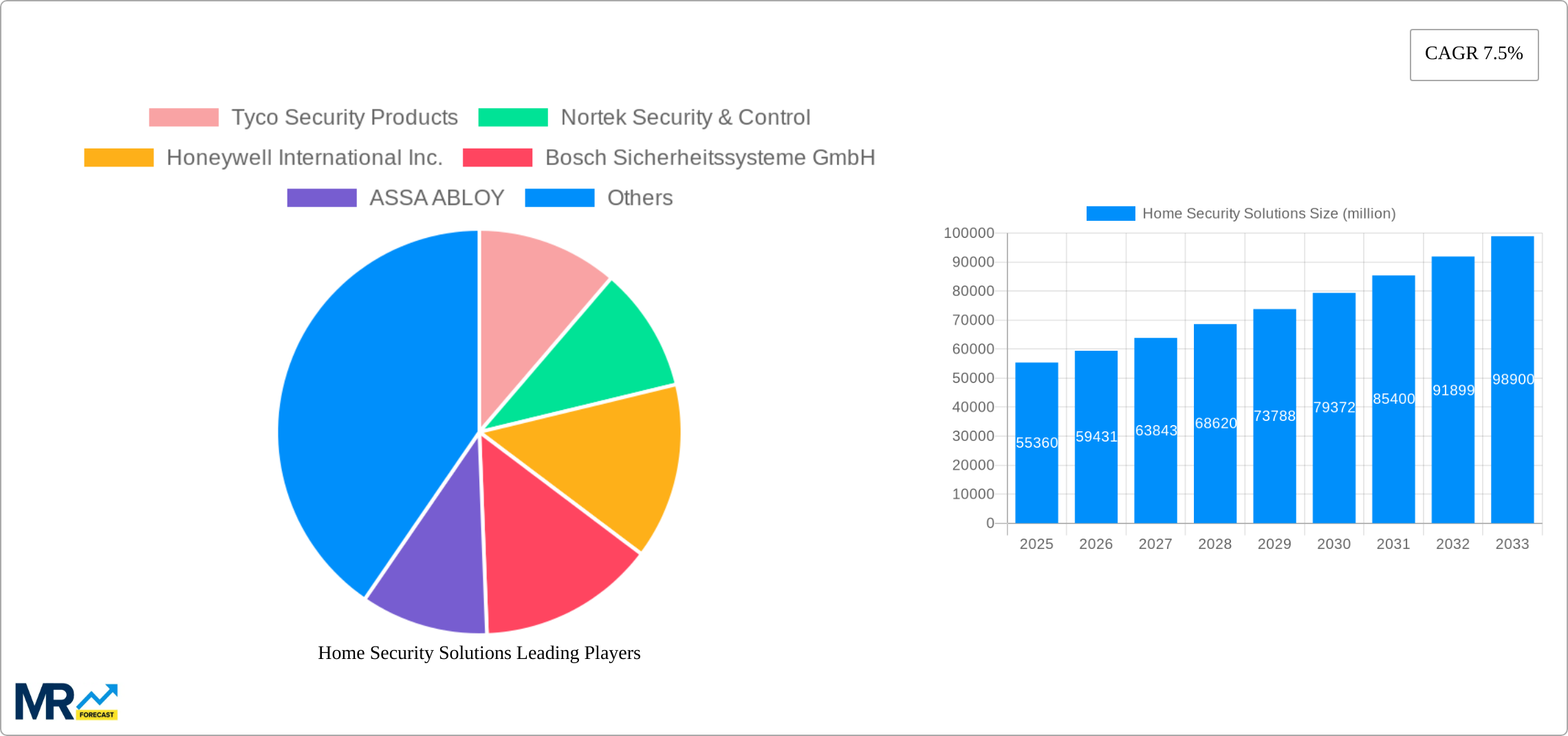

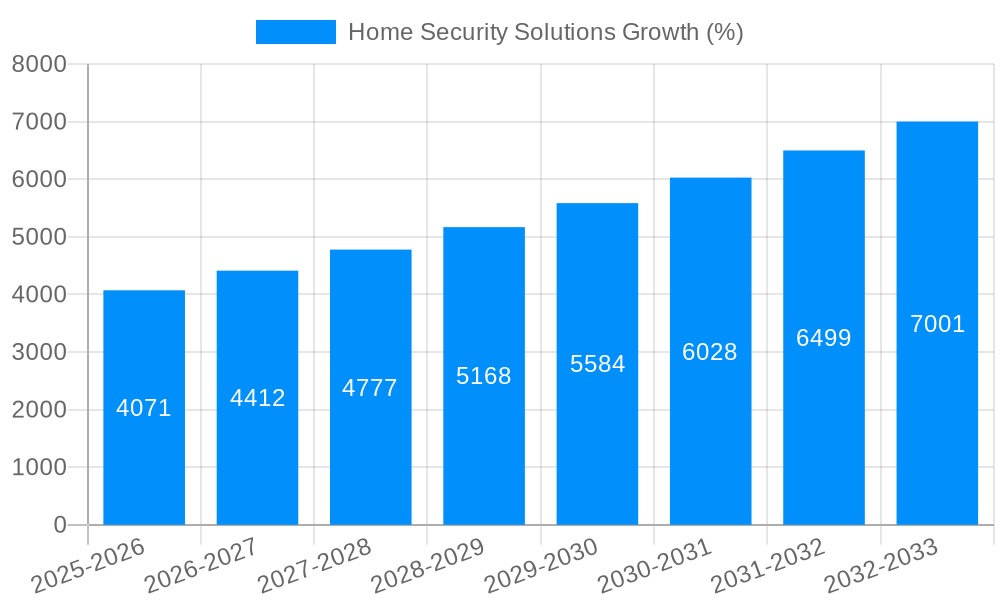

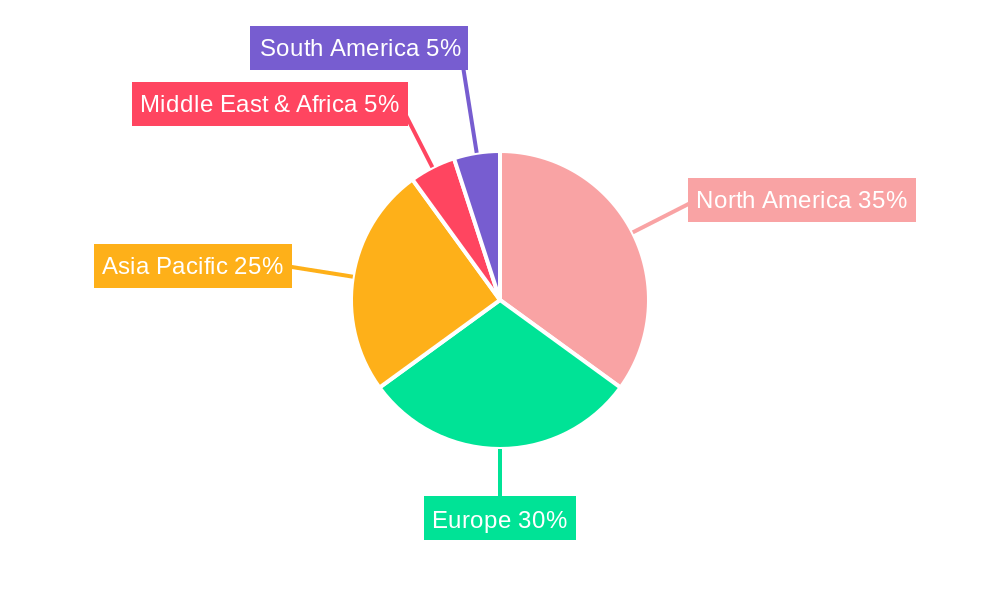

The global home security solutions market, currently valued at $55.36 billion (2025), is poised for robust growth, exhibiting a compound annual growth rate (CAGR) of 7.5% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing urbanization and rising crime rates are creating a heightened demand for home security systems among individual users and building contractors alike. Technological advancements, particularly in smart home integration, IoT devices, and AI-powered security features (like facial recognition and advanced analytics) are enhancing system capabilities and user experience, driving adoption. The market is also experiencing a shift toward subscription-based services, providing recurring revenue streams for providers and convenient, comprehensive security solutions for consumers. Furthermore, government initiatives promoting public safety and stricter building codes in several regions are indirectly contributing to market growth. The market segmentation reveals significant opportunities across various system types, with video surveillance systems currently holding a leading market share, followed by alarm and access control systems. Geographically, North America and Europe are currently the largest markets, although the Asia-Pacific region demonstrates significant growth potential due to rising disposable incomes and increasing awareness of home security.

The competitive landscape is characterized by both established players like Tyco Security Products, Honeywell, and ASSA ABLOY, and emerging technology companies. This competitive intensity leads to continuous innovation and price optimization, benefiting consumers. However, challenges exist, including concerns about data privacy and cybersecurity vulnerabilities, along with the initial high costs of installation and maintenance for some systems, potentially acting as restraints to wider market penetration, especially in developing economies. The focus of future growth will likely involve streamlining installation processes, developing more affordable, user-friendly solutions, and emphasizing data security to address consumer anxieties. Strategies centered on value-added services like remote monitoring, professional installation support, and proactive security alerts will further fuel the market’s trajectory.

The global home security solutions market experienced robust growth throughout the historical period (2019-2024), driven by rising consumer awareness of home security threats, increasing disposable incomes, and technological advancements. The market size, estimated at several billion dollars in 2025, is projected to reach tens of billions by 2033, showcasing significant expansion potential. Key insights reveal a strong preference for integrated systems offering multiple functionalities, moving away from standalone solutions. The integration of smart home technologies, such as voice assistants and mobile applications, is a major trend, enhancing user experience and convenience. Furthermore, the market is witnessing a shift toward subscription-based services, providing ongoing monitoring and maintenance, generating recurring revenue streams for providers. Competition remains fierce, with established players like Honeywell and ADT vying for market share alongside emerging technology companies offering innovative solutions. While individual users remain the largest application segment, the building contractor segment is demonstrating substantial growth, fueled by the increasing adoption of security systems in new residential constructions. The market's evolution is deeply intertwined with the rise of the Internet of Things (IoT), enabling seamless connectivity and data analysis for proactive security management. This trend also opens doors for enhanced analytics and predictive capabilities, potentially leading to customized security solutions tailored to specific user needs and risk profiles. The preference for wireless systems over wired systems is also driving market growth, driven by ease of installation and flexibility. This trend also opens doors for enhanced analytics and predictive capabilities, potentially leading to customized security solutions tailored to specific user needs and risk profiles. The increasing adoption of cloud-based services for storing and managing security data further fuels the market’s expansion. This transition to the cloud improves scalability, accessibility and cost-effectiveness for both users and providers. Finally, the growth of AI-powered features, like facial recognition and anomaly detection, further enhances the effectiveness and sophistication of home security systems.

Several factors are driving the growth of the home security solutions market. The rising incidence of burglaries and other home invasions fuels demand for robust security measures. Consumers are increasingly investing in comprehensive protection, seeking peace of mind and safeguarding their families and valuable possessions. Technological advancements, including the development of sophisticated sensors, AI-powered analytics, and user-friendly interfaces, are making home security systems more accessible and effective. The integration of home security systems with smart home ecosystems further enhances their appeal, offering seamless control and automation through mobile apps and voice commands. Government initiatives promoting public safety and supporting the adoption of security technologies also contribute to market expansion. Furthermore, favorable economic conditions in many regions, particularly in developed countries, increase consumer spending power, enabling investments in home security upgrades. The increasing urbanization and the subsequent rise in densely populated areas contribute to the heightened perception of security risks, thereby boosting demand for home security solutions. Finally, the growing awareness about the importance of cybersecurity and the vulnerability of home networks is driving the adoption of solutions that encompass both physical and digital security measures.

Despite the positive growth trajectory, several challenges and restraints hinder the market's expansion. High initial investment costs for installing comprehensive security systems can be a deterrent for budget-conscious consumers. The complexity of some systems and the need for technical expertise during installation and maintenance can create barriers for adoption, particularly among older populations. Concerns over data privacy and security surrounding connected devices are also emerging as significant issues, raising concerns about potential vulnerabilities and unauthorized access. The increasing prevalence of cyberattacks targeting home security systems highlights the need for robust cybersecurity measures. Furthermore, competition in the market is intense, with numerous established and emerging players vying for market share, leading to price wars and margin compression. The constant need for software updates and system maintenance can add to the ongoing costs for users, impacting their long-term commitment to a specific solution. Finally, the integration of various security systems and devices from different manufacturers can present interoperability challenges, hindering the seamless operation of a comprehensive home security setup.

The North American market is expected to dominate the home security solutions market throughout the forecast period (2025-2033), driven by high adoption rates of smart home technologies and a strong emphasis on home security. Within this region, the United States will be a major driver.

The Individual Users segment will continue to be the largest application segment, driven by rising consumer concerns about personal safety and property security. However, the Building Contractors segment demonstrates considerable growth potential, as new home construction increasingly incorporates security systems as standard features.

In terms of system type, Alarm Systems will retain a significant market share, due to their established popularity and cost-effectiveness. However, the market is increasingly adopting Video Surveillance Systems, propelled by advancements in camera technology, improved image quality, and cloud-based storage solutions. The Access Control Systems segment is also expected to witness healthy growth, driven by the increasing preference for smart locks and keyless entry systems.

Several factors are fueling the growth of the home security solutions industry, including the increasing affordability of smart home devices, the rising adoption of subscription-based services offering ongoing monitoring and support, and the expanding integration of home security with other smart home technologies. Furthermore, government regulations and initiatives promoting safety and security are boosting market expansion. Improved user interfaces and mobile application integration, as well as innovations in AI-powered security features, continue to increase the appeal and adoption of these solutions. Finally, the rising awareness of cybersecurity threats further contributes to the increased demand for comprehensive home security solutions.

This report provides a comprehensive analysis of the home security solutions market, offering detailed insights into market trends, growth drivers, challenges, key players, and future projections. It incorporates quantitative data, qualitative analysis, and expert opinions to deliver a holistic view of the industry landscape. The report covers historical data, current market conditions, and future forecasts, providing stakeholders with a complete understanding of the market dynamics and enabling informed decision-making. The analysis considers various segments, including system type, application, and geography, offering granular insights for specific market niches. The report's key takeaways provide valuable recommendations for industry participants and investors looking to navigate the evolving home security solutions market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.5% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.5%.

Key companies in the market include Tyco Security Products, Nortek Security & Control, Honeywell International Inc., Bosch Sicherheitssysteme GmbH, ASSA ABLOY, ADT LLC dba ADT Security Services, Vivint, Inc., MOBOTIX, MONI Smart security, United Technologies Corporation, .

The market segments include Type, Application.

The market size is estimated to be USD 55360 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Home Security Solutions," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Home Security Solutions, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.