1. What is the projected Compound Annual Growth Rate (CAGR) of the Heavy Metals Residue Testing?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Heavy Metals Residue Testing

Heavy Metals Residue TestingHeavy Metals Residue Testing by Type (Chromatography-based (HPCL, GC, LC, LC-MS/MS), Spectroscopy, Immunoassay, Other technologies), by Application (Meat & poultry, Dairy products, Processed foods, Fruits & vegetables, Cereals, grains & pulses, Nuts, seed & spice, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

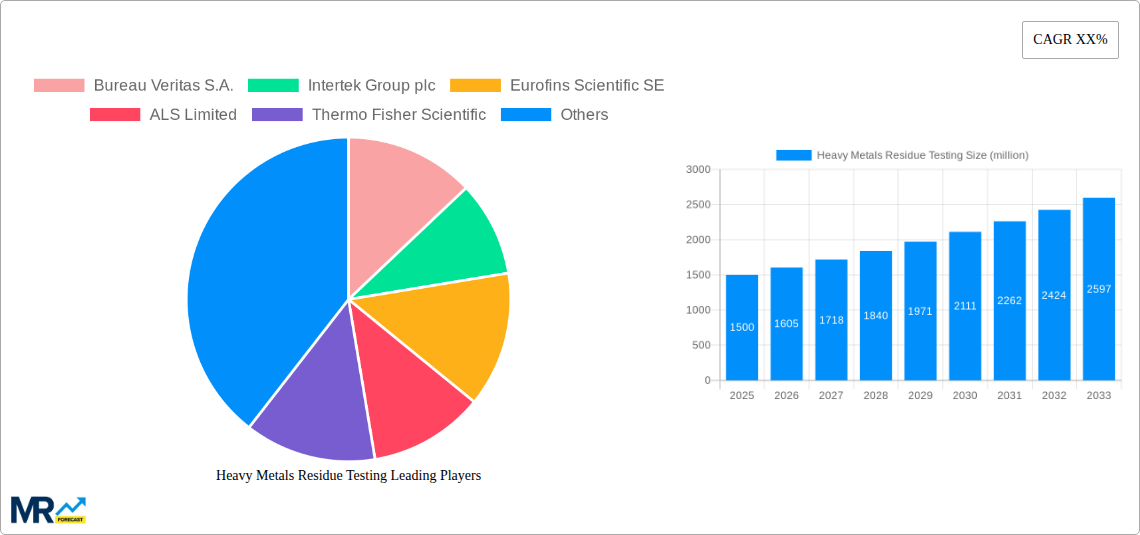

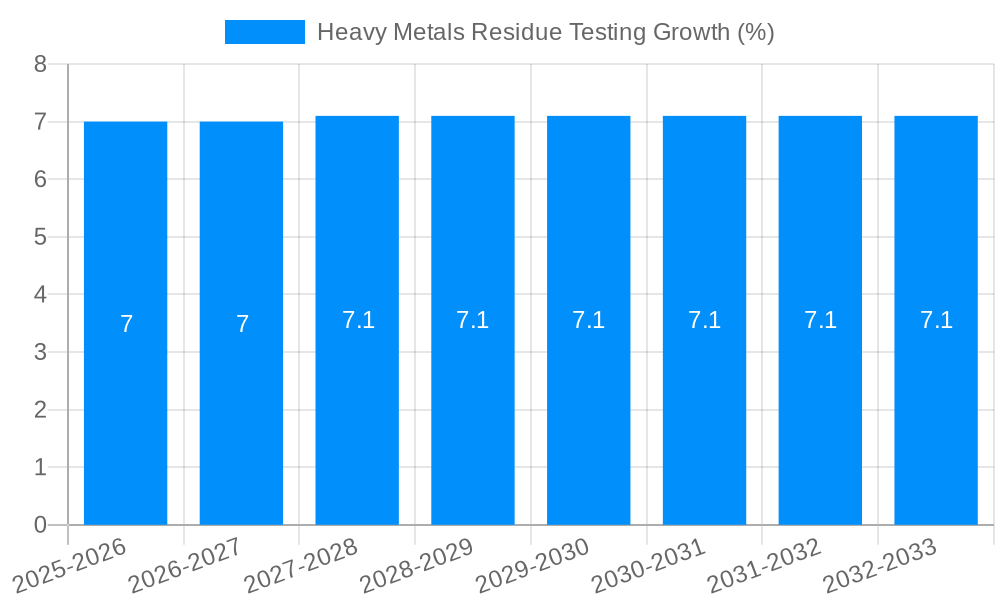

The global Heavy Metals Residue Testing market is poised for significant expansion, projected to reach approximately $1.5 billion by the end of 2025 and steadily grow at a Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This robust growth is primarily fueled by increasing consumer awareness regarding food safety and the potential health risks associated with heavy metal contamination. Stringent government regulations worldwide mandating the monitoring and control of heavy metals in food products, coupled with the rising demand for processed foods and meat & poultry products globally, are powerful market drivers. The expanding food and beverage industry, particularly in emerging economies, necessitates rigorous testing protocols to ensure product quality and consumer trust. Furthermore, advancements in analytical technologies, such as Liquid Chromatography-Mass Spectrometry/Mass Spectrometry (LC-MS/MS) and advanced spectroscopic techniques, are enhancing the accuracy, speed, and efficiency of heavy metal detection, thereby supporting market growth. The focus on enhanced food supply chain transparency and the growing number of food recalls due to contamination are also contributing to the increased adoption of comprehensive testing solutions.

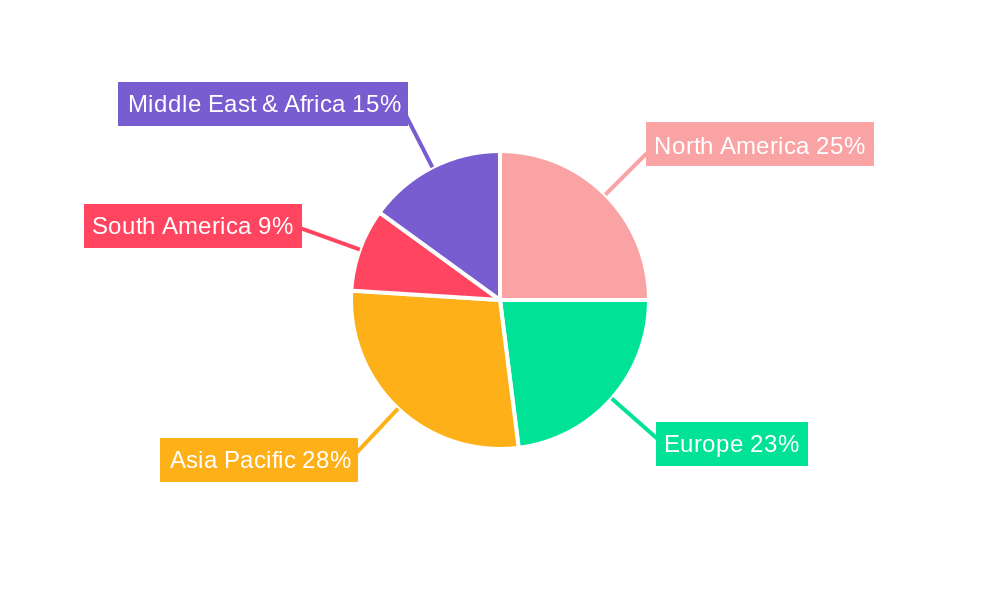

The market segmentation reveals a diversified landscape, with Chromatography-based technologies, particularly HPCL and LC-MS/MS, dominating the testing methods due to their high sensitivity and specificity. In terms of applications, the Meat & poultry and Dairy products segments are expected to command the largest market share, reflecting their high susceptibility to heavy metal contamination and the extensive regulatory oversight they face. However, the Processed foods, Fruits & vegetables, and Cereals, grains & pulses segments are also witnessing substantial growth driven by evolving dietary habits and global trade. Geographically, Asia Pacific is anticipated to emerge as the fastest-growing region, propelled by rapid industrialization, a burgeoning food processing sector, and increasing investments in food safety infrastructure in countries like China and India. North America and Europe, with their well-established regulatory frameworks and high consumer demand for safe food, will continue to represent significant market shares. Key industry players like Eurofins Scientific SE, SGS S.A., and Thermo Fisher Scientific are actively investing in research and development and expanding their service offerings to cater to the evolving demands of the global heavy metals residue testing market.

This comprehensive report offers a detailed analysis of the global Heavy Metals Residue Testing market. Covering the Historical Period of 2019-2024 and extending through the Forecast Period of 2025-2033, with a Base Year and Estimated Year of 2025, this study provides invaluable insights for stakeholders. The Study Period encompasses 2019-2033, ensuring a thorough understanding of market dynamics. The report utilizes millions as the unit of measurement for its quantitative data.

The global heavy metals residue testing market is experiencing robust growth, driven by increasing consumer awareness regarding food safety and stringent regulatory frameworks worldwide. During the Historical Period (2019-2024), the market witnessed steady expansion as governments and industries alike prioritized the detection and quantification of toxic metals such as lead, cadmium, mercury, and arsenic in food products. The prevalence of these contaminants, even at parts per million (ppm) levels, poses significant health risks, ranging from neurological damage to developmental issues, thereby necessitating rigorous testing protocols. The Estimated Year of 2025 is projected to see continued acceleration in market penetration. As the Study Period progresses towards 2033, the demand for advanced analytical techniques and rapid detection methods is expected to escalate. Emerging economies are playing an increasingly crucial role, with rising disposable incomes leading to higher consumption of processed foods and a greater demand for certified safe products. Furthermore, the globalization of food supply chains necessitates standardized testing procedures across borders to ensure compliance with international safety standards, further bolstering market growth. The integration of innovative technologies and the increasing focus on trace level detection (often in the parts per billion range, which translates to fractions of a million) are key trends shaping the market's trajectory. Industry players are investing heavily in research and development to enhance the sensitivity, accuracy, and efficiency of their testing solutions, catering to a market that is increasingly demanding faster turnaround times and more cost-effective analyses. The proactive approach by regulatory bodies to lower permissible limits for heavy metals in food products is also a significant driver, pushing the market towards more sophisticated and sensitive testing capabilities.

Several interconnected factors are propelling the growth of the heavy metals residue testing market. Foremost among these is the escalating global concern for food safety. Consumers are more informed than ever about the potential health implications of ingesting food contaminated with heavy metals, even at very low concentrations, such as a few parts per million. This heightened awareness translates into increased demand for products that have undergone rigorous testing and certification. Governments worldwide are responding to these concerns by implementing and strengthening regulations concerning the maximum permissible levels of heavy metals in various food categories. These regulations, often specifying limits in parts per million, mandate that food manufacturers and processors conduct regular testing to ensure compliance. Non-compliance can lead to severe penalties, product recalls, and significant reputational damage, creating a strong incentive for proactive testing. The expansion of the global food supply chain, characterized by complex international trade, further necessitates standardized and reliable testing methodologies to ensure that imported and exported goods meet the safety standards of importing nations. This interconnectedness of the food industry makes robust heavy metal residue testing an indispensable component of global trade, safeguarding both public health and economic stability. The increasing sophistication of analytical technologies, enabling the detection of heavy metals at trace levels, often in the sub-ppm range, also contributes significantly to market expansion by providing more accurate and comprehensive testing capabilities.

Despite its robust growth, the heavy metals residue testing market faces certain challenges and restraints that temper its expansion. One significant hurdle is the high cost associated with advanced analytical instrumentation and sophisticated testing methodologies. Technologies like Inductively Coupled Plasma Mass Spectrometry (ICP-MS), capable of detecting elements at parts per billion and even parts per trillion levels, require substantial capital investment and ongoing operational expenses. This can be a significant barrier for small and medium-sized enterprises (SMEs) within the food industry, particularly in developing economies, who may struggle to afford regular and comprehensive testing programs that measure impurities in the parts per million range. Furthermore, the complexity of sample preparation and the need for highly skilled personnel to operate and interpret results from advanced analytical equipment can also pose challenges. The availability of qualified technicians and scientists is not uniform across all regions, potentially leading to bottlenecks in testing capacity. Another restraint is the lack of standardized testing protocols across all regions and for all food types. While international bodies are working towards harmonization, variations in regulatory requirements and testing methodologies can create confusion and increase the burden on businesses operating in multiple markets. The time taken for certain testing procedures can also be a constraint, especially in industries that require rapid product release. While advancements are being made in rapid testing solutions, traditional methods can still be time-consuming, potentially delaying market access for food products.

The North America region is poised to be a dominant force in the global heavy metals residue testing market. This dominance is underpinned by a confluence of factors:

Within the Segment of Application: Processed foods, this region's dominance is particularly pronounced.

The heavy metals residue testing industry is propelled by significant growth catalysts. Increasingly stringent governmental regulations worldwide, mandating lower permissible limits for toxic metals, are a primary driver. Growing consumer awareness regarding the health risks associated with heavy metal contamination, even at parts per million levels, fuels demand for certified safe products. Furthermore, the globalization of food supply chains necessitates standardized testing to ensure international trade compliance. The continuous advancements in analytical technologies, enabling more sensitive and rapid detection of contaminants, also contribute to market expansion.

This report offers comprehensive coverage of the heavy metals residue testing market, providing in-depth analysis of market trends, driving forces, challenges, and regional dynamics. It delves into the competitive landscape, highlighting leading players and their strategies. The report meticulously examines the various testing technologies, including chromatography-based methods (HPCL, GC, LC, LC-MS/MS) and spectroscopy, alongside their applications across diverse food segments like meat & poultry, dairy products, processed foods, and fruits & vegetables. It also explores significant industry developments and future growth catalysts, presenting projections and insights for the Study Period of 2019-2033, with a focus on the Estimated Year of 2025. The market size is quantified in millions, offering a clear picture of the economic scale of this critical sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Bureau Veritas S.A., Intertek Group plc, Eurofins Scientific SE, ALS Limited, Thermo Fisher Scientific, Mérieux NutriSciences, AsureQuality, Microbac Laboratories, SGS S.A., .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Heavy Metals Residue Testing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Heavy Metals Residue Testing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.