1. What is the projected Compound Annual Growth Rate (CAGR) of the Healthcare Information Software?

The projected CAGR is approximately 14.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Healthcare Information Software

Healthcare Information SoftwareHealthcare Information Software by Type (Hospital Information Systems, Pharmacy Information Systems), by Application (Diagnostics Centers, Hospitals, Academic and Research Institutions), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

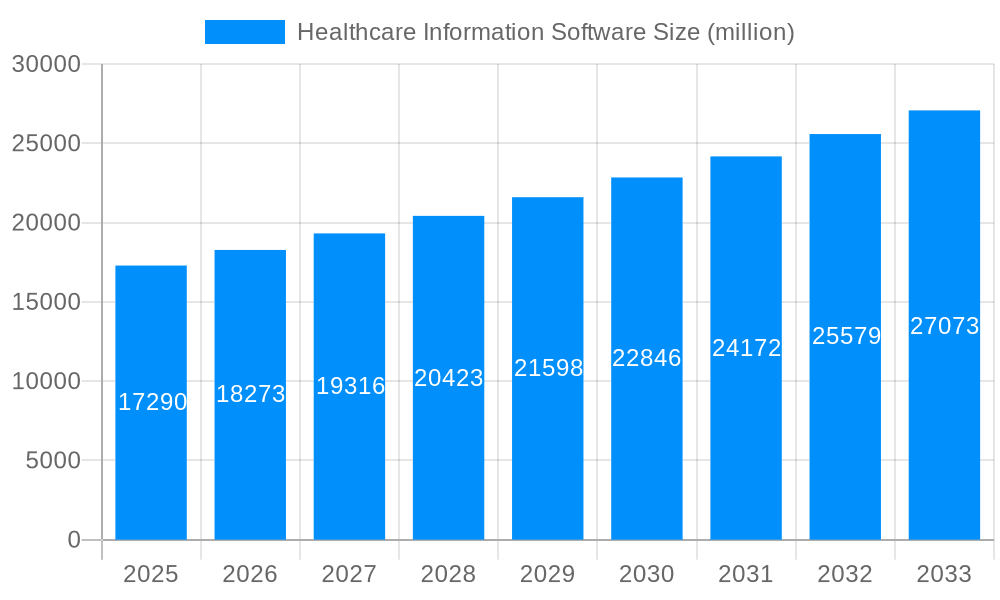

The global Healthcare Information Software market, valued at $480.49 billion in the base year 2025, is projected for significant expansion. The market is anticipated to grow at a compound annual growth rate (CAGR) of 14.9% from 2025 to 2033. This growth is propelled by the widespread adoption of electronic health records (EHRs) and the increasing demand for healthcare system interoperability. The rising incidence of chronic diseases and an aging global population are further driving the need for efficient healthcare management and data analytics, creating substantial demand for advanced software solutions. Government-led digitization initiatives in healthcare, alongside increased investments in healthcare infrastructure, are also key growth drivers. Hospital Information Systems and Pharmacy Information Systems are emerging as high-growth segments, emphasizing streamlined operations and enhanced patient care. Leading market participants such as GE Healthcare, Siemens Healthcare, and Epic Systems are actively innovating, offering advanced analytics, cloud-based solutions, and enhanced security to address evolving market needs.

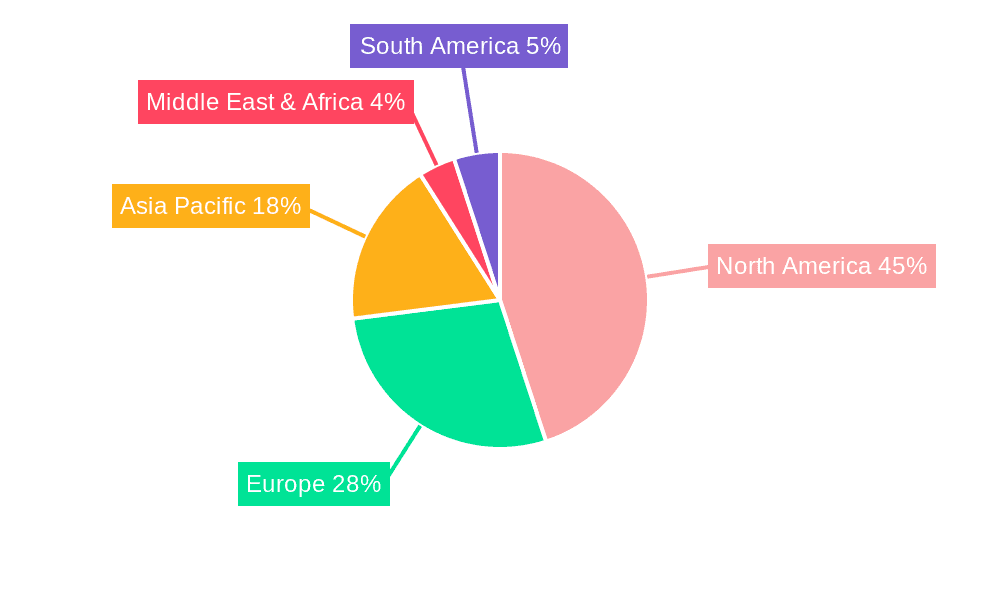

Market segmentation highlights substantial opportunities across diverse application areas. Hospitals and diagnostic centers constitute significant market segments due to their critical reliance on efficient data management. Academic and research institutions are also increasingly leveraging healthcare information software for research and data analysis. Geographically, North America currently dominates the market, supported by advanced technological adoption and substantial healthcare IT investments. However, emerging economies in the Asia-Pacific region and other developing areas are expected to experience robust growth, presenting considerable market expansion opportunities. While data security and privacy remain critical considerations, the continuous development of stringent security protocols and compliance measures is effectively addressing these concerns, ensuring sustained market growth.

The global healthcare information software market experienced significant growth during the historical period (2019-2024), driven by the increasing adoption of electronic health records (EHRs), the rising prevalence of chronic diseases, and the growing demand for improved healthcare efficiency. The market's value exceeded $XX billion in 2024, and is projected to reach $YY billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of Z%. This robust growth is fueled by several key trends. Firstly, the ongoing digital transformation within the healthcare sector is pushing hospitals, clinics, and research institutions towards comprehensive software solutions for data management, analysis, and improved patient care. Secondly, the increasing focus on value-based care models is driving the demand for software that facilitates better patient outcomes and cost-effectiveness. Thirdly, advancements in artificial intelligence (AI) and machine learning (ML) are leading to the development of sophisticated software capable of predictive analytics, personalized medicine, and improved diagnostic accuracy. The integration of these technologies promises to revolutionize healthcare delivery, optimizing workflows, enhancing diagnostic capabilities, and creating a more patient-centric approach. This trend is particularly evident in the adoption of cloud-based solutions, which offer scalability, flexibility, and cost-effectiveness, enabling healthcare providers to access and manage data securely and efficiently from anywhere. The forecast period (2025-2033) anticipates continued market expansion, with further technological advancements expected to drive even greater market penetration and reshape the healthcare landscape. The estimated market value for 2025 stands at $WW billion, highlighting the sustained momentum of this crucial sector.

Several factors are propelling the growth of the healthcare information software market. The escalating adoption of EHRs and other digital health technologies is a primary driver. These systems streamline administrative tasks, enhance patient care coordination, and reduce medical errors. Government initiatives promoting the adoption of interoperable health information systems are also playing a vital role. These initiatives often include financial incentives and regulatory mandates, encouraging wider adoption of the software. The rising prevalence of chronic diseases globally necessitates efficient management of patient data and improved care coordination, further bolstering market demand. The increasing demand for improved healthcare efficiency and reduced operational costs is another significant driver. Healthcare information software helps to optimize workflows, automate tasks, and enhance productivity, leading to substantial cost savings for healthcare providers. Moreover, the growing need for enhanced data security and patient privacy is fostering the adoption of robust and compliant software solutions. The increasing focus on telehealth and remote patient monitoring is further driving innovation and adoption, creating new opportunities for healthcare information software providers. The ability of these systems to support remote consultations, patient data tracking, and chronic disease management underscores their importance in the evolving healthcare landscape.

Despite the significant growth potential, the healthcare information software market faces certain challenges. High initial investment costs associated with implementing and maintaining these systems can be a significant barrier for smaller healthcare providers. The complexity of integrating various software systems within a healthcare organization can also present integration challenges, potentially leading to data silos and hindering interoperability. Concerns regarding data security and patient privacy are paramount; breaches can have significant legal and reputational consequences. Furthermore, the need for continuous software updates and maintenance can lead to substantial ongoing expenses. The lack of standardized data formats across different systems can impede interoperability and data exchange, creating fragmentation within the healthcare ecosystem. Finally, the need for skilled IT professionals to manage and maintain these complex systems presents a significant workforce challenge. Addressing these challenges requires collaboration among healthcare providers, technology vendors, and regulatory bodies to foster greater standardization, affordability, and security.

Hospital Information Systems (HIS) Segment Dominance:

The Hospital Information Systems (HIS) segment is projected to dominate the market throughout the forecast period. HIS provides a comprehensive platform for managing all aspects of hospital operations, including patient admissions, clinical documentation, billing, and reporting.

Growth Drivers: The increasing number of hospitals globally, coupled with the rising demand for improved operational efficiency and reduced medical errors, strongly favors the HIS segment. The need for real-time patient data access and enhanced care coordination makes HIS indispensable for modern hospitals.

Regional Variations: North America and Europe are expected to be the leading regions for HIS adoption, driven by advanced healthcare infrastructure and high levels of healthcare expenditure. However, rapid growth is also anticipated in developing economies in Asia-Pacific and Latin America, as these regions invest in modernizing their healthcare systems.

Market Size: The HIS segment is estimated to account for over $XX billion in 2025, showcasing its significant contribution to the overall market value. The forecast period projects a substantial increase in this segment's market share due to ongoing technological advancements, and increasing adoption in smaller hospitals and clinics.

Specific Examples: The integration of AI and ML capabilities into HIS is enhancing functionalities such as predictive analytics for resource allocation, improved diagnosis accuracy, and personalized treatment plans. The adoption of cloud-based HIS solutions is accelerating, providing enhanced scalability, data security, and accessibility.

Several factors are catalyzing growth in the healthcare information software industry. These include increasing government funding for healthcare IT initiatives, the rising adoption of telehealth and remote patient monitoring, and the growing demand for interoperability among different healthcare systems. Advancements in AI and machine learning are also enabling the development of more sophisticated software solutions with enhanced diagnostic capabilities and predictive analytics. Furthermore, the rising need for effective population health management is driving the adoption of software platforms that enable better data analysis and proactive patient care. These catalysts combined are creating a dynamic and rapidly expanding market.

This report provides a comprehensive analysis of the healthcare information software market, covering historical data (2019-2024), an estimated market value for 2025, and a detailed forecast for 2025-2033. The report delves into market trends, drivers, challenges, key players, and significant developments, providing valuable insights for stakeholders in the healthcare and technology industries. The report segments the market by software type, application, and geography, allowing for a nuanced understanding of market dynamics and growth opportunities. This information is crucial for businesses navigating this rapidly evolving landscape. The report's detailed analysis enables strategic decision-making, investment planning, and market positioning for participants in this vital sector. Remember to replace the "XX", "YY", "Z", and "WW" placeholders with the actual values from your data.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.9%.

Key companies in the market include GE Healthcare, Siemens Healthcare, 3M Health, McKesson, Philips Healthcare, Allscripts, Dell, Epic Systems, NextGen Healthcare, Merge Healthcare, Neusoft, InterSystems, Cerner, Carestream Health, Meditech, .

The market segments include Type, Application.

The market size is estimated to be USD 480.49 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Healthcare Information Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Healthcare Information Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.