1. What is the projected Compound Annual Growth Rate (CAGR) of the Grocery E-commerce Platform?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Grocery E-commerce Platform

Grocery E-commerce PlatformGrocery E-commerce Platform by Type (/> Local, Cloud-based), by Application (/> Commodity, Food And Drinks, Personal Care Products, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

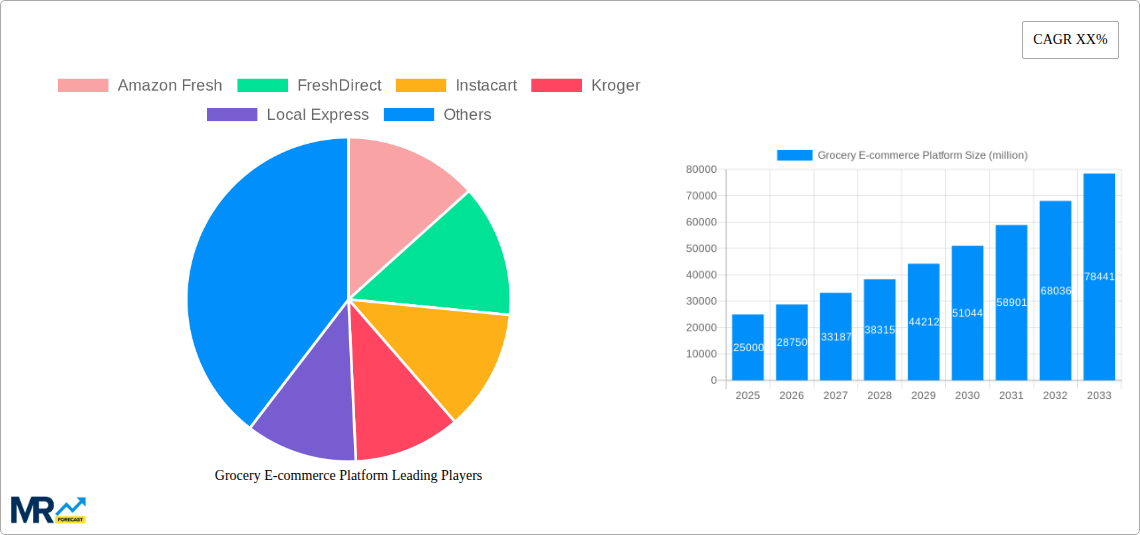

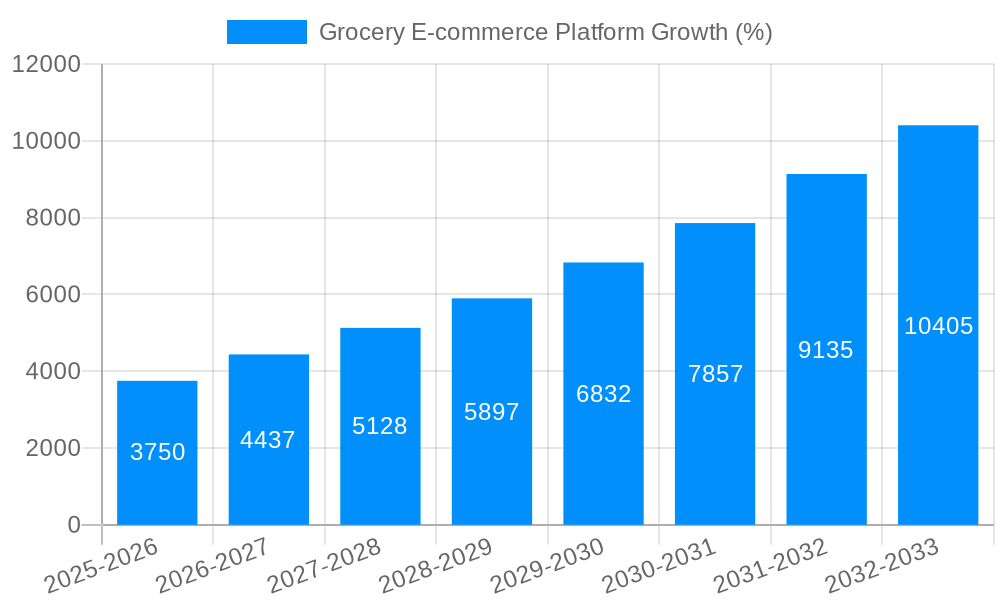

The grocery e-commerce platform market is experiencing robust growth, driven by increasing consumer preference for online convenience, technological advancements enabling seamless online shopping experiences, and the expansion of delivery and pickup options. The market's compound annual growth rate (CAGR) is estimated at 15%, indicating significant potential for expansion. This growth is fueled by several key factors, including the rising adoption of smartphones and internet penetration, particularly among younger demographics accustomed to online shopping. Furthermore, the ongoing pandemic accelerated the shift towards online grocery shopping, establishing a new consumer habit that continues to drive market expansion. Competitive pressures from established players like Amazon Fresh, Walmart, and Kroger, alongside innovative startups, are fostering innovation in areas such as delivery logistics, personalized recommendations, and subscription models, further enhancing the overall market appeal.

However, challenges remain. Maintaining profitability in a highly competitive market with slim margins continues to be a hurdle for many players. Concerns about food freshness, efficient last-mile delivery, and the integration of online and offline shopping experiences require ongoing investment and strategic solutions. Furthermore, regulatory hurdles and varying consumer preferences across different regions present unique challenges for market penetration. Despite these obstacles, the long-term outlook remains positive, driven by continuing technological advancements and the increasing integration of online grocery services into broader retail ecosystems. This suggests that strategic partnerships, improved logistics, and a focus on customer experience will be crucial factors determining success in this dynamic and ever-evolving market.

The grocery e-commerce platform market is experiencing explosive growth, driven by shifting consumer preferences and technological advancements. Over the study period (2019-2033), the market has witnessed a dramatic increase in online grocery shopping, with projections indicating continued expansion in the coming years. The estimated market value in 2025 is pegged at several billion dollars, a significant jump from the historical period (2019-2024). This growth is fueled by a confluence of factors including the increasing adoption of smartphones and internet access, the convenience of online ordering and home delivery, and the growing demand for contactless shopping options, particularly amplified by recent global events. Consumers are increasingly valuing the time saved by avoiding physical grocery stores, particularly those in urban areas with limited parking or long queues. Furthermore, the ability to compare prices and access a wider variety of products online is attracting a wider customer base. The market is characterized by a diverse range of players, from large multinational corporations like Amazon and Walmart to smaller, niche players specializing in local or organic products. Competition is fierce, leading to continuous innovation in areas like delivery speeds, personalized recommendations, and subscription services. The forecast period (2025-2033) anticipates continued market expansion, driven by technological innovations such as AI-powered inventory management, improved delivery logistics, and the expansion of online grocery services to underserved areas. The market is also expected to see further consolidation as larger players acquire smaller competitors and strive to achieve economies of scale. This evolution will likely see the emergence of even more sophisticated platforms that offer a hyper-personalized and seamless shopping experience. The base year for this analysis is 2025, providing a crucial snapshot of the current market dynamics and laying the groundwork for accurate future projections.

Several key factors are propelling the growth of the grocery e-commerce platform market. The increasing penetration of internet and smartphone usage worldwide provides a foundational layer for the accessibility of online grocery platforms. Convenience is a major driver, as consumers value the time saved by ordering groceries online and having them delivered to their doorstep, eliminating the need for trips to physical stores. The pandemic further accelerated this trend, as consumers sought safer and more contactless shopping options. The rise of subscription services and loyalty programs provides a recurring revenue stream for businesses and encourages consumer engagement. Technological advancements like AI-powered recommendation engines, improved delivery logistics and drone delivery technology are streamlining the shopping experience and enhancing efficiency. Furthermore, the expansion of grocery delivery services to previously underserved areas is creating new market opportunities. The growing popularity of meal kit delivery services also contributes to the overall growth of the online grocery market. These services provide a convenient and efficient way for consumers to access fresh ingredients and pre-portioned meals, attracting a segment of consumers seeking convenience and healthier eating habits. Finally, the increasing availability of diverse product offerings, including organic, locally sourced, and specialty items, expands the appeal of online grocery platforms to a broader consumer base.

Despite the significant growth, the grocery e-commerce platform market faces several challenges. Maintaining the freshness and quality of perishable goods during delivery remains a significant hurdle. High delivery costs, particularly for smaller orders and geographically dispersed customers, can negatively impact profitability and consumer adoption. The need for robust and reliable cold chain logistics infrastructure is crucial for ensuring product quality and reducing waste. Competition is fierce, with established players and new entrants vying for market share, leading to price wars and pressure on profit margins. Maintaining secure payment gateways and protecting sensitive consumer data are critical in building customer trust and mitigating security risks. Managing customer expectations regarding delivery times and order accuracy is vital for maintaining customer satisfaction. Integration with existing retail infrastructure and supply chains can be complex and expensive. Addressing the "last-mile" delivery problem, particularly in densely populated urban areas, is crucial for ensuring efficient and timely deliveries. Finally, addressing issues of food waste and sustainability within the delivery process is becoming increasingly important for environmentally conscious consumers.

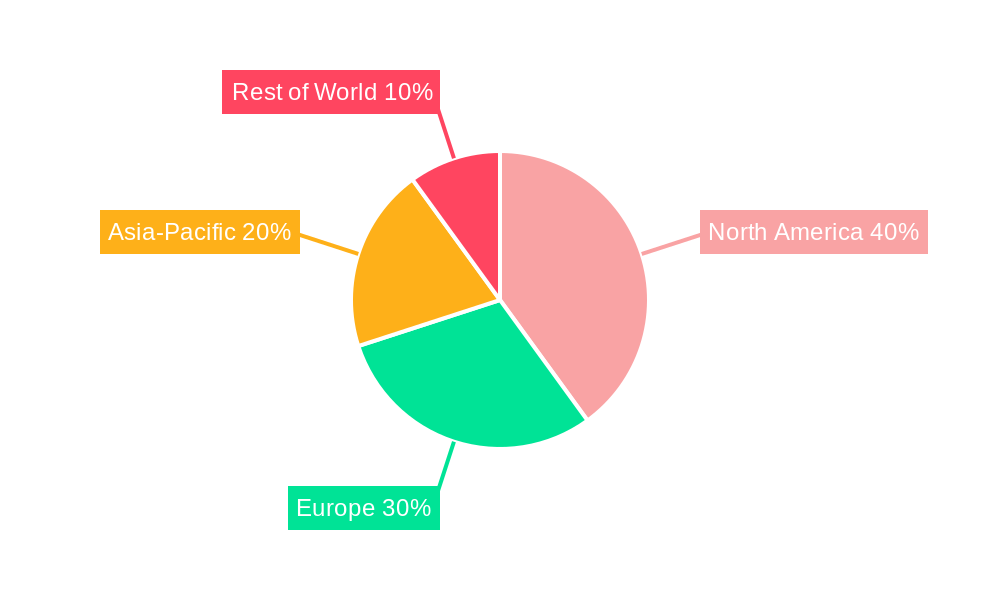

North America: This region is expected to maintain its dominant position in the grocery e-commerce market, driven by high internet penetration, strong consumer adoption of online shopping, and the presence of major players like Amazon and Walmart. The high disposable incomes and the preference for convenience contribute to the significant growth in this region. Furthermore, advanced logistics infrastructure and widespread delivery networks support the robust e-commerce ecosystem.

Europe: While exhibiting strong growth, Europe faces more fragmented markets compared to North America. Different regulatory landscapes and varying levels of internet penetration across different countries present challenges. However, increasing adoption of online grocery shopping, particularly in major urban centers, signals significant market potential.

Asia-Pacific: This region boasts a rapidly expanding middle class and increasing internet and smartphone penetration. While experiencing fast growth, challenges remain including developing reliable logistics and cold chain infrastructure in certain areas.

Segments: The online grocery delivery segment is anticipated to dominate due to its convenience and increasing demand for contactless services. The online grocery pickup segment offers a viable alternative, providing a balance between convenience and personal selection, ensuring continued growth in the forecast period. Niche segments such as organic and specialty grocery e-commerce are also demonstrating strong growth, catering to specific consumer preferences.

The paragraph above highlights the regional variances and segmentation details, offering a clearer picture of the market landscape. Each region’s specific characteristics and opportunities, along with the growth potential of different market segments, contribute to the overall market expansion. The interplay of these factors necessitates a region-specific and segment-specific approach in business strategy.

The grocery e-commerce industry is fueled by several key growth catalysts. Technological advancements in areas such as artificial intelligence for personalized recommendations and improved logistics are enhancing the customer experience and operational efficiency. Increasing consumer demand for convenience and contactless shopping, amplified by recent events, continues to drive online grocery adoption. The expansion of delivery services to previously underserved areas is opening up new markets and creating opportunities for growth. Furthermore, the rise of subscription models and loyalty programs foster customer engagement and create recurring revenue streams.

This report provides a comprehensive analysis of the grocery e-commerce platform market, covering historical data, current market trends, and future growth projections. The report offers detailed insights into key market drivers, challenges, and opportunities, providing a valuable resource for businesses operating in or seeking to enter this dynamic sector. The inclusion of profiles of leading players in the market, analysis of key regional and segmental trends, and a forecast for the coming years offers a holistic perspective for informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Amazon Fresh, FreshDirect, Instacart, Kroger, Local Express, Mercatus, Peapod, Shipt, ShopHero, Thrive Market, Volusion, Walmart, Whole Foods, Zielcommerce.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Grocery E-commerce Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Grocery E-commerce Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.