1. What is the projected Compound Annual Growth Rate (CAGR) of the Generic E-learning Courses?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Generic E-learning Courses

Generic E-learning CoursesGeneric E-learning Courses by Type (/> Courses, Content), by Application (/> Academic, Corporate), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

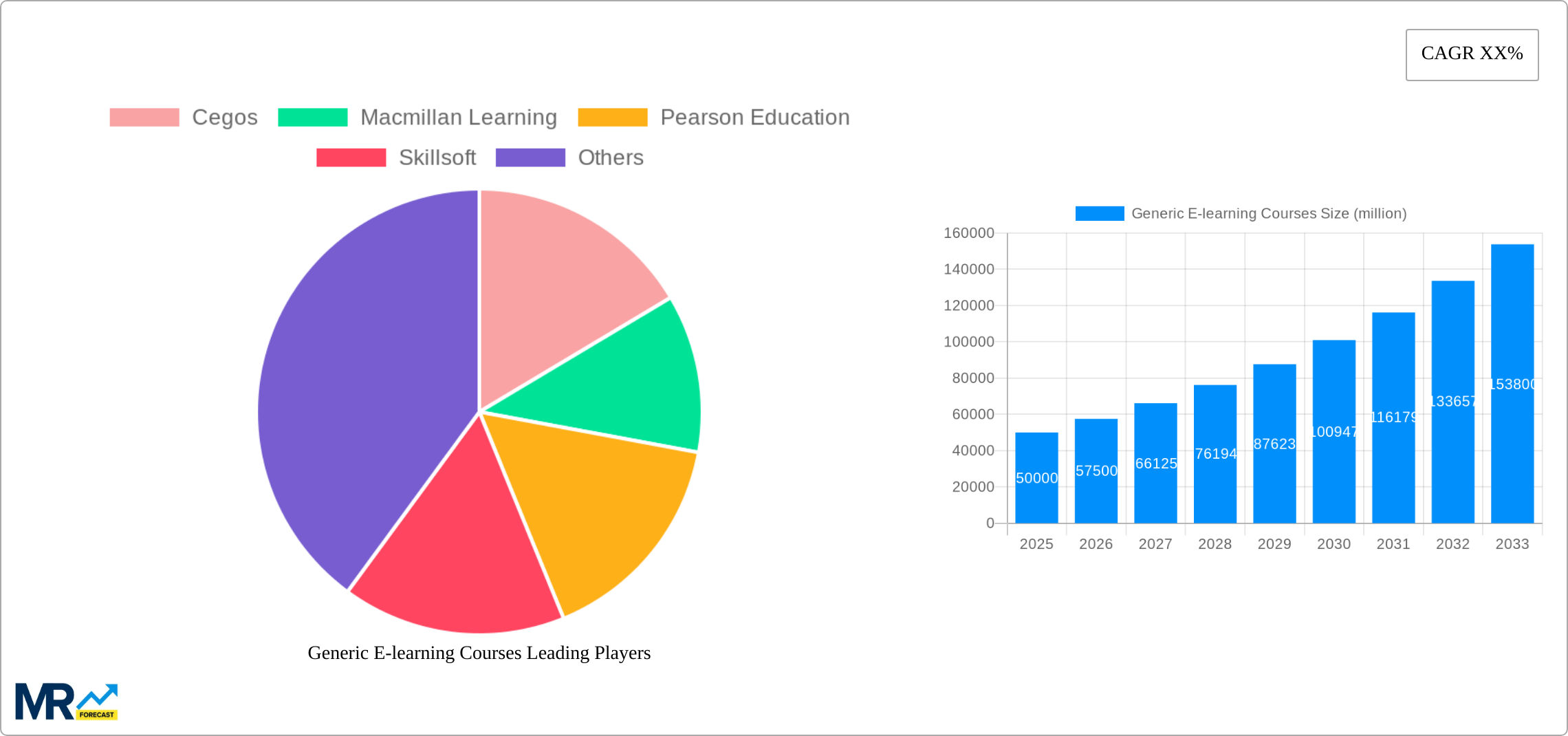

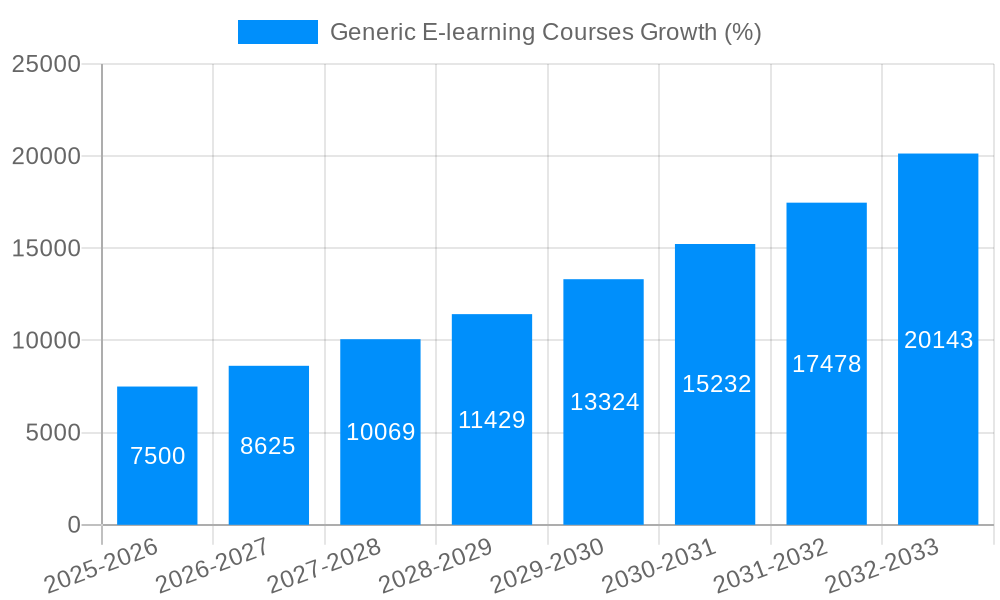

The global generic e-learning market is experiencing robust growth, driven by the increasing demand for flexible and accessible learning solutions. The market, estimated at $50 billion in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 15% from 2025 to 2033, reaching an estimated $150 billion by 2033. This expansion is fueled by several factors, including the rising adoption of digital technologies in education and corporate training, the growing need for upskilling and reskilling initiatives in a rapidly evolving job market, and the cost-effectiveness of e-learning compared to traditional classroom-based training. The market is segmented by course type (e.g., online courses, video tutorials, interactive simulations), content (e.g., technical skills, soft skills, professional development), and application (academic, corporate). The corporate segment is currently the largest revenue contributor, driven by the need for employee training and development programs. Key players such as Cegos, Macmillan Learning, Pearson Education, and Skillsoft are leading this growth through continuous innovation in course design and delivery.

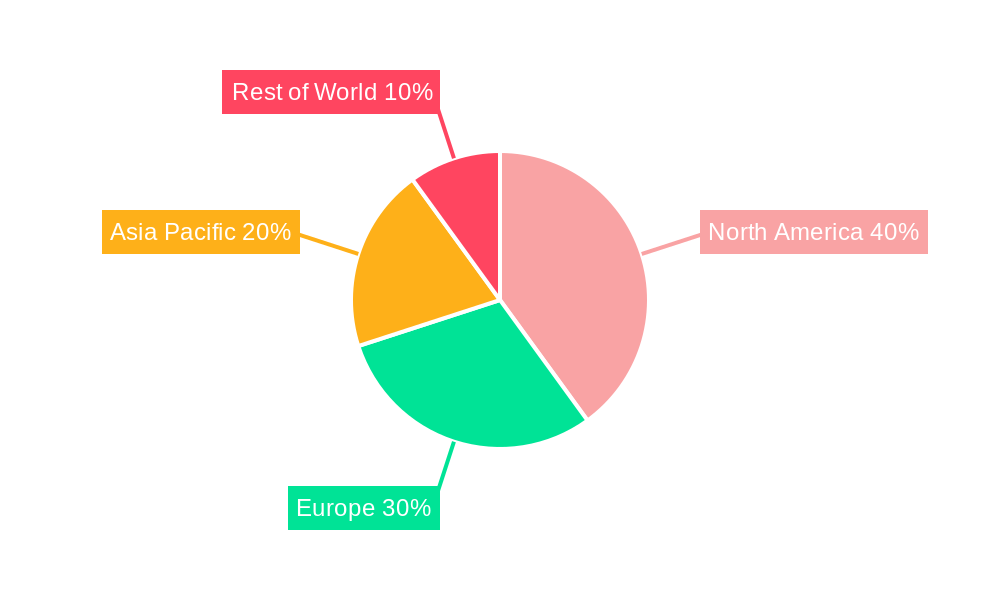

Geographical distribution reveals a significant market share for North America, driven by high technology adoption and a robust corporate training culture. However, Asia Pacific is expected to show the fastest growth rate over the forecast period, fueled by increasing internet penetration, a young and tech-savvy population, and significant investments in education and skill development initiatives in countries like India and China. While challenges exist, such as concerns about the effectiveness of online learning compared to traditional methods and the digital divide, the overall market outlook remains highly positive. The continued development of engaging and interactive e-learning platforms, personalized learning experiences, and innovative assessment tools will further propel market expansion in the coming years. The shift towards microlearning, gamified learning, and mobile-first e-learning experiences will also influence future market trends.

The global generic e-learning courses market is experiencing robust growth, projected to reach multi-million unit sales by 2033. The period from 2019 to 2024 (historical period) laid the groundwork for this expansion, with significant adoption across diverse sectors. Our analysis, based on data from 2019-2024 and projections through 2033, indicates a compound annual growth rate (CAGR) exceeding expectations. The base year for our projections is 2025, with the forecast period extending to 2033. Key market insights reveal a shift towards more accessible and affordable learning solutions, particularly within the corporate sector. The increasing demand for upskilling and reskilling initiatives, coupled with the flexibility and scalability of e-learning, are major drivers. This report examines the evolving landscape, focusing on trends in course types, content delivery methods, and application across various industries. We observe a growing preference for microlearning formats, gamified courses, and personalized learning pathways, reflecting a broader trend toward learner-centric design. Furthermore, the integration of advanced technologies like artificial intelligence (AI) and virtual reality (VR) is gradually transforming the e-learning experience, leading to more engaging and effective learning outcomes. The market is witnessing the consolidation of large players and the emergence of specialized niche providers, resulting in increased competition and innovation. The rise of mobile learning and the adoption of blended learning models are further shaping the trajectory of the generic e-learning courses market. Finally, the increasing importance of data analytics in measuring learning outcomes and improving course design is significantly impacting the market's evolution.

Several factors are converging to propel the growth of the generic e-learning courses market. The widespread adoption of digital technologies across industries has created a fertile ground for the expansion of online learning. The cost-effectiveness of e-learning compared to traditional classroom training is a significant advantage, particularly for businesses seeking to train large numbers of employees. Furthermore, the flexibility offered by e-learning allows individuals to learn at their own pace and convenience, leading to higher engagement and knowledge retention. The increasing demand for upskilling and reskilling initiatives, driven by rapid technological advancements and evolving job market demands, is a primary driver. Governments and organizations are increasingly investing in e-learning initiatives to bridge the skills gap and enhance workforce productivity. The rise of mobile learning, accessible via smartphones and tablets, is further expanding the reach of e-learning, making it convenient for learners to access courses anytime, anywhere. Moreover, the advancements in learning technologies, including interactive simulations, gamification, and personalized learning platforms, are enhancing the learning experience and improving outcomes. The growing adoption of blended learning models, which combine online and offline learning components, is also contributing to the market's expansion.

Despite the significant growth potential, the generic e-learning courses market faces certain challenges. One major obstacle is ensuring the quality and relevance of online courses. Maintaining high standards of instructional design and content curation is crucial to ensuring effective learning outcomes. The proliferation of low-quality courses can negatively impact the market's credibility and hinder its growth. Another challenge is ensuring learner engagement and motivation in online learning environments. Maintaining learner interest and participation requires innovative teaching methodologies and interactive learning tools. The digital divide, particularly in underserved communities, can limit access to e-learning resources and opportunities. Bridging this gap requires concerted efforts to increase internet accessibility and digital literacy. Furthermore, the effective assessment of learning outcomes in online environments poses a challenge. Developing reliable and valid assessment methods that accurately measure learning achievements is essential for ensuring the effectiveness of e-learning programs. Finally, the constant need for updating and revising course content to keep pace with technological advancements and industry changes presents an ongoing challenge for e-learning providers.

The corporate segment is projected to dominate the generic e-learning courses market during the forecast period (2025-2033). This dominance stems from the increasing need for businesses to upskill and reskill their workforce to meet the demands of a rapidly evolving technological landscape.

North America: This region is expected to hold a significant market share, driven by high internet penetration, a robust technological infrastructure, and a strong emphasis on continuous learning and development within corporations. The presence of established e-learning providers and a large pool of skilled professionals further contributes to the region's dominance.

Europe: The European market is also projected to experience substantial growth, driven by similar factors to North America, including high levels of technological adoption and government support for e-learning initiatives.

Asia-Pacific: The Asia-Pacific region is expected to witness significant growth, fuelled by a rapidly expanding middle class, increasing internet penetration, and growing investments in education and training programs by governments and corporations.

The corporate segment's projected dominance is attributable to several factors:

The growth of the generic e-learning courses industry is propelled by several key catalysts. The increasing demand for continuous learning and development, driven by rapid technological advancements and shifting job market demands, fuels the need for accessible and affordable training solutions. The cost-effectiveness and scalability of e-learning compared to traditional training methods are major drivers for businesses and individuals alike. Additionally, advancements in learning technologies, including gamification, personalized learning, and AI-powered learning platforms, are enhancing the effectiveness and engagement of online learning experiences. Government initiatives supporting digital literacy and online learning are also contributing to market growth.

This report provides a comprehensive overview of the generic e-learning courses market, encompassing market size and forecast, key trends, driving forces, challenges, and significant developments. It offers valuable insights into the key segments and regions dominating the market, along with profiles of leading industry players. This detailed analysis provides valuable information for businesses, investors, and educational institutions involved in or interested in the e-learning sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Cegos, Macmillan Learning, Pearson Education, Skillsoft.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Generic E-learning Courses," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Generic E-learning Courses, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.