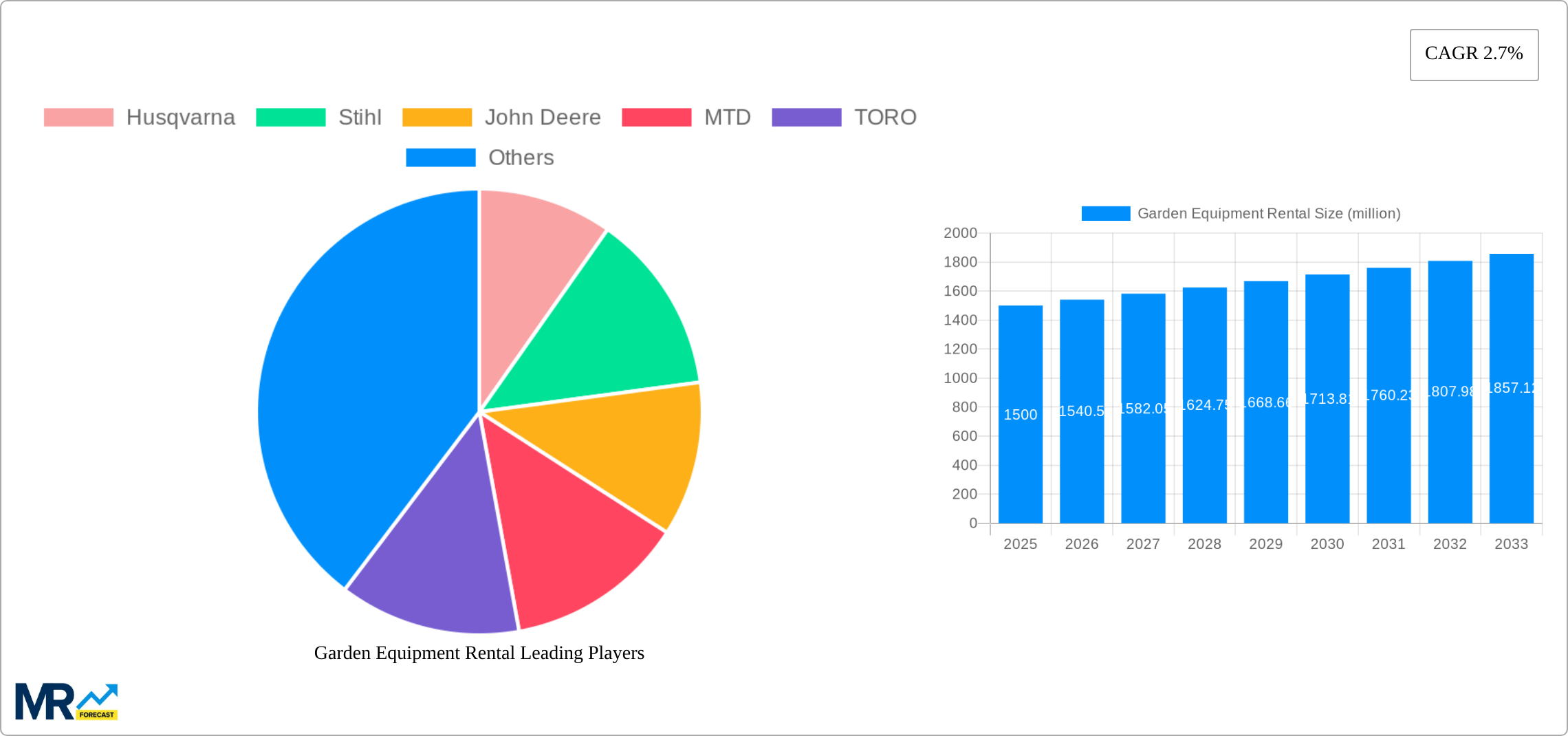

1. What is the projected Compound Annual Growth Rate (CAGR) of the Garden Equipment Rental?

The projected CAGR is approximately 2.7%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Garden Equipment Rental

Garden Equipment RentalGarden Equipment Rental by Type (Lawn Mower, Chainsaw, Hedge Trimmers, Brush Cutters, Leaf Blowers, Others), by Application (Household Used, Commercial, Public Application), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

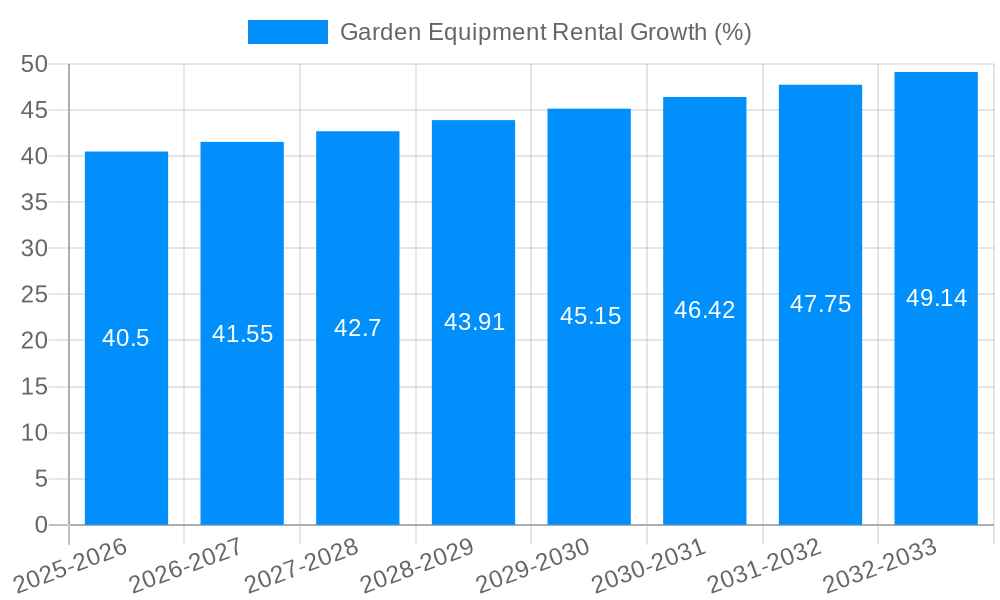

The garden equipment rental market, while exhibiting a relatively modest Compound Annual Growth Rate (CAGR) of 2.7%, presents a substantial opportunity for growth through 2033. The market's steady expansion is driven by several key factors. Increasing urbanization leads to smaller personal landholdings, making renting equipment a more cost-effective solution than purchasing. The rise of DIY landscaping and gardening trends, fueled by social media and accessible online tutorials, further boosts demand for temporary access to specialized tools. Additionally, professional landscaping and gardening businesses increasingly utilize rental services to manage fluctuating project demands and reduce capital expenditure on equipment. The market segmentation reveals strong demand across residential, commercial, and public applications. Lawn mowers, chainsaws, and hedge trimmers consistently rank among the most rented items, reflecting the widespread appeal of lawn care and garden maintenance.

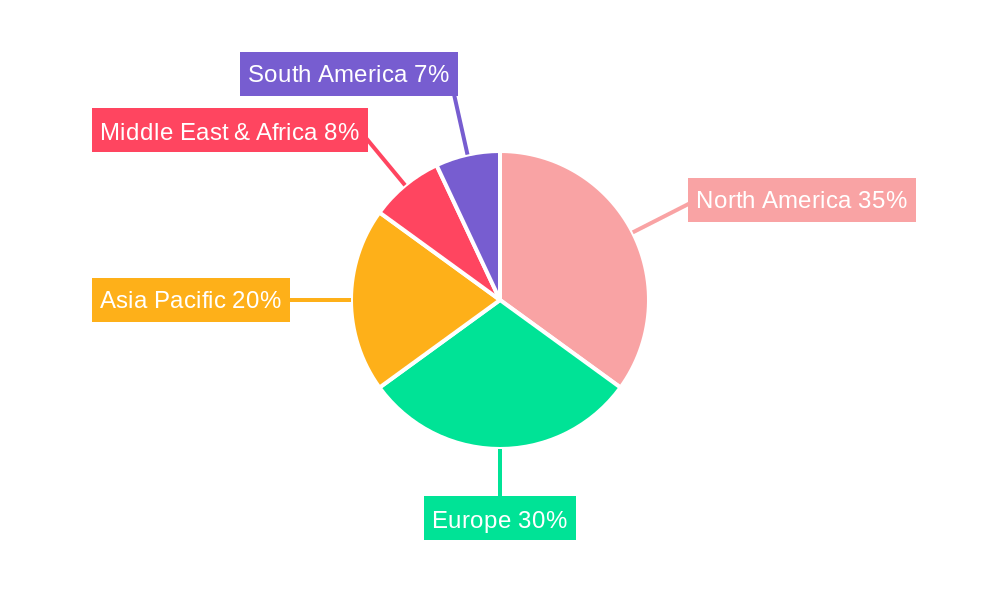

However, the market faces some challenges. Economic downturns can dampen consumer spending on discretionary services like equipment rentals. Competition from established players like Husqvarna, Stihl, and John Deere, alongside newer entrants, creates a dynamic and sometimes price-competitive landscape. Furthermore, the reliance on effective marketing and accessible rental locations is crucial for success; geographical limitations and seasonal variations in demand can impact revenue streams. Given the diverse regional distribution, North America and Europe currently represent major market segments, though Asia-Pacific's growing middle class and increasing disposable income suggest significant future potential. Strategic growth opportunities exist in streamlining rental processes, expanding rental networks, and offering value-added services such as maintenance and delivery, contributing to a more robust market expansion beyond the projected CAGR.

The garden equipment rental market, valued at USD X billion in 2025, is exhibiting robust growth, projected to reach USD Y billion by 2033, showcasing a Compound Annual Growth Rate (CAGR) of Z%. This expansion is driven by several factors, including the increasing popularity of gardening as a hobby, the rising demand for landscaping services in both residential and commercial sectors, and the growing awareness of environmental sustainability. The rental model offers a cost-effective alternative to outright purchase, particularly appealing to casual users and those undertaking short-term projects. This trend is particularly pronounced in densely populated urban areas where storage space is limited. Furthermore, advancements in equipment technology, such as the introduction of lightweight, battery-powered tools, are enhancing the appeal and accessibility of rental options. The market is seeing a shift towards specialized equipment rentals, catering to specific needs like vertical gardening or precision trimming. This specialization is expected to further fuel market growth, as users seek professional-grade tools without the commitment of ownership. The rental sector also benefits from the increasing popularity of DIY projects and the rise of online rental platforms that enhance convenience and accessibility. Competition is intensifying among established players and new entrants, leading to innovation in pricing strategies, service offerings, and technology integration. The COVID-19 pandemic accelerated the adoption of online booking systems, driving market digitalization and furthering the convenience factor for consumers.

Several key factors are accelerating the growth of the garden equipment rental market. Firstly, the rising disposable incomes in many regions are enabling consumers to allocate more funds towards leisure activities like gardening and landscaping. This trend, coupled with the increasing urbanization and the desire for aesthetically pleasing outdoor spaces, contributes significantly to market expansion. Secondly, the eco-consciousness of consumers is driving demand for sustainable and efficient gardening tools. Rental providers are responding by offering newer, greener equipment, minimizing environmental impact. The convenience offered by rental services, avoiding the hassle of maintenance, storage, and repair, is another crucial driver. Businesses, both small and large, benefit from the flexibility of renting specialized equipment as needed, particularly for seasonal work or large projects, thus reducing capital expenditure. Finally, technological advancements in garden equipment, such as lighter, more powerful and environmentally friendly models, and the rise of user-friendly online platforms for rentals are boosting market accessibility and driving adoption. The combination of these factors ensures that the market will continue its upward trajectory in the coming years.

Despite the positive growth trajectory, the garden equipment rental market faces some challenges. Seasonal fluctuations in demand pose a significant constraint; rental businesses experience peaks during spring and summer, leading to underutilization of equipment during off-seasons. Maintaining a high level of equipment availability and ensuring prompt repairs are crucial but can be expensive and resource-intensive. Furthermore, competition is fierce, requiring companies to differentiate their offerings through competitive pricing, convenient locations, and excellent customer service. Damage to rented equipment represents a significant financial risk and necessitates robust insurance and damage assessment processes. Lastly, ensuring adequate staff training on equipment operation and safety protocols is crucial for minimizing risks and providing a positive customer experience. Addressing these challenges effectively will be critical for continued market growth and profitability.

The North American market, particularly the US, is currently a dominant player in the garden equipment rental sector, fueled by high disposable incomes, a strong DIY culture, and the significant presence of established rental businesses. Within Europe, Germany and the UK represent substantial markets, though growth rates may vary depending on regional economic conditions. Asia-Pacific is also showing promising growth, driven by increasing urbanization and the adoption of Western landscaping trends, particularly in countries like China and Japan.

The dominance of lawn mowers is attributed to their versatility and the widespread need for lawn maintenance across residential, commercial and public spaces. The increasing demand for efficient and environmentally friendly models further boosts growth in this segment. The household-used application segment benefits from the accessibility and convenience offered by rental services, particularly amongst those who own smaller gardens or infrequently need lawn mowers. The commercial segment, while smaller in absolute value, shows greater growth potential due to increasing landscaping contracts and the need for reliable and durable equipment. The increasing adoption of electric and robotic lawn mowers will also influence this segment's growth, though the higher cost may limit immediate adoption in the rental sector.

The garden equipment rental industry is poised for continued growth due to several key factors. The expanding market for landscaping services, particularly in urban areas, coupled with rising disposable incomes, are creating greater demand for convenient access to specialized equipment. Technological advancements, leading to lighter, more fuel-efficient, and user-friendly tools, are enhancing both customer experience and operational efficiency. The growing adoption of online platforms for booking and managing rentals further streamlines the process and broadens market reach.

This report provides a comprehensive analysis of the garden equipment rental market, covering historical trends, current market dynamics, and future growth projections. It identifies key drivers and restraints impacting market growth, examines leading companies and their strategies, and offers in-depth segmentation by equipment type and application. This detailed analysis, coupled with market size estimations and forecasts, enables businesses to make informed decisions and capitalize on emerging opportunities within this dynamic sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.7% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 2.7%.

Key companies in the market include Husqvarna, Stihl, John Deere, MTD, TORO, The Home Depot, Honda, Blount, Craftsman, STIGA SpA, Briggs & Stratton, Stanley Black & Decker, Ariens, Makita, Hitachi, Greenworks, EMAK, Yamabiko, Zomax, Zhongjian, Worx, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Garden Equipment Rental," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Garden Equipment Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.