1. What is the projected Compound Annual Growth Rate (CAGR) of the Game Server Hosting Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Game Server Hosting Service

Game Server Hosting ServiceGame Server Hosting Service by Type (/> Virtual Server, Cloud Server, Dedicated Server), by Application (/> Individual, Enterprise), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

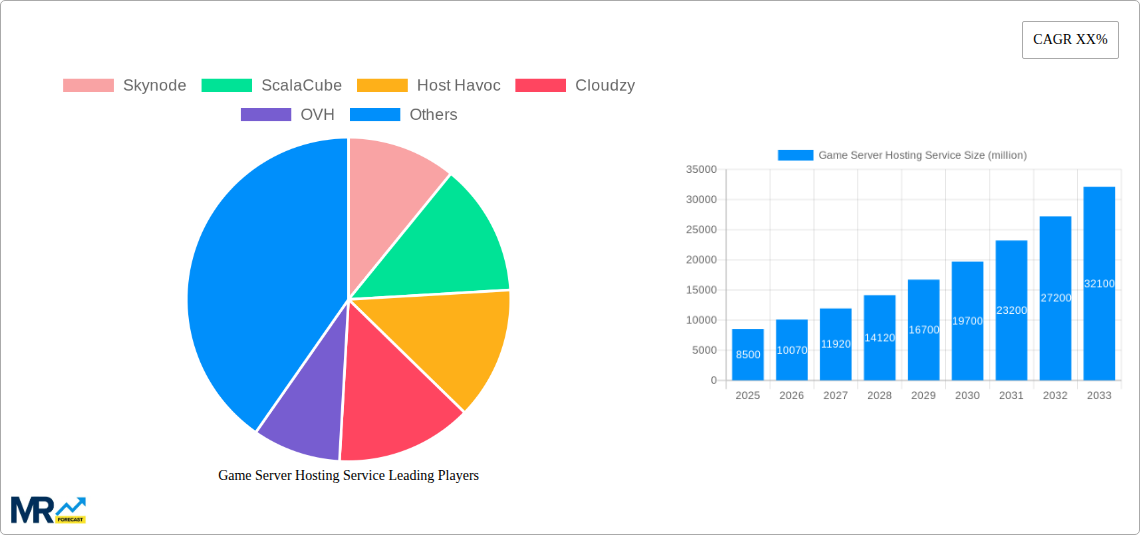

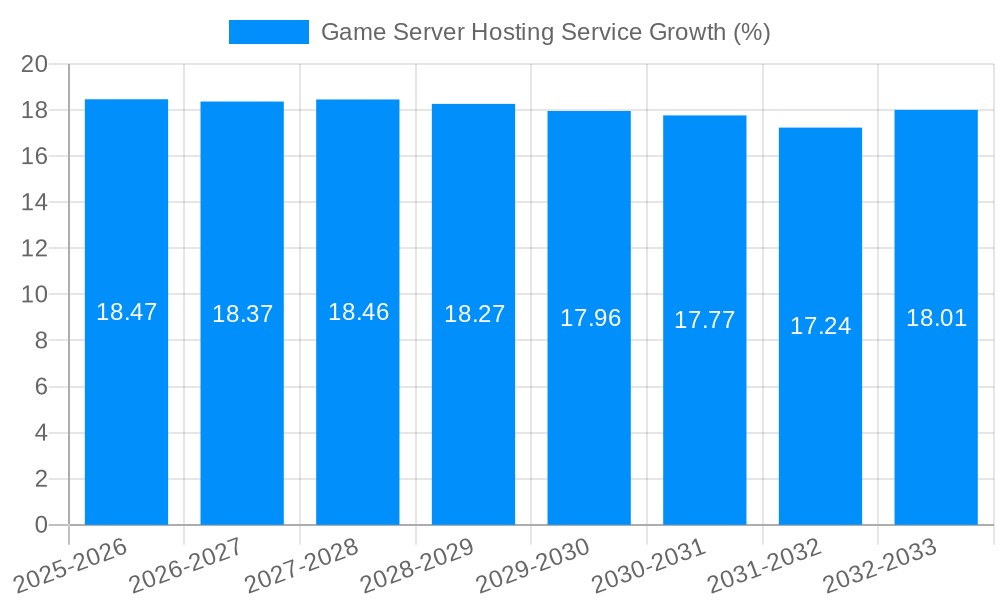

The global Game Server Hosting Service market is poised for substantial growth, projected to reach an estimated market size of $8,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 18.5% expected throughout the forecast period (2025-2033). This expansion is primarily driven by the escalating popularity of online multiplayer gaming, the increasing prevalence of esports, and the continuous development of more graphically intensive and complex games that necessitate dedicated and reliable server infrastructure. The proliferation of cloud computing technologies and the rise of specialized hosting solutions catering to specific game titles further fuel this upward trajectory. Virtual servers, cloud servers, and dedicated servers are all expected to see increased adoption as gamers and enterprises alike seek optimized performance, low latency, and enhanced security for their gaming experiences.

The market is further segmented by application, with both individual gamers and enterprises contributing significantly to demand. Individual gamers are increasingly investing in premium hosting services for a more seamless and competitive gameplay experience, while enterprises, including game developers and esports organizations, rely on these services for hosting tournaments, managing large player bases, and providing robust online infrastructure. Key trends shaping the market include the growing demand for DDoS protection, low-latency server locations, and customizable server configurations. However, potential restraints such as the high cost of advanced hosting solutions for smaller entities and the complexity of managing dedicated server environments may pose challenges. Despite these, the overarching trend of digital transformation and the continued innovation in gaming technology are expected to propel the market forward, with regions like North America and Europe currently leading in adoption, while the Asia Pacific region shows immense growth potential.

This report delves into the dynamic and rapidly evolving landscape of the Game Server Hosting Service market. Spanning a comprehensive study period from 2019 to 2033, with a base year of 2025 and an estimated year also of 2025, this analysis meticulously examines the historical performance (2019-2024) and forecasts future trajectories through the extended forecast period of 2025-2033. The report leverages extensive market intelligence to provide actionable insights into key trends, driving forces, prevailing challenges, dominant segments, growth catalysts, leading players, and significant developments within this multi-billion dollar industry.

The global Game Server Hosting Service market is on an unprecedented ascent, projected to experience substantial growth and innovation throughout the forecast period. Valued in the tens of billions of dollars, this sector is witnessing a paradigm shift driven by the exponential increase in online multiplayer gaming, the proliferation of esports, and the continuous demand for low-latency, high-performance gaming experiences. A key trend observed is the increasing adoption of Cloud Server solutions, offering unparalleled scalability, flexibility, and cost-efficiency for both individual gamers and large enterprises. Companies like Amazon and Google are heavily investing in their cloud infrastructure, providing robust and reliable platforms that cater to the demanding needs of modern gaming.

Furthermore, the market is seeing a significant rise in Dedicated Server offerings, particularly for professional esports organizations and large-scale game developers who require exclusive control over their server environment to optimize performance and security. Players such as OVH and So you Start are prominent in this segment, providing high-performance hardware and customizable configurations. The Virtual Server segment also continues to evolve, with providers like Vultr (The Constant Company) and ServerMania offering increasingly powerful and affordable virtualized solutions that democratize access to quality game hosting.

Beyond the infrastructure, the application landscape is diversifying. While Individual gamers remain a significant consumer base, seeking affordable and easy-to-use hosting for their private servers, the Enterprise segment is growing at an accelerated pace. This includes game developers, publishers, and esports teams who rely on sophisticated hosting solutions for their live operations, competitive events, and player communities. The industry also sees a growing demand for specialized hosting for emerging gaming genres and technologies, such as augmented reality (AR) and virtual reality (VR) games, which require extremely low latency and high bandwidth. The underlying trend is towards more managed, secure, and performance-optimized hosting environments, with providers increasingly offering specialized services tailored to specific game titles and player needs. This trend is fueled by a constant influx of new game titles and a growing global gaming population, pushing the overall market valuation into the hundreds of millions and beyond.

The game server hosting service market is experiencing a robust surge fueled by a confluence of powerful drivers, each contributing significantly to its multi-billion dollar valuation. At the forefront is the insatiable global appetite for online multiplayer gaming. The sheer volume of players engaging in persistent online worlds and competitive multiplayer titles creates a perpetual demand for stable, low-latency servers. This is further amplified by the meteoric rise of esports, which transforms gaming from a pastime into a professional spectacle, requiring enterprise-grade hosting solutions for tournaments and professional teams. Companies like Unity Technologies and GameServers are instrumental in supporting this ecosystem, providing the foundational infrastructure for competitive play.

The increasing accessibility of gaming hardware, coupled with the widespread availability of high-speed internet connectivity across developed and developing regions, has broadened the gaming audience exponentially. This demographic expansion translates directly into a larger potential customer base for game server hosting. Moreover, the continuous innovation within the gaming industry itself, with the release of graphically intensive and complex games, necessitates more powerful and specialized hosting solutions. Providers are compelled to constantly upgrade their infrastructure, offering advanced technologies to meet these evolving demands. The growing trend of gamers and communities seeking personalized gaming experiences, opting to host their own private servers for specific mods, game versions, or community rules, also significantly contributes to market growth. This user-driven demand for customization and control ensures a consistent market for various hosting types, from individual virtual servers to dedicated enterprise-level deployments.

Despite its impressive growth trajectory, the game server hosting service market is not without its hurdles. A primary challenge is the relentless pressure on pricing. As the market matures and becomes more competitive, especially with large cloud providers entering the fray, there's a constant downward pressure on prices, impacting the profit margins for many hosting providers. This forces companies like Skynode and ScalaCube to constantly innovate and differentiate their offerings to justify their pricing.

Another significant restraint is the technical complexity involved in managing and optimizing game servers. Ensuring low latency, high uptime, and robust security against distributed denial-of-service (DDoS) attacks requires specialized expertise and continuous investment in infrastructure and skilled personnel. Failures in these areas can lead to significant player dissatisfaction and reputational damage. Furthermore, the patching and updating cycle of popular game titles can create significant operational overhead. Hosting providers must be agile in deploying updates to their server infrastructure to support new game versions and features, often under tight deadlines imposed by game developers.

The fragmentation of the market also presents a challenge. With a vast array of game titles, each with its unique server requirements, providers struggle to offer universally optimized solutions. This necessitates specialized offerings for popular games, increasing the operational complexity and potentially limiting scalability for niche titles. Lastly, player churn and the ever-evolving gaming landscape mean that hosting providers must constantly adapt to new game releases and shifting player preferences. A game that is popular today might be overshadowed by a new release tomorrow, requiring providers to be agile in their service offerings and marketing strategies. These challenges collectively represent a significant barrier to entry and growth for some players in this dynamic market.

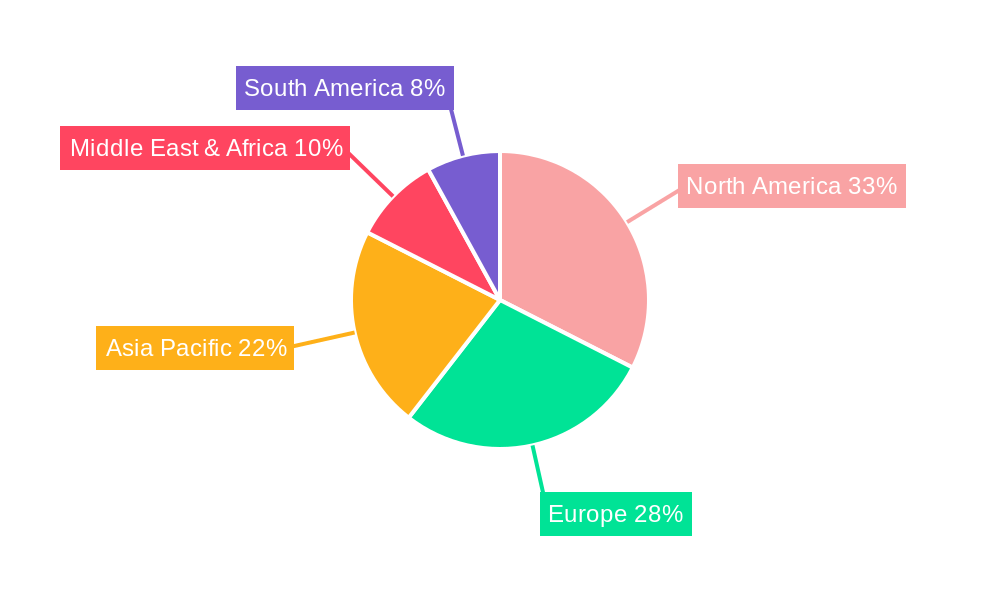

The Game Server Hosting Service market is poised for significant regional dominance and segment leadership, with North America and Asia-Pacific emerging as key powerhouses, driven by their massive gaming populations and advanced technological adoption.

Dominant Regions:

North America: This region, particularly the United States and Canada, has historically been a frontrunner in gaming adoption and esports development. The presence of a large, affluent demographic with high disposable income, coupled with a mature esports ecosystem and a strong developer base, makes it a prime market. The demand for low-latency, high-performance hosting for both individual gamers and professional organizations is exceptionally high. Major tech giants like Amazon and Google have a strong presence here, offering robust cloud infrastructure that underpins much of the market. Furthermore, numerous dedicated game server hosting providers like Host Havoc and GTXGaming have established strong customer bases in this region. The sheer volume of active online gamers, coupled with a high propensity to spend on gaming-related services, ensures North America will continue to be a dominant force.

Asia-Pacific: This region represents the largest and fastest-growing gaming market globally, driven by countries like China, South Korea, Japan, and Southeast Asian nations. The sheer volume of mobile gamers, rapidly expanding internet infrastructure, and a cultural embrace of gaming and esports contribute to its dominance. While mobile gaming often has different hosting requirements, the growth in PC and console gaming, alongside the rise of esports, is driving significant demand for dedicated and cloud-based game server hosting. Companies like Huawei, with its extensive cloud offerings, and regional players are increasingly catering to this massive and dynamic market. The rapid urbanization and increasing disposable incomes in many Asia-Pacific countries further fuel this growth.

Dominant Segments:

Cloud Server (Type): The Cloud Server segment is anticipated to lead the market's growth trajectory. Its inherent advantages of scalability, flexibility, on-demand resource allocation, and cost-effectiveness make it the preferred choice for a wide range of users. For individual gamers, cloud servers offer an accessible entry point to hosting their own game servers without the need for significant upfront investment in hardware. For enterprises, cloud solutions provide the agility to scale resources up or down based on player demand, critical for managing fluctuating player bases during game launches or major in-game events. The continuous advancements in cloud computing, including sophisticated orchestration tools and global network infrastructure, further enhance the appeal of cloud servers for game hosting. Providers like Vultr (The Constant Company) and ExtraVM are making significant inroads in this segment by offering competitive pricing and powerful virtualized environments.

Individual (Application): While the Enterprise segment is growing rapidly, the Individual application segment is expected to maintain a substantial market share due to the sheer volume of independent gamers. The desire for private servers for friends, modding communities, or specific game versions remains a strong driver. The increasing affordability and user-friendliness of game server hosting platforms have made it easier than ever for individuals to set up and manage their own gaming environments. Companies such as Shockbyte and Nodecraft have built their success on catering to this segment, offering a wide range of customizable options and support. The continuous release of games with strong modding communities and the enduring popularity of sandbox and survival games further solidify the dominance of the individual user base.

The interplay of these dominant regions and segments, supported by robust technological advancements and a constantly expanding player base, will shape the future landscape of the game server hosting service market, driving its valuation into the tens of millions and beyond.

Several key factors are acting as significant growth catalysts for the game server hosting service industry. The ever-increasing popularity and global reach of esports are a primary driver, demanding robust and low-latency hosting solutions for competitive play. The continuous innovation in game development, leading to more complex and graphically intensive titles, necessitates advanced hosting capabilities. Furthermore, the growing trend of user-generated content and modding communities fosters a demand for customizable server environments. The widespread adoption of cloud infrastructure, offering scalability and cost-effectiveness, is democratizing access to high-quality game hosting for a broader audience, from individual enthusiasts to large enterprises.

This report offers a comprehensive analysis of the Game Server Hosting Service market, providing in-depth insights into its multifaceted landscape. It meticulously examines market trends, driving forces, prevailing challenges, and dominant segments, offering a holistic view of the industry's current state and future potential. The report details the key regions and countries poised for significant growth, alongside the specific server types and application segments expected to lead the market. Furthermore, it identifies crucial growth catalysts that are propelling the industry forward and provides a thorough overview of the leading players and their strategic contributions. The analysis of significant developments, including recent technological advancements and strategic partnerships, offers valuable context for understanding the market's dynamic evolution. This comprehensive coverage aims to equip stakeholders with the knowledge necessary to navigate this multi-billion dollar market, enabling informed decision-making and strategic planning for future success.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Skynode, ScalaCube, Host Havoc, Cloudzy, OVH, Google, Amazon, Citadel Servers, So you Start, Vultr(The Constant Company), Streamline Servers, ExtraVM, GTXGaming, GameServers, Pingperfect, Unity Technologies, ServerMania, Huawei, Hosting Services, Shockbyte, Nodecraft, IONOS, IBM, GGServers, Hostinger, Leaseweb, InterServer, Hosting, KnownHost, A2 Hosting, InMotion Hosting, GigeNET, LogicServers, VibeGAMES.net.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Game Server Hosting Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Game Server Hosting Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.