1. What is the projected Compound Annual Growth Rate (CAGR) of the Game Placement Ads?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Game Placement Ads

Game Placement AdsGame Placement Ads by Type (Static Ads, Dynamic Ads), by Application (Computer Games, Mobile Game, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

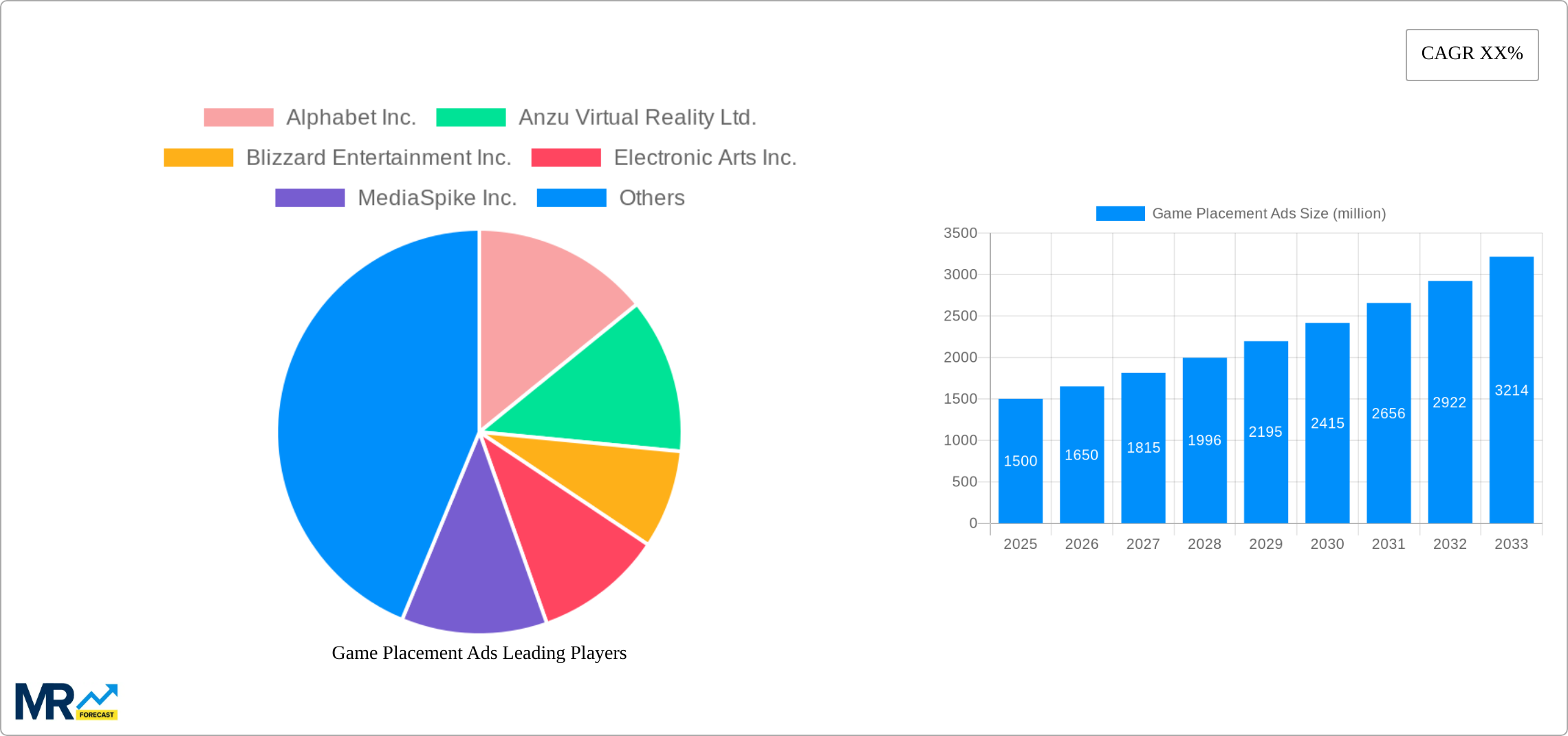

The in-game advertising market, specifically game placement ads, is experiencing robust growth, driven by the expanding gaming industry and increasing player engagement. The market's value is substantial, with projections indicating a significant compound annual growth rate (CAGR). This growth is fueled by several factors: the rising popularity of mobile and computer gaming, the development of more sophisticated and less disruptive ad formats (like dynamic ads that seamlessly integrate into gameplay), and the increasing willingness of game developers and publishers to incorporate advertising as a monetization strategy. Key segments, including static and dynamic ads within computer and mobile games, contribute to this expanding market, with mobile gaming currently leading the charge due to its wider accessibility and larger player base. Major players like Alphabet Inc., Electronic Arts, and Anzu Virtual Reality are actively shaping this market through innovative ad technologies and strategic partnerships, further driving market expansion and diversification.

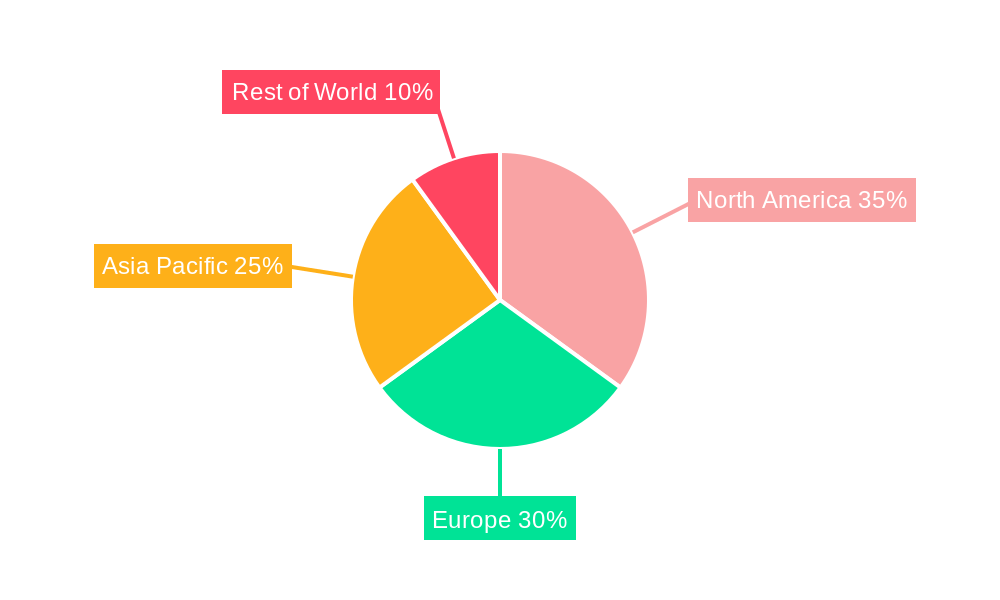

However, challenges remain. One significant restraint is the potential for negative player experience if ads are poorly integrated or disruptive. This necessitates a focus on developing non-intrusive ad formats that enhance, rather than detract from, the gaming experience. Another challenge is the need for robust measurement and reporting tools to effectively demonstrate return on investment (ROI) for advertisers. Future growth will depend on overcoming these hurdles and continuing to innovate in ad formats and targeting capabilities to enhance user experience and maximize advertiser value. Geographical distribution shows strong growth across North America and Europe, reflecting these regions' advanced gaming markets and higher levels of ad spending. However, Asia-Pacific, with its rapidly expanding gaming population, presents a significant opportunity for future market expansion. The continued evolution of the gaming industry and advancements in advertising technology will dictate the future trajectory of the game placement advertising market. Market fragmentation across various game genres and platforms, however, poses a challenge for comprehensive analysis and market predictions.

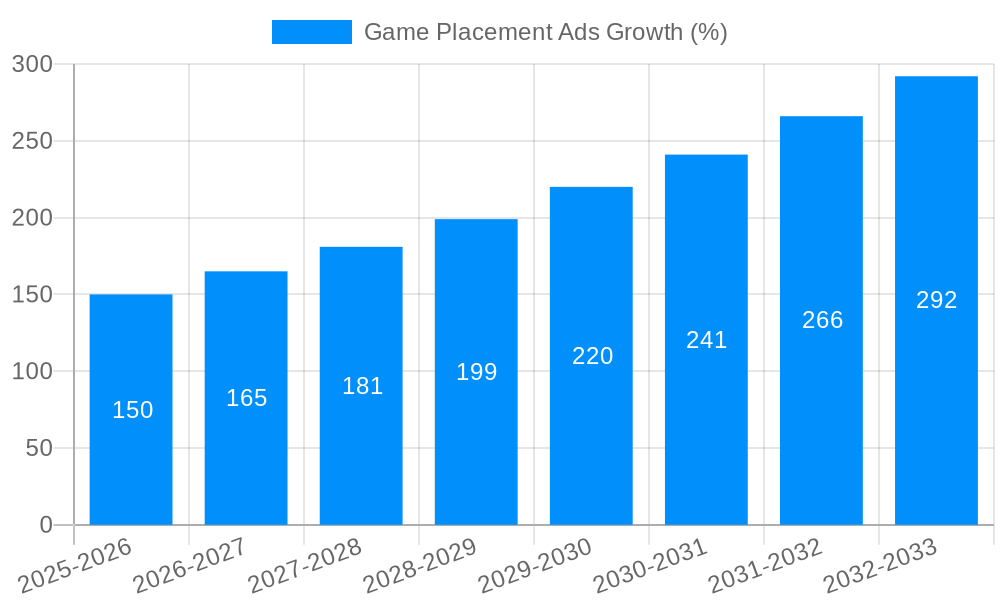

The game placement advertising market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. The period between 2019 and 2024 witnessed significant foundational development, with the market laying the groundwork for the impressive expansion anticipated in the forecast period (2025-2033). This growth is fueled by several converging factors. Firstly, the meteoric rise of the gaming industry itself, encompassing both mobile and computer games, provides an increasingly vast and engaged audience for advertisers. Secondly, advancements in ad technology have allowed for more sophisticated, less intrusive, and ultimately more effective game placement ads. This includes the evolution from simple static ads to dynamic, contextually relevant ads that seamlessly integrate into the gameplay experience. The shift towards in-game advertising is partly driven by the declining effectiveness of traditional advertising methods and the increasing sophistication of ad-blocking technologies. Players are becoming more accepting of in-game ads, provided they are non-disruptive and offer some value, such as rewarding players with in-game currency or benefits. The market is witnessing a move towards more immersive and interactive advertising formats, blurring the lines between advertising and gameplay, leading to higher engagement and improved ROI for advertisers. Moreover, the increasing adoption of advanced analytics and measurement tools provides advertisers with granular insights into campaign performance, allowing for better optimization and targeting. This data-driven approach enhances the effectiveness of game placement ads and further strengthens investor confidence in the market's future. The estimated market value in 2025 underscores the burgeoning nature of this sector, positioning it as a key player in the broader digital advertising landscape.

Several key factors are propelling the growth of the game placement ads market. The expanding gaming audience, particularly within the mobile gaming sector, provides a massive and increasingly engaged target demographic for advertisers. The immersive nature of games allows for more impactful advertising, with ads integrated seamlessly into the game environment to avoid disrupting the player experience, leading to higher engagement rates compared to traditional banner ads. Technological advancements are also playing a crucial role, with the development of dynamic and interactive ad formats providing more engaging and personalized advertising experiences. These advancements allow for real-time ad adjustments based on player behavior and preferences, optimizing campaign effectiveness. Furthermore, the increasing sophistication of ad measurement and analytics provides advertisers with valuable data-driven insights into campaign performance, allowing for more informed decision-making and improved return on investment (ROI). Finally, the increasing difficulty and cost of reaching audiences through traditional advertising methods are driving advertisers towards alternative channels, including game placement ads, offering a potentially more cost-effective and targeted approach. The combined effect of these factors positions the game placement ads market for sustained and significant growth over the forecast period.

Despite the significant growth potential, the game placement ads market faces several challenges. One major concern is the potential for ad fatigue and negative player experiences if ads are implemented poorly or are too intrusive. Striking the right balance between monetization and maintaining a positive player experience is crucial for the long-term success of this sector. Another challenge is ensuring accurate ad measurement and attribution, especially given the diversity of gaming platforms and devices. The development of standardized measurement methodologies is essential for building trust and confidence among advertisers. Furthermore, the fragmented nature of the gaming industry, with numerous different game developers and publishers, can present challenges in terms of standardization and scalability of ad placement solutions. The need for collaboration and cooperation across the industry is vital to overcoming these obstacles. Additionally, concerns regarding data privacy and user consent are paramount. Advertisers must adhere to stringent data privacy regulations and ensure transparency with players regarding data collection and usage practices. Finally, competition from other digital advertising channels remains a significant challenge, requiring game placement advertising platforms to continuously innovate and offer unique value propositions to attract and retain advertisers.

The mobile game segment is poised to dominate the game placement ads market. Mobile gaming’s unparalleled reach and accessibility drive this prediction. Several factors contribute to this dominance:

Geographically, North America and Asia are expected to lead the market.

The growth within the mobile game segment is driven by several interconnected factors. The continuous innovation in mobile game design, alongside increasingly sophisticated in-game advertising technologies, creates a powerful synergy. The increasing sophistication of ad platforms allows for more targeted and less intrusive ad experiences, leading to improved player acceptance. Advertisers are recognizing the high ROI potential of this segment due to its enormous audience size and the ability to effectively target specific demographics. The convergence of these elements positions the mobile game segment as the undisputed leader in the game placement ads market in the coming years.

The industry's growth is fueled by the increasing adoption of advanced analytics, providing crucial data-driven insights for campaign optimization. The rise of immersive and interactive ad formats is another significant factor, as these ads create more engaging player experiences, leading to greater ad recall and ROI. Furthermore, the gaming industry's continuous expansion, fueled by ever-increasing mobile penetration and technological advancements, provides a vast and expanding audience for advertisers.

This report provides a comprehensive overview of the Game Placement Ads market, examining its current state, future growth trajectories, and key players. It offers a detailed analysis of market trends, driving factors, challenges, and growth catalysts. The report also includes a regional breakdown, focusing on key segments and countries dominating the market, along with an in-depth profile of leading industry participants. The insights provided equip stakeholders with the necessary information to make informed business decisions and capitalize on the opportunities within this rapidly expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Alphabet Inc., Anzu Virtual Reality Ltd., Blizzard Entertainment Inc., Electronic Arts Inc., MediaSpike Inc., IronSource Ltd., Motive Interactive Inc., Playwire LLC, RapidFire Inc., WPP Plc..

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Game Placement Ads," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Game Placement Ads, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.