1. What is the projected Compound Annual Growth Rate (CAGR) of the Game Asset Trading Platform?

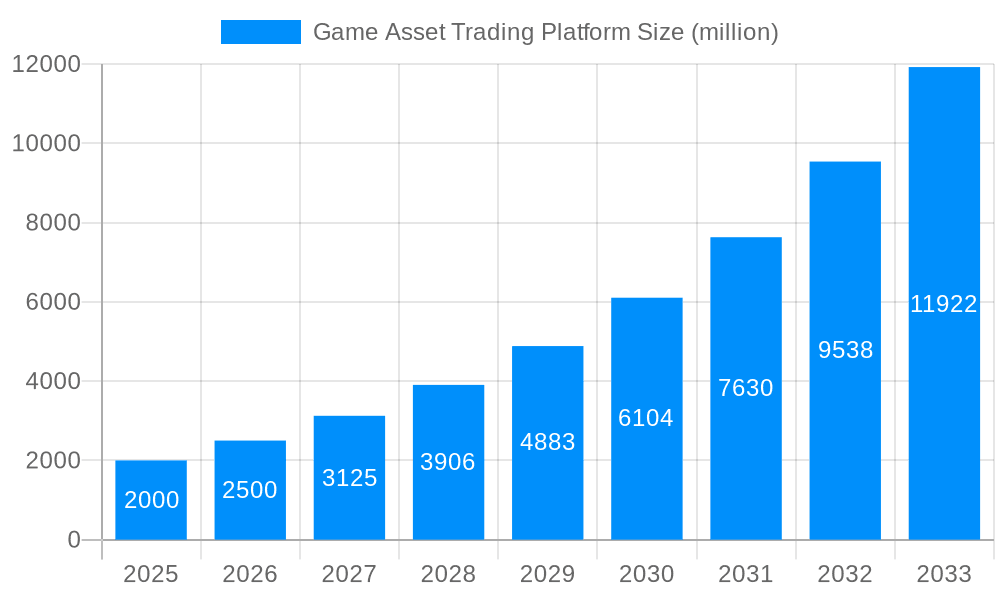

The projected CAGR is approximately 11.06%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Game Asset Trading Platform

Game Asset Trading PlatformGame Asset Trading Platform by Application (Game Developer, Game Player), by Type (Account Transaction, Game Currency Trading, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

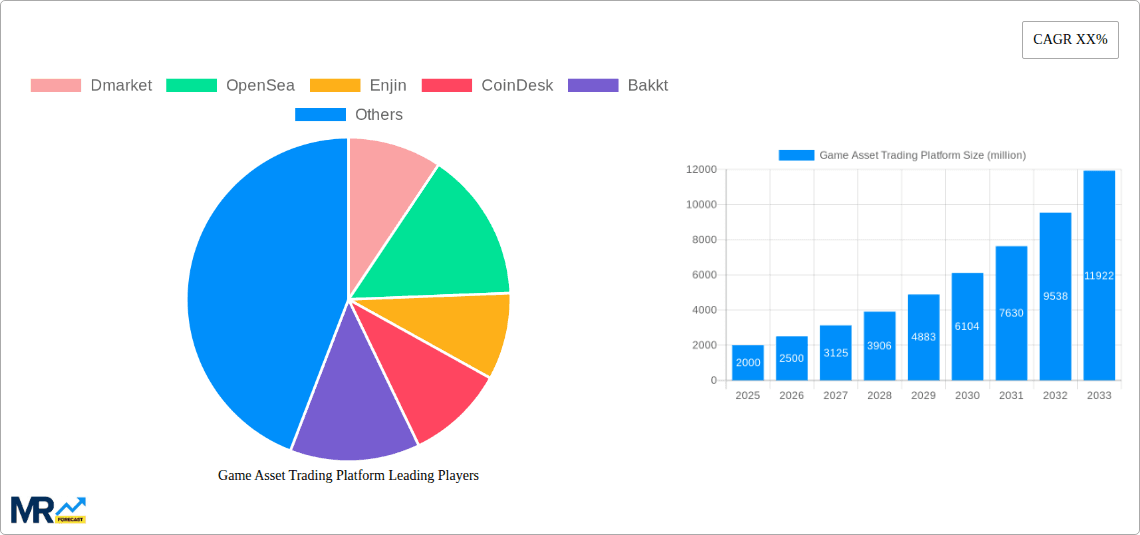

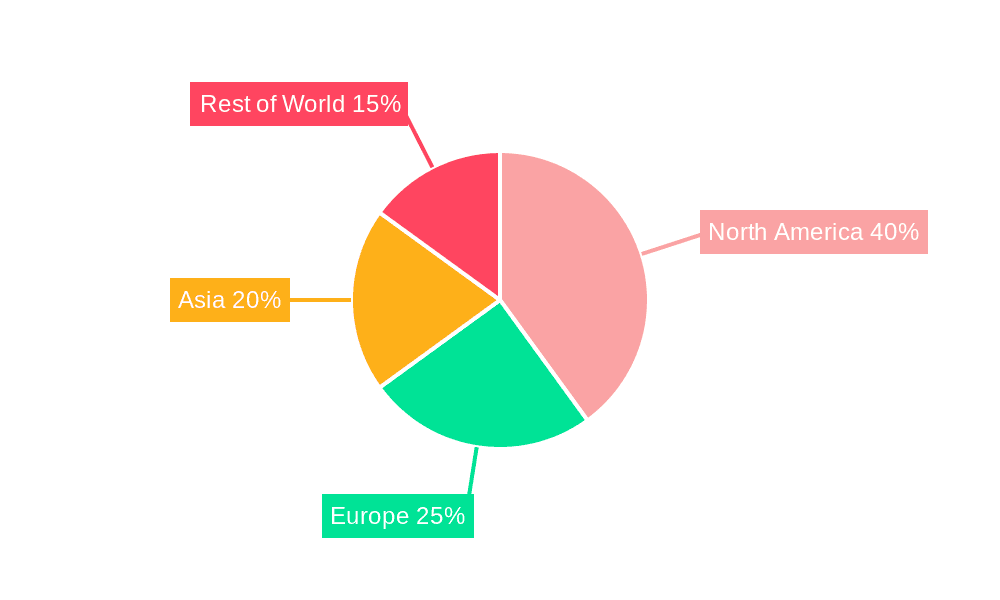

The Game Asset Trading Platform market is experiencing significant growth, driven by the increasing popularity of blockchain technology, NFTs (Non-Fungible Tokens), and the expanding metaverse. The integration of in-game assets with real-world value, facilitated by these platforms, is attracting both game developers and players. This market segment is fueled by the ability to buy, sell, and trade virtual items, including characters, skins, weapons, and virtual land, creating a thriving secondary market. The rise of play-to-earn (P2E) gaming models further intensifies this trend, as players can monetize their in-game achievements. We estimate the 2025 market size to be $2.5 billion, with a Compound Annual Growth Rate (CAGR) of 25% projected through 2033. This growth is largely due to increased user adoption and the introduction of new gaming platforms incorporating robust asset trading functionalities. Key restraints include regulatory uncertainty surrounding digital assets and the potential for market volatility. The market is segmented by application (game developers and players) and type of transaction (account transactions, game currency trading, and other). North America and Asia-Pacific currently hold the largest market shares, but emerging markets in other regions are poised for substantial growth. Leading companies are actively developing and improving their platforms to enhance security, liquidity, and user experience. This competitive landscape will likely see consolidation and innovation as the market matures.

The diverse range of platforms catering to different game genres and player preferences highlights the market’s dynamism. The integration of blockchain technology provides a secure and transparent environment for asset trading, boosting trust and facilitating wider adoption. However, challenges remain, such as the need for enhanced user education regarding digital asset security and the ongoing development of regulatory frameworks to mitigate risks associated with fraud and market manipulation. Future growth will be driven by further technological advancements, expansion into new gaming markets, and the continued evolution of the metaverse, presenting significant opportunities for investors and businesses alike. Continued development of user-friendly interfaces and improved security measures are crucial for broader market penetration and the sustained expansion of the Game Asset Trading Platform market.

The global game asset trading platform market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. Driven by the rise of blockchain technology, NFTs (Non-Fungible Tokens), and the increasing popularity of play-to-earn (P2E) games, this market segment is rapidly evolving. The historical period (2019-2024) witnessed a steady climb in adoption, particularly amongst game players seeking to monetize in-game assets and developers looking for new revenue streams. The estimated market value for 2025 stands at several hundred million dollars, a significant jump from previous years. This growth is further fueled by the increasing integration of digital assets into mainstream gaming, blurring the lines between virtual and real-world economies. The forecast period (2025-2033) anticipates even more substantial growth, potentially reaching billions of dollars, driven by technological advancements, regulatory clarity (in certain jurisdictions), and wider user acceptance. Key market insights reveal a strong preference for platforms offering secure, transparent, and user-friendly trading experiences. The emergence of specialized platforms catering to specific game genres or asset types further contributes to market segmentation and growth. The integration of advanced features like decentralized finance (DeFi) protocols, automated market makers (AMMs), and sophisticated analytics tools are also attracting a wider range of users, both individual players and institutional investors. Furthermore, the increasing number of partnerships between game developers and trading platforms is fostering innovation and accelerating market penetration. The base year for our analysis is 2025, providing a crucial benchmark against which to assess future market trends.

Several factors contribute to the rapid expansion of the game asset trading platform market. Firstly, the rise of NFTs has revolutionized the way in-game assets are perceived and traded. NFTs allow for the creation of unique, verifiable digital ownership of in-game items, leading to increased demand and value. Secondly, the increasing popularity of P2E games has created a new economic model within the gaming industry, where players can earn real-world value by trading in-game assets. This creates a powerful incentive for players to participate and invest in the market. Thirdly, the growing adoption of blockchain technology provides a secure and transparent infrastructure for trading digital assets, mitigating risks associated with traditional centralized platforms. This trust factor encourages more players and developers to engage. Fourthly, technological advancements in areas like smart contracts and decentralized exchanges are streamlining the trading process, making it more efficient and accessible for a wider audience. Finally, the increasing integration of game asset trading platforms with established cryptocurrency exchanges and payment gateways expands market liquidity and user accessibility, driving further adoption. The combination of these factors is creating a synergistic effect that propels the game asset trading platform market towards significant growth in the coming years.

Despite its rapid growth, the game asset trading platform market faces significant challenges. Regulatory uncertainty remains a major hurdle, with varying legal frameworks across different jurisdictions creating confusion and limiting market expansion. The volatile nature of cryptocurrency markets poses a risk to the value of game assets, creating price fluctuations that can impact user confidence and investment decisions. Security concerns, including the potential for hacks and scams, are also a persistent threat, impacting the trust and reputation of individual platforms. Scalability issues, particularly during periods of high trading volume, can lead to network congestion and hinder user experience. Furthermore, the lack of standardization in asset formats and trading protocols creates interoperability challenges, limiting the seamless exchange of assets across different platforms. The complexity of understanding blockchain technology and NFT functionalities can be a barrier to entry for some users. Finally, the potential for market manipulation and insider trading poses a threat to the fair and transparent operation of the market. Addressing these challenges is crucial for the sustainable growth and development of the game asset trading platform sector.

The Game Player segment is poised to dominate the market during the forecast period. This is driven by the substantial increase in gamers worldwide and the growing desire to monetize in-game achievements and collections.

North America and Asia are predicted to lead in terms of regional market share. North America’s strong gaming culture and early adoption of blockchain technology provide a fertile ground for growth. Asia, particularly East and Southeast Asia, boasts a massive gaming population with a high propensity for engaging with digital economies.

Account Transaction type is also expected to see significant growth, representing the core functionality of most trading platforms. As more players buy, sell, and trade assets, this segment is intrinsically linked to the overall market expansion.

Game Currency Trading presents a substantial segment. The growth of in-game currencies with real-world value directly impacts the trading volumes and overall market size.

The sheer size and engagement of the gaming communities in these regions, coupled with the high volume of transactions within the Account Transaction and Game Currency Trading segments, position them as the key drivers of market dominance. The continued expansion of the P2E gaming model further reinforces this segment's leading role in the industry. Further, regulatory developments focusing on consumer protection and asset clarity in these regions could also greatly impact growth. However, challenges remain, including the need for platforms to enhance security measures, improve user experience, and address regulatory concerns to fully realize their market potential.

The confluence of factors like the widespread adoption of blockchain technology, the rising popularity of NFTs and the burgeoning P2E gaming model is acting as a significant catalyst for growth in the game asset trading platform industry. These advancements create new opportunities for players to monetize their in-game assets, encouraging wider participation and investment in the market, leading to increased trading volume and platform expansion. Furthermore, ongoing technological improvements enhance platform security, streamline trading processes, and boost overall user experience, attracting even more users and accelerating market growth.

This report provides a comprehensive overview of the Game Asset Trading Platform market, encompassing historical data, current market dynamics, and future projections. It offers invaluable insights into key market drivers, trends, challenges, and growth opportunities, enabling stakeholders to make informed decisions. The report's detailed analysis of market segments, leading players, and regional performance provides a complete and nuanced perspective on this rapidly evolving sector. Furthermore, the report addresses potential risks and mitigation strategies, offering a practical roadmap for future investment and development within the industry.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.06% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 11.06%.

Key companies in the market include Dmarket, OpenSea, Enjin, CoinDesk, Bakkt, BitMax, Bittrex, Interdax, Devexperts, ErisX, Bit Mon Ex, Ledger Vault, Kraken, MMOGA, GAEX, Bryllite Platform, .

The market segments include Application, Type.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Game Asset Trading Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Game Asset Trading Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.