1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Asset Derivatives Trading Platform?

The projected CAGR is approximately 12.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Asset Derivatives Trading Platform

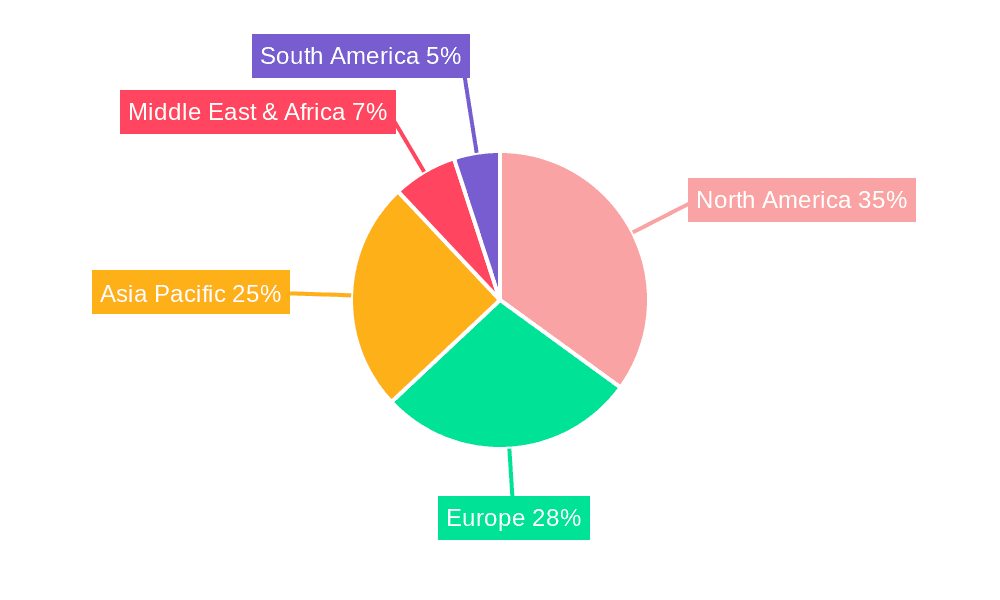

Digital Asset Derivatives Trading PlatformDigital Asset Derivatives Trading Platform by Type (Regional Platforms, Global Platforms), by Application (Retail Investor, Professional Investor), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

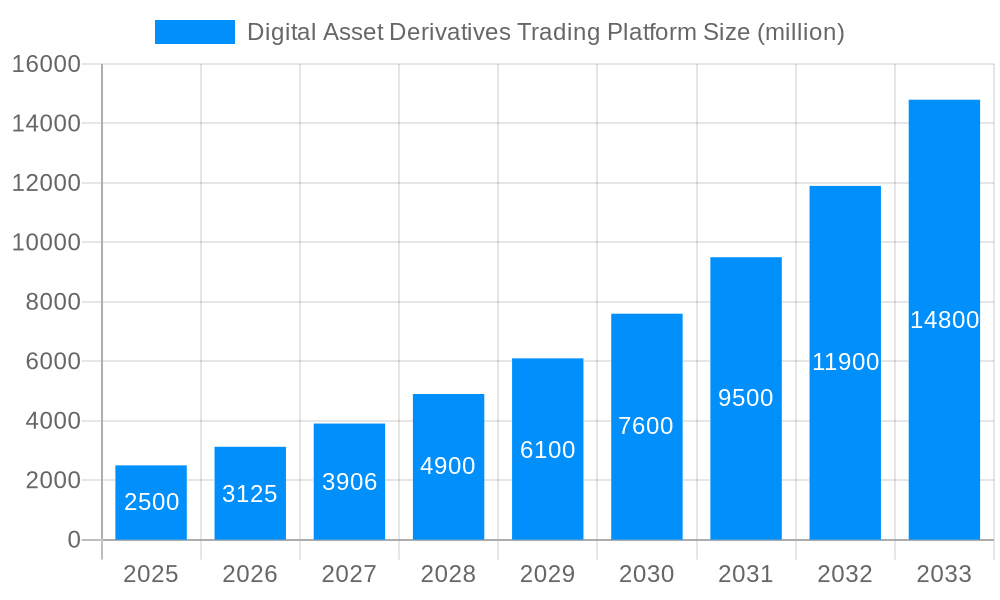

The digital asset derivatives trading platform market is experiencing rapid expansion, driven by increasing institutional and retail investor participation in cryptocurrency markets. The market's growth is fueled by several key factors: the rising adoption of cryptocurrencies as an asset class, the increasing sophistication of trading strategies employed by investors seeking higher returns, and the continuous innovation in platform technology, offering greater efficiency and security. The market is segmented by platform type (regional versus global) and investor type (retail versus professional), with global platforms attracting a significant share due to their broader reach and liquidity. While regulatory uncertainty and security concerns pose challenges, the overall market trajectory remains bullish, with a projected Compound Annual Growth Rate (CAGR) exceeding 25% over the forecast period (2025-2033). This significant growth is further supported by the expansion of the cryptocurrency market itself and the growing awareness among investors about the potential for high returns from derivatives trading.

Several key trends are shaping the market landscape. Increased competition among platforms is driving innovation in areas such as user experience, trading fees, and product offerings. The integration of advanced technologies, such as artificial intelligence and machine learning, is enhancing trading capabilities and risk management. Furthermore, the growing adoption of decentralized finance (DeFi) protocols is leading to the emergence of decentralized derivatives exchanges, providing users with greater control and transparency. Despite the growth potential, the market faces challenges, primarily in regulatory compliance and mitigating the risks associated with volatile cryptocurrency markets. The evolving regulatory landscape across various jurisdictions will significantly influence platform adoption and growth. Nevertheless, the long-term outlook for the digital asset derivatives trading platform market remains positive, with ample opportunity for growth and innovation across different segments and geographic regions. Leading platforms like Binance, Coinbase, and Deribit are consolidating their market share, while newer entrants are constantly vying for a place in the rapidly evolving competitive landscape.

The global digital asset derivatives trading platform market exhibited robust growth throughout the historical period (2019-2024), fueled by increasing cryptocurrency adoption, institutional investor participation, and the development of sophisticated trading instruments. The market witnessed a surge in trading volume, particularly in Bitcoin and Ethereum derivatives, exceeding hundreds of billions of dollars annually by 2024. This growth was driven by both retail and professional investors seeking higher leverage and diverse trading strategies. The estimated market value in 2025 is projected to reach several billion USD, reflecting the continued maturation and institutionalization of the cryptocurrency market. The forecast period (2025-2033) anticipates sustained expansion, although at a potentially slower pace than the initial explosive growth, as regulatory scrutiny increases and market volatility fluctuates. Key trends shaping the market include the rise of decentralized finance (DeFi) derivatives, the increasing integration of traditional financial infrastructure with crypto trading platforms, and the ongoing development of innovative trading products like options and structured products. Competition among platforms is fierce, with established players like Binance and Coinbase vying for market share against newer, more specialized platforms focusing on niche segments, such as DeFi or institutional clients. The overall trend suggests a dynamic and evolving market characterized by innovation, competition, and increasing regulatory oversight. The market's continued growth will depend heavily on the broader adoption of cryptocurrencies, technological advancements, and the overall regulatory landscape. By 2033, the market is projected to reach tens of billions of USD, showcasing the long-term potential of this rapidly evolving sector.

Several key factors are driving the expansion of the digital asset derivatives trading platform market. The increasing institutional adoption of cryptocurrencies is a significant force, as hedge funds, asset management firms, and other institutional investors seek to incorporate digital assets into their portfolios. This institutional interest drives the demand for sophisticated trading platforms capable of handling large volumes and providing advanced risk management tools. The development of innovative derivative products beyond basic futures and perpetual contracts, such as options and structured products, offers investors a wider range of risk management and trading strategies, further fueling market growth. The growing popularity of decentralized finance (DeFi) is also a considerable driver, as DeFi protocols offer decentralized alternatives to traditional centralized exchanges, appealing to users seeking greater transparency and security. Moreover, technological advancements, including improvements in blockchain technology, high-frequency trading algorithms, and enhanced security protocols, continue to improve the efficiency and scalability of trading platforms. Finally, the relatively low barriers to entry for retail investors, combined with the potential for high returns (and correspondingly high risks), have contributed to significant retail participation, thereby boosting trading volumes.

Despite the significant growth potential, several challenges and restraints hinder the expansion of the digital asset derivatives trading platform market. Regulatory uncertainty remains a major obstacle, as governments worldwide grapple with how to regulate cryptocurrencies and related derivatives. Varying regulatory frameworks across different jurisdictions create complexity for platforms operating globally and can limit accessibility for certain user groups. Security concerns, particularly the risk of hacking and theft, continue to be a significant challenge, requiring platforms to invest heavily in robust security infrastructure and risk management protocols. Market volatility, inherent in the cryptocurrency market, presents a considerable risk for both traders and platforms. Sudden price swings can lead to significant losses and impact liquidity. Furthermore, the complexity of some derivative products can pose a barrier to entry for less sophisticated retail investors, leading to potential misuse and losses. Competition among platforms is exceptionally fierce, requiring platforms to differentiate themselves through innovation, superior technology, and attractive user interfaces. Lastly, the potential for market manipulation and the lack of standardized regulatory frameworks represent ongoing challenges to market integrity and growth.

The global digital asset derivatives trading platform market is geographically diverse, but certain regions and segments are expected to exhibit faster growth.

Segments Dominating the Market:

Paragraph Elaboration:

The dominance of global platforms is intrinsically linked to the nature of the cryptocurrency market itself, which is inherently global and operates 24/7. These platforms are better positioned to capitalize on this continuous trading cycle and the diverse trading preferences of users across different time zones. The professional investor segment's continued dominance reflects the growing institutionalization of the cryptocurrency market. These investors bring sophisticated risk management tools and advanced trading strategies, driving trading volumes and fostering market maturity. While retail investors remain a substantial user base, professional investors’ larger trades and strategic influence create a disproportionately larger impact on market dynamics and platform revenue. The increased sophistication of trading tools and platforms catered specifically to the professional segment will further solidify their dominant position in the years to come. The high volume and frequency of transactions made by professional investors greatly benefit global platforms that facilitate this high-velocity trading. The synergy between these two dominant segments will likely continue driving overall market growth and shaping its future trajectory.

Several factors will continue to propel growth within the digital asset derivatives trading platform industry. Continued institutional adoption, coupled with advancements in technology like faster and more secure blockchain solutions, will attract more sophisticated trading strategies. The evolution of derivative product offerings, including the development of more complex and nuanced instruments, will attract a wider range of investors. Furthermore, regulatory clarity and standardization across different jurisdictions will foster greater investor confidence and stimulate market participation.

This report offers a comprehensive analysis of the digital asset derivatives trading platform market, encompassing historical data, current market dynamics, and future projections. It provides insights into key market trends, growth drivers, challenges, and leading players, enabling a thorough understanding of the market's evolution and future potential. The report's detailed segmentation and regional analysis provide a nuanced perspective on different market segments and geographical regions, allowing for a strategic assessment of investment opportunities and market positioning.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 12.6%.

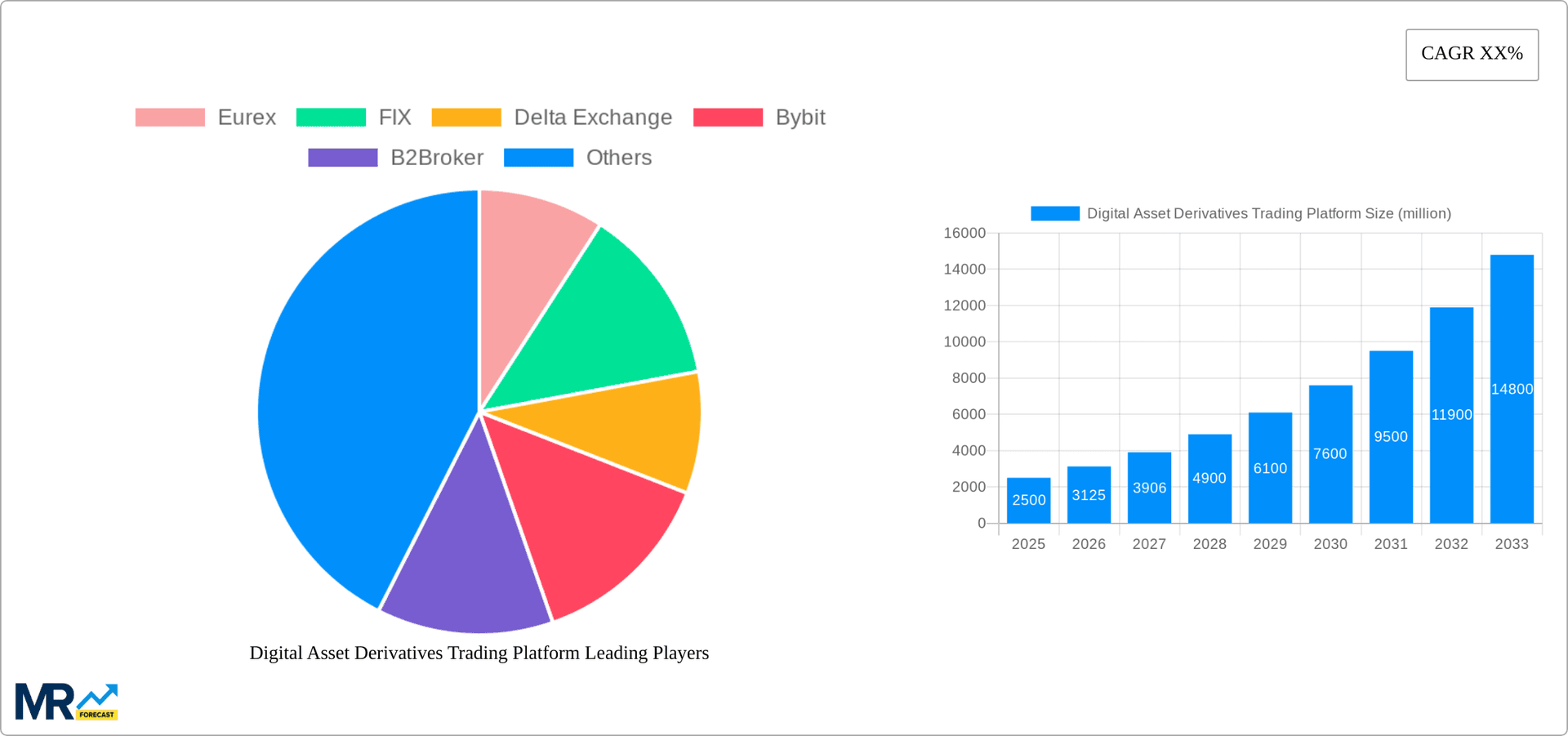

Key companies in the market include Eurex, FIX, Delta Exchange, Bybit, B2Broker, StormGain, Bingbon, Phemex, CoinTiger, Binance, Deribit, Coinbase, Lever Network, dFuture, Hegic, Deri Protocol, Perpetual, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Digital Asset Derivatives Trading Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Asset Derivatives Trading Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.