1. What is the projected Compound Annual Growth Rate (CAGR) of the Digital Currency Derivatives Trading Platform?

The projected CAGR is approximately 14.13%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Digital Currency Derivatives Trading Platform

Digital Currency Derivatives Trading PlatformDigital Currency Derivatives Trading Platform by Type (Regional Platforms, Global Platforms), by Application (Retail Investor, Professional Investor), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

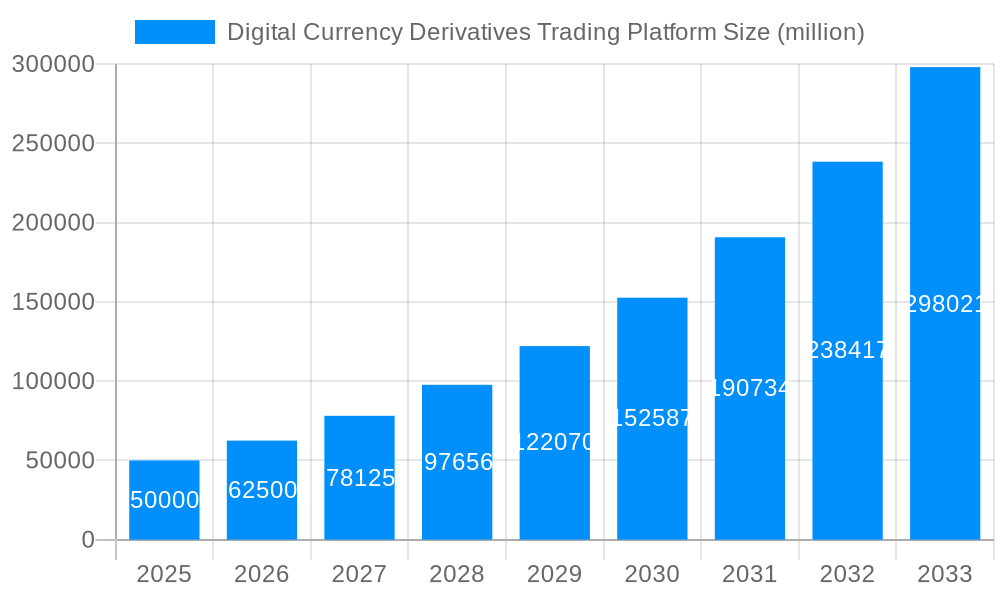

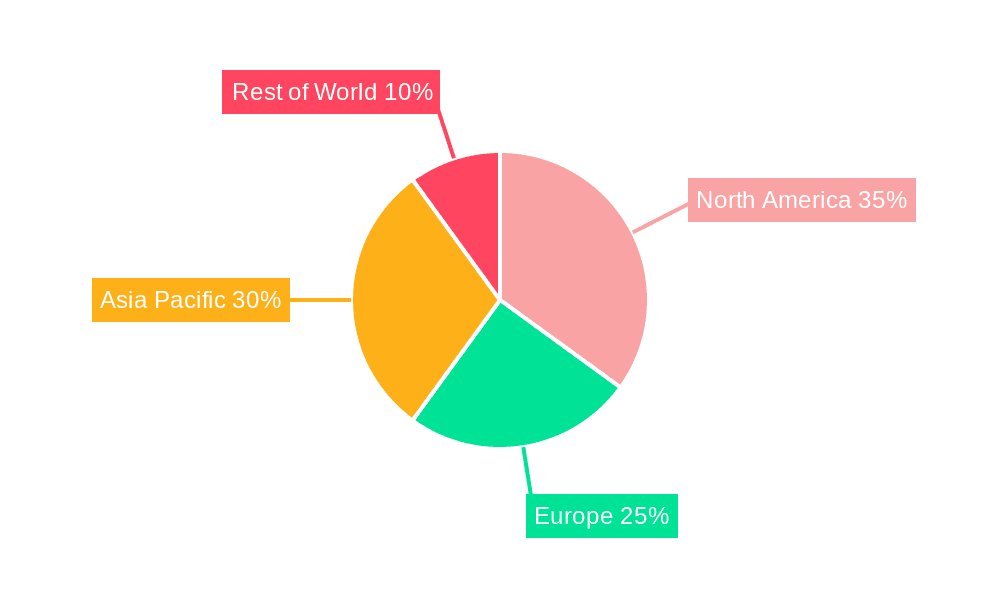

The global digital currency derivatives trading platform market is experiencing rapid growth, driven by increasing cryptocurrency adoption, institutional investor interest, and the development of sophisticated trading platforms. The market, estimated at $50 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 25% from 2025 to 2033, reaching approximately $300 billion by 2033. This expansion is fueled by several key factors. The rise of decentralized finance (DeFi) and the increasing institutionalization of the cryptocurrency market have broadened the appeal of derivatives trading. The availability of innovative trading tools, including leveraged trading and futures contracts, on user-friendly platforms is attracting both retail and professional investors. Furthermore, regulatory clarity (although still evolving) in certain jurisdictions is gradually fostering a more secure and legitimate trading environment. Geographic expansion is also a major driver, with regions like Asia-Pacific and North America demonstrating significant market share and growth potential due to increased cryptocurrency awareness and tech-savviness within those markets.

However, challenges persist. Regulatory uncertainty across different countries remains a significant constraint, leading to compliance complexities and potential limitations on market growth. Security risks associated with cryptocurrency exchanges and platforms continue to be a major concern, impacting investor confidence and requiring robust security measures. Furthermore, the volatility inherent in the cryptocurrency market itself presents risks to both investors and platforms. The market is segmented by platform type (regional and global) and investor type (retail and professional), with global platforms currently dominating due to their broader reach and liquidity. Competition among established players like Binance, Coinbase, and Eurex, as well as emerging decentralized platforms, is fierce, driving innovation and platform improvements to attract and retain customers. The future of the market will depend on addressing the regulatory landscape, enhancing security protocols, and delivering a seamless and user-friendly experience to investors of all levels.

The digital currency derivatives trading platform market experienced explosive growth during the historical period (2019-2024), fueled by increasing cryptocurrency adoption and the maturation of the DeFi ecosystem. The market witnessed a surge in trading volume, with billions of dollars changing hands daily across various platforms. This rapid expansion attracted significant investments, leading to platform enhancements, increased liquidity, and the introduction of innovative derivative products. The estimated market value in 2025 stands at [Insert Market Value in Millions], reflecting the sustained momentum. While the early years were characterized by a relatively smaller number of dominant players, the market landscape has become increasingly competitive, with new entrants consistently emerging. The historical period saw the rise of both centralized exchanges, offering traditional exchange-like services, and decentralized platforms leveraging blockchain technology to offer greater transparency and decentralization. Regulatory uncertainty remains a significant factor, influencing platform strategies and investor behavior. The forecast period (2025-2033) projects continued growth, driven by institutional adoption, technological advancements (like improved security protocols and faster transaction speeds), and the expanding use of derivatives for hedging and speculation. This expansion, however, may not be linear, influenced by macroeconomic factors, regulatory developments, and the inherent volatility of the cryptocurrency market itself. The increasing sophistication of trading strategies and the demand for advanced analytical tools also shape the trajectory of the market. Platforms are adapting by offering sophisticated charting tools, algorithmic trading capabilities, and advanced risk management features to cater to a more professionalized user base. Overall, the market is poised for substantial growth but faces ongoing challenges related to regulation, security, and maintaining market integrity.

Several key factors are driving the phenomenal growth of the digital currency derivatives trading platform market. The increasing institutional adoption of cryptocurrencies is a crucial driver. Hedge funds, investment firms, and other institutional players are increasingly using derivatives to manage risk and participate in the crypto market, injecting significant liquidity and sophistication. The expansion of the DeFi (Decentralized Finance) ecosystem has also played a vital role. DeFi platforms offer decentralized, transparent, and often more efficient alternatives to traditional financial instruments, attracting a significant user base and fueling the growth of related derivatives markets. Technological advancements, including faster transaction speeds and more robust security protocols, have also made these platforms more accessible and trustworthy, enhancing user confidence. Furthermore, the inherent volatility of cryptocurrencies itself drives demand for hedging tools offered by derivatives platforms. Traders use derivatives to protect themselves against potential price drops, creating consistent trading activity. The development of innovative derivative products tailored to the unique characteristics of cryptocurrencies is also contributing to growth. Finally, the relative ease of access and the global nature of these platforms are attracting a wider pool of investors, regardless of geographical location, furthering the expansion of the market.

Despite its impressive growth, the digital currency derivatives trading platform market faces several challenges. Regulatory uncertainty across various jurisdictions remains a major hurdle. Lack of clear, consistent regulatory frameworks creates ambiguity for both platforms and users, potentially hindering investment and innovation. Security concerns are ever-present, with the potential for hacking, fraud, and other security breaches impacting user trust and platform stability. The inherent volatility of cryptocurrencies themselves poses risks to both traders and platforms. Extreme price swings can lead to significant losses and instability, potentially impacting liquidity and platform operations. Competition within the market is intense, requiring platforms to constantly innovate and adapt to maintain market share. Maintaining user trust is crucial, especially given the potential for scams and fraudulent activities. Moreover, ensuring the efficient and transparent operation of these platforms is vital to prevent market manipulation and ensure fair trading practices. Addressing these challenges will be crucial for the sustainable growth and stability of the digital currency derivatives trading platform market.

The global digital currency derivatives trading platform market is expected to witness significant growth across various regions and segments in the forecast period. However, the Global Platforms segment, catering to both Retail Investors and Professional Investors, is projected to hold a commanding market share.

Global Platforms: These platforms offer a broad reach, attracting users worldwide and benefiting from economies of scale. Their ability to provide diverse derivative products and superior liquidity attracts both retail and professional investors. The seamless experience across geographical boundaries makes them attractive to a diverse investor base. The ability to offer 24/7 trading, catering to different time zones, is another key advantage. Large global platforms have the resources to invest heavily in security, compliance, and technological advancements, building trust among users. The aggregated trading volumes on global platforms significantly surpass those on regional platforms, further consolidating their market dominance. The growing institutional investment in cryptocurrencies further strengthens the significance of global platforms which possess the infrastructure to cater to sophisticated trading needs.

Retail Investors: The accessibility of digital currency derivatives trading platforms has drawn a substantial retail investor base. These investors are drawn to the potential for high returns, relatively low barriers to entry, and the ease of use of many platforms. The availability of leveraged trading, albeit with inherent risks, also contributes to their participation. The growing awareness of cryptocurrencies and derivatives, coupled with educational resources provided by various platforms, fosters the growth of this segment. However, protecting these investors from potentially high-risk trades remains a key concern for regulators and platforms alike.

Professional Investors: High-frequency traders, algorithmic trading firms, and institutional investors are increasingly active in this market. Their sophisticated trading strategies and significant trading volumes contribute substantially to overall market liquidity. The need for advanced analytical tools, API access, and superior risk management features drives their preference for global platforms offering comprehensive functionalities. These professional investors often demand robust security measures, reliable infrastructure, and compliance with regulatory standards, making global platforms with advanced technology the preferred choice.

Several factors catalyze the growth of the digital currency derivatives trading platform industry. Firstly, institutional adoption is accelerating rapidly, driving up trading volumes and market liquidity. Secondly, technological advancements, such as improved security protocols and faster transaction speeds, are making these platforms more efficient and trustworthy. Thirdly, a growing awareness and understanding of cryptocurrency derivatives among both retail and institutional investors fuel demand for sophisticated trading platforms. Lastly, innovative product offerings, including more complex and specialized derivatives, expand the market's scope and attract new users. These combined factors are propelling the industry's continued expansion.

This report provides a comprehensive analysis of the digital currency derivatives trading platform market, encompassing historical data, current market dynamics, and future projections. It delves into key market drivers, challenges, and growth catalysts, offering a granular understanding of the competitive landscape. The report profiles leading players, examining their market share, strategies, and technological advancements. Detailed regional and segment-wise analysis is presented, providing insights into growth opportunities and potential market dominance. This in-depth analysis provides valuable insights for stakeholders seeking to navigate this rapidly evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.13% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 14.13%.

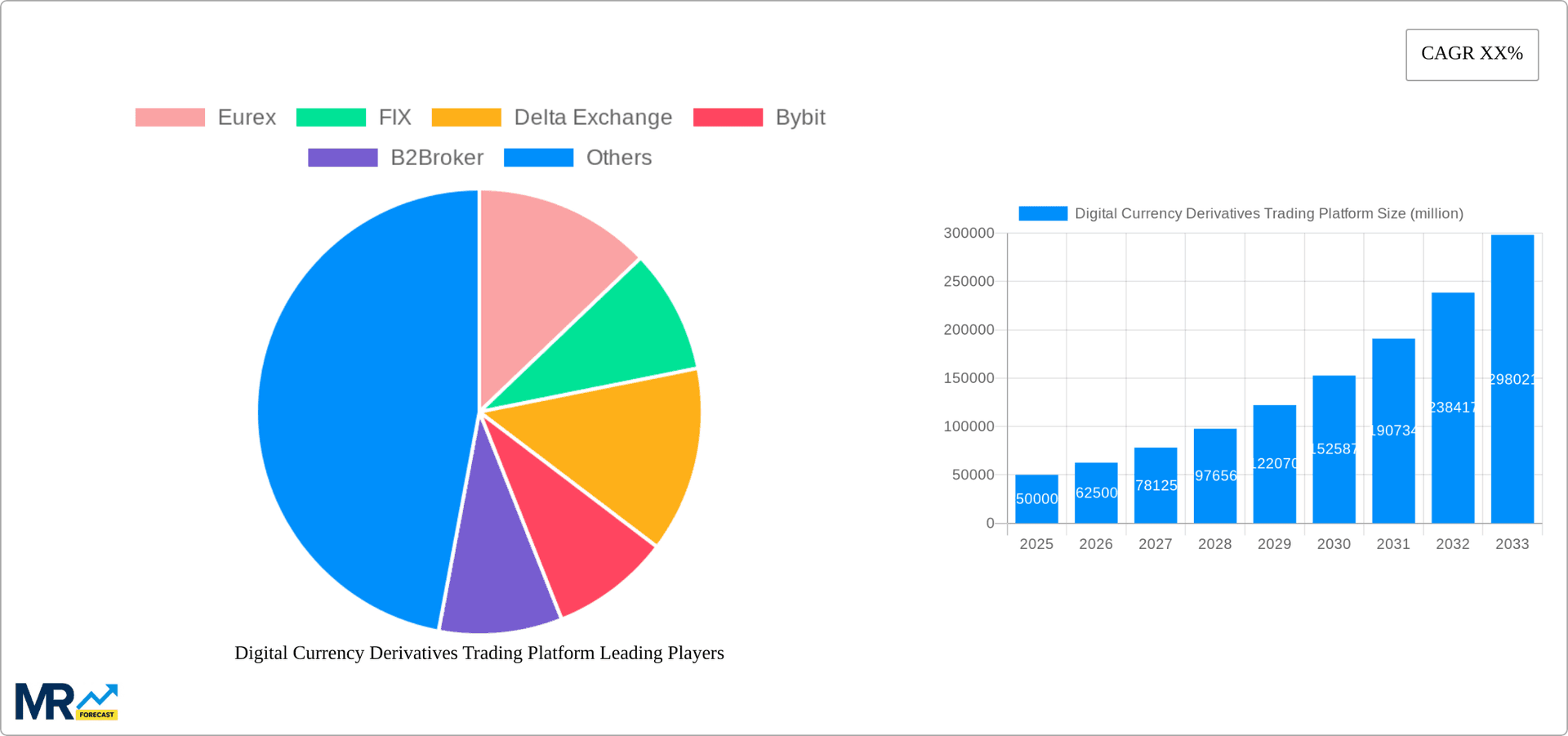

Key companies in the market include Eurex, FIX, Delta Exchange, Bybit, B2Broker, StormGain, Bingbon, Phemex, CoinTiger, Binance, Deribit, Coinbase, Lever Network, dFuture, Hegic, Deri Protocol, Perpetual, .

The market segments include Type, Application.

The market size is estimated to be USD XXX N/A as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in N/A.

Yes, the market keyword associated with the report is "Digital Currency Derivatives Trading Platform," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Digital Currency Derivatives Trading Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.