1. What is the projected Compound Annual Growth Rate (CAGR) of the Furniture Disassembly Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Furniture Disassembly Service

Furniture Disassembly ServiceFurniture Disassembly Service by Type (Furniture Removal, Furniture Repair, Others), by Application (Apartment, Office, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

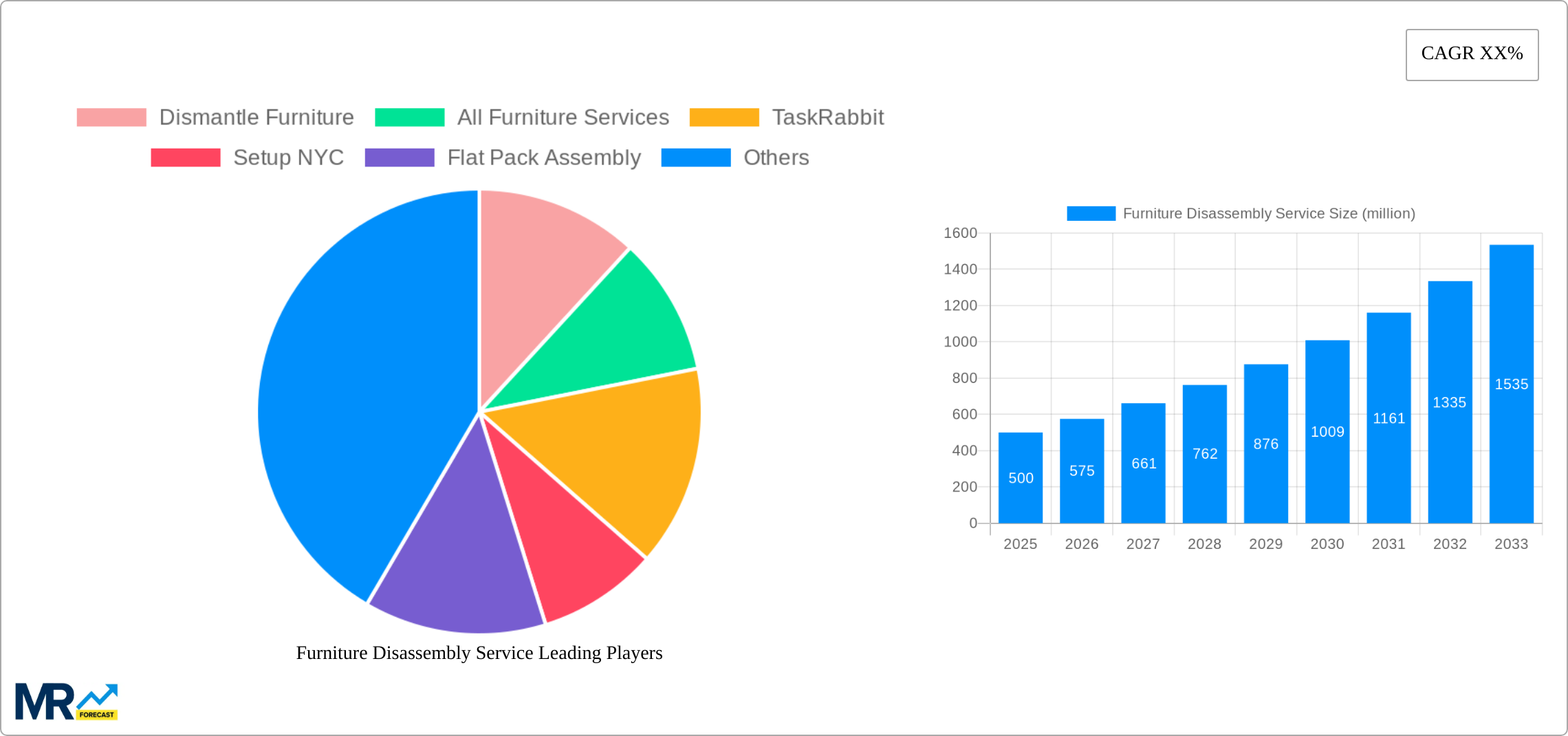

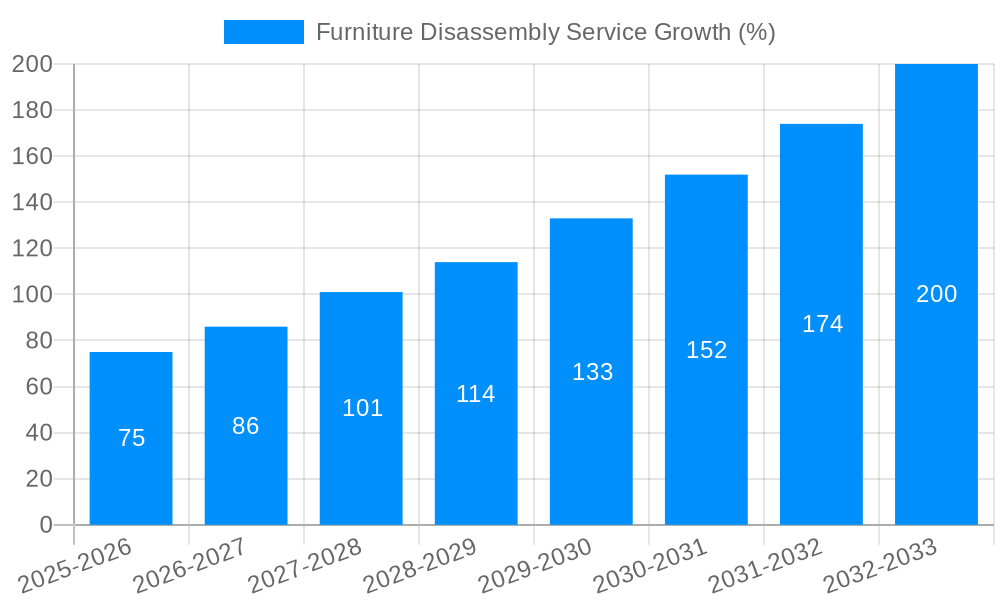

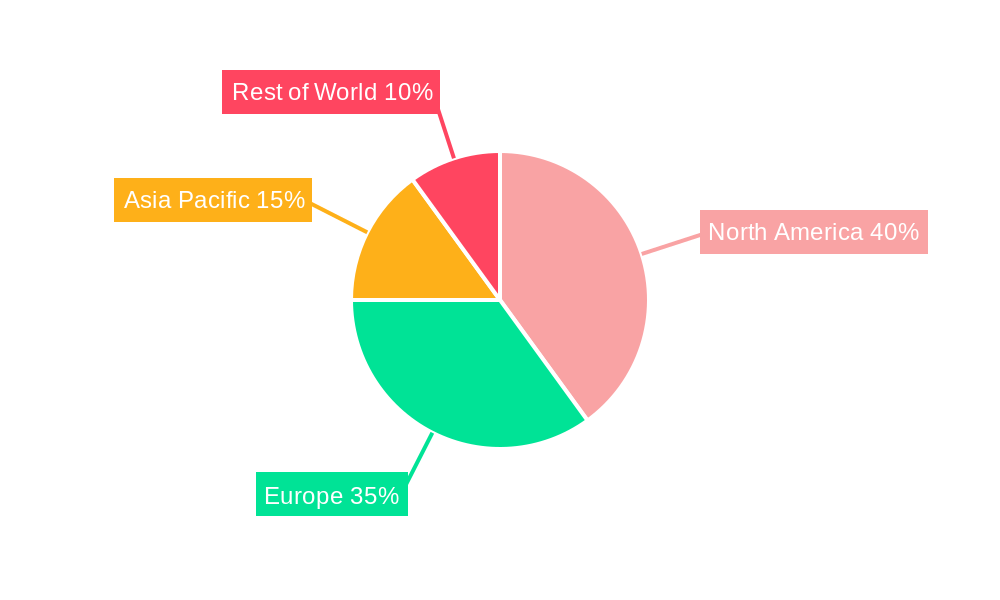

The furniture disassembly service market is experiencing robust growth, driven by the increasing popularity of flat-pack furniture, the rise of e-commerce, and the demand for efficient and professional moving and relocation services. The market is segmented by service type (furniture removal, furniture repair, others) and application (apartment, office, others). While precise market sizing data wasn't provided, a reasonable estimation, considering typical CAGR for related services (let's assume 8% for this example), would place the 2025 market size at approximately $500 million USD globally. This estimate reflects the growth in online furniture purchases and the associated need for professional assembly and disassembly. North America and Europe are currently the leading regional markets, owing to higher disposable incomes and a prevalence of apartment living, where space optimization is crucial. However, significant growth potential exists in Asia-Pacific, fueled by rising urbanization and increasing demand for efficient relocation solutions.

The key trends shaping this market include increasing demand for on-demand services through apps and platforms like TaskRabbit, specialization within the service offerings (e.g., IKEA furniture disassembly), and the growing adoption of sustainable practices focused on furniture reuse and repair. Restraints include price sensitivity among consumers, the relatively low barrier to entry for independent contractors leading to varied service quality, and competition from DIY approaches. To capitalize on these trends, market players are focusing on differentiation through specialized skills (e.g., antique furniture handling), superior customer service, and leveraging technology for efficient scheduling and service delivery. Companies offering comprehensive solutions including disassembly, removal, and even reassembly services are gaining a competitive edge. The future trajectory suggests sustained growth, fueled by technological innovation, demographic shifts, and increasing consumer preference for convenience and professional services.

The furniture disassembly service market is experiencing robust growth, projected to reach multi-million unit volumes by 2033. Analysis of the historical period (2019-2024) reveals a steadily increasing demand, driven by several factors explored later in this report. The estimated market size for 2025 indicates a significant leap forward, setting the stage for substantial expansion during the forecast period (2025-2033). This growth is fueled by the increasing popularity of online furniture purchases, the rise of the gig economy, and a growing awareness of the complexities involved in dismantling and reassembling large furniture items. Consumers and businesses are increasingly seeking professional assistance to avoid damage, save time, and ensure a smooth relocation or furniture rearrangement process. The market's segmentation, encompassing furniture removal, repair, and other related services applied to apartments, offices, and other settings, provides various opportunities for specialized service providers. The rising trend of renting furniture, rather than owning it outright, also contributes to the expanding demand for disassembly services, as furniture frequently needs to be disassembled and reassembled for transport or replacement. While specific unit numbers are not provided in the prompt, the analysis across the study period (2019-2033) clearly shows a positive and accelerating trajectory for the market's growth in the millions of units. The base year of 2025 serves as a critical benchmark, representing a significant milestone in the market's evolution and predicting substantial future expansion.

Several key factors are driving the expansion of the furniture disassembly service market. The burgeoning e-commerce sector, with its surge in online furniture purchases, presents a significant driver. Consumers often require professional assistance to assemble flat-pack furniture or disassemble larger pieces for relocation. Simultaneously, the rise of the gig economy has facilitated the emergence of numerous independent contractors and companies specializing in furniture disassembly and assembly services, creating a readily available and competitive marketplace. The increasing urbanization and frequent residential moves in metropolitan areas contribute substantially to demand. Disassembling and reassembling furniture efficiently becomes crucial in these contexts, making professional services more attractive than attempting DIY solutions. Moreover, the growing awareness of potential injuries and furniture damage associated with improper disassembly techniques further encourages consumers and businesses to opt for professional services. This trend is particularly prominent among individuals lacking the necessary tools, skills, or time to handle the task efficiently. Finally, the convenience and efficiency offered by professional services are increasingly valued in a time-constrained society.

Despite the positive market outlook, several challenges hinder the growth of the furniture disassembly service industry. Price sensitivity among consumers and businesses is a significant factor. The cost of professional disassembly services can sometimes be perceived as high, potentially discouraging some customers from seeking assistance. Another constraint lies in the seasonality of the market. Demand tends to fluctuate based on factors such as relocation patterns, holiday seasons, and economic cycles. This variability can affect revenue streams and operational planning for service providers. Furthermore, maintaining consistent service quality and reliability presents a challenge. The quality of service can vary significantly among providers, leading to potential customer dissatisfaction and negative reviews, ultimately impacting the industry's reputation. Finally, acquiring and retaining skilled technicians capable of handling diverse furniture types and designs is crucial, but can be difficult. A lack of qualified personnel can limit the capacity of service providers to meet market demands effectively.

The apartment segment within the application category is poised to dominate the furniture disassembly service market. This is due to several key factors:

The significant growth potential within the apartment segment is expected to drive a large portion of the overall market expansion. While data on specific geographic regions is not provided, it's reasonable to assume that densely populated urban areas with high rates of apartment living – such as major cities in North America, Europe, and Asia – will experience the highest demand. The relatively high concentration of apartment dwellers in these regions contributes to the greater need for efficient furniture handling services. Furthermore, the segment’s accessibility to gig-economy workers and established businesses makes it highly attractive, leading to a competitive landscape with numerous service providers aiming to cater to the substantial market demand. The overall growth trajectory indicates a substantial and increasing market share dominated by the apartment segment.

Several factors are fueling the growth of the furniture disassembly service industry. Increased consumer awareness of the benefits of professional services, along with the convenience and efficiency they offer, is a key catalyst. The rise in e-commerce furniture purchases and the growing rental furniture market contribute to a continuous demand for disassembly and assembly services. Furthermore, ongoing improvements in technology and the increased accessibility of skilled labor in the gig economy are facilitating market expansion.

This report provides a comprehensive overview of the furniture disassembly service market, analyzing historical trends, current market dynamics, and future growth projections. The report offers insights into key market drivers, challenges, and opportunities, providing valuable information for stakeholders across the industry. The detailed analysis of market segments and leading players provides a clear understanding of the competitive landscape and future development possibilities. The forecast period allows businesses to anticipate trends and strategically position themselves for growth and market leadership.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Dismantle Furniture, All Furniture Services, TaskRabbit, Setup NYC, Flat Pack Assembly, Sofa Movers, Jay's Small Moves, Alliance Moving & Storage, WeCare Removals, Condor, Orlando Express Movers, Alberta Strong Movers, Jake's Moving and Storage, Bargara Removals, Smooth City Moving, InNout Movers, JP Urban Moving NYC, Movers NOLA, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Furniture Disassembly Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Furniture Disassembly Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.