1. What is the projected Compound Annual Growth Rate (CAGR) of the Fund Investment Strategy?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fund Investment Strategy

Fund Investment StrategyFund Investment Strategy by Type (Raised Funds, Private Equity), by Application (Enterprise, Personal), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

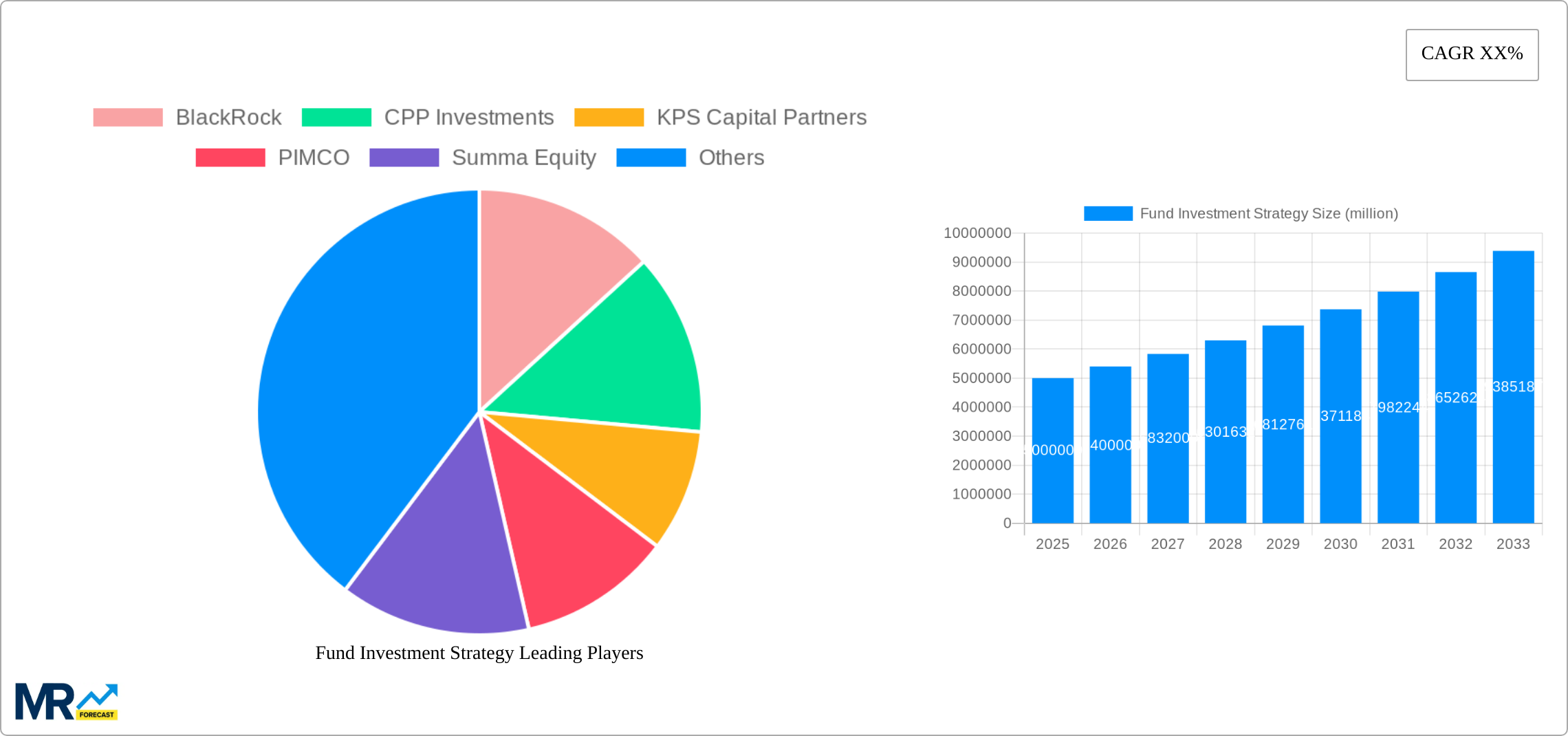

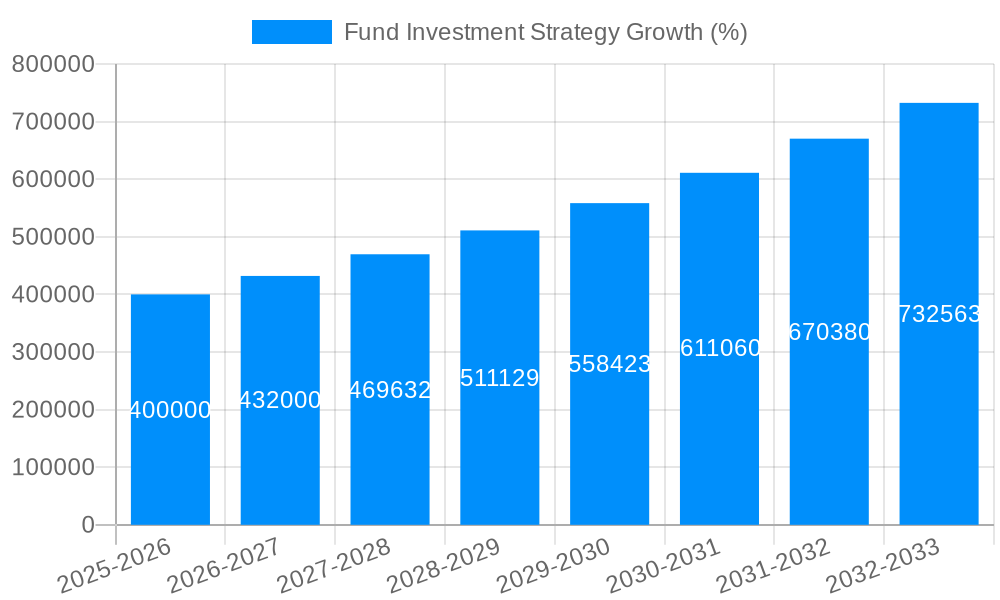

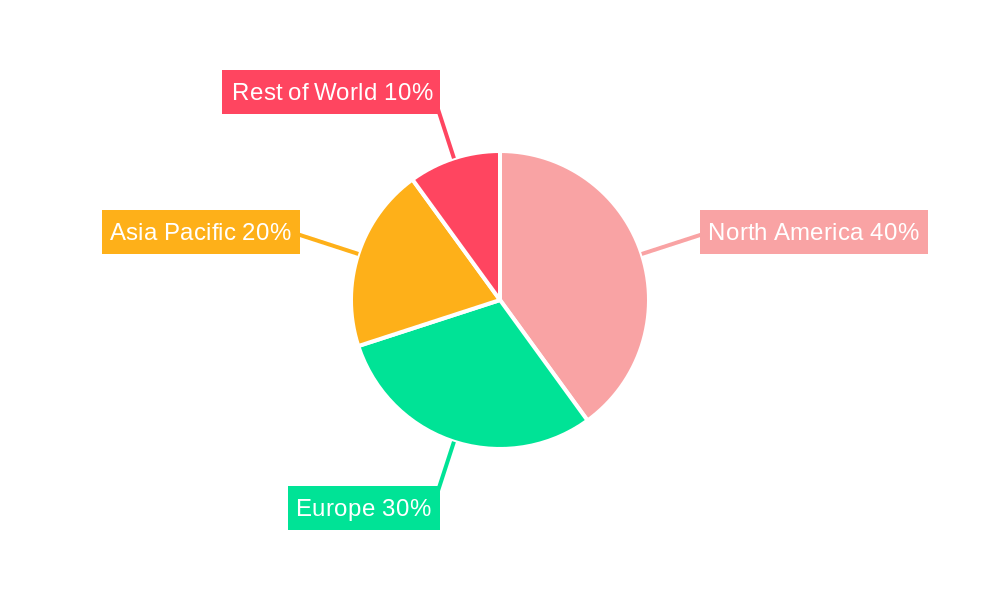

The Fund Investment Strategy market is experiencing robust growth, driven by increasing institutional and private investor interest in diversified portfolio strategies and the pursuit of higher returns in a low-interest-rate environment. The market, estimated at $5 trillion in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033, reaching approximately $9.5 trillion by 2033. This expansion is fueled by several key factors. Firstly, the increasing complexity of global markets necessitates sophisticated investment strategies, boosting demand for professional fund management. Secondly, the rise of ESG (Environmental, Social, and Governance) investing is reshaping the investment landscape, leading to the creation of specialized funds focusing on sustainable and responsible investments. Thirdly, technological advancements, such as AI-driven portfolio optimization and blockchain-based security enhancements, are enhancing efficiency and transparency within the fund management industry. The market is segmented by fund type (e.g., Raised Funds, Private Equity) and application (e.g., Enterprise, Personal), allowing for targeted investment strategies. While regulatory changes and geopolitical uncertainties present potential restraints, the overall outlook remains positive, particularly in North America and Asia-Pacific regions, which are anticipated to dominate market share due to high investor activity and economic growth.

The competitive landscape is marked by a mix of large global players like BlackRock and PIMCO, alongside specialized boutique firms such as Summa Equity and Impax, catering to niche market segments. The presence of these diverse players fosters innovation and competition, ultimately benefiting investors. Future growth will likely be influenced by the adoption of innovative technologies, the evolution of regulatory frameworks, and shifts in investor preferences towards specific asset classes and investment themes. The continued development of ESG investing and the increasing importance of data analytics will further shape the market trajectory. Regional variations will persist, driven by economic conditions, regulatory environments, and investor demographics. Expansion into emerging markets presents significant opportunities, while challenges remain in navigating diverse regulatory landscapes and addressing investor education needs in less developed regions.

The fund investment strategy landscape from 2019 to 2033 reveals a dynamic interplay of macroeconomic factors, technological advancements, and evolving investor preferences. The historical period (2019-2024) witnessed significant growth driven by low interest rates and a search for higher yields, pushing investors towards alternative asset classes like private equity and real estate. The base year (2025) marks a potential inflection point, with projected shifts in regulatory environments and increasing scrutiny of ESG (environmental, social, and governance) factors significantly influencing investment decisions. The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace, as investors navigate a more complex and uncertain global economic environment. We see a growing preference for diversified portfolios, incorporating both traditional and alternative investments. The rise of fintech and the increasing availability of data analytics are empowering investors with enhanced tools for due diligence, risk management, and performance measurement. Furthermore, the increasing focus on impact investing reflects a growing societal demand for investments that generate both financial returns and positive social and environmental outcomes. The emergence of thematic investing, focusing on specific trends such as sustainable energy or artificial intelligence, is reshaping portfolio allocation strategies. This trend is further fueled by a younger generation of investors who prioritize values-aligned investments, a trend exemplified by the growing popularity of funds like Triodos, focused on sustainable and ethical investments. This intricate interplay of macroeconomic shifts, regulatory changes, technological advancements, and evolving investor preferences will continue to shape the fund investment strategy sector over the next decade, creating both opportunities and challenges for fund managers and investors alike. Fund managers like BlackRock, with their vast resources and global reach, are well-positioned to navigate this evolving landscape, while smaller, specialized firms like Summa Equity, focusing on sustainable investments, are capturing niche market segments and demonstrating significant growth.

Several key factors are driving the evolution of fund investment strategies. Firstly, the persistent search for yield in a low-interest-rate environment continues to propel investors towards alternative asset classes, such as private equity and infrastructure funds, managed by firms like KPS Capital Partners and PIMCO. Secondly, the increasing awareness of environmental, social, and governance (ESG) factors is fundamentally reshaping investment decisions. Investors are actively seeking opportunities that align with their values, leading to the growth of impact investing and sustainable finance initiatives. This is evident in the rise of firms like Impax, specializing in sustainable infrastructure investments. Thirdly, technological advancements, particularly in areas like artificial intelligence and big data analytics, are providing investors with more sophisticated tools for due diligence, portfolio optimization, and risk management, improving decision making and efficiency across the industry. This is benefiting both established players like Dimensional Investing and newer entrants. Fourthly, regulatory changes, both at national and international levels, are influencing investment strategies. Regulations aimed at improving transparency, enhancing investor protection, and promoting sustainable finance are reshaping industry practices. Finally, the growing complexity of the global economic landscape, characterized by geopolitical uncertainty and increasing market volatility, is driving demand for sophisticated risk management strategies and proactive portfolio diversification, pushing innovation in fund management and investment approaches across the sector. This complexity creates both opportunities and challenges for organizations including ACE & Company and Cornerstone Strategic Value Fund, Inc.

Despite significant growth, the fund investment strategy sector faces several challenges and restraints. Firstly, increased regulatory scrutiny and compliance costs pose significant burdens on fund managers, especially smaller firms, potentially hindering their ability to compete effectively. Secondly, geopolitical uncertainty and macroeconomic volatility create significant headwinds, increasing market risk and impacting investor sentiment. Thirdly, the rising tide of ESG considerations, while creating opportunities, also presents challenges in terms of data collection, measurement, and reporting, requiring significant investments in infrastructure and expertise. Fourthly, intense competition amongst fund managers, from established giants like BlackRock to niche players, puts pressure on fees and necessitates continuous innovation in investment strategies and client service. Finally, the increasing complexity of investment products and strategies can present challenges for investors who lack sophisticated knowledge and resources. This necessitates increased efforts in financial literacy and education to ensure transparency and informed decision-making. These factors, while not necessarily slowing growth, do influence the pace and trajectory of development within the fund investment strategy sector.

The Private Equity segment is poised for significant dominance in the forecast period (2025-2033). This is driven by several factors:

Geographic Dominance: While North America and Europe currently hold a significant share of the market, Asia-Pacific is projected to witness the highest growth rate, driven by factors like increasing domestic wealth and a rapidly expanding middle class. This makes regions like China and India attractive investment destinations.

The Enterprise Application of fund investment strategies will also play a significant role. Large enterprises leverage private equity for acquisitions, restructuring, and expansion, while smaller enterprises utilize the funds for growth capital, expansion, or acquisition. This contributes significantly to market growth and is closely tied to the success of the Private Equity segment.

The fund investment strategy industry's growth is catalyzed by several key factors: the persistent search for yield, the rising popularity of alternative investments, technological advancements enabling sophisticated data analysis and portfolio management, and a growing awareness and demand for ESG-compliant investments. These factors collectively drive both innovation and capital flows into the sector. The increasing availability of data and sophisticated analytical tools empower fund managers to make more informed investment decisions, optimize portfolios, and manage risks effectively. Simultaneously, the growing emphasis on sustainable and responsible investing attracts a wider investor base and fuels competition for innovative and impactful projects. This dynamic interplay of factors shapes the market's trajectory and fosters continuous growth.

This report offers a comprehensive analysis of the fund investment strategy landscape, encompassing historical performance, current trends, and future projections. It provides valuable insights into the key drivers and restraints shaping the market, identifies leading players and their strategies, and highlights significant developments and emerging trends. The report's detailed segmentation analysis, covering fund types, investment applications, and geographic regions, provides a granular understanding of the market dynamics and growth potential across various segments. Ultimately, this report serves as a valuable resource for investors, fund managers, and industry professionals seeking a comprehensive understanding of the evolving fund investment strategy sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BlackRock, CPP Investments, KPS Capital Partners, PIMCO, Summa Equity, ACE & Company, Triodos, Thornburg, Cornerstone Strategic Value Fund,Inc., ICI, Dimensional Investing, Impax, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Fund Investment Strategy," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fund Investment Strategy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.