1. What is the projected Compound Annual Growth Rate (CAGR) of the Fund Investment Advisory?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fund Investment Advisory

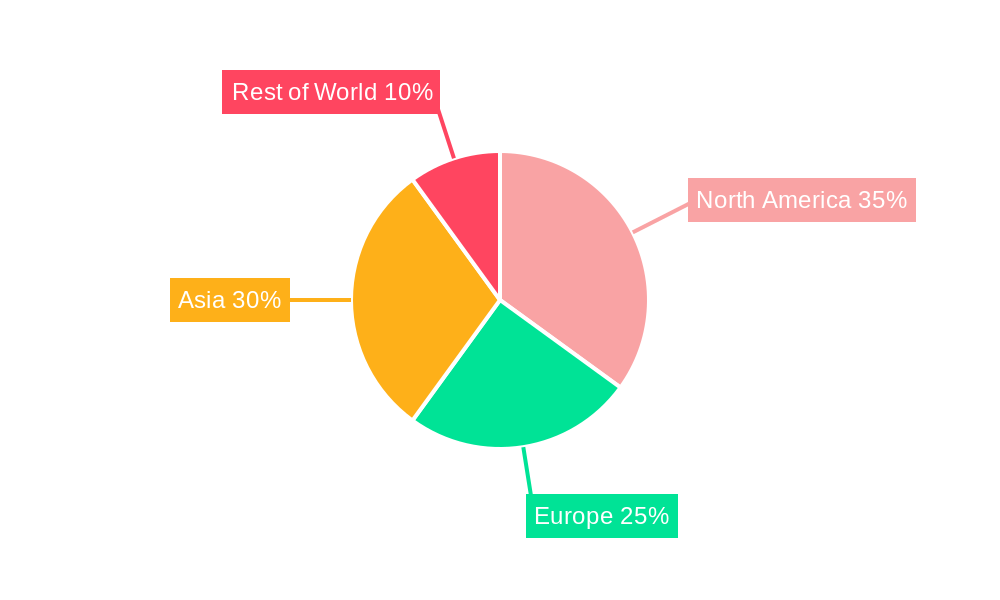

Fund Investment AdvisoryFund Investment Advisory by Type (Robo Advisor, Traditional Investment Advisory), by Application (Personal Finance, Corporate Pension Fund, Insurance Fund, University Endowment Fund, Corporate Investment), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

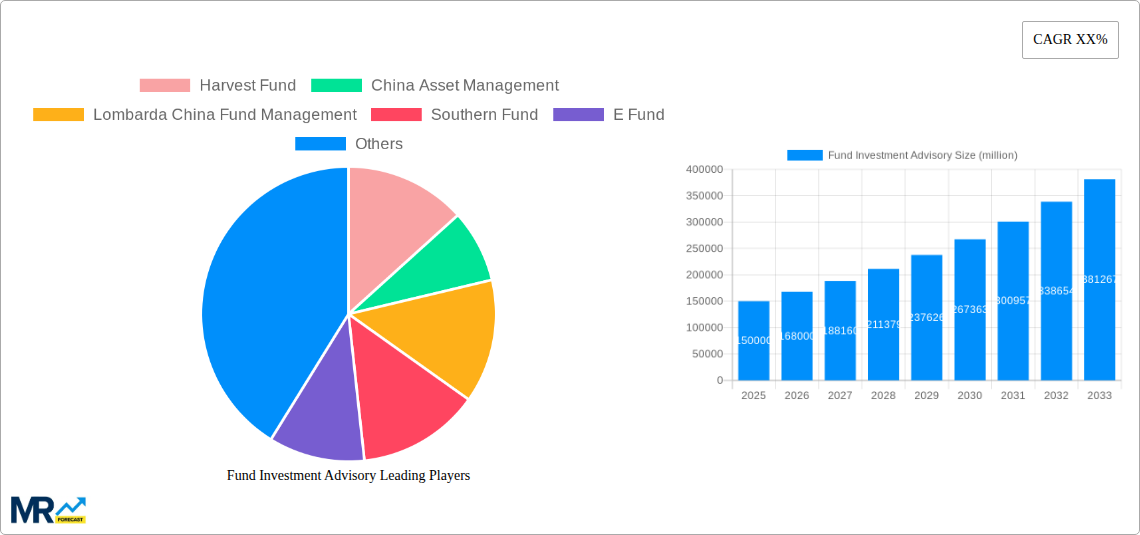

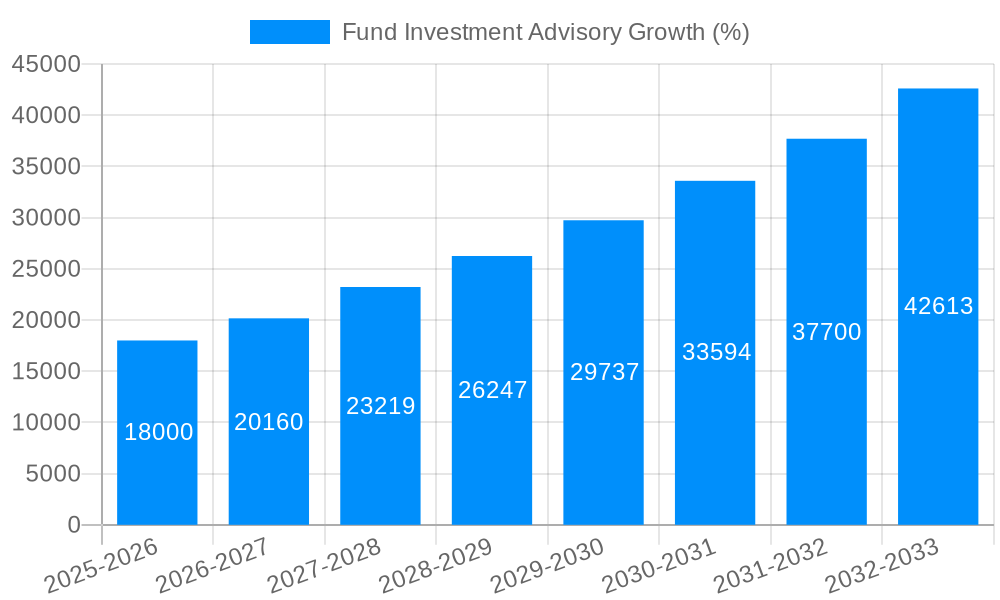

The Fund Investment Advisory market is experiencing robust growth, driven by increasing investor sophistication, a surge in high-net-worth individuals (HNWIs), and the rising popularity of actively managed funds. The market, estimated at $150 billion in 2025, is projected to expand at a compound annual growth rate (CAGR) of 12% from 2025 to 2033, reaching an estimated $450 billion by 2033. This significant expansion is fueled by several key factors: a growing preference for professional financial guidance among retail and institutional investors seeking optimized portfolio management and risk mitigation; the proliferation of innovative investment products and strategies, necessitating specialized advisory services; and regulatory changes promoting transparency and investor protection, increasing the demand for qualified advisors. Leading players like Harvest Fund, China Asset Management, and others are leveraging technological advancements, such as AI-powered portfolio analytics and robo-advisory platforms, to enhance service offerings and cater to evolving investor needs.

Despite the positive outlook, challenges remain. Increased competition among advisory firms, regulatory scrutiny, and the inherent risks associated with market volatility are potential constraints on market growth. Segmentation within the market is significant, with distinct service offerings catering to different investor profiles (e.g., retail, institutional, HNWIs). Geographic variations also exist, with developed economies exhibiting greater adoption of advisory services than emerging markets. Future growth hinges on addressing these challenges through continuous innovation, strategic partnerships, and a strong focus on client relationship management. The evolving regulatory landscape will also play a critical role in shaping market dynamics and opportunities.

The fund investment advisory market in China, encompassing giants like Harvest Fund, China Asset Management, and E Fund, experienced significant growth from 2019 to 2024, driven primarily by increasing retail investor participation and a growing preference for professionally managed investment portfolios. The historical period (2019-2024) saw a surge in assets under management (AUM) exceeding several hundred billion USD, reflecting a robust appetite for diversified investment options. The base year, 2025, projects a continued upward trajectory, with AUM expected to reach a new high. This growth is fueled by several factors, including favorable government policies encouraging financial inclusion, rising disposable incomes among the burgeoning middle class, and the increasing sophistication of Chinese investors. However, the market is not without its complexities. Competition among established players like China Merchants Bank and Ping An Bank, coupled with the emergence of fintech-driven advisory platforms, creates a dynamic and competitive landscape. Furthermore, the market is witnessing a shift towards personalized advisory services, with investors demanding tailored strategies to align with their specific risk profiles and financial goals. The estimated year 2025 shows a clear preference for actively managed funds, particularly those focused on equity and fixed income markets. Looking ahead to the forecast period (2025-2033), the report anticipates continued growth, although at a potentially moderated pace compared to the historical period, driven by factors including regulatory changes and macroeconomic conditions. The market's maturity and increased investor awareness will shape future trends, likely leading to greater focus on ESG (environmental, social, and governance) investing and alternative investment strategies. The anticipated increase in AUM from 2025 to 2033 could reach several trillion USD, indicating a massive and promising market in the coming decade. This growth necessitates a deeper understanding of investor behavior, regulatory frameworks, and evolving market dynamics to effectively navigate the complexities and capitalize on the opportunities presented by this sector.

The rapid expansion of the Chinese fund investment advisory market is fueled by a confluence of factors. Firstly, the rising affluence of the Chinese population, coupled with increased financial literacy, has led to a surge in retail investor participation. Individuals are seeking professional guidance to navigate the complexities of the financial markets and optimize their investment returns. Secondly, government initiatives aimed at fostering financial inclusion and promoting market development are playing a crucial role. These policies, combined with relaxed regulations in certain sectors, encourage investment and create a more welcoming environment for both domestic and international players. Technological advancements, particularly the rise of fintech platforms, are also driving growth. These platforms provide convenient access to investment services, personalized advice, and automated portfolio management tools, thus democratizing access to professional financial guidance. The increasing complexity of financial products and market conditions, alongside a growing need for diversification, further fuels the demand for expert advisory services. The presence of established financial institutions like ICBC and Huatai Securities, along with innovative fintech firms, intensifies competition, leading to better services and lower costs for investors. Finally, the growing awareness of the importance of long-term financial planning and wealth management among the Chinese population contributes to the sustained demand for fund investment advisory services, driving significant growth in the coming years.

Despite the promising growth trajectory, several challenges and restraints could impede the progress of the fund investment advisory market. Regulatory uncertainty and evolving compliance requirements pose a significant hurdle for firms operating in this sector. Keeping abreast of changes in regulations and adapting business practices accordingly necessitates substantial investments in compliance and legal expertise. Furthermore, intense competition among established players and emerging fintech firms creates a highly competitive landscape. This necessitates continuous innovation, strategic partnerships, and a focus on delivering superior value propositions to attract and retain clients. The risk of market volatility and macroeconomic uncertainty represents another critical challenge. Unexpected economic downturns or geopolitical events can significantly impact investor sentiment and investment outcomes, affecting the performance of advisory firms and eroding investor confidence. Moreover, educating investors about financial products and risk management remains an ongoing challenge, particularly in light of increasing product complexity. Misunderstandings or lack of sufficient understanding can lead to investor dissatisfaction and regulatory scrutiny. Finally, ensuring the ethical and responsible conduct of advisory firms, particularly in the wake of potential conflicts of interest, is crucial for maintaining market integrity and fostering trust among investors. Addressing these challenges will be paramount to ensuring the sustainable growth and development of the fund investment advisory market in China.

Tier-1 Cities: Major metropolitan areas like Beijing, Shanghai, Guangzhou, and Shenzhen are expected to dominate the market due to higher concentrations of high-net-worth individuals and sophisticated investors. These cities have well-established financial ecosystems and are attractive hubs for both domestic and international investment firms.

Equity Funds: Equity funds are likely to remain a significant segment, attracting substantial investments due to their potential for higher returns, especially with the sustained growth of the Chinese economy. However, the inherent volatility of equities requires careful consideration and sophisticated risk management strategies.

Fixed Income Funds: Fixed-income funds provide a stable, lower-risk alternative for investors seeking capital preservation. These funds are particularly attractive to conservative investors and pension funds, ensuring a steady flow of investment into this segment.

Hybrid Funds: These funds offer a blend of equity and fixed income investments, aiming to achieve a balance between growth and stability. Their flexibility and ability to cater to diverse investor risk profiles position them for continued growth within the market.

Technological advancements: The integration of Artificial Intelligence (AI) and other technologies facilitates the development of more personalized and data-driven advisory services, optimizing portfolio construction and risk management for investors.

Rise of Fintech: Fintech companies are disrupting the traditional investment advisory model with innovative digital platforms, enhancing accessibility and lowering costs for retail investors. This encourages higher participation and market expansion.

The dominance of these segments and regions is primarily due to several factors. The concentration of wealth and financial expertise in Tier-1 cities attracts leading financial institutions, creating a positive feedback loop. The consistent demand for higher returns fuels the popularity of equity funds, while the need for stability ensures the appeal of fixed-income products. Hybrid funds strike a balance catering to a broader range of investor preferences. The rapid evolution of technology empowers the industry to customize its offerings and cater to individual investor needs effectively.

The fund investment advisory industry’s growth is significantly propelled by increasing investor awareness, heightened financial literacy, and a growing preference for professional investment management. Government regulations that encourage market development and financial inclusion further stimulate this growth. The integration of technology, including AI-driven advisory services and the proliferation of fintech platforms, provides accessibility and innovative solutions, further fueling market expansion.

This report offers a detailed analysis of the Chinese fund investment advisory market, providing insights into key trends, driving forces, challenges, and growth opportunities. It presents a comprehensive overview of the leading players, examines key segments and regions, and forecasts market growth through 2033, offering invaluable information for stakeholders in the financial services industry. The report also analyzes the impact of regulatory changes and technological advancements on the market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Harvest Fund, China Asset Management, Lombarda China Fund Management, Southern Fund, E Fund, China Merchants Bank, Ping An Bank, Huatai Securities, Guotai Junan Asset Management, Galaxy Securities, China Securities, CICC, Shen Wan Hongyuan, Guolian Securities, ICBC, Tengan Fund, Yingmi Fund, Ant Fund, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Fund Investment Advisory," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fund Investment Advisory, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.