1. What is the projected Compound Annual Growth Rate (CAGR) of the Freight Transport Brokerage?

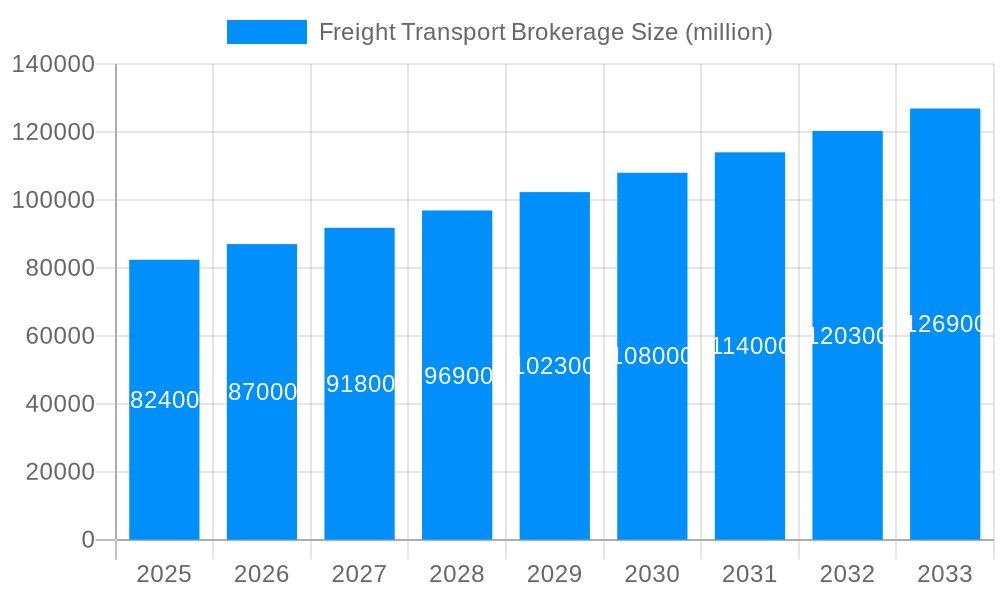

The projected CAGR is approximately 7.86%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Freight Transport Brokerage

Freight Transport BrokerageFreight Transport Brokerage by Type (/> Truckload, LTL, Other), by Application (/> Food and Beverage, Manufacturing, Retail, Auto and Industrial, Chemical, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

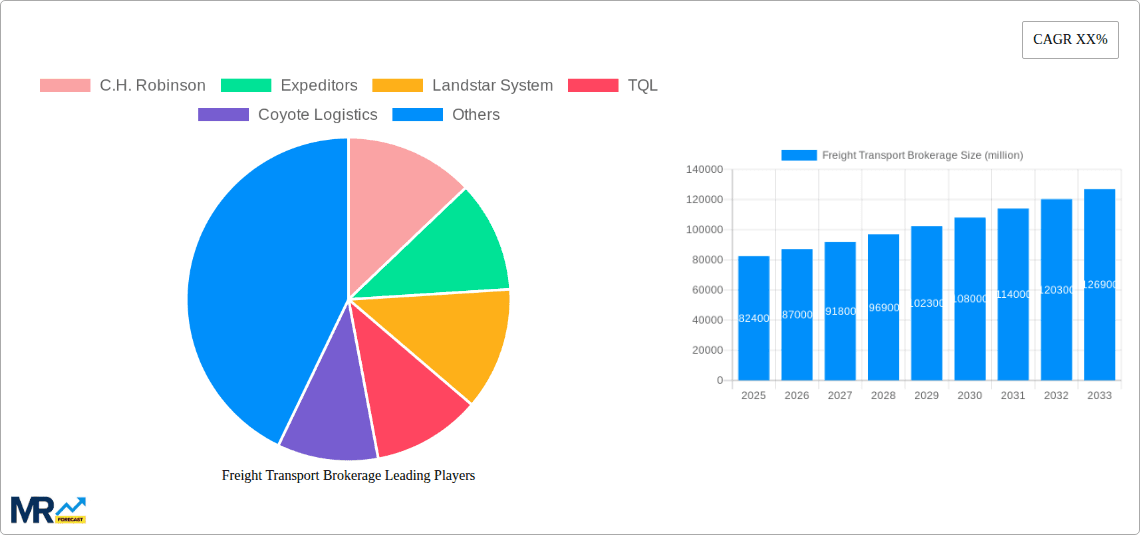

The global freight transport brokerage market is projected to reach $16.91 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.86%. This robust expansion is driven by increasing supply chain complexity, escalating demand for efficient logistics, and the widespread adoption of digital technologies. Key growth catalysts include the imperative for enhanced shipment visibility and control, the continuous pressure to optimize transportation expenditures, and the growing reliance of businesses on third-party logistics (3PL) providers. Industry fragmentation presents significant consolidation opportunities, while technological advancements, such as sophisticated Transportation Management Systems (TMS) and advanced data analytics, are revolutionizing brokerage operations and competitive strategies. The market features numerous participants, with major players like C.H. Robinson, Expeditors, and Landstar System leading. Emerging niche brokers with specialized services are further intensifying the competitive environment.

Continued growth will be supported by ongoing technological innovation and a sustained trend towards outsourcing logistics functions. Potential challenges encompass fuel price volatility, driver shortages, and evolving regulatory landscapes. Despite these hurdles, the long-term forecast is highly optimistic, with continuous technology investments and strategic alliances positioning the freight transport brokerage market for substantial expansion beyond 2033. Market segmentation across transportation modes (e.g., truckload, LTL, intermodal), shipment types, and geographical regions will continue to foster specialized service offerings and shape market dynamics. Brokers' capacity to leverage data analytics for enhanced efficiency, trend prediction, and value-added services will be critical for sustained success.

The freight transport brokerage market, valued at $XXX million in 2025, is experiencing robust growth, projected to reach $YYY million by 2033, exhibiting a CAGR of Z%. This expansion is fueled by several key factors. The increasing complexity of global supply chains necessitates the expertise of brokers to navigate the intricacies of logistics, from finding suitable carriers to managing risk and ensuring timely delivery. E-commerce's relentless growth significantly contributes to the demand for efficient freight transport, pushing brokers to optimize delivery networks and enhance last-mile solutions. Furthermore, technological advancements, such as digital freight matching platforms and advanced data analytics, are streamlining operations and improving efficiency for brokers, leading to cost savings and enhanced service offerings. Fluctuations in fuel prices and driver shortages continue to create volatility in the market, however, brokers are adept at adjusting to these changes, demonstrating resilience and adaptability within the dynamic transportation landscape. The ongoing trend towards just-in-time inventory management also fuels demand, placing a premium on reliable and timely freight delivery, a service where brokers play a crucial role. Finally, the increasing focus on sustainability within the logistics sector is impacting the market, with brokers now actively seeking and facilitating eco-friendly transportation solutions for their clients. This trend suggests a shift towards a more sustainable and environmentally conscious freight transportation sector.

Several powerful forces are propelling the growth of the freight transport brokerage market. The surging e-commerce sector, with its demand for rapid and efficient last-mile delivery, is a primary driver. This necessitates sophisticated logistics solutions that brokers are uniquely positioned to provide. Simultaneously, the increasing globalization of supply chains adds complexity, requiring specialized expertise to manage the intricate network of transportation and handling. This complexity creates a high demand for brokerage services which can optimize costs and timing, mitigate risks, and ensure the seamless flow of goods across borders. The adoption of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is transforming the brokerage sector, enabling better predictive analytics, route optimization, and efficient carrier selection. This technology-driven efficiency translates into cost savings and faster delivery times, making brokerage services even more attractive. Finally, the consolidation within the transportation industry, with larger carriers and logistics providers seeking out brokerage services to expand their reach and capacity, contributes significantly to market growth.

Despite the significant growth potential, the freight transport brokerage market faces several challenges. Fluctuations in fuel prices represent a major factor influencing profitability and operational efficiency. The persistent driver shortage across many regions continues to create capacity constraints, leading to increased costs and potential delays. Moreover, intense competition among brokers, coupled with pressure to maintain competitive pricing, can erode profit margins. Regulatory changes and compliance requirements, varying across regions and jurisdictions, also pose a significant hurdle for brokers needing to navigate complex legislative landscapes. Furthermore, economic downturns can significantly impact freight volumes, leading to decreased demand for brokerage services. Finally, security concerns and the risk of cargo theft remain significant challenges, requiring brokers to implement robust security measures and risk mitigation strategies.

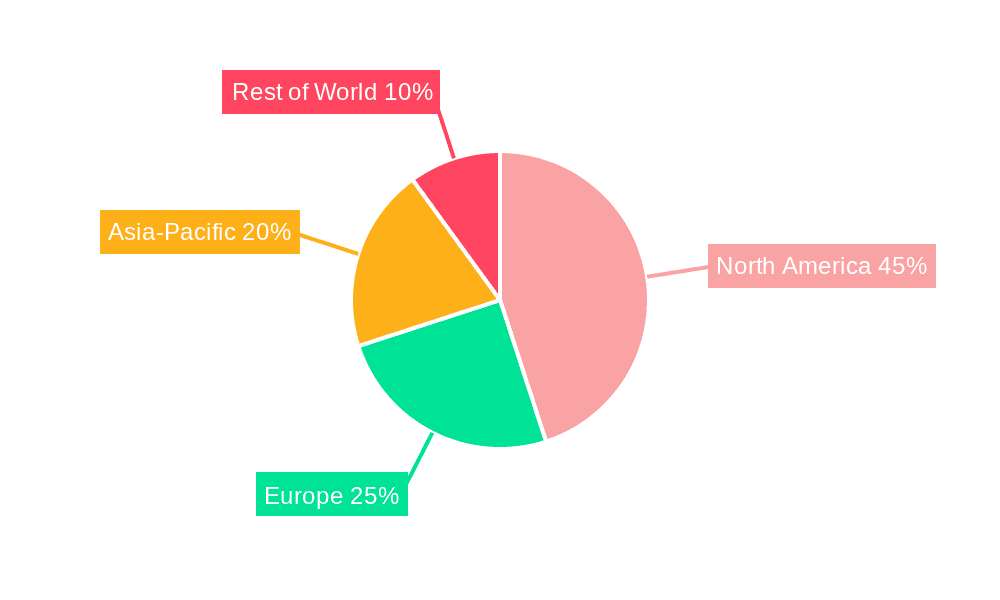

North America: This region is expected to hold a significant market share due to the robust e-commerce sector, extensive transportation networks, and high demand for efficient logistics solutions. The US in particular benefits from a well-developed infrastructure and a large number of established brokerage firms. Canada and Mexico also contribute significantly, though their markets are relatively smaller. The growing manufacturing sector in Mexico, combined with increasing trade with the US, is expected to drive growth.

Europe: While fragmented compared to North America, the European market exhibits substantial growth potential. Strong manufacturing activity and expanding intra-European trade create a steady demand for freight brokerage services. However, regulatory differences across countries within the EU can present challenges for brokers. Germany, France, and the UK are expected to be leading markets within Europe.

Asia-Pacific: Rapid economic growth and the rise of e-commerce in countries like China, India, and Japan are key drivers in this region. However, infrastructure limitations in certain areas may hinder growth. The increasing focus on supply chain resilience in this region may lead to higher demand for brokers, especially those with expertise in risk management.

Segment Dominance: The full truckload (FTL) segment is projected to hold the largest share of the market due to the higher value of shipments and the specialized service requirements involved. However, the less-than-truckload (LTL) segment is also expected to experience substantial growth driven by the increasing demand for smaller, less expensive shipments. The growth of specialized freight brokerage services, such as those focusing on oversized cargo or hazardous materials, also presents a significant opportunity.

The freight transport brokerage industry is experiencing significant growth due to several key factors: the exponential growth of e-commerce, demanding efficient last-mile delivery solutions; increased global trade and complex supply chains requiring specialized brokerage services; and the adoption of advanced technologies like AI and ML that improve operational efficiency. Furthermore, the industry is witnessing a consolidation trend, resulting in larger, more capable brokerage firms better equipped to handle complex logistics.

This report provides a comprehensive analysis of the freight transport brokerage market, covering historical data (2019-2024), the current market (2025), and future projections (2025-2033). It delves into key market trends, driving forces, challenges, regional analysis, segment breakdowns, and profiles of leading players. The report provides valuable insights into the market dynamics and serves as a critical resource for industry stakeholders seeking a deeper understanding of this dynamic sector. The detailed analysis facilitates informed decision-making and strategic planning within the freight transport brokerage landscape.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.86% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.86%.

Key companies in the market include C.H. Robinson, Expeditors, Landstar System, TQL, Coyote Logistics, XPO Logistics, Yusen Logistics, Echo Global Logistics, JB Hunt Transport, Worldwide Express, Hub Group, GlobalTranz Enterprises, Allen Lund, Transplace, Werner Logistics, BNSF Logistics.

The market segments include Type, Application.

The market size is estimated to be USD 16.91 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Freight Transport Brokerage," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Freight Transport Brokerage, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.