1. What is the projected Compound Annual Growth Rate (CAGR) of the Freight Logistics Brokerage?

The projected CAGR is approximately 6.3%.

Freight Logistics Brokerage

Freight Logistics BrokerageFreight Logistics Brokerage by Type (Truckload, LTL, Other), by Application (Food and Beverage, Manufacturing, Retail, Auto and Industrial, Chemical, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

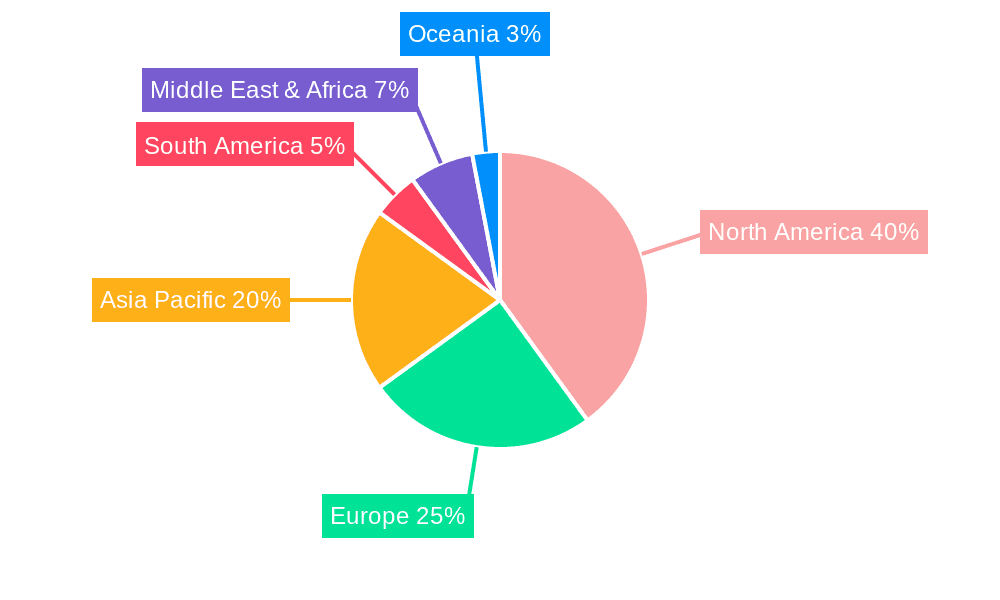

The global freight logistics brokerage market is poised for significant expansion, driven by the escalating demand for optimized and cost-efficient supply chain operations across a multitude of industries. Key growth drivers include the burgeoning e-commerce sector, increasing business globalization, and the critical need for just-in-time inventory management. The market is segmented by transportation mode (Truckload, LTL, and Others) and industry application (Food and Beverage, Manufacturing, Retail, Auto and Industrial, Chemical, and Others). Truckload brokerage presently commands the largest market share due to its inherent flexibility and widespread utility. Nevertheless, the Less Than Truckload (LTL) segment is anticipated to experience substantial growth, fueled by the rising demand for economical transport of smaller shipments. Geographically, North America leads the market, supported by robust economic activity and advanced logistics infrastructure. However, the Asia-Pacific region is projected to exhibit the highest growth trajectory, propelled by rapid industrialization and expanding e-commerce penetration in key economies such as China and India.

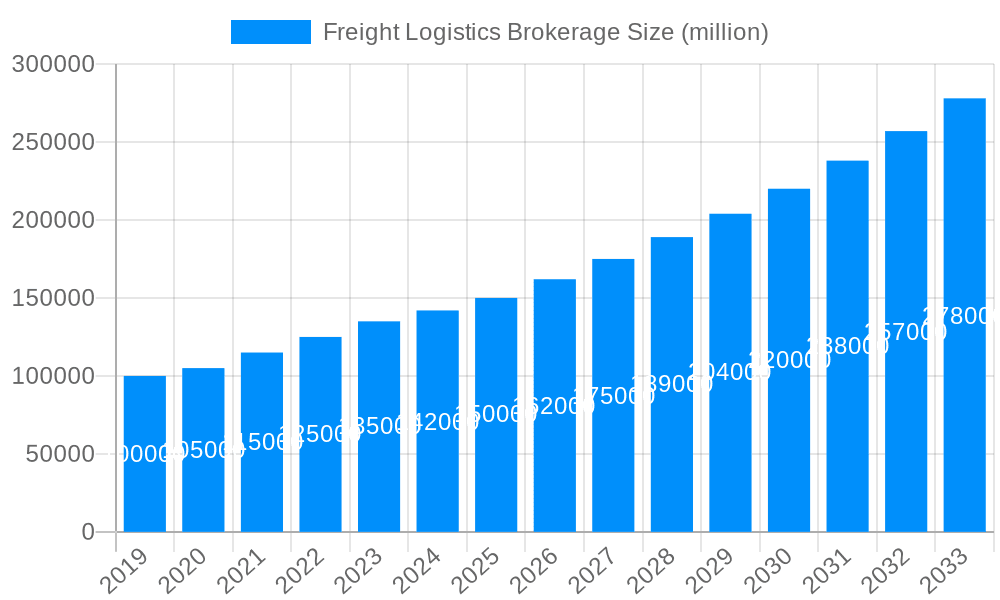

The forecast period (2025-2033) predicts sustained market expansion, with an estimated Compound Annual Growth Rate (CAGR) of 6.3%. This growth will be propelled by continuous digitalization in the logistics sector, the wider adoption of advanced analytics for freight optimization, and the increasing preference for integrated logistics solutions spanning warehousing, transportation, and last-mile delivery. While North America is expected to maintain a dominant market position, the Asia-Pacific region is set for considerable growth, surpassing the global average CAGR. Industry consolidation through mergers and acquisitions will also redefine the competitive landscape, fostering larger, technologically advanced entities offering comprehensive service portfolios. Market players are increasingly prioritizing sustainability initiatives, including carbon emission reduction, to address environmental concerns and attract eco-conscious clientele.

The current market size is valued at approximately 17.96 billion.

The freight logistics brokerage market, valued at $XXX million in 2025, is experiencing robust growth, projected to reach $YYY million by 2033. This expansion is fueled by several key factors. The increasing complexity of global supply chains, coupled with fluctuating fuel prices and driver shortages, is driving a greater reliance on specialized brokerage services. Businesses are increasingly outsourcing their logistics needs to focus on core competencies, leading to a surge in demand for efficient and cost-effective brokerage solutions. Technological advancements, such as advanced transportation management systems (TMS) and digital freight matching platforms, are streamlining operations and improving transparency throughout the supply chain. These systems allow brokers to optimize routes, track shipments in real-time, and negotiate better rates with carriers. The e-commerce boom also significantly contributes to market growth, requiring efficient and flexible logistics solutions to manage the increasing volume of smaller, faster shipments. Furthermore, regulatory changes and environmental concerns are pushing the industry toward more sustainable and environmentally friendly practices, creating new opportunities for brokers specializing in these areas. The historical period (2019-2024) showed considerable growth despite global challenges, setting the stage for a period of continued expansion.

Several key drivers are accelerating the growth of the freight logistics brokerage market. The escalating complexity of global supply chains necessitates the expertise of brokers to navigate the intricacies of international trade, regulatory compliance, and carrier selection. Simultaneously, the persistent shortage of truck drivers and escalating fuel costs are making transportation increasingly unpredictable and expensive. Brokers possess the market knowledge and relationships to mitigate these risks, ensuring timely and cost-effective delivery. The rise of e-commerce continues to fuel demand for efficient last-mile delivery solutions, a sector where brokers play a vital role in coordinating diverse transportation options. Technological advancements, particularly in the realm of digital freight matching and TMS, are enhancing efficiency and transparency, further supporting the market's expansion. Finally, the increasing focus on sustainability is creating new opportunities for brokers specializing in green logistics solutions, catering to businesses committed to reducing their environmental footprint.

Despite significant growth, the freight logistics brokerage industry faces several challenges. Fluctuating fuel prices and driver shortages remain major headwinds, impacting operational costs and delivery timelines. Competition within the brokerage sector is intense, with numerous players vying for market share. Maintaining profitability requires efficient operations, strong carrier relationships, and effective pricing strategies. Regulatory compliance is another significant challenge, with brokers needing to navigate complex rules and regulations at both national and international levels. Furthermore, the industry is susceptible to economic downturns, as reduced business activity can lead to a decline in shipping volumes and reduced demand for brokerage services. Finally, cybersecurity threats pose a growing concern, as brokers handle sensitive customer and transactional data. Managing these risks requires robust security measures and proactive threat management strategies.

The North American market currently dominates the freight logistics brokerage sector, driven by the large and diverse manufacturing, retail, and e-commerce sectors. Within this region, the truckload segment is particularly strong, accounting for a significant portion of overall brokerage activity. However, the LTL (Less-than-Truckload) segment is also experiencing significant growth, fueled by the rising popularity of e-commerce and the need for efficient handling of smaller shipments.

The forecast period (2025-2033) indicates continued growth in these regions and segments, although other regions, like Asia-Pacific, are expected to experience a faster growth rate driven by developing economies and expanding manufacturing bases. The "Other" segment within both "Type" and "Application" also holds potential for expansion, as new modes of transport and specialized logistics needs emerge. This segment requires further analysis to pinpoint specific emerging areas.

The industry's growth is further propelled by the increasing adoption of technology, particularly digital freight matching platforms and advanced transportation management systems (TMS). These technologies improve efficiency, transparency, and cost optimization, offering significant competitive advantages to brokerage firms. Additionally, the growing focus on supply chain resilience, accelerated by recent global disruptions, is pushing businesses to seek reliable and adaptable logistics partners, further boosting demand for brokerage services. Finally, the increasing emphasis on sustainability within supply chains creates new opportunities for brokers to provide eco-friendly solutions and attract environmentally conscious clients.

This report provides a comprehensive overview of the freight logistics brokerage market, covering historical performance, current trends, and future projections. It analyzes key market drivers and restraints, identifies leading players, and explores significant developments shaping the industry. The report's detailed segmentation allows for a granular understanding of market dynamics across various regions, transportation modes, and application sectors. The analysis incorporates both qualitative and quantitative data to present a robust and insightful assessment of this rapidly evolving market. The comprehensive forecast offers valuable insights for businesses operating within or seeking to enter the freight logistics brokerage sector.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 6.3%.

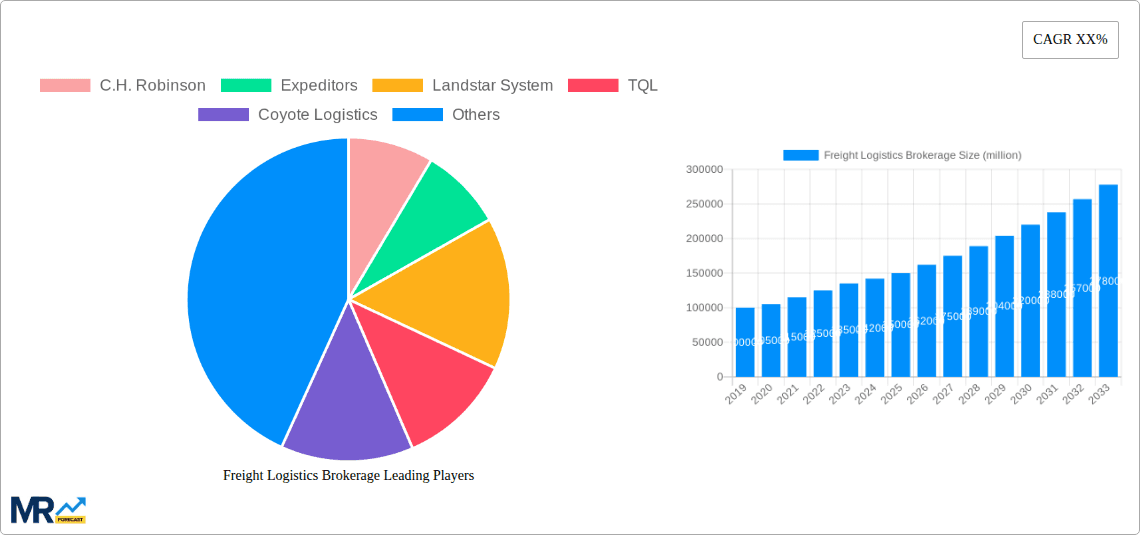

Key companies in the market include C.H. Robinson, Expeditors, Landstar System, TQL, Coyote Logistics, XPO Logistics, Yusen Logistics, Echo Global Logistics, JB Hunt Transport, Worldwide Express, Hub Group, GlobalTranz Enterprises, Allen Lund, Transplace, Werner Logistics, BNSF Logistics, .

The market segments include Type, Application.

The market size is estimated to be USD 17.96 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Freight Logistics Brokerage," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Freight Logistics Brokerage, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.