1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Plastic Packaging?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Food Plastic Packaging

Food Plastic PackagingFood Plastic Packaging by Application (Domestic, Commercial, World Food Plastic Packaging Production ), by Type (Thermoset Polymer, Thermoplastic Polymer, Elastomer, World Food Plastic Packaging Production ), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

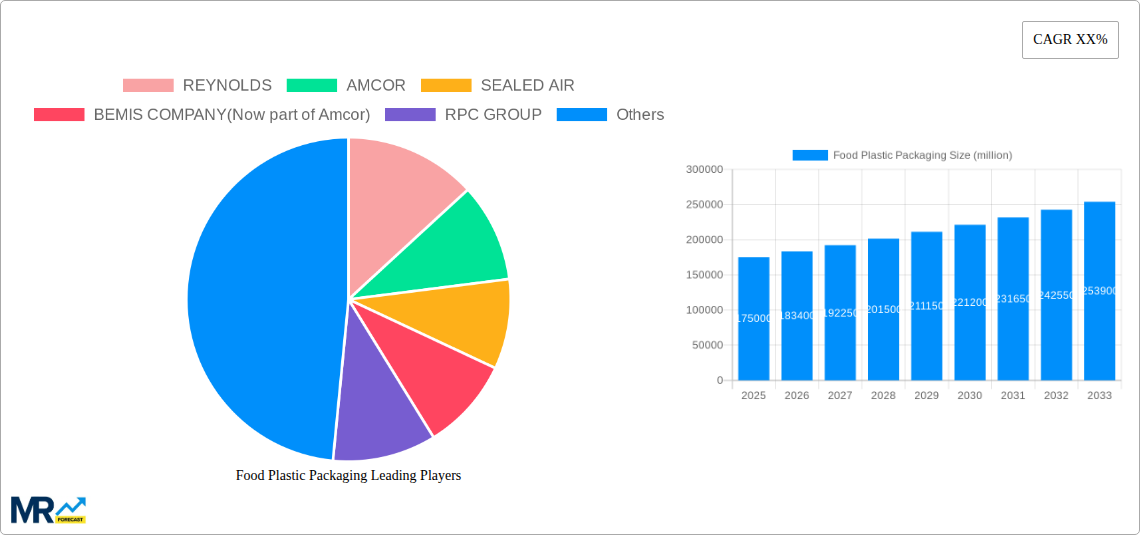

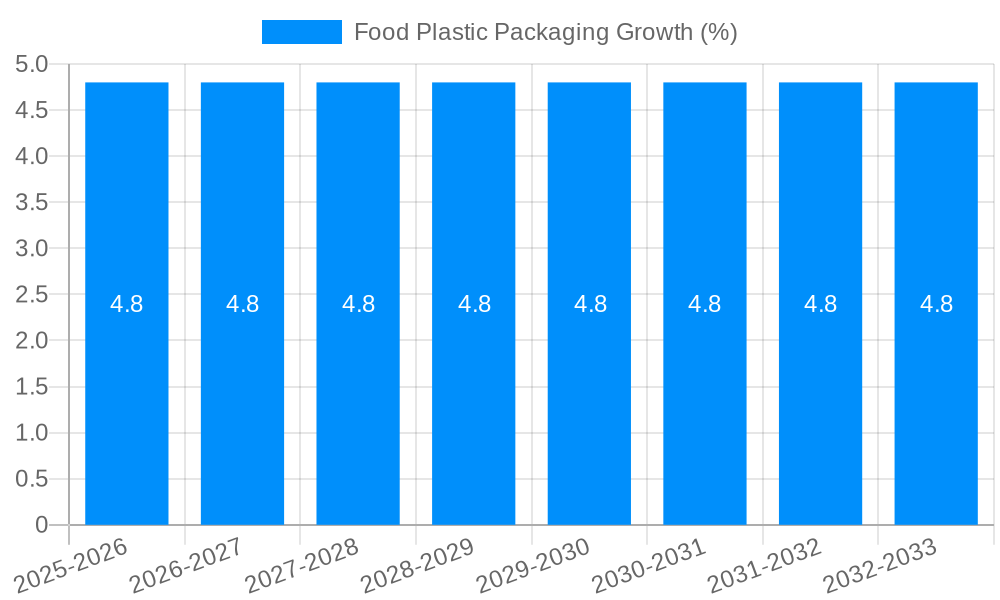

The global food plastic packaging market is poised for substantial growth, projected to reach an estimated market size of USD 175 billion by 2025, expanding at a robust Compound Annual Growth Rate (CAGR) of 4.8% through 2033. This expansion is primarily fueled by the increasing demand for convenient, safe, and shelf-stable food products worldwide. Consumers' evolving lifestyles, characterized by busy schedules and a preference for ready-to-eat meals, directly translate to a higher consumption of packaged foods. Furthermore, the inherent properties of plastic – its lightweight nature, excellent barrier capabilities against moisture and oxygen, and cost-effectiveness – make it an indispensable material for preserving food quality and extending shelf life, thereby minimizing food waste. The World Food Plastic Packaging Production sector is a critical enabler of this growth, with advancements in material science leading to the development of more sustainable and recyclable plastic solutions, addressing growing environmental concerns.

The market's trajectory is further shaped by several key drivers, including the burgeoning middle class in emerging economies, which is increasing disposable incomes and consequently, the demand for packaged goods. The continuous innovation in packaging designs, offering enhanced functionality, improved aesthetics, and extended product shelf life, also plays a pivotal role. The Thermoplastic Polymer segment, in particular, is expected to dominate due to its versatility and widespread adoption across various food packaging applications, from rigid containers to flexible films. While the market experiences robust growth, potential restraints include stricter regulatory frameworks concerning plastic usage and disposal, and increasing consumer preference for sustainable alternatives like paper and biodegradable materials. However, the industry is actively responding through investments in recycling technologies and the development of bio-based plastics, ensuring its continued relevance and contribution to global food security and distribution.

This comprehensive report delves into the dynamic world of food plastic packaging, offering an in-depth analysis of production, consumption, and market trends from the historical period of 2019-2024, with a strategic focus on the base year 2025 and an extensive forecast extending to 2033. The study employs a robust methodology to project the global food plastic packaging production value, expected to reach a significant $520 million in the estimated year 2025, and forecasts its trajectory through 2033.

The report meticulously examines key market drivers, emerging trends, and critical challenges shaping the industry. It provides granular insights into the market segmentation by Application (Domestic, Commercial) and Type (Thermoset Polymer, Thermoplastic Polymer, Elastomer), offering a nuanced understanding of each segment's contribution to the overall market landscape. Furthermore, it highlights pivotal industry developments and strategic initiatives undertaken by leading global players, including REYNOLDS, AMCOR, SEALED AIR, BEMIS COMPANY (Now part of Amcor), RPC GROUP, ALPLA, PLASTIPAK, CONSTANTIA, COVERIS, and BERRY GLOBAL.

With a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to navigate the complexities of the food plastic packaging market, identify lucrative opportunities, and formulate effective business strategies.

The global food plastic packaging market is undergoing a significant transformation, driven by evolving consumer preferences, stringent regulatory landscapes, and technological advancements. From 2019 to 2024, we observed a steady growth pattern, fueled by the convenience and versatility that plastic packaging offers to the food industry. However, the period ahead, particularly the forecast from 2025 to 2033, will be characterized by a paradigm shift towards sustainability and enhanced functionality. The estimated production value of $520 million in 2025 signifies the market's robust foundation, but future growth will be contingent on addressing environmental concerns. A key trend is the escalating demand for lightweight and flexible packaging solutions that not only reduce material usage but also optimize logistics and minimize carbon footprints. This includes a surge in the adoption of mono-material packaging, designed for easier recyclability, moving away from complex multi-layer structures. Innovations in barrier technologies are also paramount, extending shelf life and reducing food waste, a critical concern for both consumers and manufacturers. The integration of smart packaging solutions, incorporating features like temperature indicators and tamper-evident seals, is gaining traction, enhancing food safety and consumer trust. Furthermore, there's a noticeable move towards bio-based and biodegradable plastics, driven by both regulatory pressures and growing consumer awareness regarding environmental impact. The market will witness a greater emphasis on extended producer responsibility (EPR) schemes, prompting manufacturers to invest in robust collection and recycling infrastructure. The aesthetic appeal and branding opportunities presented by plastic packaging will continue to be leveraged, but with a growing emphasis on transparency regarding the origin and recyclability of the materials used. The competitive landscape will intensify as companies vie for market share by offering innovative, sustainable, and cost-effective packaging solutions that cater to the diverse needs of the global food industry. The interplay between technological innovation, consumer sentiment, and regulatory frameworks will sculpt the future trajectory of this vital sector.

Several powerful forces are propelling the growth and evolution of the food plastic packaging market. The most significant driver is the ever-increasing global population and the corresponding rise in food demand. As more mouths need to be fed, the need for efficient, safe, and convenient packaging solutions intensifies. Plastic packaging, with its ability to preserve freshness, prevent spoilage, and extend shelf life, plays a crucial role in meeting this demand, especially in a globalized food supply chain. Another formidable force is the convenience factor that plastic packaging offers to modern consumers. Ready-to-eat meals, single-serving portions, and easily portable food items are staples in busy lifestyles, and plastic packaging is the enabler of this convenience. This trend is particularly strong in urbanized and developing economies. Furthermore, advancements in material science and processing technologies are continuously creating new possibilities for plastic packaging. Innovations in lightweighting, enhanced barrier properties, and improved recyclability are making plastics more sustainable and functional, addressing some of the key environmental concerns. The growing e-commerce sector also contributes significantly, as robust and protective packaging is essential for delivering perishable food items safely through complex logistics networks. Finally, the economic advantages offered by plastic packaging, such as its relatively low cost of production and its durability, make it an attractive option for food manufacturers, particularly small and medium-sized enterprises, enabling them to compete effectively in the market. These combined forces create a fertile ground for the continued, albeit evolving, dominance of plastic in food packaging.

Despite its widespread adoption and inherent advantages, the food plastic packaging sector faces significant challenges and restraints that are reshaping its future trajectory. The most prominent challenge is the mounting environmental concern and public outcry against plastic waste. The persistent issue of plastic pollution, particularly single-use plastics, has led to increased regulatory scrutiny and a growing consumer demand for more sustainable alternatives. This has resulted in bans and restrictions on certain types of plastic packaging in various regions, forcing manufacturers to adapt and innovate. Fluctuations in raw material prices, primarily derived from crude oil, can impact the cost-effectiveness of plastic packaging, creating uncertainty for manufacturers and potentially leading to price hikes for consumers. Developing and scaling up effective recycling infrastructure remains a significant hurdle. While many plastics are technically recyclable, the economic viability and efficiency of collection, sorting, and reprocessing systems vary widely across the globe. This often leads to lower recycling rates than desired, exacerbating the waste management problem. Consumer perception and education also play a crucial role. Misinformation and a lack of understanding about the recyclability and environmental impact of different plastic types can influence purchasing decisions and put pressure on brands. Furthermore, the development of truly compostable or biodegradable alternatives that match the performance and cost-effectiveness of conventional plastics is an ongoing research and development challenge. Finally, competition from alternative packaging materials, such as paper, glass, and metal, although often facing their own sustainability challenges, presents a continuous threat in specific applications. These restraints necessitate a proactive and innovative approach from the industry to overcome these obstacles and ensure its long-term viability.

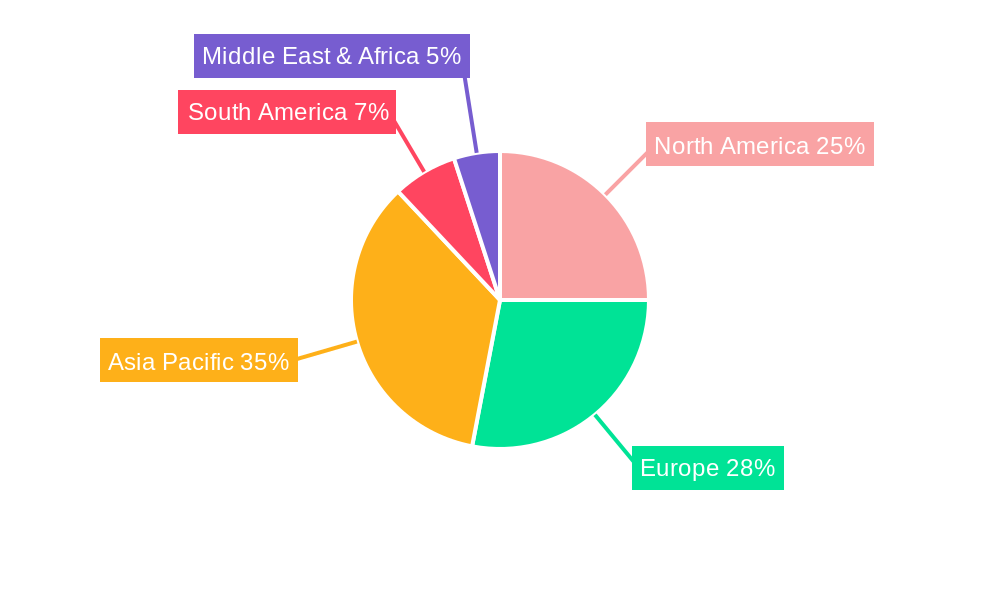

The global food plastic packaging market is characterized by regional dynamics and segment dominance that are crucial for understanding its future growth.

Dominating Regions/Countries:

Asia-Pacific: This region is poised to dominate the food plastic packaging market due to a confluence of factors.

North America: This region remains a significant player due to its mature food industry and high consumer spending power.

Dominating Segments:

Application: Commercial

Type: Thermoplastic Polymer

The interplay of these dominating regions and segments underscores the current landscape and future potential of the food plastic packaging market, highlighting areas of high demand and production.

Several key catalysts are fueling the growth of the food plastic packaging industry. The increasing demand for convenience foods driven by busy lifestyles and urbanization is a primary driver. Technological advancements in material science, leading to lighter, stronger, and more sustainable plastics with enhanced barrier properties, are opening new application avenues. The expanding e-commerce sector, requiring robust packaging for food delivery, is another significant catalyst. Furthermore, the growing global population and rising disposable incomes in emerging economies translate directly into increased demand for packaged food. Finally, innovations in recycling technologies and the development of circular economy models are helping to mitigate environmental concerns and foster continued industry growth.

This report provides a holistic and detailed analysis of the World Food Plastic Packaging Production market, spanning the historical period of 2019-2024 and extending to a comprehensive forecast through 2033. It offers granular insights into market dynamics, including segmentation by Application (Domestic, Commercial) and Type (Thermoset Polymer, Thermoplastic Polymer, Elastomer). The report meticulously examines key trends, driving forces, challenges, and growth catalysts, underpinned by robust market data and projections, with an estimated market value of $520 million for the base year 2025. Furthermore, it identifies the dominant regions and segments poised for significant growth, alongside an in-depth review of the leading players and their strategic developments. This report is an essential tool for stakeholders seeking to understand the intricate landscape and future trajectory of the global food plastic packaging industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include REYNOLDS, AMCOR, SEALED AIR, BEMIS COMPANY(Now part of Amcor), RPC GROUP, ALPLA, PLASTIPAK, CONSTANTIA, COVERIS, BERRY GLOBAL, .

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Food Plastic Packaging," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food Plastic Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.