1. What is the projected Compound Annual Growth Rate (CAGR) of the Foam Food Container?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Foam Food Container

Foam Food ContainerFoam Food Container by Type (Expanded Polystyrene (Eps) Foam Food Container, Polyurethane (Pu) Foam Food Container, Biodegradable Foam Food Container), by Application (Ready to Eat Food, Frozen Food, Ice Cream & Dairy Products, Bakery & Confectionery Food Items, Meat, Seafood & Poultry Items), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

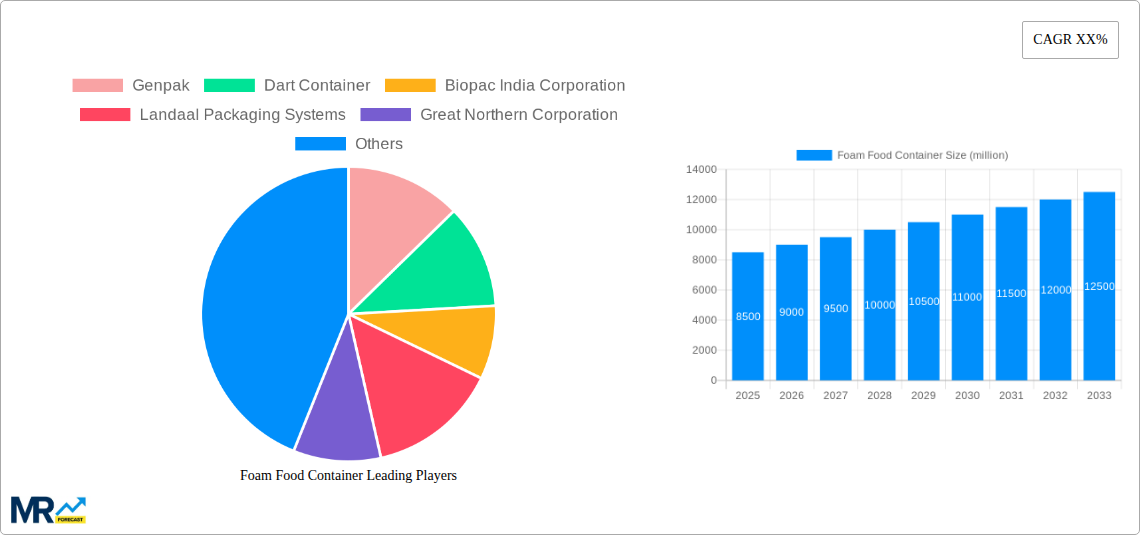

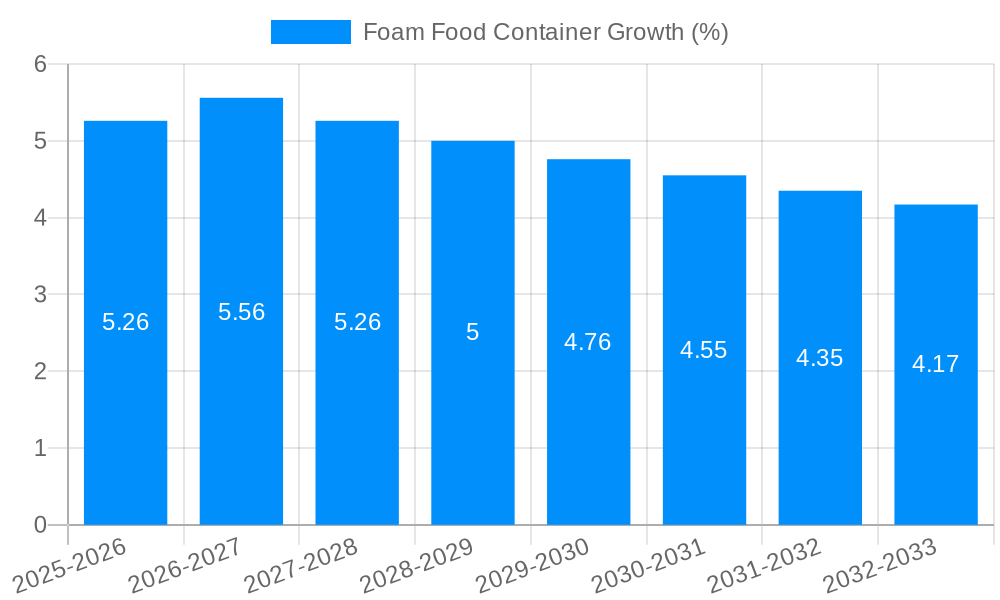

The global Foam Food Container market is poised for substantial growth, projected to reach an estimated market size of approximately $8,500 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 5.5% from 2025 to 2033. This expansion is primarily fueled by the escalating demand for convenient and cost-effective food packaging solutions across various food service sectors. The "Ready to Eat Food" segment is expected to dominate the market, driven by the increasing consumer preference for on-the-go meals and the burgeoning food delivery industry. Similarly, the "Frozen Food" and "Ice Cream & Dairy Products" segments will continue to be significant contributors, benefiting from advancements in cold chain logistics and the growing global consumption of these items. The widespread adoption of Expanded Polystyrene (EPS) foam containers, owing to their excellent insulation properties and affordability, is a key driver for market expansion. However, rising environmental concerns and stringent regulations regarding single-use plastics are also spurring innovation in alternative materials, leading to a growing segment of Biodegradable Foam Food Containers.

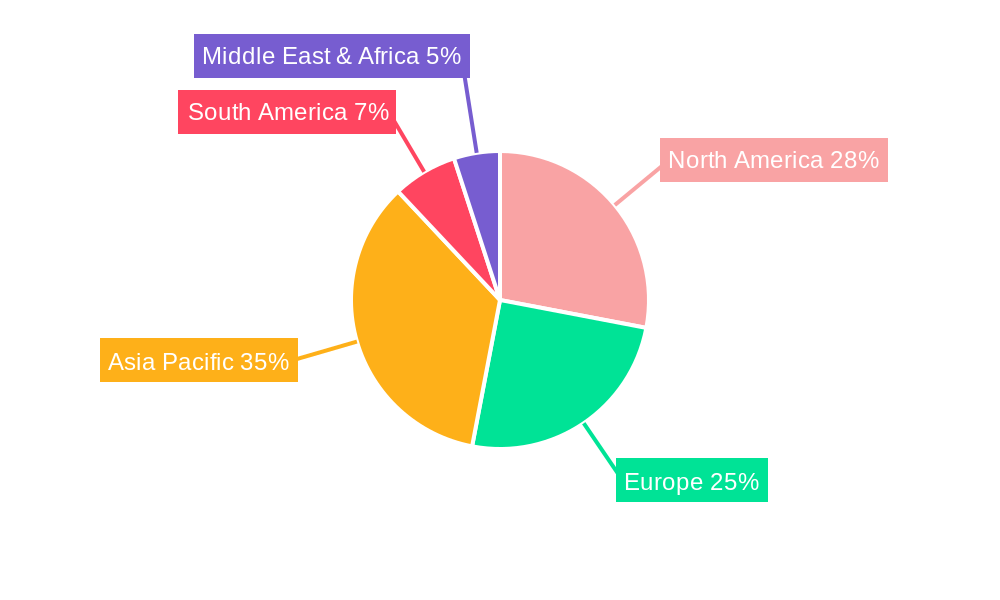

Geographically, the Asia Pacific region is anticipated to emerge as the largest and fastest-growing market for foam food containers. Rapid urbanization, a rising disposable income, and the burgeoning food service industry in countries like China and India are creating immense opportunities. North America and Europe, while mature markets, will continue to exhibit steady growth, with a growing emphasis on sustainable packaging alternatives and specialized foam container designs. Key restraints for the market include fluctuating raw material prices and the increasing pressure from regulatory bodies and consumers to adopt eco-friendly packaging solutions. Companies like Genpak, Dart Container, and Biopac India Corporation are actively investing in research and development to offer innovative and sustainable foam food container solutions, aiming to capture a significant share of this evolving market.

The global Foam Food Container market is undergoing a significant transformation, driven by a confluence of evolving consumer preferences, regulatory pressures, and technological advancements. Throughout the study period of 2019-2033, with a base year of 2025 and an estimated year of 2025, this sector has witnessed dynamic shifts. During the historical period (2019-2024), the market was largely dominated by traditional Expanded Polystyrene (EPS) foam containers, owing to their affordability, excellent insulation properties, and widespread availability. These containers proved indispensable for a variety of food applications, from hot ready-to-eat meals to frozen delicacies, enabling efficient food transportation and preservation. The convenience factor associated with EPS foam containers played a pivotal role in their market penetration, especially in the burgeoning food delivery and takeaway segments.

However, the landscape began to shift as environmental concerns escalated. Public awareness regarding plastic waste and its impact on ecosystems spurred a demand for more sustainable packaging solutions. This growing consciousness, coupled with stringent government regulations aimed at curbing single-use plastics, has prompted a gradual but steady re-evaluation of EPS foam's dominance. While still holding a substantial market share due to its cost-effectiveness and performance, its growth trajectory is increasingly being challenged by emerging alternatives. The forecast period (2025-2033) is anticipated to witness a more pronounced diversification, with a greater emphasis on biodegradable and recyclable foam options. Innovators are actively exploring novel materials and manufacturing processes to offer containers that are both functional and environmentally responsible. The industry is also witnessing a surge in research and development focused on enhancing the performance of biodegradable foams, aiming to match the insulation and durability of traditional EPS without the long-term environmental burden. This evolving market dynamic underscores the industry's adaptability and its commitment to balancing consumer needs with ecological imperatives, setting the stage for a more sustainable future in food packaging. The market's projected growth, estimated at approximately USD 5,000 million in 2025, indicates a resilient demand for food containers, but the composition of this demand is expected to evolve significantly.

The resilience and continued growth of the foam food container market are underpinned by several powerful driving forces. Foremost among these is the persistent and expanding global demand for convenience food. As urbanization accelerates and lifestyles become increasingly fast-paced, the reliance on ready-to-eat meals, takeout, and food delivery services continues to surge. Foam containers, with their inherent ability to maintain food temperature – keeping hot foods hot and cold foods cold – are exceptionally well-suited to meet the stringent requirements of these segments. This insulation property is critical for ensuring food quality and safety during transit, a non-negotiable aspect for both consumers and food service providers. Furthermore, the cost-effectiveness of traditional foam materials like EPS remains a significant advantage. For businesses operating on tight margins, especially small and medium-sized enterprises in the food sector, the affordability of these containers directly translates to lower operational costs and more competitive pricing for consumers. This economic incentive, coupled with the widespread availability of EPS, continues to fuel its adoption, particularly in developing economies where budget-conscious consumers and businesses are prevalent. The inherent durability and leak-resistant nature of many foam food containers also contribute to their appeal, minimizing product loss and enhancing customer satisfaction. These factors collectively ensure that foam food containers remain a practical and economically viable choice for a substantial portion of the food industry.

Despite the strong market drivers, the foam food container industry faces considerable challenges and restraints that are shaping its future trajectory. The most prominent and pervasive issue is the growing environmental concern surrounding single-use plastics. Expanded Polystyrene (EPS) foam, in particular, is often criticized for its persistence in the environment and the difficulties associated with its recycling. This has led to increasing public outcry and regulatory pressure, with many governments and municipalities implementing bans or restrictions on certain types of foam packaging. This regulatory landscape creates significant uncertainty for manufacturers and can necessitate costly shifts in production and materials. Furthermore, the perception of foam containers as environmentally unfriendly can negatively impact brand image for food businesses that rely heavily on them. This has spurred a growing demand for sustainable alternatives, prompting consumers to actively seek out products packaged in eco-friendly materials. Material cost volatility is another potential restraint. Fluctuations in the price of raw materials used in foam production can impact profit margins and make it challenging to maintain consistent pricing. The development and adoption of advanced biodegradable or compostable foam alternatives, while promising, also present their own set of challenges, including potentially higher manufacturing costs, different performance characteristics, and the need for specialized disposal infrastructure, which is not yet universally available. These combined factors create a complex operating environment for the foam food container industry.

The global Foam Food Container market is characterized by regional variations in consumption patterns and segment dominance, heavily influenced by economic development, regulatory frameworks, and consumer preferences. North America and Asia-Pacific are poised to be the leading regions in the market, with a significant portion of this dominance attributed to the Expanded Polystyrene (EPS) Foam Food Container segment and its application in Ready to Eat Food and Frozen Food.

In North America, the established food service infrastructure, coupled with a high per capita consumption of convenience foods, drives substantial demand for foam food containers. The region's robust food delivery and takeaway culture, further amplified by the proliferation of third-party delivery apps, creates a constant need for reliable and cost-effective packaging solutions. EPS foam containers, due to their superior insulation properties that ensure food remains at optimal temperatures during transit and their affordability, continue to be a preferred choice for a wide array of ready-to-eat meals, including fast food, diner-style dishes, and family meal deals. Similarly, the large market for frozen foods, encompassing everything from individual meals to bulk grocery items, benefits significantly from the protective and insulating qualities of EPS containers. While regulatory pressures concerning single-use plastics are mounting, the sheer volume of demand and the lack of readily scalable and cost-competitive alternatives for certain applications mean that EPS containers will likely maintain a significant market share in the near to medium term.

The Asia-Pacific region is exhibiting the most rapid growth and is projected to emerge as a dominant force in the foam food container market. This surge is fueled by several converging factors: rapid urbanization, a burgeoning middle class with increasing disposable incomes, and a significant expansion of the food service industry, particularly street food vendors and local eateries. The extensive network of small-scale food businesses in countries like China, India, and Southeast Asian nations heavily relies on affordable and functional packaging. EPS foam containers are ideal for their operations, accommodating a wide variety of dishes, from hot stir-fries and noodles to chilled desserts and snacks, all of which fall under the Ready to Eat Food application segment. Furthermore, the growing popularity of convenience foods and the expansion of organized retail are boosting the demand for frozen food packaging. The sheer population size and the increasing adoption of Westernized eating habits in this region translate to an enormous potential market. While environmental regulations are gradually being introduced, the economic imperative and the immediate need for practical packaging solutions mean that EPS foam containers are set to dominate this segment for the foreseeable future. The affordability of EPS allows businesses to offer competitive pricing, a crucial factor in these price-sensitive markets. Consequently, the combined market size and growth potential in these regions, heavily reliant on EPS for ready-to-eat and frozen food applications, will define the dominant force within the global foam food container industry for the study period.

Several key factors are acting as growth catalysts for the foam food container industry. The persistent global demand for convenience foods, driven by urbanization and evolving lifestyles, is a primary driver. The food delivery and takeaway sector's exponential growth necessitates reliable, insulated, and cost-effective packaging solutions, a niche foam containers excel in. Furthermore, ongoing innovation in material science is leading to the development of improved biodegradable and compostable foam options, addressing environmental concerns and opening new market opportunities. The increasing affordability of these newer materials, while still a factor, is steadily improving, making them more competitive.

This comprehensive report offers an in-depth analysis of the Foam Food Container market, providing critical insights for stakeholders. It meticulously examines market dynamics throughout the study period of 2019-2033, with a focus on the base and estimated year of 2025, and an extended forecast period from 2025-2033. The report delves into the historical trends from 2019-2024, providing a solid foundation for understanding past performance. It identifies the key driving forces, such as the booming convenience food sector and the persistent demand for cost-effective packaging. Simultaneously, it addresses the significant challenges and restraints, including environmental concerns and evolving regulations. The report further highlights key regions and segments poised for dominance, offering detailed segmentation analysis by type and application. This includes an exhaustive review of Expanded Polystyrene (EPS) Foam Food Container, Polyurethane (PU) Foam Food Container, and Biodegradable Foam Food Container, alongside their applications in Ready to Eat Food, Frozen Food, Ice Cream & Dairy Products, Bakery & Confectionery Food Items, and Meat, Seafood & Poultry Items. It also pinpoints crucial growth catalysts and provides a detailed overview of leading industry players and their strategic developments. This report serves as an indispensable resource for strategic planning, investment decisions, and understanding the future trajectory of the foam food container industry.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Genpak, Dart Container, Biopac India Corporation, Landaal Packaging Systems, Great Northern Corporation, Megafoam Containers Enterprise, Republic Plastics, Styrotech Corporation, Packaging Resources, Beltec Sdn, Citi Pak, Reach Plastic Industrial, Di Xiang Trading, Bestern Industry And Trade, Luheng Papers Company, Jeafer Foodservice Solutions, ZBR Packaging Materials.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Foam Food Container," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Foam Food Container, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.