1. What is the projected Compound Annual Growth Rate (CAGR) of the First-person Shooting Game?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

First-person Shooting Game

First-person Shooting GameFirst-person Shooting Game by Type (Client Game, Mobile Game, Under 18 Years Old, 18-35 Years Old, Above 35 Years Old), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

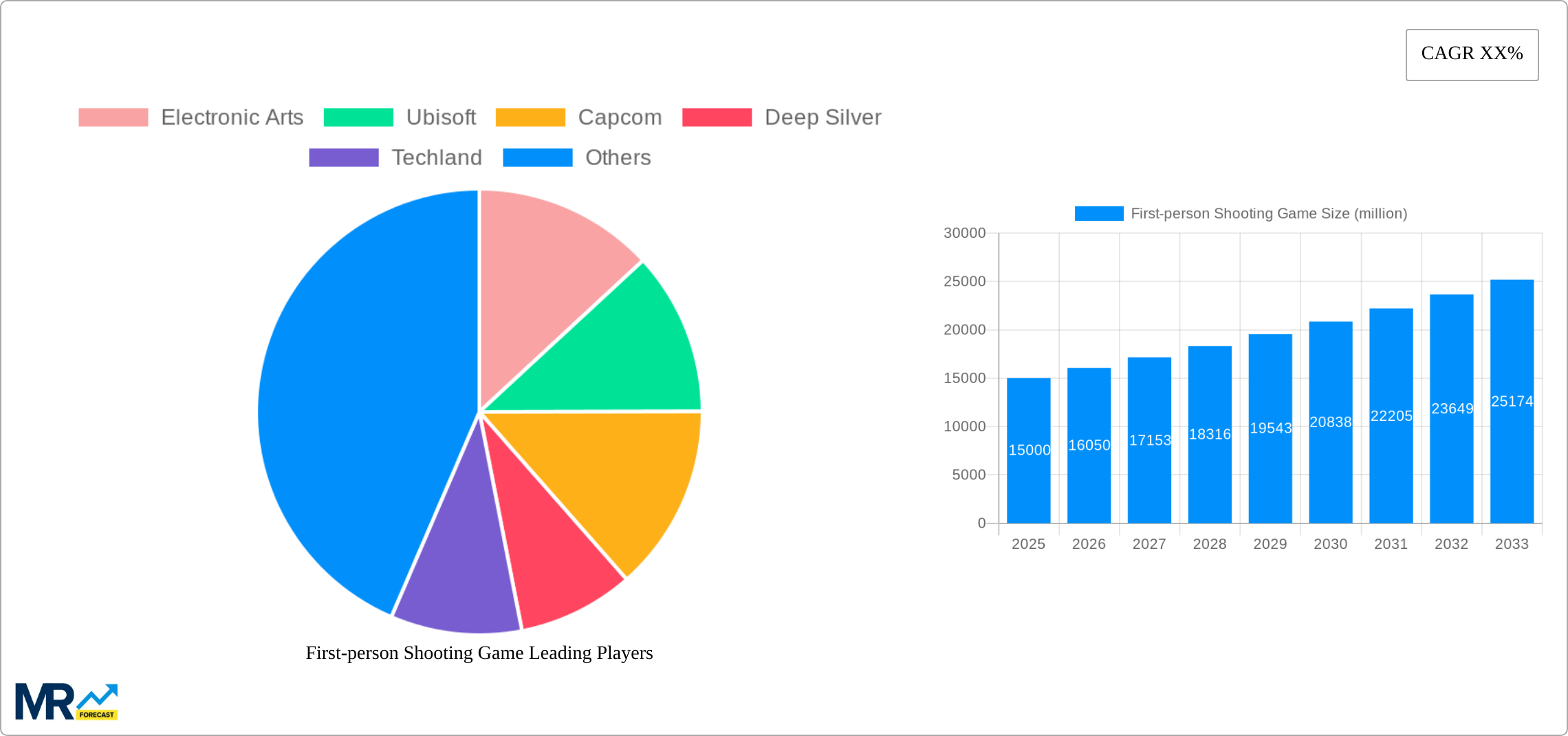

The first-person shooter (FPS) game market is a dynamic and highly competitive sector within the broader gaming industry. While precise market size figures are not provided, considering the prominent companies involved (Electronic Arts, Activision Blizzard, Tencent, etc.) and the enduring popularity of FPS titles, a reasonable estimate for the 2025 market size could be around $15 billion USD. This is supported by the presence of major players across numerous segments – client games, mobile games, and diverse age demographics (under 18, 18-35, and above 35). The market is driven by continuous technological advancements (improved graphics, VR/AR integration), the release of highly anticipated sequels and new IPs, and the growing popularity of esports competitions surrounding FPS games. Trends include the increasing prevalence of free-to-play models with in-app purchases, cross-platform play, and the integration of battle royale elements into established franchises. However, challenges exist, including potential market saturation, the rising cost of game development, and the need to adapt to evolving player preferences and technological changes. A conservative Compound Annual Growth Rate (CAGR) of 7% is estimated for the forecast period (2025-2033), reflecting a balanced outlook considering market maturity and ongoing innovation.

The geographical distribution of the FPS market is heavily influenced by established gaming markets. North America and Europe consistently hold significant market share, due to high penetration of gaming hardware and strong established gaming cultures. Asia Pacific, particularly China, South Korea, and Japan, also represents a substantial and rapidly growing market segment. The mobile gaming segment within FPS is experiencing accelerated growth globally, fueled by smartphone penetration and easier accessibility. Further segmentation by age reveals a broad appeal, with significant player bases across all age groups, though the 18-35 demographic typically demonstrates the highest engagement and spending. This diversification across regions, platforms, and age demographics contributes to the overall resilience and growth potential of the FPS gaming market.

The first-person shooter (FPS) game market experienced explosive growth during the historical period (2019-2024), exceeding 100 million units sold annually in several key titles. This surge was fueled by technological advancements, the rise of esports, and the increasing accessibility of gaming through mobile platforms. The market shows a clear trend towards diversification, with subgenres like battle royale, hero shooters, and immersive simulations gaining significant traction. While traditional console and PC FPS games continue to hold a considerable market share, mobile FPS games are rapidly closing the gap, particularly in emerging markets with high smartphone penetration. The average revenue per user (ARPU) has also shown a steady increase, driven by in-game purchases, cosmetic items, and battle passes. The historical period saw the consolidation of major players, with several large publishers acquiring smaller studios to expand their portfolios and leverage popular game franchises. The market is highly competitive, with established giants like Activision Blizzard and Electronic Arts vying for dominance against emerging independent developers who are disrupting the industry with innovative gameplay mechanics and business models. The forecast period (2025-2033) projects continued growth, driven by the increasing adoption of virtual reality (VR) and augmented reality (AR) technologies, the expansion of esports, and the potential for metaverse integration. However, challenges remain, including the need for constant innovation to maintain player engagement and the potential for market saturation in specific subgenres. The overall trend points towards a vibrant and dynamic market with significant growth opportunities for both established players and new entrants. The estimated market size for 2025 is projected to surpass 150 million units sold, indicating the sustained popularity and profitability of the FPS genre.

Several factors contribute to the ongoing success and expansion of the first-person shooter game market. Firstly, technological advancements, such as enhanced graphics capabilities, improved physics engines, and the development of VR/AR technology, create increasingly immersive and engaging gaming experiences. Secondly, the rise of esports and competitive gaming has boosted the popularity of FPS games, creating a significant revenue stream through sponsorships, tournaments, and merchandise. The accessibility of mobile gaming platforms further expands the market's reach, bringing FPS games to a broader audience, including casual players. Social interaction, integral to many modern FPS titles, is a significant driver, facilitating community building and player engagement through online multiplayer modes. Finally, the continuous evolution of game mechanics, including the introduction of new subgenres and innovative gameplay features, keeps the genre fresh and appealing to a diverse player base, thereby ensuring sustained growth and market expansion. The increasing affordability of high-performance gaming hardware also plays a significant role in broadening the market's appeal.

Despite its remarkable growth, the first-person shooter game market faces several challenges. Intense competition among established publishers and emerging developers creates pressure to consistently innovate and deliver high-quality, engaging content to retain players. The risk of market saturation in specific subgenres, like battle royale, requires developers to continuously explore new gameplay mechanics and introduce fresh experiences to avoid player fatigue. Maintaining player engagement is crucial, particularly in the face of ever-evolving player expectations and the constant influx of new games. Concerns about violence and its potential impact on young players lead to regulatory scrutiny and the need for responsible game design. The cost of game development, including talent acquisition, marketing, and technological advancements, can be significant, impacting the profitability of smaller studios. Finally, managing the evolving landscape of platform distribution and user monetization strategies adds complexity to the business side of the FPS market.

The 18-35-year-old segment is expected to dominate the FPS market throughout the forecast period (2025-2033).

Demographics: This age group represents a significant portion of active gamers globally, with the disposable income and free time to invest in gaming. They are also the primary adopters of new technologies and gaming trends.

Market Penetration: The majority of successful FPS titles have historically targeted this demographic, establishing a robust player base and creating a feedback loop that fuels ongoing development and market expansion.

Esports Influence: Esports is heavily concentrated within the 18-35 age range. The competitive aspect of FPS gaming, particularly in popular titles, further strengthens this demographic's engagement and overall market dominance.

Mobile Gaming Growth: The rise of mobile gaming significantly impacts the 18-35-year-old segment. The accessibility and convenience of mobile FPS games contribute to increased market penetration and player engagement. The prevalence of mobile devices among this age group contributes to greater market reach and revenue generation.

Spending Habits: The 18-35 demographic exhibits a higher propensity to spend money on in-game purchases, cosmetic items, and battle passes, contributing significantly to the market's overall revenue.

Technological Adoption: This demographic readily embraces new technologies, including VR and AR, leading to higher adoption rates for these immersive gaming experiences and boosting the market for related FPS titles.

In geographical terms, North America and Asia are projected to remain dominant markets. However, the growth potential in emerging markets in Latin America, Africa, and Southeast Asia is significant, particularly driven by the expansion of mobile gaming and increasing internet penetration.

The FPS market's growth is fueled by several key catalysts: the continuous innovation in game mechanics and storytelling; the growing popularity of esports; and the expanding reach of mobile gaming platforms. Furthermore, technological advancements like VR/AR and cloud gaming are enhancing player immersion and accessibility, further driving market expansion.

This report offers a comprehensive overview of the first-person shooter game market, analyzing key trends, growth drivers, challenges, and leading players. It provides detailed insights into market segmentation, regional performance, and future growth projections, offering valuable information for stakeholders in the gaming industry. The report leverages historical data, current market trends, and future projections to provide a holistic understanding of the FPS market landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Electronic Arts, Ubisoft, Capcom, Deep Silver, Techland, Riot Games, Valve Corporation, PUBG Corporation, Activision Blizzard, New Blood Interactive, Epic Games, Bungie, Xbox Game Studios, Crowbar Collective, Superhot Team, Coffee Stain Publishing, 2K Games, Tencent, Nintendo, Take-Two Interactive, Tiancity, BANDAI, .

The market segments include Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "First-person Shooting Game," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the First-person Shooting Game, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.