1. What is the projected Compound Annual Growth Rate (CAGR) of the Fingerprint Biometrics in the VAR?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fingerprint Biometrics in the VAR

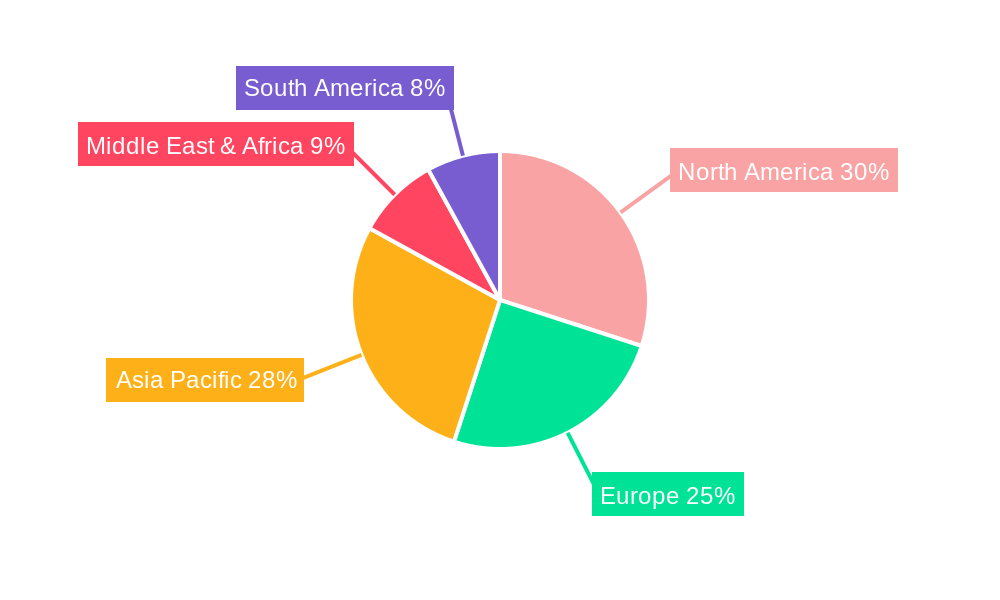

Fingerprint Biometrics in the VARFingerprint Biometrics in the VAR by Type (Non-AFIS Biometrics in VAR, AFIS Biometrics in VAR), by Application (Commercial, Household, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

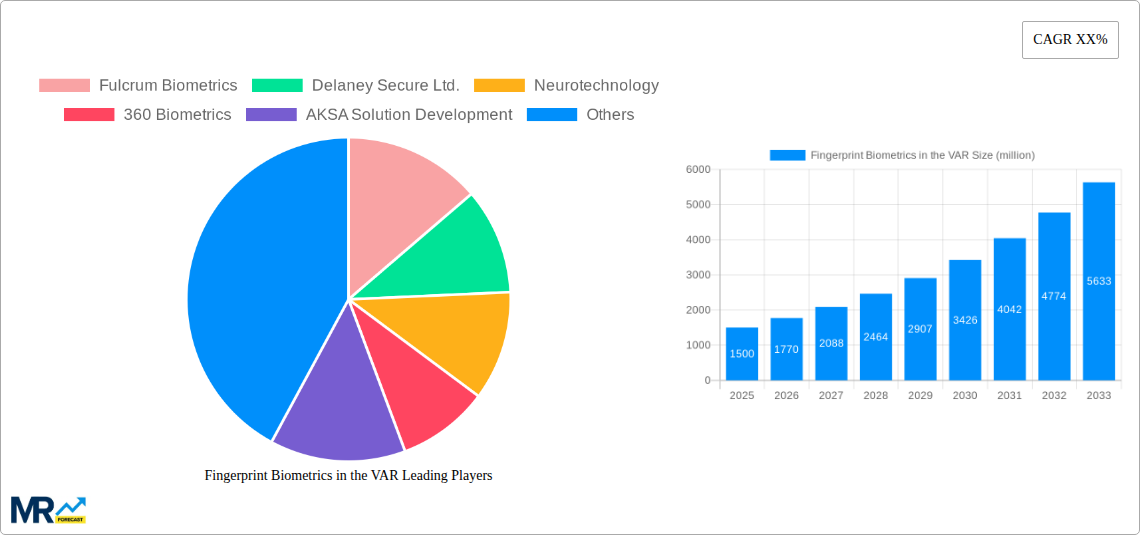

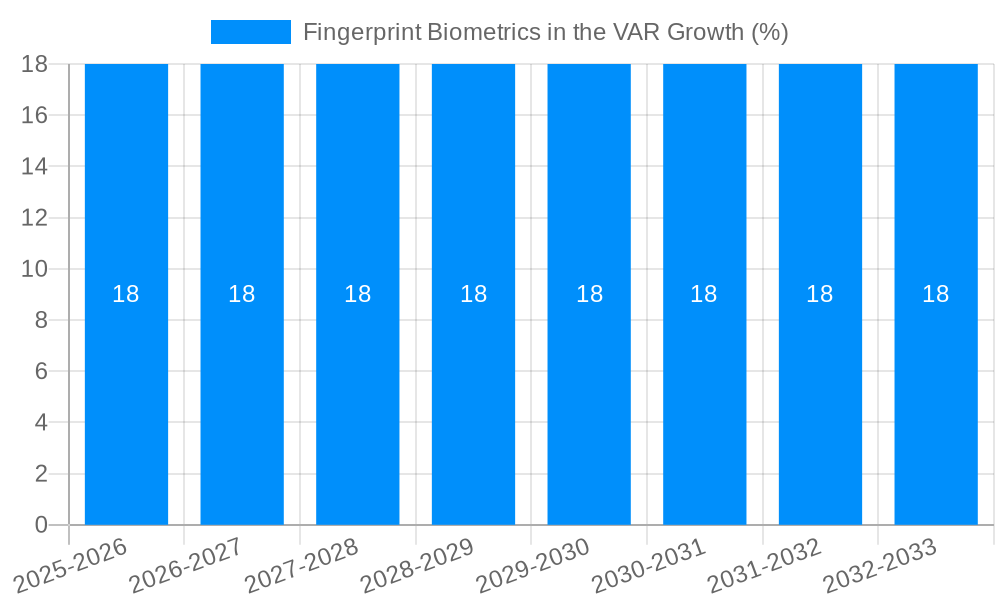

The Fingerprint Biometrics in the VAR (Value Added Reseller) market is experiencing robust growth, projected to reach an estimated market size of $1,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of 18% anticipated from 2025 to 2033. This significant expansion is fueled by the increasing demand for enhanced security solutions across both commercial and household applications. The proliferation of smart devices, the rise of remote workforces, and the growing need for secure access control in various industries are primary drivers propelling the adoption of fingerprint biometric technologies. VARs play a crucial role in this ecosystem by integrating and customizing these solutions to meet specific end-user requirements, thereby widening their reach and impact. The market's trajectory indicates a substantial and sustained upward trend, reflecting the growing reliance on biometric authentication for its accuracy, convenience, and inherent security features over traditional methods.

Key segments within the Fingerprint Biometrics in the VAR market include Non-AFIS (Automated Fingerprint Identification System) biometrics and AFIS biometrics, catering to diverse application needs. Commercial applications, encompassing enterprise security, banking, and retail, represent a significant portion of the market share due to higher security demands and larger deployment scales. Household applications, including smart home security and personal device authentication, are also witnessing considerable growth as consumer awareness and product availability increase. While the market is largely driven by enhanced security needs and technological advancements, potential restraints such as the high initial cost of implementation for some advanced systems and data privacy concerns could pose challenges. However, the ongoing innovation in fingerprint sensing technology, coupled with the expanding network of value-added resellers and system integrators, is expected to overcome these hurdles, ensuring continued market expansion.

This comprehensive report delves into the intricate landscape of the Fingerprint Biometrics in the Value-Added Reseller (VAR) market, providing an in-depth analysis of its historical trajectory, present standing, and projected future. Spanning a study period from 2019 to 2033, with a specific focus on the base year 2025 and a forecast period from 2025 to 2033, this report offers critical insights for stakeholders navigating this rapidly evolving sector. We examine the market's performance through its historical period (2019-2024), analyze the current market dynamics in the estimated year 2025, and provide robust forecasts for the coming years. Leveraging a granular approach, the report dissects the market by type (Non-AFIS Biometrics in VAR, AFIS Biometrics in VAR) and application (Commercial, Household, Others), offering a nuanced understanding of segment-specific growth and adoption trends. Furthermore, the report highlights key industry developments and profiles leading players, providing a holistic view of the Fingerprint Biometrics in the VAR ecosystem.

XXX The Fingerprint Biometrics in the VAR market is exhibiting a dynamic growth trajectory, driven by an escalating demand for enhanced security and seamless authentication solutions across diverse end-user industries. In the historical period (2019-2024), the market witnessed a steady expansion, fueled by initial adoption in commercial settings, particularly in access control and endpoint security. The base year of 2025 marks a pivotal point, with the market poised for accelerated growth, estimated to reach a valuation of approximately $1.5 billion. This expansion is underpinned by a confluence of factors, including the increasing prevalence of mobile devices with integrated fingerprint sensors, a growing awareness of data breaches and the need for robust identity verification, and government initiatives promoting digital identity solutions. The forecast period (2025-2033) anticipates a compound annual growth rate (CAGR) of approximately 12.5%, projecting the market to surge towards an impressive valuation exceeding $3.8 billion by 2033.

Key market insights include the significant shift towards Non-AFIS (Automated Fingerprint Identification System) biometrics in the VAR segment, driven by its cost-effectiveness and suitability for a wide range of commercial and household applications. While AFIS biometrics, historically dominant in law enforcement and large-scale identity management, continues to hold a substantial market share, Non-AFIS solutions are rapidly gaining traction due to their ease of integration and lower barrier to entry for smaller VARs and end-users. The Commercial application segment is expected to continue its dominance throughout the forecast period, driven by the widespread adoption of fingerprint authentication for employee access, secure data management, and point-of-sale systems. However, the Household segment is projected to experience the highest CAGR, fueled by the increasing integration of fingerprint sensors in smart home devices, personal security systems, and consumer electronics. The "Others" segment, encompassing niche applications like portable identity verification devices and specialized industrial uses, is also expected to contribute to the overall market growth, albeit at a more moderate pace. Value-added resellers are increasingly playing a crucial role in bundling fingerprint biometric solutions with other security software and hardware, offering tailored packages that meet the specific needs of their clientele. This collaborative approach is instrumental in driving market penetration and fostering innovation. The competitive landscape is characterized by the presence of both established players and emerging innovators, each vying for market share through product differentiation, strategic partnerships, and aggressive market penetration strategies.

The surge in demand for fingerprint biometrics within the Value-Added Reseller (VAR) ecosystem is propelled by a powerful combination of technological advancements, evolving security threats, and changing consumer and enterprise expectations. The proliferation of smartphones and tablets equipped with highly accurate and affordable fingerprint sensors has normalized biometric authentication for everyday users, creating a fertile ground for broader adoption. This familiarity translates directly into a willingness to embrace similar solutions in professional and domestic environments. Concurrently, the ever-increasing sophistication and frequency of cyberattacks and data breaches are compelling organizations to seek more robust and tamper-proof security measures than traditional password-based systems. Fingerprint biometrics offer a convenient yet highly secure alternative, significantly reducing the risk of unauthorized access. Furthermore, regulatory compliance mandates across various sectors, such as financial services and healthcare, are increasingly requiring the implementation of advanced authentication methods, with fingerprint biometrics often being a preferred choice due to its inherent security and user-friendliness. The growing focus on digital transformation initiatives across industries also necessitates secure and seamless identity management, making fingerprint biometrics an integral component of modern digital infrastructures.

Despite the robust growth, the Fingerprint Biometrics in the VAR market is not without its challenges and restraints. One significant hurdle is the perception of cost, particularly for smaller businesses and individual consumers, where the initial investment in hardware and software integration can be a deterrent. While prices have decreased, the upfront expenditure can still be a barrier compared to more traditional, albeit less secure, authentication methods. Another critical concern revolves around privacy and data security. The collection and storage of sensitive biometric data necessitate stringent security protocols and transparent data handling policies to build and maintain user trust. Any perceived mishandling or breach of this data can have severe repercussions, leading to customer apprehension and reluctance to adopt the technology. Furthermore, the accuracy and reliability of fingerprint sensors can be affected by external factors such as dirt, moisture, or wear on the finger, leading to occasional false rejections or acceptances. While advancements in sensor technology are mitigating these issues, they remain a point of consideration for certain applications. The integration complexity can also pose a challenge for some VARs and their clients, requiring specialized expertise for seamless deployment and ongoing support. Finally, the presence of alternative biometric modalities like facial recognition and iris scanning, which are also rapidly advancing, presents a competitive challenge, offering users and VARs a wider array of choices and potentially diverting market share from fingerprint-only solutions.

The Fingerprint Biometrics in the VAR market is projected to witness significant dominance from North America, particularly the United States, in terms of both revenue and adoption. This dominance is attributed to a multifaceted combination of factors, including a highly developed technological infrastructure, a strong emphasis on cybersecurity across both commercial and governmental sectors, and a substantial presence of leading technology companies and VARs. The Commercial segment, encompassing a wide array of applications from enterprise access control and secure data management to point-of-sale systems and financial transactions, is expected to be the primary revenue driver within the VAR ecosystem.

In North America, the United States leads due to its robust economy, high disposable income, and proactive adoption of new technologies. Government initiatives aimed at enhancing national security and promoting digital identity solutions further bolster the market. The strong presence of venture capital and R&D investment fuels innovation, leading to the development of advanced fingerprint biometric solutions that are then integrated and distributed by a vast network of VARs. The U.S. market's maturity in adopting enterprise-grade security solutions means businesses are more inclined to invest in comprehensive biometric systems.

Within the broader market, the Commercial application segment is poised for sustained leadership throughout the forecast period. This is driven by an unyielding need for enhanced security in a globalized and increasingly digitalized world.

The Non-AFIS Biometrics in VAR segment is also projected for substantial growth and is expected to contribute significantly to the overall market dominance, particularly within the Commercial and Household applications. This is because Non-AFIS solutions are typically more scalable, cost-effective, and easier to integrate for VARs serving a broader range of clients, including small and medium-sized enterprises (SMEs) and individual consumers.

While the Household segment is expected to grow at a faster CAGR, its current market size is smaller than the Commercial segment. However, as smart home adoption accelerates and security concerns within residences increase, this segment will become increasingly significant, with VARs playing a key role in educating consumers and offering integrated solutions. The "Others" segment, while niche, will also see steady growth, driven by specialized applications that VARs can cater to with tailored solutions.

The growth of the Fingerprint Biometrics in the VAR industry is significantly catalyzed by increasing consumer familiarity and acceptance due to the widespread integration of fingerprint sensors in smartphones. This has lowered the psychological barrier to adoption for more advanced biometric solutions. Furthermore, escalating cybersecurity threats and the constant need for more robust and user-friendly authentication methods are compelling businesses of all sizes to invest in these technologies. The development of more accurate, faster, and cost-effective fingerprint sensors and algorithms by companies like Neurotechnology and Bromba Biometrics makes them more accessible and attractive for VARs to integrate into their offerings. Finally, government mandates and industry-specific regulations requiring enhanced identity verification are creating a consistent demand for fingerprint biometric solutions.

This report provides an exhaustive examination of the Fingerprint Biometrics in the VAR market, offering a deep dive into its market size, growth projections, and competitive dynamics. It meticulously analyzes key trends, including the rising adoption of Non-AFIS biometrics in commercial applications and the increasing penetration in household devices. The report details the primary growth drivers, such as technological advancements and the escalating need for enhanced security, alongside crucial challenges like cost perceptions and privacy concerns. Furthermore, it identifies dominant regions and segments, offering strategic insights into market leadership, and profiles leading companies and their contributions. The report concludes with an outlook on future developments, equipping stakeholders with the knowledge necessary to make informed decisions and capitalize on emerging opportunities in this dynamic market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Fulcrum Biometrics, Delaney Secure Ltd., Neurotechnology, 360 Biometrics, AKSA Solution Development, AutoStar Technologies, Bayometric, Bromba Biometrics, California Peripherals and Components, Digital Data Systems, DYDEX-HS, Eyenetwatch, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Fingerprint Biometrics in the VAR," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fingerprint Biometrics in the VAR, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.