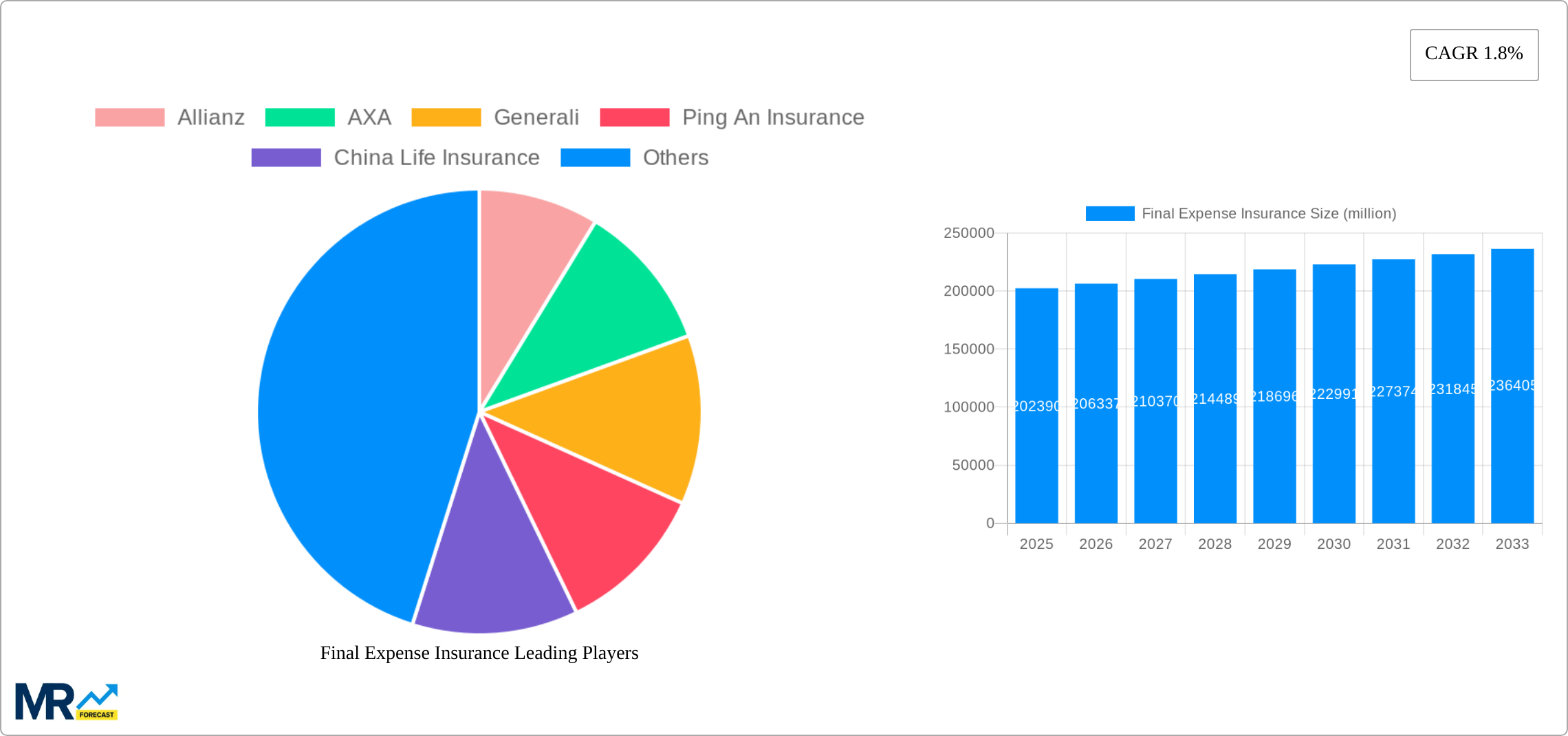

1. What is the projected Compound Annual Growth Rate (CAGR) of the Final Expense Insurance?

The projected CAGR is approximately 1.8%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Final Expense Insurance

Final Expense InsuranceFinal Expense Insurance by Type (Permanent, Non-Permanent, From 50 to 65 Years Old, From 65 to 75 Years Old, Above and Equal to 75 Years Old), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

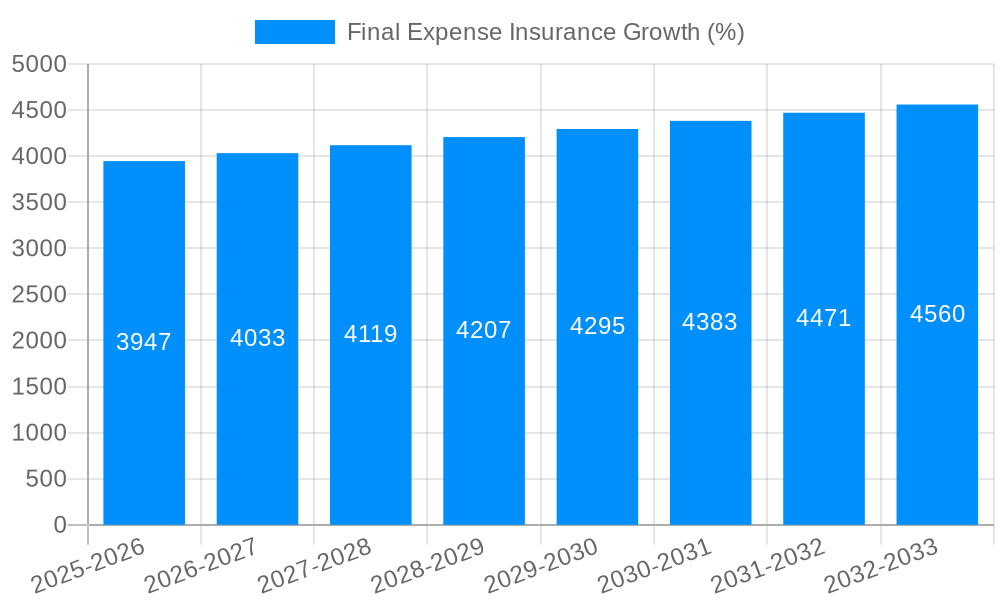

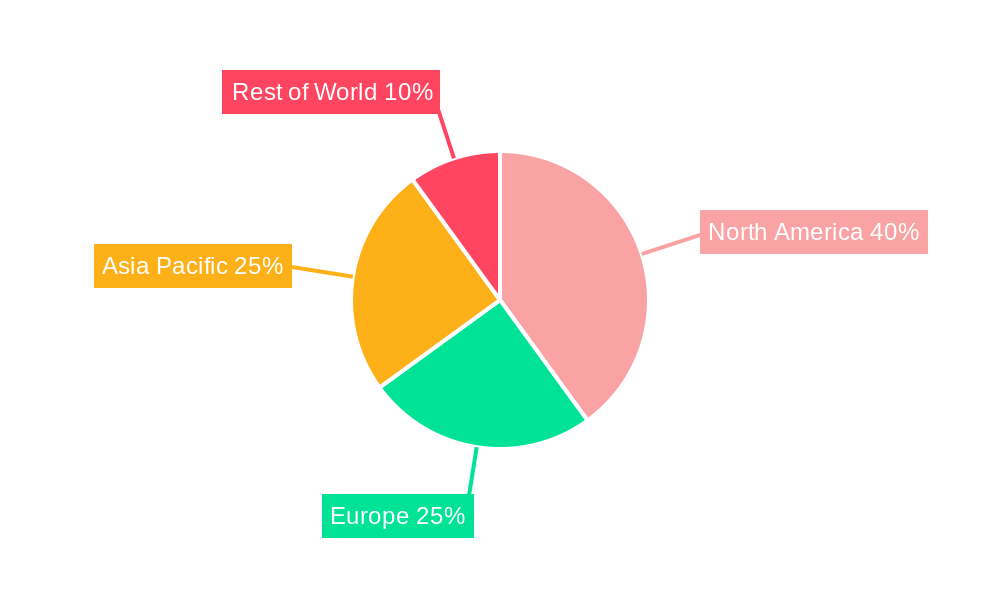

The global final expense insurance market, valued at approximately $202.39 billion in 2023, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 1.8% from 2025 to 2033. This growth is driven by several factors. The aging global population, particularly in developed nations like North America and Europe, is a significant driver, as older individuals increasingly seek financial protection for their end-of-life expenses. Furthermore, rising healthcare costs and funeral expenses are incentivizing individuals to secure final expense insurance to alleviate the financial burden on their families. Increased awareness of the product's benefits through targeted marketing and financial literacy initiatives also contributes to market expansion. However, the market faces challenges. Competition among established players like Allianz, AXA, and Generali, alongside newer entrants, is intensifying, leading to price pressures. Furthermore, misconceptions about final expense insurance and its affordability can hinder market penetration, particularly among younger demographics. Segmentation by age (50-65, 65-75, 75+) highlights the strong correlation between age and demand, with the older age groups representing the largest market segments. The geographical distribution shows significant market shares held by North America and Asia-Pacific regions, reflecting these regions' large populations and evolving insurance landscapes.

The market's segmentation by policy type (permanent and non-permanent) offers opportunities for insurers to tailor their product offerings. Permanent policies, offering lifelong coverage, appeal to individuals seeking long-term security, while non-permanent options provide flexibility and affordability for those with shorter-term needs. Strategic partnerships with healthcare providers and funeral homes could improve market penetration and convenience for consumers. Insurers must invest in technological advancements, like online applications and digital platforms, to enhance customer experience and streamline the purchasing process. Finally, effective communication strategies are crucial to addressing misconceptions and building consumer confidence in the value proposition of final expense insurance.

The global final expense insurance market is experiencing robust growth, projected to reach multi-million dollar valuations by 2033. The study period from 2019 to 2033 reveals a consistent upward trajectory, with the base year 2025 serving as a pivotal point for market analysis. The estimated market value for 2025 signifies a significant milestone in this expansion. The forecast period, spanning 2025 to 2033, promises further growth fueled by several key factors discussed below. Analysis of the historical period (2019-2024) indicates a steady increase in demand, particularly driven by an aging global population and a growing awareness of the need for affordable end-of-life financial planning. This trend is reflected across various segments, with variations in growth rates depending on factors such as age group and policy type. The increasing accessibility of online insurance platforms and innovative product offerings are also contributing to this surge. Furthermore, a shift in consumer preferences towards simpler, more transparent insurance products is driving demand for final expense insurance, specifically simpler policies that cater to the specific needs of individuals in their later years. The rising costs of funeral services and associated expenses are further incentivizing individuals to proactively secure financial protection. The market’s overall growth, however, is likely to be nuanced by economic fluctuations and regulatory changes across different regions.

Several factors are significantly contributing to the expansion of the final expense insurance market. The most prominent is the global aging population, with a substantial increase in the number of individuals reaching and exceeding retirement age. This demographic shift creates a larger pool of potential customers concerned about covering end-of-life expenses. Simultaneously, rising healthcare costs and funeral expenses are making final expense insurance an increasingly attractive option for mitigating financial burdens on surviving family members. The growing awareness of the importance of financial planning for end-of-life events is also playing a significant role. Increased marketing and educational campaigns promoting the benefits of final expense insurance are contributing to improved consumer understanding and adoption. The accessibility of online insurance platforms and the availability of simpler, more understandable policies further facilitate market penetration. Finally, the development of innovative insurance products tailored to specific needs and financial situations, alongside competitive pricing strategies, attract a wider range of consumers. These combined factors create a powerful synergy driving robust growth in this market segment.

Despite the positive growth outlook, the final expense insurance market faces certain challenges. One significant hurdle is the persistent misconception surrounding insurance policies. Some potential customers may lack a clear understanding of the benefits or underestimate the importance of securing their financial future during their later years. Furthermore, regulatory complexities and varying insurance regulations across different regions create obstacles for both insurers and consumers. These complexities can impact the ease of policy acquisition and market penetration. Economic downturns also significantly impact consumer spending, which may lead to a reduced demand for non-essential insurance products. The prevalence of alternative financial planning solutions can also pose competition, influencing consumer choice. Finally, increasing healthcare costs and inflation directly influence the cost of insurance premiums, potentially hindering affordability for some segments of the population. Addressing these challenges requires collaborative efforts from insurers, regulatory bodies, and educational initiatives to promote awareness and streamline processes.

The segment showing the most significant growth potential is the "Above and Equal to 75 Years Old" demographic. This is primarily due to the rapidly expanding elderly population globally.

This segment's dominance isn't solely reliant on demographic shifts; it’s also influenced by the increasing affordability of plans, simplified application processes, and targeted marketing campaigns focused on this population's needs and concerns. The focus of insurance companies on offering suitable plans and services for this population is a key factor driving this market segment.

The final expense insurance market's growth is further propelled by the increasing availability of online insurance platforms. These platforms offer convenience, accessibility, and competitive pricing, expanding market reach and attracting a wider customer base. Innovative product development, offering plans tailored to specific needs and financial situations, also drives growth. Moreover, strong partnerships between insurance companies and funeral homes create streamlined processes and increased convenience for customers, accelerating market expansion.

This report provides a detailed analysis of the final expense insurance market, including comprehensive market sizing, segmentation analysis, and future growth projections. It further examines key industry trends, driving factors, challenges, and opportunities, offering valuable insights into the competitive landscape and potential investment strategies. The report also features a detailed analysis of the leading players in the market, highlighting their market share, competitive strategies, and future prospects. The insights gathered provide a comprehensive understanding of the final expense insurance market, enabling businesses to strategize for sustained growth and market leadership.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.8% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 1.8%.

Key companies in the market include Allianz, AXA, Generali, Ping An Insurance, China Life Insurance, Prudential PLC, Lincoln National Corporation, Zurich Insurance, Nippon Life Insurance, Japan Post Holdings, AEGON, Metlife, Manulife Financial, CPIC, Chubb, AIG, Aviva, Allstate, LIC, Prudential Financial, UnitedHealthcare, AIA, Aflac, Legal & General.

The market segments include Type.

The market size is estimated to be USD 202390 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Final Expense Insurance," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Final Expense Insurance, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.