1. What is the projected Compound Annual Growth Rate (CAGR) of the File Uploader?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

File Uploader

File UploaderFile Uploader by Application (Business, Personal), by Type (Remote Upload, Client-to-server Upload, Peer-to-peer (P2P)), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

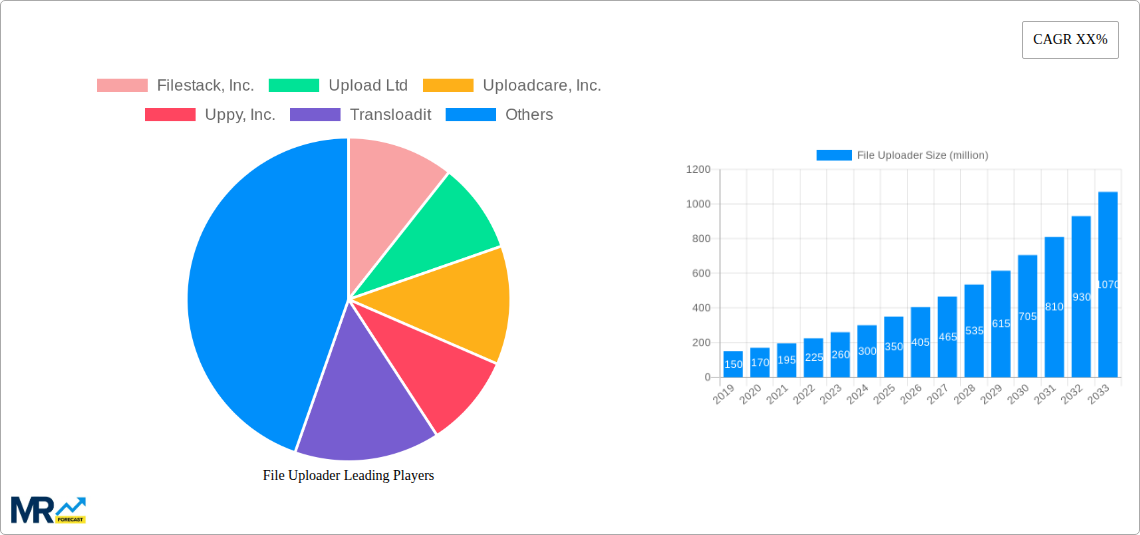

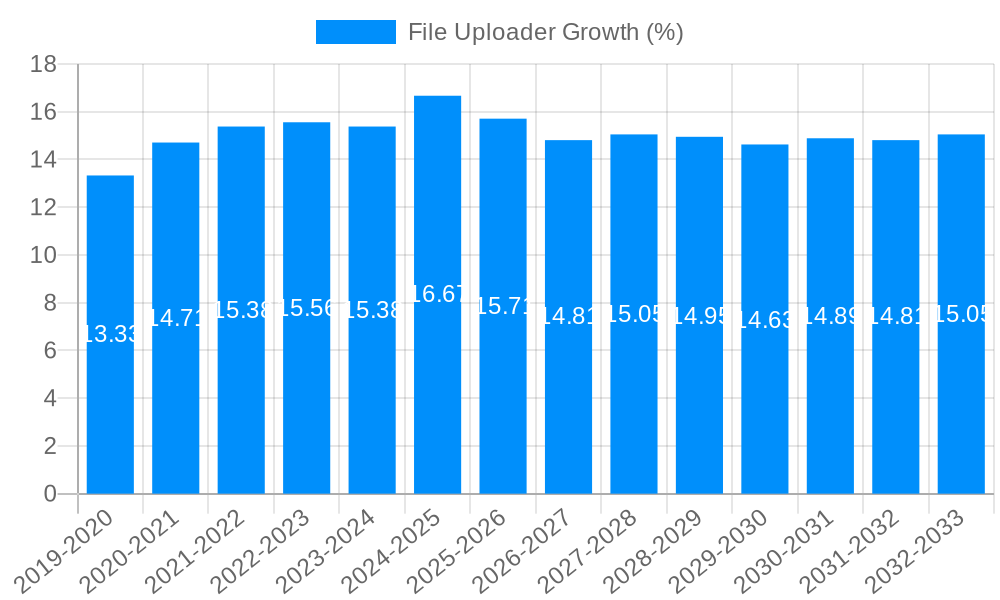

The global File Uploader market is poised for substantial expansion, projected to reach an estimated market size of $350 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15% anticipated over the forecast period of 2025-2033. This growth trajectory is primarily propelled by the escalating demand for efficient and secure file transfer solutions across various industries. Businesses are increasingly reliant on cloud-based platforms and sophisticated data management tools, driving the adoption of advanced file uploader solutions that offer seamless integration, enhanced user experience, and robust security features. The surge in remote work and the proliferation of digital content creation further amplify the need for reliable and scalable file uploading capabilities.

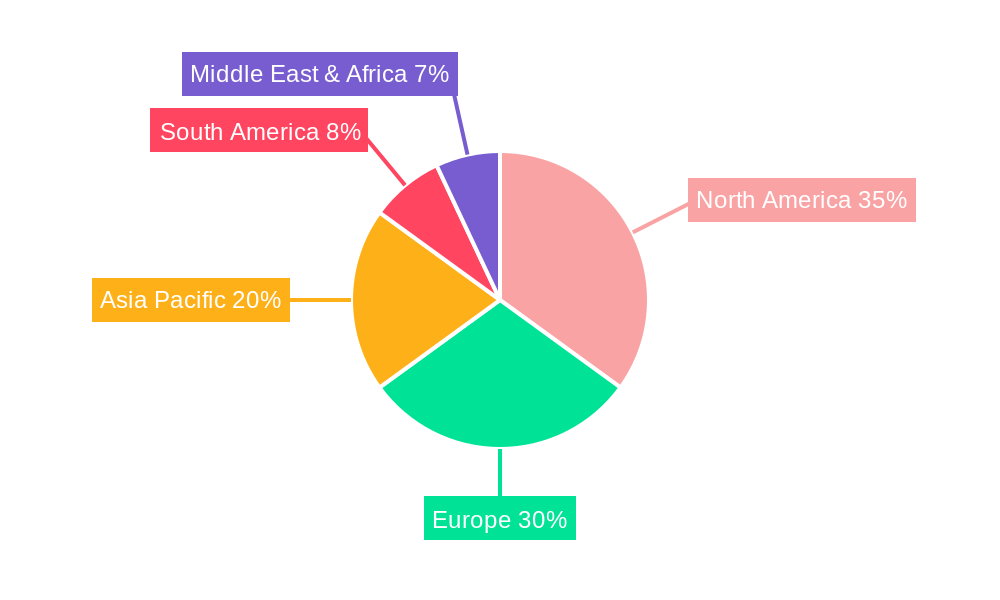

The market segmentation reveals key areas of opportunity, with "Business" applications dominating the landscape due to their critical role in enterprise workflows, data sharing, and collaborative projects. The "Remote Upload" segment is expected to witness the most significant growth, reflecting the ongoing shift towards decentralized workforces and the need for asynchronous data transfer. Leading players such as Filestack, Inc., Uploadcare, Inc., and Transloadit are at the forefront of innovation, offering feature-rich platforms that cater to the evolving needs of developers and businesses. Geographically, North America and Europe are expected to remain dominant markets, driven by advanced technological infrastructure and high digital adoption rates. However, the Asia Pacific region, particularly China and India, presents a significant growth frontier due to its burgeoning digital economy and increasing enterprise digitization initiatives. Challenges such as data privacy concerns and the need for specialized integration for complex legacy systems are being addressed through continuous product development and strategic partnerships, ensuring sustained market momentum.

This comprehensive report delves into the burgeoning global File Uploader market, a sector projected to witness substantial growth and innovation over the study period of 2019-2033. With a base year of 2025 and a forecast period extending to 2033, the market is anticipated to evolve from an estimated value in the millions in 2025 to significantly higher figures by the end of the forecast horizon. This analysis meticulously examines the historical trajectory from 2019-2024, shedding light on past trends and laying the groundwork for understanding future market dynamics. The report investigates key players, emerging technologies, and the diverse applications driving this vital segment of the digital infrastructure. Understanding the intricate interplay of these elements is crucial for stakeholders seeking to navigate and capitalize on this dynamic market.

The File Uploader market is experiencing a seismic shift, driven by an insatiable demand for seamless and efficient digital data transfer. In the historical period of 2019-2024, the market has already demonstrated robust growth, with transactions in the tens of millions of dollars annually. This expansion has been fueled by the increasing digitization of business operations and the pervasive use of cloud-based services. Businesses across all sectors are increasingly reliant on robust file uploading solutions to manage documents, share large media files, and integrate with other cloud applications. This trend is expected to accelerate significantly, with projections indicating a market value well into the hundreds of millions by the end of the forecast period in 2033. The rise of remote work has also been a paramount catalyst, democratizing access and necessitating reliable tools for sharing information irrespective of geographical location. Furthermore, the growing prevalence of rich media content, such as high-definition videos and extensive design assets, further amplifies the need for high-capacity and high-speed uploading capabilities. The market is also witnessing a greater emphasis on security and compliance, with organizations demanding solutions that offer end-to-end encryption, robust access controls, and adherence to data privacy regulations. This has led to the development of more sophisticated features, including granular permission settings, audit trails, and compliance certifications, further enhancing the value proposition of advanced file uploader solutions. The increasing integration of AI and machine learning into file uploader platforms is another significant trend. These technologies are being leveraged for tasks such as intelligent file categorization, automated metadata generation, and proactive security threat detection. This evolution is transforming file uploaders from simple transfer tools into intelligent data management hubs. As the digital landscape continues to expand, the demand for specialized and scalable file uploading solutions will only intensify, promising continued innovation and market expansion. The current estimation for 2025 places the market value in the tens of millions, a figure that is set to multiply exponentially over the next decade.

The File Uploader market's impressive growth trajectory is primarily propelled by a confluence of technological advancements and evolving user demands. The widespread adoption of cloud computing services has created an unprecedented need for efficient and secure methods of transferring data to and from cloud storage. This includes everything from vast enterprise datasets to personal photo libraries. The explosive growth of digital content, particularly high-definition video, large design files, and complex datasets for scientific research, necessitates robust and scalable solutions capable of handling substantial file sizes with speed and reliability. Furthermore, the global shift towards remote and hybrid work models has made seamless file sharing a non-negotiable requirement for business continuity and collaboration. Employees need to access and share critical documents and projects from anywhere, at any time. The increasing emphasis on data security and regulatory compliance across various industries, such as healthcare and finance, is also a significant driver. Organizations are actively seeking file uploader solutions that offer advanced encryption, access controls, and audit trails to protect sensitive information and meet stringent legal requirements. This has spurred innovation in security features, making secure uploading a primary consideration for businesses. The burgeoning e-commerce sector also contributes significantly, as businesses require efficient ways to upload product images, customer data, and order information, further driving the demand for reliable and scalable file transfer mechanisms.

Despite the promising growth, the File Uploader market is not without its hurdles. One of the primary challenges is ensuring robust security and data privacy in an increasingly complex threat landscape. Malicious actors are constantly developing new methods to intercept or compromise data during transit, necessitating continuous investment in advanced security protocols and encryption technologies. For organizations, the financial burden of implementing and maintaining these sophisticated security measures can be substantial. Another significant restraint is the ongoing need to manage and optimize bandwidth, especially for users with limited or inconsistent internet access. Large file uploads can consume significant bandwidth, leading to slow transfer speeds and potential disruptions, particularly in emerging markets or remote areas. The complexity of integrating file uploaders with existing legacy systems within businesses can also present a considerable challenge. Many organizations operate with older IT infrastructures, and ensuring seamless interoperability with modern cloud-based uploading solutions requires significant development effort and investment. Furthermore, the proliferation of free or low-cost uploading services, while beneficial for individuals, can sometimes devalue premium solutions and create pricing pressures for businesses seeking more comprehensive features and support. The ever-evolving regulatory landscape around data protection and cross-border data transfer also poses a challenge, requiring solutions to adapt and comply with diverse international standards. Finally, ensuring a consistent and reliable user experience across a wide array of devices and network conditions remains an ongoing development challenge.

The File Uploader market is poised for significant dominance by North America, particularly the United States, driven by its advanced technological infrastructure, early adoption of cloud computing, and a substantial concentration of businesses across various sectors that heavily rely on digital data transfer. The region’s strong economy and significant investment in research and development foster an environment conducive to the innovation and deployment of cutting-edge file uploading solutions.

The segment anticipated to dominate the market is Application: Business.

The Type: Client-to-server Upload is also a significant contributor, forming the backbone of most business-to-cloud and application-to-cloud data transfers. While other types like Remote Upload and Peer-to-peer (P2P) have their niches, the core business functions heavily rely on the direct transfer of files from end-user devices or client applications to a server or cloud storage. The market for business applications, driven by these needs, is projected to account for the lion's share of the multi-million dollar revenue expected in the coming years.

Several key catalysts are driving exceptional growth within the File Uploader industry. The relentless surge in digital content creation, particularly high-resolution media and large datasets, directly translates to an amplified demand for robust uploading solutions. The ongoing global adoption of cloud computing services across all business verticals creates a foundational need for seamless data ingress and egress capabilities. Furthermore, the persistent shift towards remote and hybrid work models necessitates reliable and accessible file-sharing tools, making efficient uploading indispensable for collaboration and productivity. The increasing focus on data security and regulatory compliance is also a significant growth driver, pushing demand for advanced encryption and access control features.

This report offers an exhaustive exploration of the File Uploader market, providing granular insights into its multi-million dollar valuation and future potential. It meticulously details market trends, driving forces such as cloud adoption and remote work, and the challenges including security concerns and bandwidth limitations. The analysis delves into key regional dominance, with a particular focus on North America, and highlights the paramount importance of the 'Business' application segment and 'Client-to-server Upload' type in driving market value. Furthermore, it identifies crucial growth catalysts and provides a comprehensive overview of the leading players and significant developments shaping the industry landscape, offering stakeholders a strategic roadmap for navigating this dynamic and evolving sector.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Filestack, Inc., Upload Ltd, Uploadcare, Inc., Uppy, Inc., Transloadit, IBM.

The market segments include Application, Type.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "File Uploader," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the File Uploader, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.