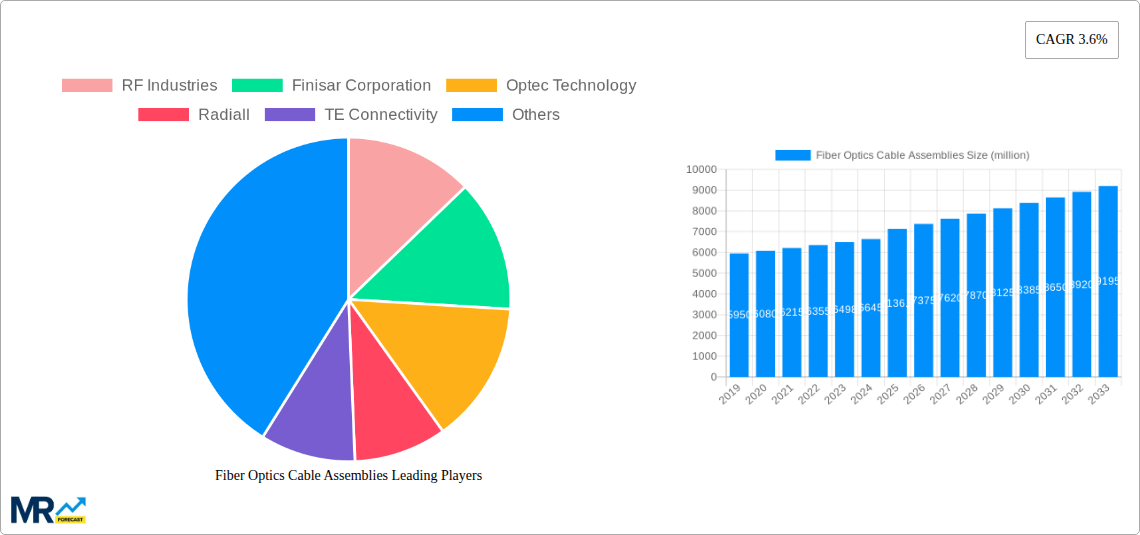

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fiber Optics Cable Assemblies?

The projected CAGR is approximately 3.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Fiber Optics Cable Assemblies

Fiber Optics Cable AssembliesFiber Optics Cable Assemblies by Type (Single Mode, Multiple Mode), by Application (Automotive, IT and Telecommunication, Defense and Government, Industries, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

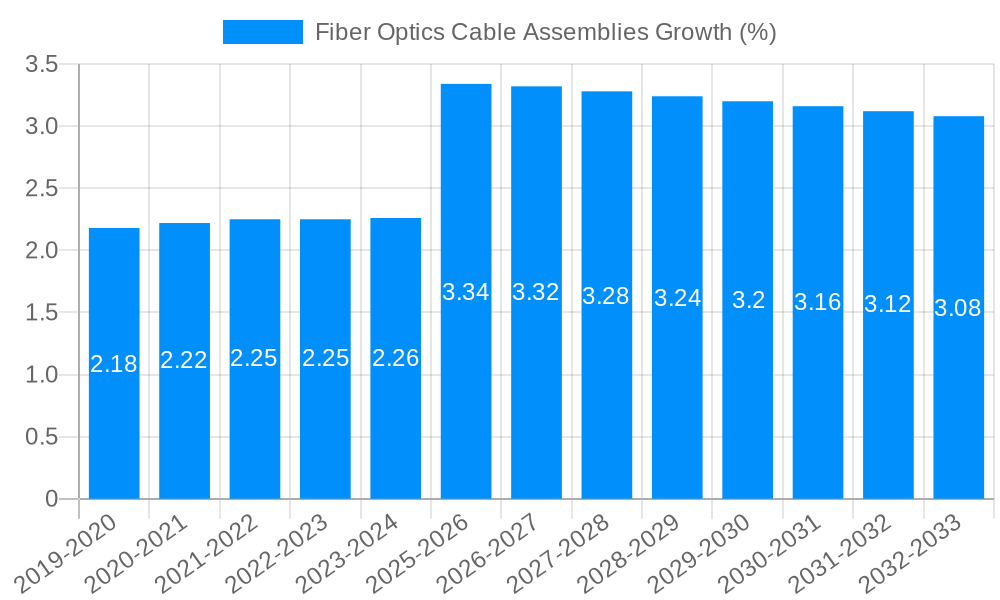

The global Fiber Optics Cable Assemblies market is poised for steady growth, projected to reach a substantial USD 7136.8 million by the estimated year 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.6% throughout the forecast period of 2025-2033. This sustained expansion is underpinned by the ever-increasing demand for high-speed data transmission across various sectors. The IT and Telecommunication industry, in particular, remains a dominant force, driven by the proliferation of 5G networks, cloud computing, and the burgeoning Internet of Things (IoT) ecosystem. Automotive applications are also witnessing a significant uptick, fueled by the integration of advanced driver-assistance systems (ADAS) and in-car connectivity solutions that rely heavily on the bandwidth and reliability of fiber optics. The Defense and Government sectors continue to be substantial contributors, leveraging fiber optics for secure and high-capacity communication infrastructure.

The market dynamics are characterized by a clear trend towards miniaturization and higher performance, pushing innovation in single-mode fiber optic assemblies, which offer superior bandwidth and longer transmission distances, making them ideal for long-haul telecommunications and backbone networks. While multiple-mode assemblies cater to shorter-distance, higher-bandwidth applications within buildings and data centers. Emerging trends include the development of more robust and environmentally resistant cable assemblies for harsh industrial environments and advancements in specialized fiber optics for niche applications like medical imaging and industrial automation. However, the market faces certain restraints, primarily related to the initial high cost of fiber optic infrastructure deployment and the need for skilled labor for installation and maintenance, which can present barriers to widespread adoption in certain developing regions.

This comprehensive report delves into the dynamic global market for Fiber Optics Cable Assemblies, providing an in-depth analysis of trends, drivers, challenges, and opportunities shaping this critical sector. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, the report offers historical context from 2019-2024 and a robust forecast for the period 2025-2033. We project the market to witness a significant expansion, with current market valuations expected to reach hundreds of millions of US dollars by the end of the forecast period.

XXX The global Fiber Optics Cable Assemblies market is experiencing an unprecedented surge, driven by the insatiable demand for higher bandwidth and faster data transmission speeds across virtually every industry. The foundational shifts in digital infrastructure, fueled by the widespread adoption of cloud computing, the proliferation of the Internet of Things (IoT), and the relentless growth of data centers, are directly translating into increased consumption of advanced fiber optic solutions. We are observing a clear trend towards higher-density connector solutions and ruggedized assemblies designed to withstand harsh environmental conditions, particularly in sectors like defense and automotive. Furthermore, the integration of fiber optics into newer applications, such as advanced manufacturing and smart city initiatives, is opening up novel avenues for market growth. The increasing emphasis on network reliability and efficiency, coupled with the ongoing expansion of 5G and future wireless technologies, necessitates robust and high-performance fiber optic connectivity, thereby solidifying its position as a cornerstone of modern communication. The market is also witnessing a gradual shift towards more customized and integrated assembly solutions, moving beyond standard offerings to cater to specific application requirements. This evolution signifies a maturity in the market, where suppliers are increasingly focused on providing value-added services and tailored product portfolios. The overall market trajectory suggests a sustained upward movement, with continuous innovation in materials, manufacturing processes, and connector technologies contributing to the market's resilience and expansion. The projected growth is underpinned by significant investments in digital transformation initiatives globally, underscoring the indispensable role of fiber optics in enabling the digital economy.

The propulsion of the Fiber Optics Cable Assemblies market is primarily orchestrated by the escalating global demand for high-speed data connectivity. The relentless expansion of data traffic, fueled by streaming services, online gaming, and the ever-increasing volume of data generated by IoT devices, necessitates the deployment of infrastructure capable of handling these immense loads. This demand is particularly pronounced in the IT and Telecommunication segment, which is constantly upgrading its networks to support 5G deployment and future wireless generations. Furthermore, the burgeoning digital transformation across industries, from manufacturing to healthcare, is accelerating the adoption of fiber optic solutions. Automated processes, real-time data analytics, and the interconnectedness of systems all rely on robust and high-bandwidth communication. The Defense and Government sector, with its critical need for secure and high-speed communication networks for command and control, surveillance, and intelligence gathering, represents another significant driving force. Additionally, advancements in fiber optic technology itself, leading to smaller, more durable, and higher-performing cable assemblies, are making them increasingly attractive for a wider range of applications, including within the automotive industry for advanced driver-assistance systems (ADAS) and in-vehicle infotainment.

Despite the robust growth trajectory, the Fiber Optics Cable Assemblies market is not without its hurdles. One significant challenge lies in the complexity and cost of installation and maintenance. While fiber optics offer superior performance, their installation often requires specialized tools, skilled labor, and meticulous handling, which can translate into higher initial investment and operational costs for end-users. This can be a deterrent in price-sensitive markets or for smaller enterprises. Another restraint stems from the rapid pace of technological evolution. While innovation is a driver, it also presents a challenge for manufacturers to continuously invest in R&D and upgrade their production capabilities to keep pace with evolving industry standards and emerging technologies. This can lead to shorter product lifecycles and increased obsolescence risks. Furthermore, the availability and pricing of raw materials, particularly the high-purity silica glass required for fiber production, can be subject to supply chain fluctuations and geopolitical influences, potentially impacting manufacturing costs and market stability. The increasing competition among a growing number of market players, both established and emerging, also exerts pressure on profit margins, necessitating a focus on operational efficiency and product differentiation. Finally, the lack of standardization in certain niche applications can create fragmentation and hinder widespread adoption.

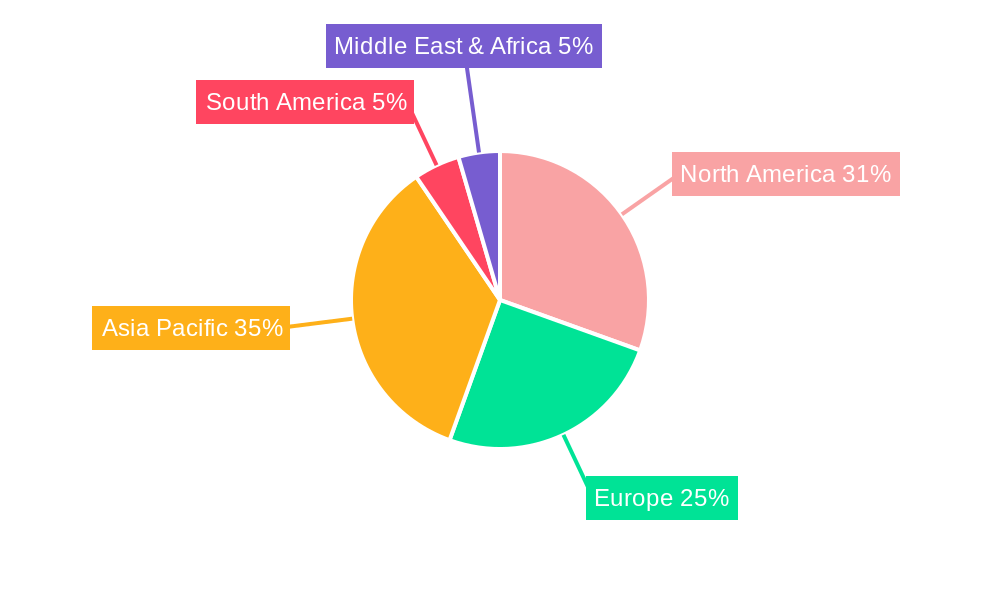

The global Fiber Optics Cable Assemblies market is characterized by distinct regional dynamics and segment dominance.

Dominating Segments:

IT and Telecommunication: This segment stands as the undisputed leader and is projected to maintain its dominance throughout the forecast period. The relentless expansion of global data traffic, driven by cloud computing, big data analytics, and the widespread adoption of 5G networks, necessitates continuous investment in high-bandwidth fiber optic infrastructure. Data centers, the backbone of cloud services, require massive deployments of fiber optic cable assemblies for their internal connectivity and interconnections. The ongoing rollout of 5G, which offers significantly higher speeds and lower latency compared to previous generations, is a primary catalyst, demanding extensive fiber optic deployments to cell towers and network infrastructure. The telecommunication industry’s need for reliable and high-capacity backbone networks to support the increasing demand for video streaming, online gaming, and other data-intensive applications further solidifies this segment's leadership. The market value within this segment alone is expected to reach hundreds of millions in revenue.

Single Mode Fiber: Within the "Type" segmentation, Single Mode fiber is expected to be the dominant category. Single mode fiber offers superior bandwidth and longer transmission distances with minimal signal loss, making it the preferred choice for long-haul telecommunications, high-speed data networks, and backbone infrastructure. Its ability to support higher data rates and its suitability for future network upgrades are key factors driving its market share. The demand for single mode fiber is intrinsically linked to the growth of the IT and Telecommunication segment.

Dominating Regions:

North America: This region, particularly the United States, is a powerhouse in the Fiber Optics Cable Assemblies market. Its highly developed IT and Telecommunication infrastructure, coupled with significant investments in 5G deployment and data center expansion, drives substantial demand. The presence of major technology companies and robust R&D initiatives further contributes to its leadership. Government initiatives aimed at expanding broadband access and digital infrastructure also play a crucial role. The market value contributed by North America is estimated to be in the hundreds of millions.

Asia Pacific: This region is poised for significant growth and is rapidly emerging as a dominant force. The massive and growing populations, coupled with increasing digitalization across developing economies, are fueling an unprecedented demand for telecommunication infrastructure. China, in particular, is a major player, with substantial government investment in 5G and fiber optic networks. The rapid industrialization and increasing adoption of IoT solutions in countries like India and Southeast Asian nations are also contributing to robust market expansion. The projected growth rate in this region is expected to outpace other regions, making it a key focus for market players.

The interplay between these dominant segments and regions creates a powerful market dynamic, with investments and technological advancements in the IT and Telecommunication sector, primarily utilizing Single Mode fiber, being heavily concentrated in North America and rapidly expanding across Asia Pacific.

The Fiber Optics Cable Assemblies industry is experiencing robust growth, catalyzed by the insatiable global demand for higher bandwidth and faster data speeds. The accelerating adoption of 5G technology worldwide, requiring extensive fiber optic backhaul and front-haul networks, is a primary growth catalyst. Furthermore, the exponential rise of cloud computing and data centers, which are heavily reliant on high-density, high-performance fiber optic interconnectivity, significantly fuels market expansion. The increasing integration of IoT devices across industries, from smart homes to industrial automation, generates vast amounts of data, necessitating robust fiber optic infrastructure for efficient transmission.

This report provides a holistic and granular view of the Fiber Optics Cable Assemblies market. It meticulously analyzes the interplay of technological advancements, evolving market demands, and economic factors that define the sector's trajectory. The study encompasses a detailed breakdown of market segmentation by type (Single Mode, Multiple Mode), application (Automotive, IT and Telecommunication, Defense and Government, Industries, Others), and offers insightful analysis of regional market dynamics. Furthermore, the report scrutinizes the impact of industry developments, identifies key growth drivers and restraints, and profiles the leading players, offering a comprehensive understanding of the competitive landscape.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.6% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.6%.

Key companies in the market include RF Industries, Finisar Corporation, Optec Technology, Radiall, TE Connectivity, Carlisle Companies Incorporated, Molex Incorporated, Amphenol Fiber Systems International, Corning, .

The market segments include Type, Application.

The market size is estimated to be USD 7136.8 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Fiber Optics Cable Assemblies," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Fiber Optics Cable Assemblies, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.