1. What is the projected Compound Annual Growth Rate (CAGR) of the Extended Warranty Service Contract?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Extended Warranty Service Contract

Extended Warranty Service ContractExtended Warranty Service Contract by Type (Standard Protection Plan, Accidental Protection Plan), by Application (Automobile, Consumer Electronics, Home Appliances, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

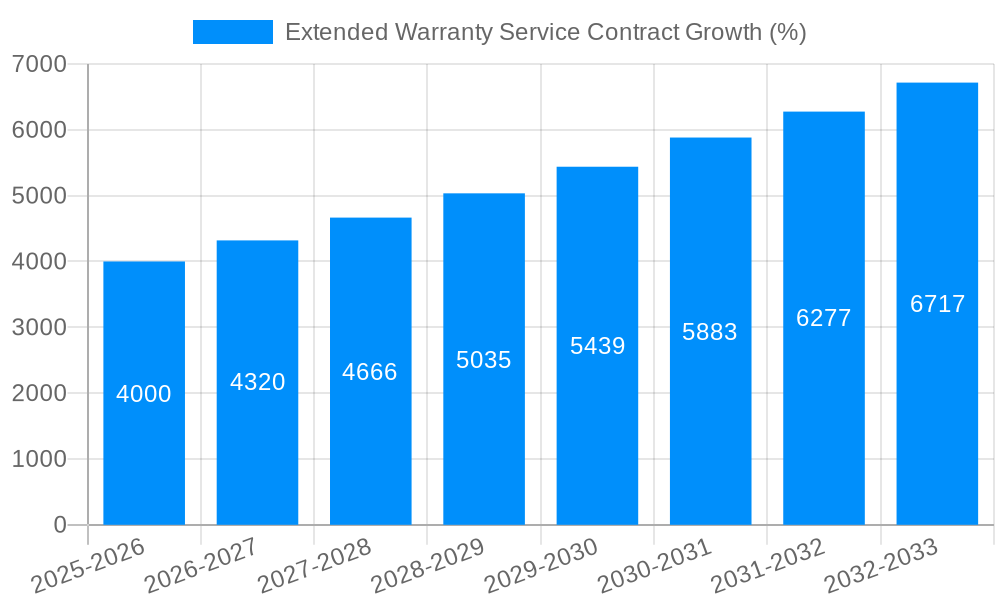

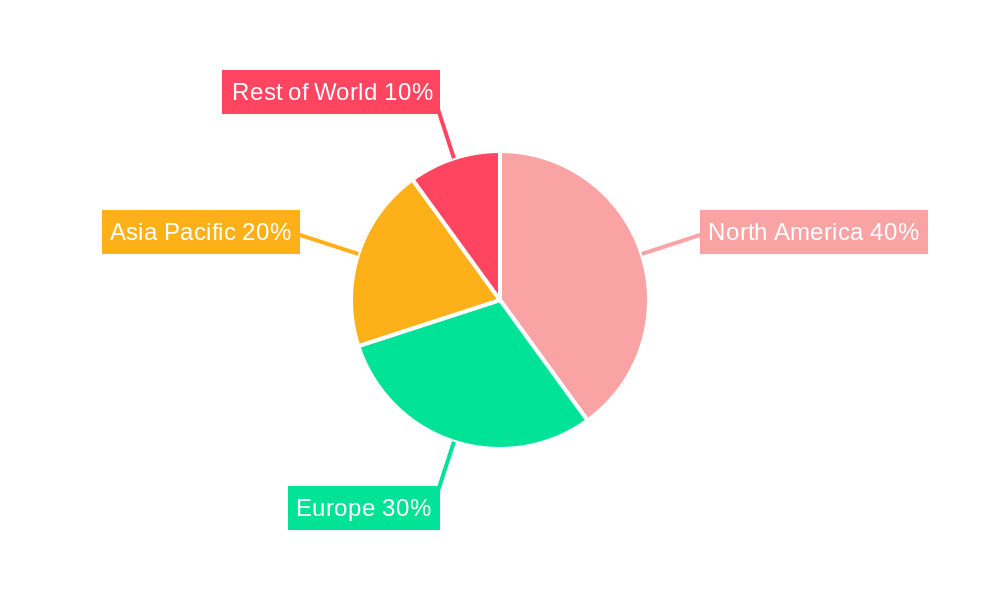

The extended warranty service contract market is experiencing robust growth, driven by increasing consumer electronics adoption, a rising preference for longer product lifespans, and the escalating cost of repairs. The market's expansion is further fueled by innovative product offerings, including bundled warranties and service packages tailored to specific consumer needs. The CAGR (Compound Annual Growth Rate) – let's assume a conservative 8% based on industry averages – indicates a significant upward trajectory. Segmentation reveals that Standard Protection Plans currently dominate the market, but Accidental Protection Plans are showing substantial growth, reflecting a consumer shift towards comprehensive coverage. The automobile sector holds the largest share of the market, followed by consumer electronics and home appliances. Major players like Asurion, AIG, and Assurant are aggressively vying for market dominance through strategic partnerships, technological advancements (like remote diagnostics and proactive maintenance), and targeted marketing campaigns. Regional analysis points to North America and Europe currently holding the largest market share, but Asia-Pacific is poised for substantial growth in the coming years, fueled by rising disposable incomes and increasing consumer electronics penetration. Despite the positive outlook, challenges remain. These include the increasing competition, potential economic downturns impacting consumer spending, and the need for the industry to address consumer concerns about warranty claim processes and transparency.

The market’s future trajectory hinges on several factors. The success of companies will depend on their ability to innovate their offerings, enhance customer service, effectively manage claims, and adapt to evolving technological landscapes. Developing strong brand loyalty will also be crucial as consumers become more discerning about the value proposition offered by different warranty providers. Moreover, regulatory changes affecting consumer protection laws could significantly influence the market dynamics. Further growth will likely be witnessed in developing markets where awareness of the benefits of extended warranties continues to rise, accompanied by improved affordability and availability. The market is expected to show steady expansion into the next decade, driven by the enduring value proposition for consumers seeking peace of mind and protection against unexpected repair costs.

The global extended warranty service contract market exhibited robust growth during the historical period (2019-2024), exceeding XXX million units. This upward trajectory is projected to continue throughout the forecast period (2025-2033), reaching an estimated XXX million units by 2033. Several factors contribute to this expansion. Firstly, increasing consumer awareness regarding the potential for unexpected repair costs and the financial protection offered by extended warranties is driving demand. Secondly, the complexity and cost of modern consumer electronics and automobiles are significant factors, making consumers more inclined to purchase extended protection. The market is also witnessing diversification, with providers offering increasingly specialized plans tailored to specific product types and consumer needs. This trend is evident across various application segments, particularly in the automotive and consumer electronics sectors. The growing popularity of online purchasing and the ease of adding extended warranties during the checkout process have also fueled market growth. Competition among providers is fierce, leading to innovative product offerings and competitive pricing strategies that benefit consumers. While the market is showing strong growth, challenges remain, such as managing customer expectations and claims processing efficiently, and ensuring profitability in a competitive landscape.

Several key drivers are propelling the growth of the extended warranty service contract market. The rising cost of repairs for complex consumer goods, including appliances, electronics, and automobiles, is a significant factor. Consumers are increasingly seeking financial protection against unforeseen breakdowns and hefty repair bills. The escalating price of new technology, combined with the desire to extend the lifespan of expensive purchases, is encouraging more consumers to opt for extended warranty coverage. Moreover, the market's shift towards online sales platforms has facilitated the seamless integration of warranty options during the purchase process. This accessibility has made it easier than ever before for consumers to add extended warranties to their purchases, thereby boosting market growth. Furthermore, the emergence of diverse product offerings, such as bundled packages and customized warranty plans to cater to specific customer needs, has also contributed significantly to market expansion. Finally, aggressive marketing campaigns by providers highlighting the benefits and value proposition of extended warranty protection are effectively influencing consumer decisions.

Despite the positive growth trajectory, the extended warranty service contract market faces several challenges. One significant hurdle is the prevalence of fraudulent claims. Providers must invest heavily in robust claim verification processes to prevent abuse and maintain profitability. Maintaining customer trust is paramount. Negative experiences with claims processing, such as lengthy delays or denials, can severely damage a provider's reputation and affect future sales. Furthermore, intense competition among providers necessitates efficient operational management to ensure competitive pricing and profitability. This requires optimizing operational costs, including claims management and customer service. The complex regulatory environment varies significantly across different jurisdictions, requiring providers to navigate diverse legal landscapes and comply with evolving regulations. Finally, the risk of adverse economic conditions, such as recessions, can impact consumer spending and reduce demand for extended warranty products.

The Consumer Electronics segment is poised to dominate the extended warranty market due to the increasing complexity and cost of electronic devices. Consumers are increasingly investing in high-end smartphones, laptops, and other electronic gadgets, making them more prone to potential malfunctions and high repair costs. The rising adoption of smart home devices also contributes to the segment's growth.

The Standard Protection Plan type consistently holds a major share of the market. Its comprehensiveness and broader appeal to consumers seeking basic protection against malfunctions make it a popular choice. This contrasts with the Accidental Protection Plan, which focuses on specific accidental damage and usually carries a smaller market share. While both types contribute to market growth, the standard plan maintains a stronger overall position.

The extended warranty service contract industry's growth is fueled by a confluence of factors. Rising consumer disposable incomes, the increasing sophistication and cost of electronic devices and automobiles, and the growing preference for extending the lifespan of assets are key drivers. Furthermore, the enhanced accessibility of extended warranties through online retail platforms and effective marketing campaigns highlighting their value proposition are significantly contributing to market expansion.

The extended warranty market is experiencing robust growth, driven by several factors including rising consumer incomes, increasing technological complexity, and enhanced accessibility through online platforms. The market's future is bright, with continuing innovation in product offerings and evolving consumer expectations shaping the industry's trajectory.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Asurion, American International Group (AIG), Assurant, Allstate (SquareTrade), Amtrust, American Home Shield, Ally Financial, Allianz Global Assistance, Automobile Protection Corporation (APCO), Endurance Warranty Services, CarShield, CARCHEX, Corporate Warranties India, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Extended Warranty Service Contract," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Extended Warranty Service Contract, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.