1. What is the projected Compound Annual Growth Rate (CAGR) of the Exhibition Organizing?

The projected CAGR is approximately 3.3%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Exhibition Organizing

Exhibition OrganizingExhibition Organizing by Type (5, 000-20, 000 Sqm, 20, 000-100, 000 Sqm, More Than 100, 000 Sqm), by Application (Art Exhibitions, Academic Exhibitions, Commercial Exhibitions, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

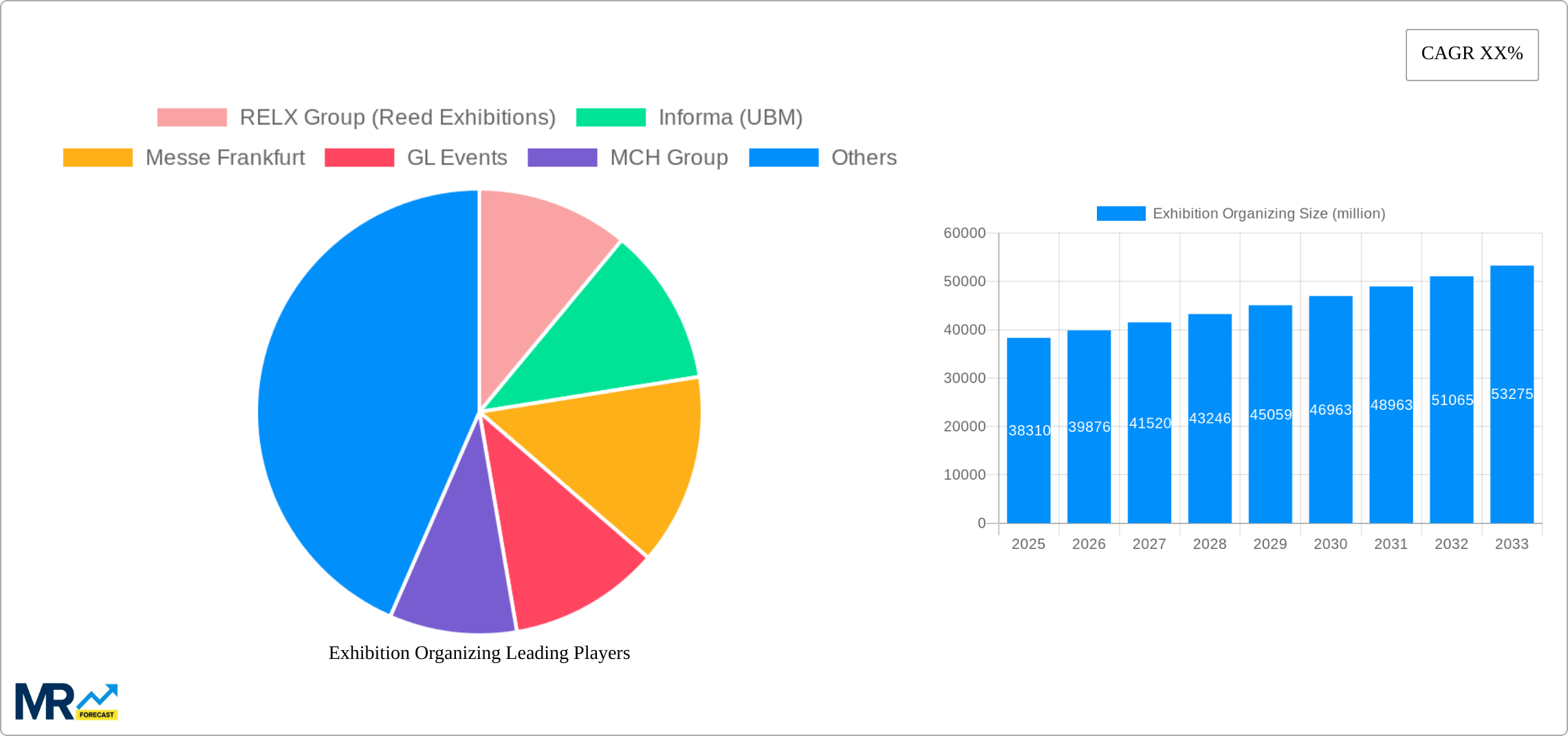

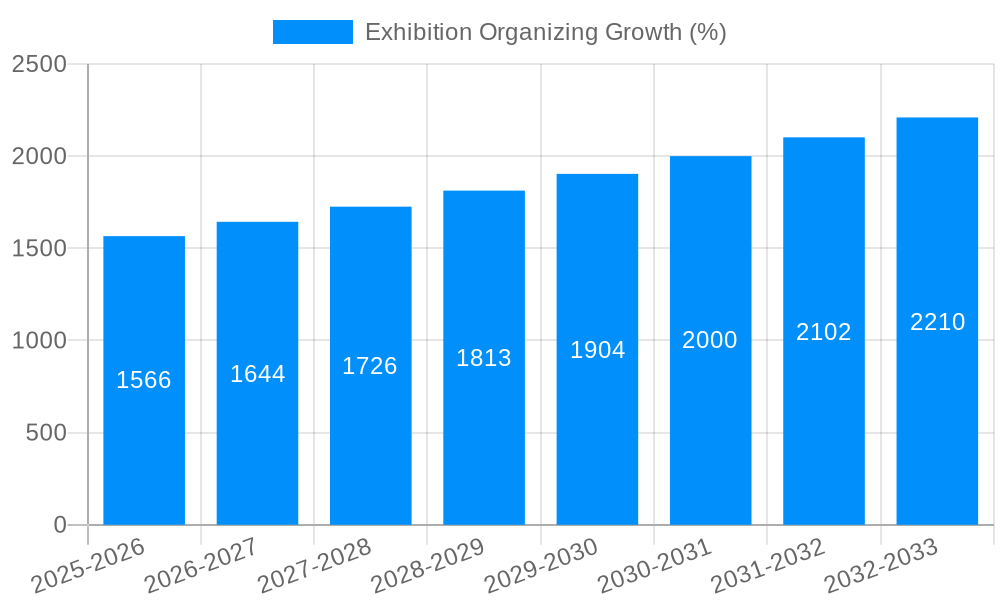

The global exhibition organizing market, valued at $30.6 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.3% from 2025 to 2033. This growth is fueled by several key drivers. The increasing need for businesses to showcase their products and services, coupled with the effectiveness of in-person networking opportunities offered by exhibitions, significantly contributes to market expansion. Furthermore, the rise of specialized exhibitions catering to niche industries and the adoption of advanced technologies, such as virtual and hybrid event formats, are driving innovation and attracting a wider audience. The segmentation of the market by exhibition type (5,000-20,000 sqm, 20,000-100,000 sqm, and over 100,000 sqm) and application (art exhibitions, academic exhibitions, commercial exhibitions, and others) highlights the market's diversity and adaptability to evolving industry needs. While the market faces certain restraints, such as economic fluctuations and competition from other marketing channels, the overall positive outlook is supported by the sustained demand for face-to-face interaction and the ongoing development of innovative exhibition formats.

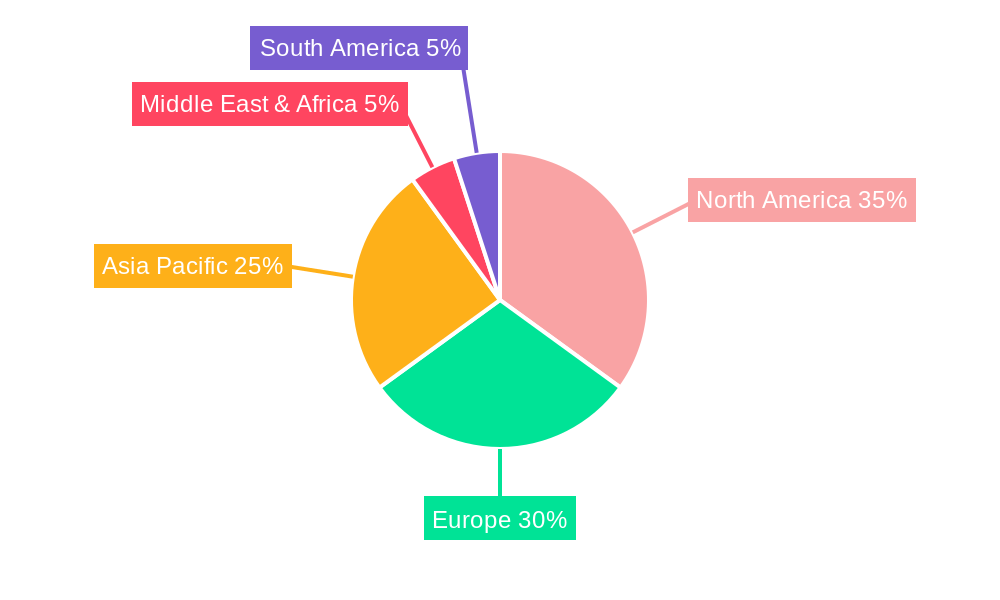

The market is dominated by major players like RELX Group, Informa, Messe Frankfurt, and others, indicating a consolidated yet competitive landscape. Regional variations in market growth are expected, with North America and Europe likely maintaining substantial market shares due to established exhibition infrastructure and strong economic activity. However, the Asia-Pacific region is expected to witness significant growth, driven by expanding economies and increasing investment in infrastructure for events. The continued focus on enhancing visitor experience, incorporating sustainable practices, and leveraging digital technologies to improve efficiency and reach will be crucial for success in this dynamic market. Strategic acquisitions, partnerships, and the development of innovative exhibition formats will likely shape the market landscape in the coming years. The long-term growth trajectory points towards a consistently expanding market, with continued opportunities for both established players and new entrants.

The global exhibition organizing market, valued at several billion dollars in 2024, is experiencing a dynamic shift. Post-pandemic, the industry is witnessing a resurgence, albeit with a renewed focus on digital integration and hybrid event formats. The historical period (2019-2024) saw significant disruption due to unforeseen circumstances, but the forecast period (2025-2033) projects substantial growth. Key trends include a surge in demand for smaller, more specialized exhibitions targeting niche markets, a trend moving away from the mega-events that previously dominated the sector. This is driven by the need for more targeted audience engagement and increased ROI for exhibitors. Simultaneously, the integration of digital technologies, from virtual reality tours and online networking platforms to sophisticated data analytics for improved event management, is fundamentally changing the landscape. Sustainability is emerging as a significant concern, with organizers increasingly adopting eco-friendly practices and promoting their sustainability efforts to attract environmentally conscious attendees. Furthermore, the industry is seeing a rise in experiential exhibitions, focusing on interactive displays and immersive experiences rather than just static displays, to increase visitor engagement and dwell time. This necessitates a more agile and adaptable approach from exhibition organizers, capable of seamlessly integrating physical and digital strategies to meet the evolving demands of exhibitors and visitors. The estimated market value for 2025 suggests a robust recovery and significant future growth potential. Major players like RELX Group (Reed Exhibitions) and Informa are strategically adapting their portfolios to leverage these trends. The competition is intense, with companies vying for market share through innovative event formats and technological advancements. The market is witnessing a consolidation phase with mergers and acquisitions creating larger, more diversified players.

Several factors are fueling the expansion of the exhibition organizing market. Firstly, the enduring effectiveness of in-person networking remains a critical driver. Businesses recognize the value of face-to-face interactions for building relationships, generating leads, and closing deals, despite the rise of digital communication. Secondly, the increasing need for specialized industry events caters to the growing complexity and fragmentation of global markets. Niche exhibitions allow for focused targeting of specific demographics and industry sectors, resulting in greater efficiency and ROI for both exhibitors and attendees. Thirdly, technological advancements provide exhibition organizers with new tools to enhance the overall experience, including better event management platforms, data analytics for performance measurement, and the aforementioned integration of virtual and augmented reality technologies. Finally, the growing global economy and increasing investment in various sectors stimulate demand for platforms that facilitate business-to-business (B2B) interactions, contributing to the growth of the exhibition organizing market. These combined factors are expected to drive substantial growth in the coming years, with a projection of substantial market expansion during the forecast period (2025-2033).

Despite its positive outlook, the exhibition organizing market faces certain challenges. The lingering impact of the global pandemic continues to cause uncertainty, particularly regarding the possibility of future disruptions and the associated costs of implementing safety measures. Increasing competition among organizers necessitates continuous innovation and investment to stay ahead of the curve, creating pressure on profit margins. Furthermore, the cost of venue rentals, logistics, and marketing can be significant, impacting the overall profitability of events. The industry also faces the challenge of attracting and retaining both exhibitors and attendees, particularly in the face of increased competition from online alternatives. Economic downturns can significantly impact the willingness of businesses to invest in exhibition participation, affecting revenue streams. Finally, the sustainability concerns mentioned previously require investment in environmentally friendly practices which adds to operational expenses. Organizers need to strategically manage these challenges to ensure sustained growth and profitability in the long term.

The exhibition organizing market exhibits diverse growth patterns across regions and segments. While a comprehensive analysis requires deeper regional breakdown, certain segments show clear dominance:

Segment: The "20,000-100,000 Sqm" exhibition type represents a substantial market segment. This size allows for a significant number of exhibitors and attendees while maintaining a manageable scale for effective networking and engagement. Larger events (more than 100,000 sqm) are often limited to mega-trade shows, while smaller events (5,000-20,000 sqm) may lack the critical mass needed for broad industry representation.

Application: "Commercial Exhibitions" constitute the largest segment within the application category. These events cater to a vast range of businesses, from startups to multinational corporations, across numerous sectors, making them a highly profitable focus for exhibition organizers. Art and academic exhibitions, while valuable, often operate on smaller scales. "Others" represents a diverse range and thus its market potential is widely spread.

Geographic Regions: While specific data may vary, mature economies in North America and Europe have historically held significant market share. However, the emerging markets of Asia, specifically countries like China and India, are witnessing rapid growth, driven by economic development and increasing business activity. This shift is particularly significant in the larger exhibition sizes.

Paragraph summarizing dominance: The 20,000-100,000 sqm segment is projected to maintain market leadership during the forecast period due to its optimal size balancing scale and manageability. Commercial exhibitions, driven by the robust B2B activity in mature and emerging economies, are expected to contribute significantly to the overall market growth. While the European and North American markets remain substantial, the burgeoning economies of Asia-Pacific promise significant future expansion, particularly concerning larger scale commercial exhibitions.

The exhibition organizing industry is poised for significant growth, fueled by several key factors. The resurgence of in-person networking after the pandemic, the increasing sophistication of digital event management tools, and the expansion of niche market events are all contributing to a dynamic and expanding market. The strategic adoption of sustainable practices is also becoming a major growth catalyst, attracting environmentally conscious exhibitors and attendees. Furthermore, the global economic growth, especially in emerging markets, provides fertile ground for expansion. These factors, combined, position the exhibition organizing sector for robust growth in the coming years.

This report provides a comprehensive overview of the exhibition organizing market, covering historical trends (2019-2024), current market conditions (Base Year 2025, Estimated Year 2025), and future projections (Forecast Period 2025-2033). The report analyzes key market drivers, challenges, dominant segments (by size and application), leading players, and significant industry developments, providing valuable insights for stakeholders across the exhibition organizing ecosystem. The report highlights the ongoing transition towards a more digitally integrated and sustainable industry, shaping the future of events.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.3% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 3.3%.

Key companies in the market include RELX Group (Reed Exhibitions), Informa (UBM), Messe Frankfurt, GL Events, MCH Group, Fiera Milano, Deutsche Messe, Koelnmesse, Messe Dusseldorf, Viparis, Emerald Expositions, Messe Munchen, Messe Berlin, Hong Kong Trade Development Council (HKTDC), Coex, i2i Events Group, NurnbergMesse GmbH, ITE Group, Tokyo Big Sight, Fira Barcelona, Jaarbeurs, Tarsus Group, Comexposium Groupe, Artexis Group, SNIEC Shanghai, .

The market segments include Type, Application.

The market size is estimated to be USD 30600 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Exhibition Organizing," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Exhibition Organizing, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.