1. What is the projected Compound Annual Growth Rate (CAGR) of the Evening Economy?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Evening Economy

Evening EconomyEvening Economy by Type (Eating and Drinking Economy, Entertainment Economy, Nightlife Economy, Others), by Application (City, Town, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

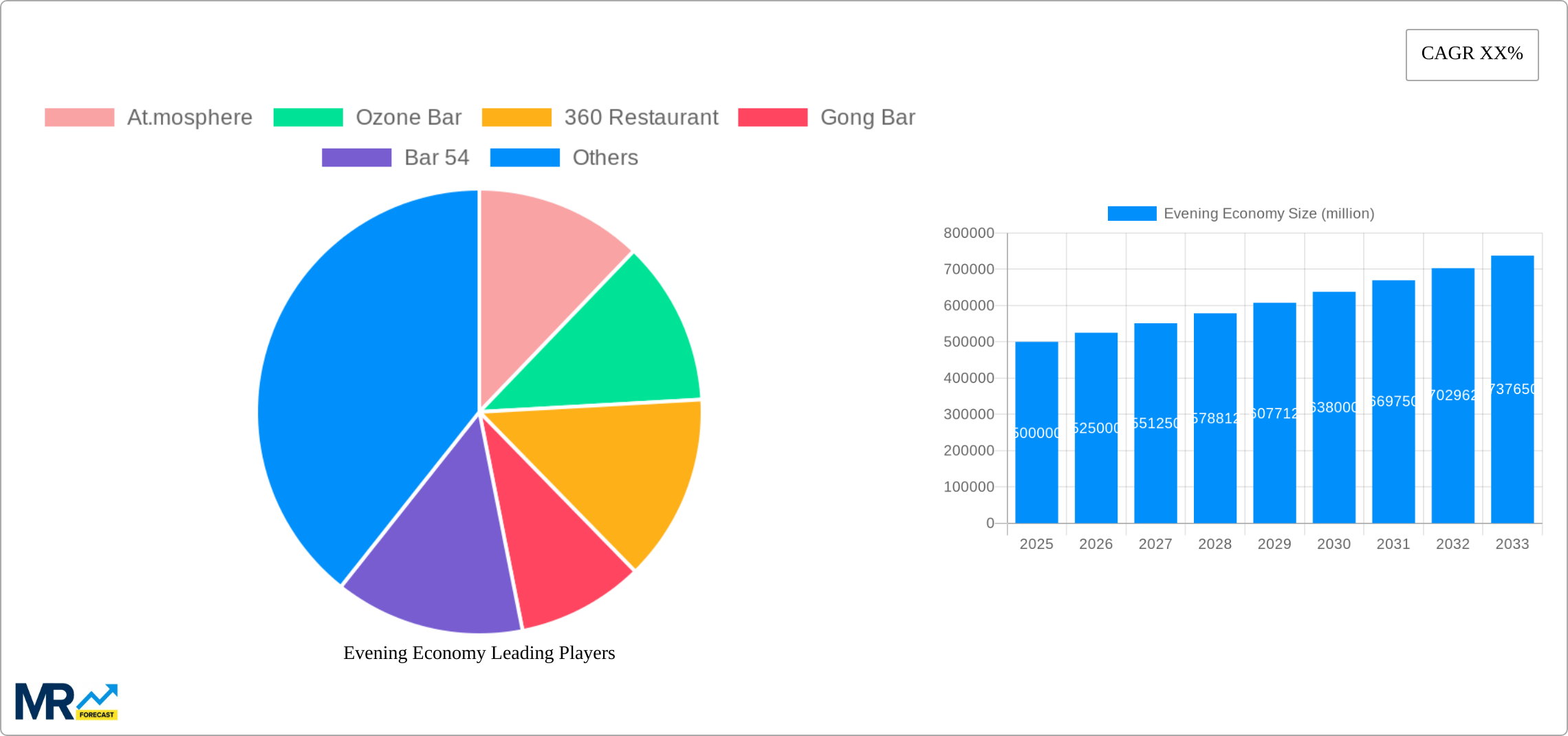

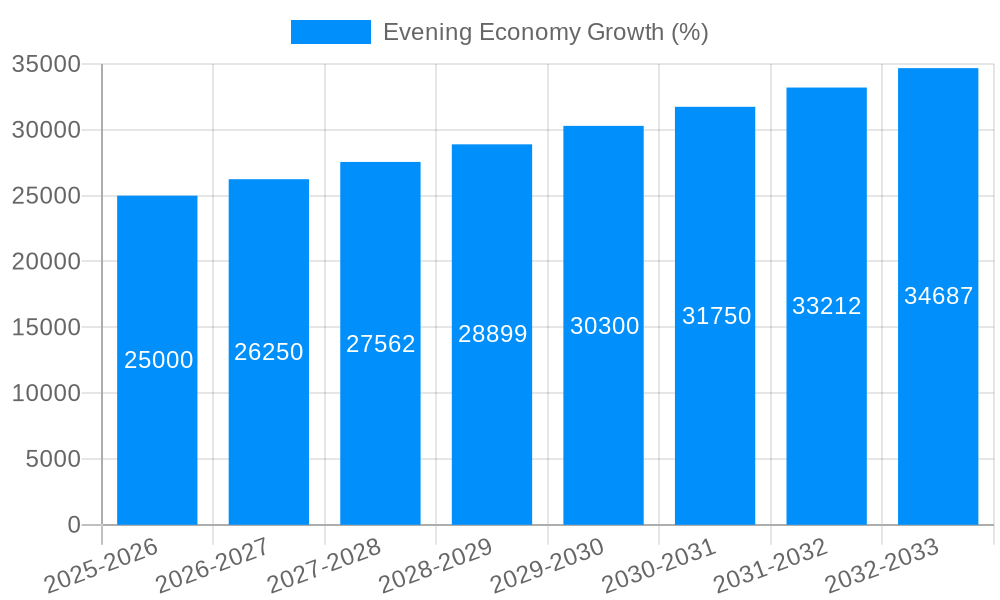

The global evening economy, encompassing entertainment, nightlife, dining, and related services, is a dynamic and rapidly expanding market. While precise figures for market size aren't provided, considering the listed companies (spanning quick-service restaurants to upscale bars and restaurants) and geographic regions, a reasonable estimate for the 2025 market size could be in the range of $2 trillion USD. This is a conservative estimate, acknowledging that the evening economy's contribution varies significantly across regions and its definition may encompass additional services. A compound annual growth rate (CAGR) of 5% is a plausible projection for the forecast period (2025-2033), driven by several key factors. These include rising disposable incomes, especially in emerging markets, a growing young adult population with higher spending power on leisure and entertainment, urbanization leading to higher concentration of consumers in urban centers, and the increasing popularity of experiential consumption – people prioritizing unique and memorable experiences over material goods. Technological advancements, such as online booking platforms and personalized recommendations, also contribute to market growth by enhancing accessibility and consumer engagement.

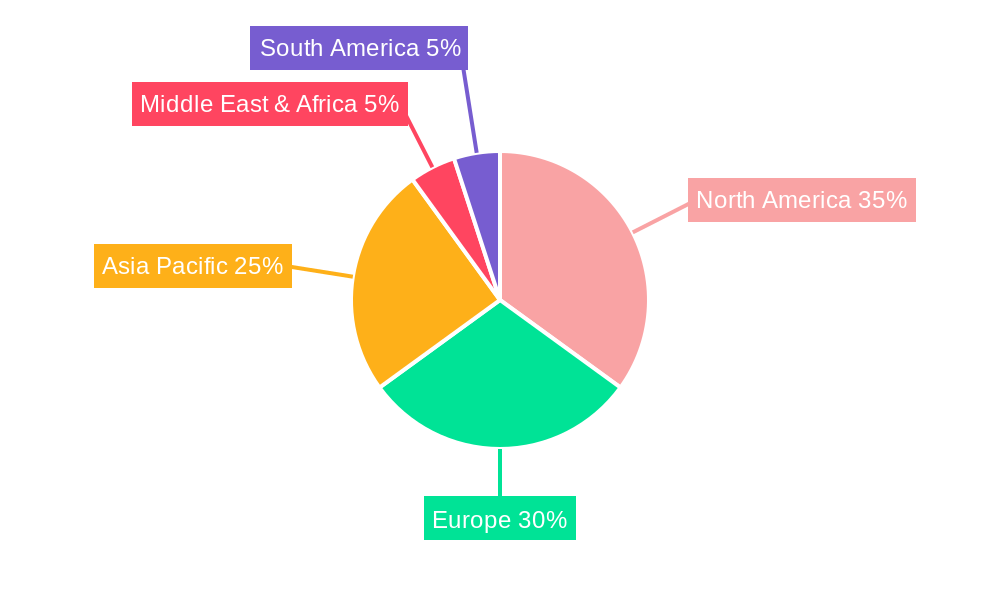

However, the sector faces challenges. Economic downturns can significantly impact discretionary spending on entertainment and dining. Government regulations, particularly concerning alcohol sales and licensing, can pose restrictions. Moreover, rising inflation and cost of living pressures could dampen consumer demand in certain segments. The evening economy’s segmentation – into eating and drinking, entertainment, nightlife, and others – reveals distinct market dynamics. While the eating and drinking segment represents a large portion, nightlife and entertainment venues are key drivers of growth, particularly in urban areas. Regional variations are significant. North America and Europe currently hold substantial market shares, but the Asia-Pacific region exhibits high growth potential due to rapid economic development and evolving consumer preferences. The future of the evening economy will depend on how effectively businesses adapt to changing consumer habits, embrace technological innovations, and navigate economic uncertainties.

The evening economy, encompassing activities undertaken between the late afternoon and early morning hours, represents a significant and dynamic sector with a projected value exceeding $XXX million by 2033. Analysis of the period from 2019 to 2024 reveals a steady growth trajectory, influenced by shifting societal trends, technological advancements, and evolving consumer preferences. The eating and drinking segment, fueled by the increasing popularity of upscale dining experiences and casual eateries, dominates the market. The nightlife economy, encompassing bars, clubs, and entertainment venues like At.mosphere and Ozone Bar, also contributes substantially. However, the COVID-19 pandemic significantly impacted the evening economy, causing temporary closures and a shift towards delivery and takeout services. The subsequent recovery has been uneven, with some segments showing faster growth than others. The post-pandemic era has seen a resurgence in in-person social gatherings, benefiting establishments catering to this demand. The increasing integration of technology, such as online booking platforms and mobile payment systems, is also reshaping consumer behavior and streamlining operations for businesses within the evening economy. Furthermore, the growth of the "experience economy," emphasizing memorable and engaging experiences over solely transactional ones, has propelled the demand for unique and high-quality evening entertainment options. Future projections indicate sustained growth, particularly in the entertainment and nightlife sectors, driven by ongoing urbanization, rising disposable incomes, and the continued adoption of innovative technologies. This growth will be influenced by factors such as changing demographics, evolving consumer tastes, and the introduction of new entertainment concepts. A nuanced understanding of these trends is crucial for investors, businesses, and policymakers seeking to navigate this dynamic sector successfully.

Several key factors are driving the expansion of the evening economy. Firstly, the rise in disposable incomes, particularly among young adults and urban populations, allows for greater spending on leisure and entertainment activities after work hours. Secondly, changing work patterns, including flexible working arrangements and the gig economy, provide more opportunities for individuals to engage in evening activities. The rise of urbanization continues to fuel the growth of the evening economy, concentrating populations and creating vibrant hubs of activity in city centers. Furthermore, the proliferation of social media and online platforms facilitates the promotion and discovery of evening events, driving increased participation. Technological advancements, such as mobile payment systems and online reservation tools, have streamlined transactions and access to evening economy services. The desire for unique and memorable experiences, a core tenet of the experience economy, fuels demand for innovative and high-quality offerings, driving competition and innovation within the sector. The trend towards work-life integration, blurring the lines between professional and personal life, also contributes to increased participation in evening activities. Finally, the evolving demographics, with an increasing proportion of young adults in many regions, further fuels demand for activities and experiences that cater to their preferences.

Despite its significant potential, the evening economy faces several challenges. Fluctuating economic conditions can directly impact consumer spending on discretionary activities, creating uncertainty for businesses. The high operating costs associated with running late-night establishments, including staffing and security, can pose a significant financial burden. Stricter regulations and licensing requirements in certain jurisdictions can impede the growth of certain sectors. Competition within the evening economy is intense, requiring businesses to constantly innovate and differentiate themselves to attract and retain customers. Concerns related to public safety and security, particularly late at night, can negatively impact consumer confidence and participation. Maintaining a sustainable business model amidst fluctuating consumer demand is another challenge, requiring businesses to adapt their strategies based on seasonal variations and external economic factors. Lastly, the impact of external factors such as public health crises or major events can severely disrupt operations and revenue streams, highlighting the vulnerability of businesses in this sector.

The evening economy exhibits significant regional variations. Major cities in developed countries, such as New York, London, and Tokyo, are expected to continue dominating the market due to their high population densities, diverse offerings, and strong consumer spending. Within the segments, the Eating and Drinking Economy is projected to maintain its leading position, driven by the continued rise in disposable incomes and the increasing demand for diverse culinary experiences.

City Centers: The concentration of businesses, entertainment venues, and residential areas in city centers creates a high concentration of evening activity, fostering a dynamic and thriving evening economy. Cities with well-developed public transportation systems and walkable urban environments are particularly well-positioned to capitalize on this trend.

High-Income Demographics: Consumers with higher disposable incomes are more likely to participate in various aspects of the evening economy, driving demand for premium experiences in upscale restaurants, bars, and entertainment venues like Marini's on 57 and the Signature Lounge at the 95th.

Tourism: Major tourist destinations benefit significantly from the evening economy, as visitors often seek out dining, entertainment, and nightlife options during their trips. This contributes to a significant influx of revenue and supports numerous businesses operating during evening hours.

Upscale Establishments: The segment encompassing upscale restaurants, bars, and lounges (like At.mosphere, Ozone Bar, 360 Restaurant) is anticipated to exhibit faster growth compared to budget-friendly options. This is fueled by the desire for premium experiences and the willingness of affluent consumers to spend on high-quality services and unique atmospheres.

Technological Integration: Businesses effectively integrating technology – online ordering, reservation systems, mobile payments – will gain a competitive advantage, enhancing efficiency and attracting tech-savvy consumers.

The Nightlife Economy is poised for strong growth, driven by younger demographics and the desire for social interaction, exemplified by establishments such as Gong Bar and Bar 54. However, challenges like regulations concerning alcohol service and public safety will need to be addressed. Smaller towns and rural areas may exhibit slower growth due to lower population densities and limited economic activity. The "Others" segment, encompassing activities like sporting events and cultural performances, is expected to see consistent growth but at a slower rate than the dominant segments.

The evening economy's growth is catalyzed by several factors. Increased disposable incomes, urbanization leading to concentrated populations, and the continuous advancement of technology driving convenience and engagement are primary drivers. The experience economy's emphasis on memorable experiences fuels demand for diverse and high-quality options. Government policies promoting tourism and supporting local businesses in urban areas further stimulate the sector's growth.

This report provides a comprehensive overview of the evening economy, analyzing key trends, driving forces, challenges, and growth opportunities. It identifies leading players and significant developments, offering valuable insights for businesses, investors, and policymakers. The projected growth trajectory highlights the sector's considerable potential and its importance to the overall economy.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include At.mosphere, Ozone Bar, 360 Restaurant, Gong Bar, Bar 54, Marini's on 57, Sky Bar, Cloud 9, New Asia bar, Signature Lounge at the 95th, 7-ELEVEN, Cumberland Farms, QuikTrip, Wawa, Circle K, McDonald’s, Kentucky Fried Chicken, Jack in the Box, Whataburger, Dunkin’ Donuts, Steak' n Shake, Perkins, Taco Cabana, IHOP, Waffle House, Denny’s, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Evening Economy," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Evening Economy, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.