1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethereum?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Ethereum

EthereumEthereum by Type (Exchange, Purchase, Mining), by Application (Transaction, Investment), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

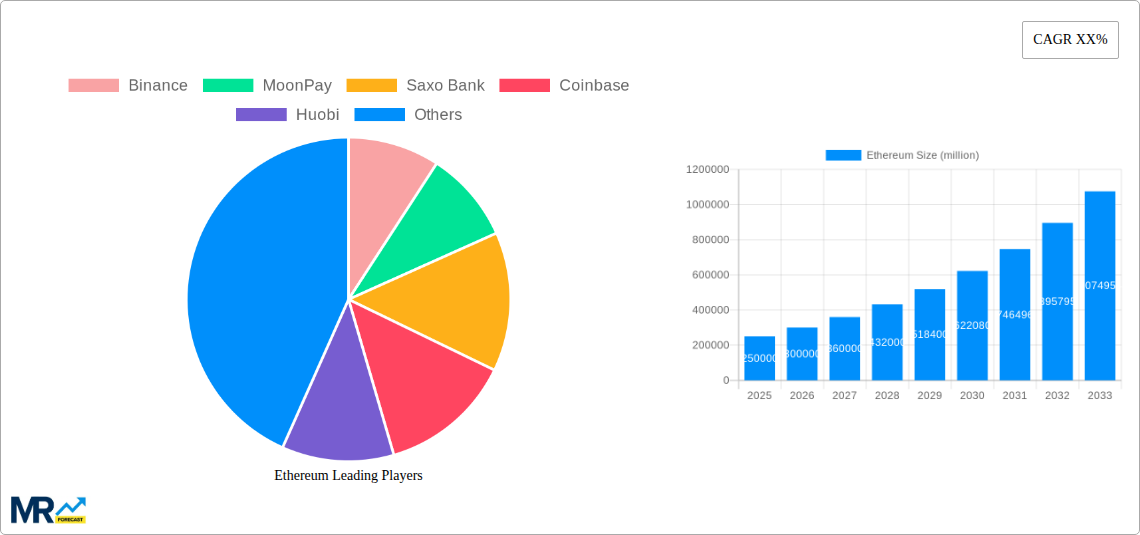

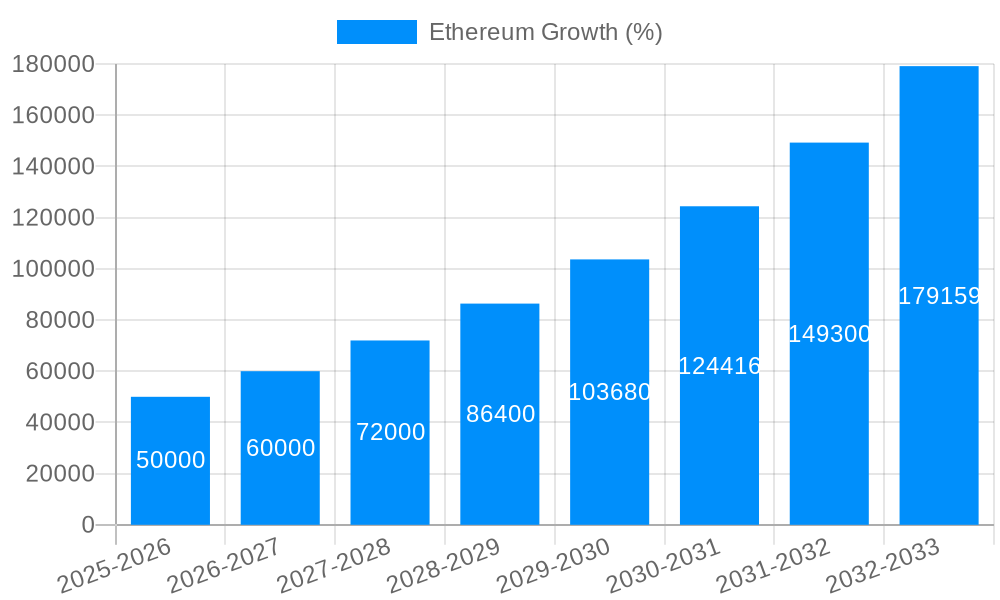

The Ethereum market, encompassing exchange, purchase, mining, and transaction/investment applications, is experiencing robust growth. While precise market sizing data was not provided, industry analysis suggests a substantial market value, potentially exceeding $100 billion in 2025, considering the significant adoption of Ethereum in DeFi, NFTs, and enterprise blockchain solutions. A Compound Annual Growth Rate (CAGR) of at least 20% is plausible through 2033, driven by several key factors. Increased institutional investment, the burgeoning metaverse and NFT markets, and the expanding utility of Ethereum in decentralized applications (dApps) fuel this expansion. The growing demand for scalability solutions, such as layer-2 scaling technologies and sharding, is also a significant driver. However, regulatory uncertainty, competition from emerging blockchain platforms, and the environmental concerns related to energy consumption in mining pose potential restraints to growth. Segment analysis reveals that the transaction and investment applications currently dominate the market share, although the relative proportions of exchange, purchase and mining are expected to evolve with technological advancements and changing regulatory landscapes. Geographically, North America and Asia-Pacific, particularly the United States and China, are expected to lead the market due to high levels of technological adoption and venture capital investment. However, emerging economies in other regions are likely to show strong growth as blockchain technology adoption expands.

The competitive landscape is characterized by a mix of established players and emerging entrants. Major exchanges like Binance, Coinbase, and Huobi play a significant role in trading volume, while companies like MoonPay focus on simplifying cryptocurrency purchasing. Saxo Bank and eToro represent the traditional finance sector's foray into crypto, signaling broader mainstream adoption. The market is witnessing increased consolidation and partnerships, reflecting a trend toward collaboration and enhanced user experiences. Future growth will hinge upon successful navigation of regulatory challenges, continued technological innovation, and the maturation of the overall crypto ecosystem. The increasing focus on sustainable mining practices and the development of more efficient consensus mechanisms will also influence the long-term trajectory of the Ethereum market.

The Ethereum network, a decentralized platform built on blockchain technology, has witnessed explosive growth since its inception. Over the historical period (2019-2024), we observed a surge in user adoption, driven primarily by the rise of decentralized finance (DeFi) applications and non-fungible tokens (NFTs). This period saw transaction volumes exceeding hundreds of millions, with billions of dollars transacted through Ethereum-based applications. By the base year (2025), we estimate the market valuation in the tens of billions. The forecast period (2025-2033) projects continued expansion, fueled by technological advancements such as Ethereum 2.0 and the increasing integration of Ethereum into various industries. While the market experienced volatility, characterized by periods of significant price swings, the overall trend indicates a sustained upward trajectory. The adoption of Ethereum has extended beyond the purely speculative investment realm. We are seeing major adoption by businesses who are integrating Ethereum's capabilities into their systems – demonstrating confidence in the long-term viability of the platform. Increased institutional involvement and regulatory clarity are further bolstering growth, although challenges remain in scalability and energy consumption. The projected market size by 2033 is expected to reach hundreds of billions, reflecting a compound annual growth rate (CAGR) in the double digits, showcasing the transformative potential of Ethereum’s underlying technology. This growth, however, is not without its fluctuations, subject to macroeconomic conditions and technological disruptions, thus highlighting the need for continuous monitoring and analysis of the market dynamics. The next decade will be crucial in determining whether Ethereum truly becomes the foundational layer for a decentralized internet.

Several key factors are driving the growth of the Ethereum ecosystem. The increasing adoption of DeFi applications, offering innovative financial services without intermediaries, is a primary driver. The meteoric rise of NFTs, facilitating the creation and trading of unique digital assets, has also contributed significantly to Ethereum's expansion. The development of Ethereum 2.0, aiming to improve scalability and efficiency, is poised to further accelerate growth. The growing interest from institutional investors, seeking exposure to the burgeoning digital asset market, is injecting substantial capital into the ecosystem. Furthermore, the development of robust developer tools and a thriving community of developers continually enhance the platform's functionality and attract further innovation. This combination of technological advancements, financial applications, and community support creates a powerful synergistic effect, ensuring the continued growth and expansion of Ethereum’s influence in the digital asset space. The rising demand from a broader user base, transcending traditional financial markets, further fuels its expansion, creating a self-reinforcing cycle of development and adoption. Lastly, the increased integration of Ethereum into real-world applications, from supply chain management to digital identity verification, underlines its growing utility beyond speculative trading.

Despite its considerable success, Ethereum faces significant challenges that could hinder its growth. Scalability remains a key concern, with transaction fees (gas fees) often becoming prohibitively expensive during periods of high network congestion. This can limit accessibility and adoption, particularly for users with limited resources. The environmental impact of Ethereum's energy consumption is another significant challenge, drawing criticism and regulatory scrutiny. The complexity of Ethereum's technology can also pose a barrier to entry for newcomers, hindering wider adoption. Competition from other blockchain platforms offering similar functionalities but with potentially improved scalability or lower energy consumption presents a considerable threat. Furthermore, regulatory uncertainty in different jurisdictions around the world could significantly impact the growth of the Ethereum ecosystem. Finally, security vulnerabilities, while addressed through ongoing development, remain a persistent concern, capable of damaging the trust and confidence of users.

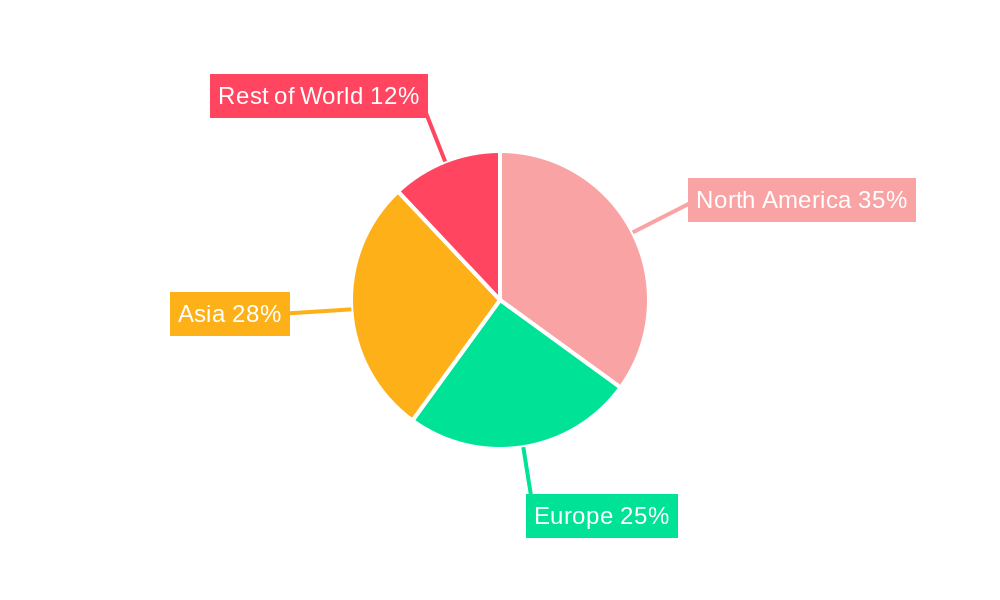

The global Ethereum market is characterized by diverse regional and segmental contributions. However, several key areas show disproportionately high growth potential within the forecast period.

Investment Segment: The investment segment is expected to maintain significant dominance throughout the forecast period. Institutional investors and high-net-worth individuals are increasingly allocating assets to Ethereum, propelled by the asset’s potential for appreciation and its role in the broader blockchain revolution. The growing interest in DeFi protocols and NFT marketplaces further emphasizes this trend.

North America: North America, particularly the United States, maintains a leading position due to the presence of major tech hubs, early adoption of cryptocurrency, and a strong regulatory framework (albeit still evolving). This region boasts a large concentration of both individual investors and institutional players significantly contributing to the overall trading volumes and market capitalization.

Asia: Asia, specifically countries like China (despite regulatory restrictions), South Korea, and Japan, represent another critical area for Ethereum's growth. While regulatory uncertainty exists, the strong tech infrastructure and a significant population familiar with digital technologies provide fertile ground for expansion. The rapid integration of blockchain solutions into various sectors also supports this projected growth.

Europe: Europe, particularly regions like Western Europe, is seeing increasing adoption of Ethereum driven by regulatory clarity in certain countries and the presence of major financial institutions exploring blockchain technologies. The EU's regulatory approach, while still developing, is anticipated to provide a more favorable environment for crypto compared to other regions with more stringent rules.

In summary, while the investment segment globally holds significant potential, the geographical distribution of growth highlights the importance of regional regulatory frameworks and technological infrastructure in driving Ethereum adoption. The synergistic growth of these segments creates a positive feedback loop, with each supporting the growth and adoption of the others.

The Ethereum industry's growth is propelled by a confluence of factors. The expanding DeFi ecosystem, with innovative financial applications, and the continued evolution of NFTs, creating new opportunities for digital asset ownership and trading are major drivers. Furthermore, the technological advancements in Ethereum, particularly Ethereum 2.0, promising increased scalability and efficiency, will significantly contribute to future growth. Increasing institutional adoption and regulatory clarity in various jurisdictions, while still evolving, provide a more stable environment for investment and growth in the sector. The strengthening developer community continuously innovating and expanding functionalities further fuels this momentum.

This report provides a comprehensive overview of the Ethereum market, covering historical trends, current market dynamics, and future projections. The analysis includes detailed insights into driving forces, challenges, key players, and significant developments within the Ethereum ecosystem. The report's key findings include sustained growth projections, the dominant role of the investment segment, and the importance of regional regulatory landscapes and technological infrastructure. This detailed analysis provides valuable insights for investors, businesses, and policymakers navigating the rapidly evolving landscape of the Ethereum blockchain network.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Binance, MoonPay, Saxo Bank, Coinbase, Huobi, Axi, eToro, Coinmama, Gemini, Luno, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Ethereum," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Ethereum, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.