1. What is the projected Compound Annual Growth Rate (CAGR) of the Esports Betting Software?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Esports Betting Software

Esports Betting SoftwareEsports Betting Software by Type (/> Pre-match Betting, Live Betting), by Application (/> People Aged 18-29, People Aged 30-39, People Aged 40-49, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

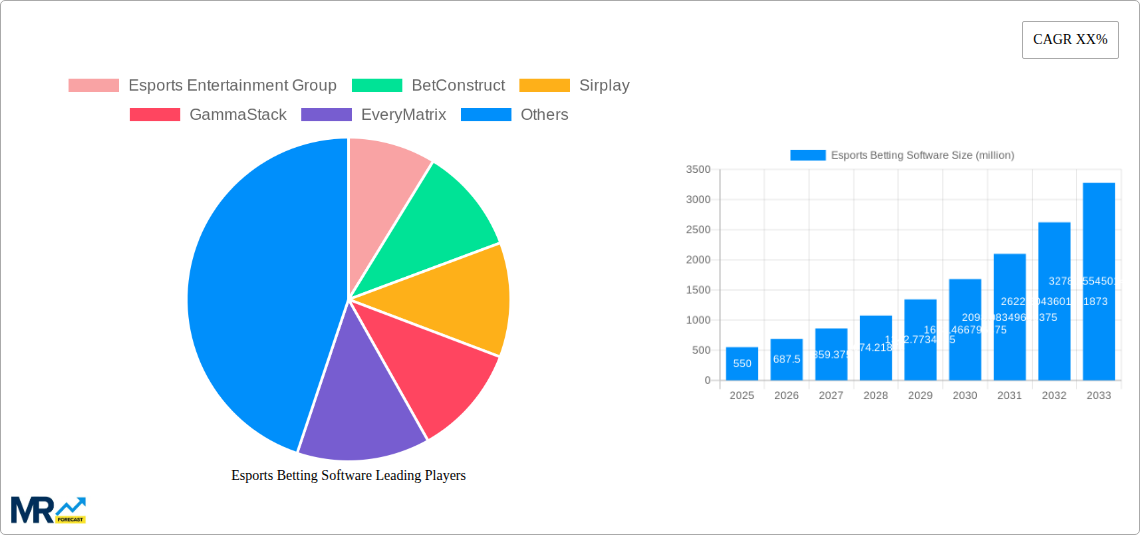

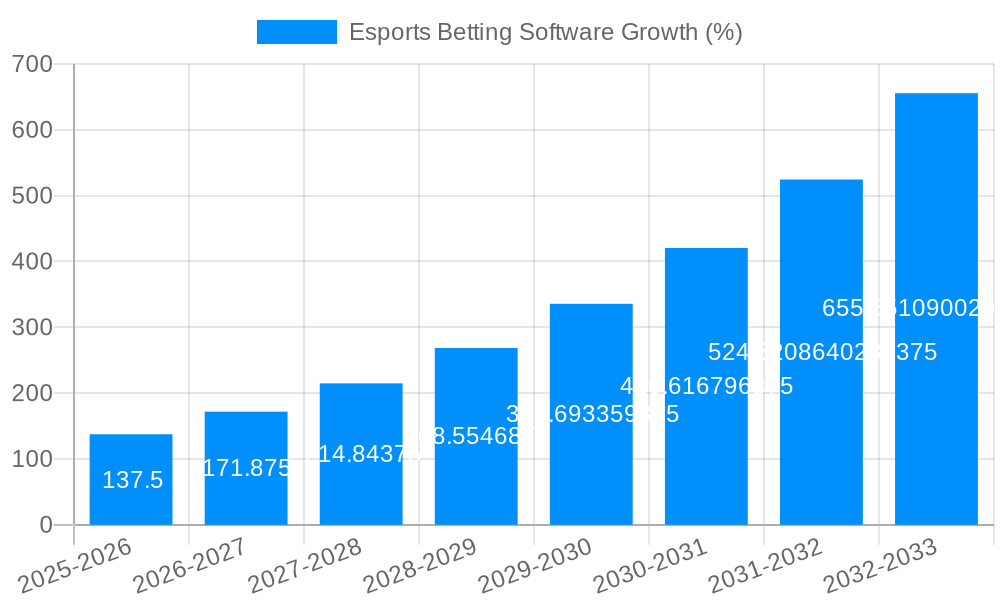

The esports betting software market is experiencing rapid growth, driven by the increasing popularity of esports globally and the concurrent rise of online betting platforms. While precise market figures were not provided, a reasonable estimation, considering the involvement of major players like Bet365, Playtech, and Entain, suggests a current market size (2025) exceeding $500 million. This substantial valuation reflects the high demand for sophisticated software capable of managing complex betting operations within the dynamic esports landscape. The market's Compound Annual Growth Rate (CAGR) is likely in the range of 20-25%, indicating significant expansion potential through 2033. Key drivers include the expanding esports audience, technological advancements enabling seamless integration of betting options into game broadcasts and platforms, and the legalization and regulation of online gambling in various regions. Furthermore, the increasing sophistication of betting options, including in-play betting and specialized esports markets, fuels demand for feature-rich software solutions.

Trends shaping the market include the rise of mobile-first betting experiences, the integration of artificial intelligence for fraud detection and risk management, and the increasing focus on responsible gambling initiatives. Restraints include regulatory hurdles varying across different jurisdictions, concerns regarding data security and player protection, and potential competition from established sports betting platforms expanding into the esports sector. Segmentation within the market is evident, with specialized software targeting different esports titles, betting types, and regional regulations. The competitive landscape is highly fragmented, characterized by a mix of large established gaming and betting companies and smaller specialized software providers. The continuous evolution of esports and the increasing sophistication of betting preferences are likely to drive further market growth and innovation in the years to come.

The esports betting software market is experiencing explosive growth, projected to reach multi-billion dollar valuations by 2033. The study period from 2019-2024 reveals a significant upward trajectory, laying the foundation for the estimated $XXX million market value in 2025. This momentum is expected to continue throughout the forecast period (2025-2033), driven by several key factors. Firstly, the ever-increasing popularity of esports itself fuels demand for sophisticated and reliable betting platforms. Viewers are not just watching; they are actively engaging with the competitive landscape through betting, creating a lucrative market for software providers. Secondly, technological advancements are constantly refining the user experience, incorporating features like live in-game betting, enhanced data visualization, and personalized betting options. These improvements attract new bettors and enhance loyalty among existing users. Thirdly, the regulatory landscape is evolving, with various jurisdictions gradually legalizing and regulating esports betting, opening up new markets and boosting investor confidence. This increased legitimacy fosters a more mature and stable market environment. Finally, the strategic partnerships forged between software providers, esports organizations, and betting operators are crucial for market expansion. These collaborations leverage each partner's strengths to deliver comprehensive and engaging betting experiences, attracting a broader range of users. The market is witnessing a shift towards more personalized and data-driven betting solutions, indicating a sophisticated evolution beyond basic wagering platforms. The integration of advanced analytics and AI-powered prediction models is enhancing the overall betting experience and creating new revenue streams for market participants.

Several key factors are accelerating the growth of the esports betting software market. The surging popularity of esports globally is a primary driver. Millions of viewers worldwide tune in to esports competitions, creating a massive potential audience for betting activities. The increasing accessibility of esports betting through mobile apps and user-friendly interfaces further expands the market reach. Furthermore, the development of innovative betting options, such as in-play betting and prop bets, adds excitement and engagement for bettors, leading to higher transaction volumes. Technological advancements, particularly in the areas of data analytics and artificial intelligence, are enabling more accurate predictions and personalized betting experiences, thereby attracting more sophisticated bettors. The expanding regulatory frameworks in various regions are also contributing to market growth by providing a more secure and transparent environment for both operators and players. Finally, the strategic partnerships between esports organizations, betting operators, and software providers are crucial in driving market expansion. These partnerships combine expertise and resources to offer a more comprehensive and attractive betting experience. The combined effect of these factors promises sustained and robust growth for the esports betting software market.

Despite the significant growth potential, the esports betting software market faces several challenges. Regulatory uncertainty remains a major hurdle in many jurisdictions. Varying legal frameworks across different regions create complexities for software providers seeking to operate globally. This necessitates significant investment in legal compliance and navigating diverse regulatory landscapes. Furthermore, the risk of fraud and match-fixing is a persistent concern that requires robust security measures and anti-fraud technologies. Maintaining the integrity of the betting ecosystem is crucial for building trust and attracting users. The intense competition among established software providers and new entrants presents another challenge. Differentiating offerings and securing a competitive edge require constant innovation and investment in research and development. The need to adapt to the ever-evolving technological landscape is also critical. Staying ahead of the curve requires continuous investment in updates, features, and security protocols. Lastly, addressing concerns about responsible gambling and player protection is paramount. Implementing effective measures to promote responsible betting habits is not only ethically crucial but also essential for maintaining the long-term sustainability of the market.

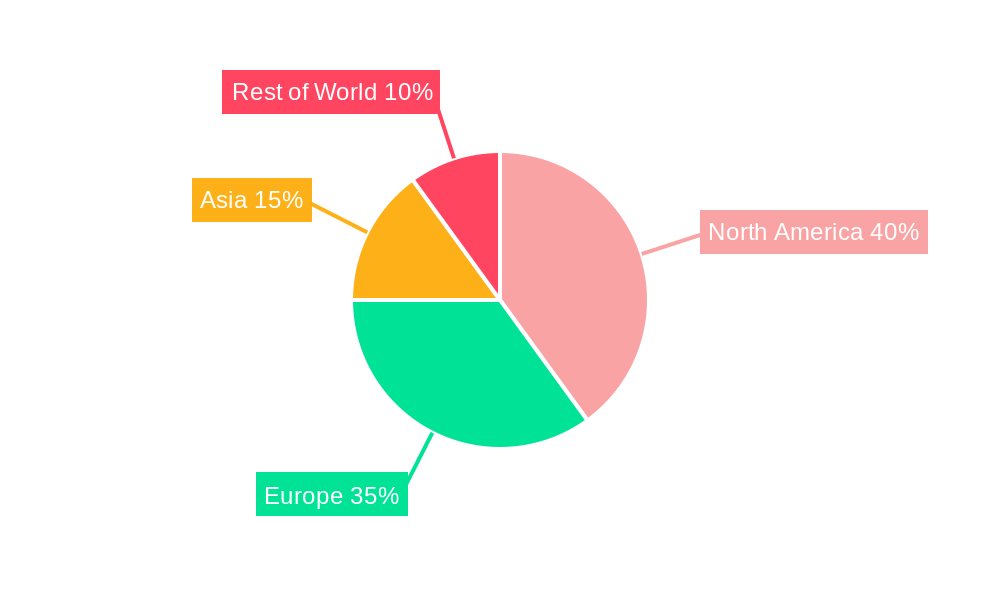

The esports betting software market is geographically diverse, with several regions exhibiting strong growth potential. North America and Europe are currently leading the market, driven by mature gaming cultures, high internet penetration, and relatively relaxed regulatory environments. However, Asia-Pacific is showing significant promise, with rapidly growing esports viewership and a substantial untapped market potential.

In terms of segments, the in-play betting segment is projected to dominate the market due to its high engagement levels. The thrill of real-time betting coupled with sophisticated analytics and data visualization enhances the user experience. Moreover, the mobile betting segment is expected to experience significant growth, driven by the increasing adoption of smartphones and the convenience of mobile betting platforms. The demand for personalized betting experiences, powered by AI and machine learning, is also influencing market segmentation.

The global nature of esports, however, suggests a relatively even distribution of growth across regions in the coming years. The key will be navigating regional regulatory landscapes effectively and catering to specific cultural nuances in the different markets.

The esports betting software industry is propelled by several key catalysts. The ever-expanding esports audience generates immense demand for betting platforms, creating a massive market opportunity. Technological advancements, particularly in AI and data analytics, are enhancing the user experience and attracting sophisticated bettors. The increasing legalization and regulation of esports betting in various jurisdictions fosters a more stable and transparent environment, attracting significant investment and boosting market confidence. Finally, strategic partnerships between software providers, esports organizations, and betting operators amplify market reach and enhance service offerings, driving further growth and adoption.

This report provides a comprehensive analysis of the esports betting software market, covering market size, trends, drivers, challenges, key players, and future outlook. It offers valuable insights for stakeholders looking to understand and capitalize on the growth opportunities within this dynamic sector. The detailed analysis incorporates historical data, current market estimations, and future projections to provide a clear picture of the market landscape. The report also incorporates detailed competitive profiling of leading players, highlighting their strengths, weaknesses, strategies, and market positioning.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Esports Entertainment Group, BetConstruct, Sirplay, GammaStack, EveryMatrix, Bet365, Playtech, Entain, PandaScore, William Hill, Pinnacle, Sbtech, Betvictor, Rivalry Ltd, Gamesys, Midnite, BetOnline, Intertops, Betway, Betfred, Interwetten, EGB, Betfoc, Kambi Group Plc.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Esports Betting Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Esports Betting Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.