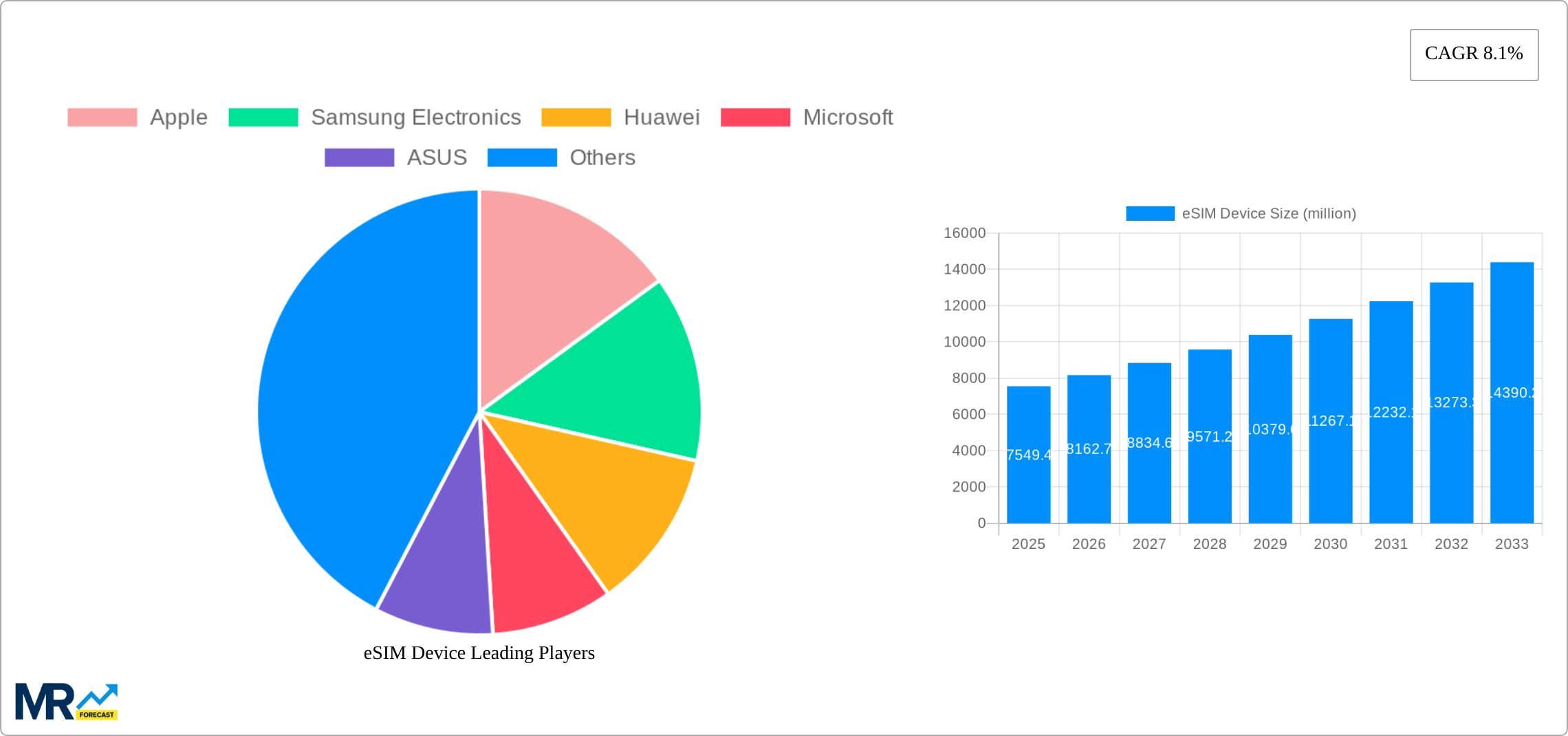

1. What is the projected Compound Annual Growth Rate (CAGR) of the eSIM Device?

The projected CAGR is approximately 8.1%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

eSIM Device

eSIM DeviceeSIM Device by Application (18-24 Years Old, 25-30 Years Old, 30-35 Years Old, 35-40 Years Old, Above 40 Years Old), by Type (eSIM Smart Watch, eSIM Tablet and Notebook, eSIM Smartphone), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

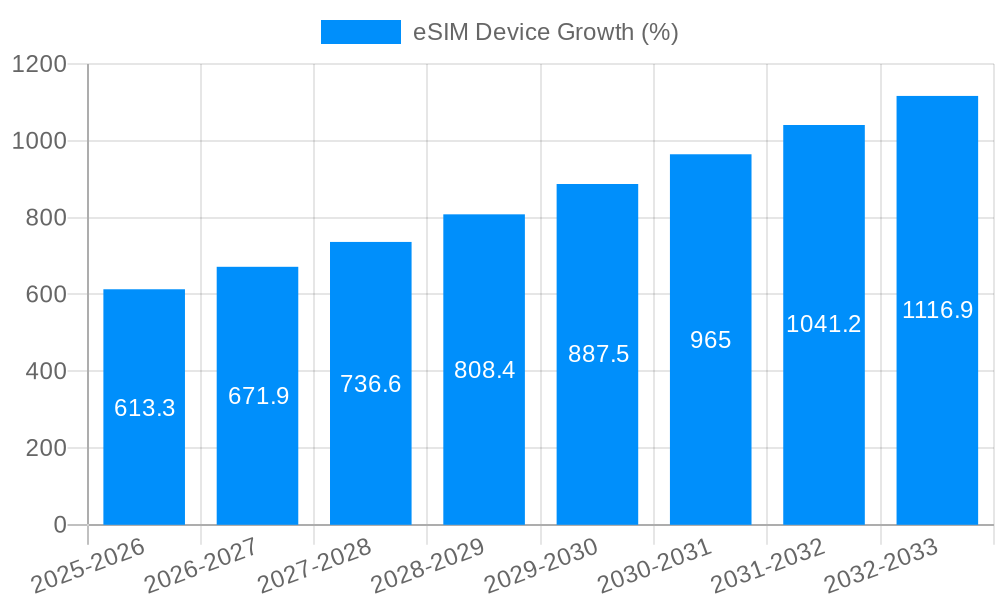

The global eSIM device market, valued at $7,549.4 million in 2025, is projected to experience robust growth, driven by the increasing adoption of IoT devices, the rising demand for seamless connectivity, and the convenience offered by eSIM technology. The market's Compound Annual Growth Rate (CAGR) of 8.1% from 2025 to 2033 indicates a significant expansion, with substantial growth expected across various segments. The age demographic segmentation highlights strong demand across all age groups, suggesting broad market appeal, though the 18-24 and 25-30 year-old segments are likely to demonstrate faster growth given their higher adoption rates of new technologies. The device type segmentation shows strong growth potential across eSIM smartphones, smartwatches, and tablets/notebooks, indicating a diversification of eSIM applications beyond mobile phones. Geographic growth will be driven by increasing smartphone penetration and improving digital infrastructure in developing economies within Asia Pacific, while North America and Europe will continue to hold significant market share due to early adoption and advanced technological infrastructure. Major players like Apple, Samsung, Huawei, and Google are constantly innovating and expanding their eSIM device portfolios, fostering competition and accelerating market growth.

The market's growth trajectory is influenced by several factors. The increasing integration of eSIM technology into wearable devices and IoT applications presents significant opportunities for expansion. Technological advancements, such as improved eSIM security protocols and enhanced network capabilities, are further fueling market growth. However, challenges such as the need for broader consumer awareness, potential security concerns surrounding eSIM technology, and regulatory hurdles in certain regions could pose some limitations to market growth. Nevertheless, the overall market outlook remains positive, indicating substantial potential for eSIM device adoption in the coming years. Future growth will hinge upon continued innovation in device functionalities, a user-friendly experience, and seamless integration with existing telecommunications infrastructure.

The global eSIM device market is experiencing explosive growth, driven by the increasing demand for seamless connectivity and the proliferation of IoT devices. Over the study period (2019-2033), the market has witnessed a significant shift from traditional SIM cards to embedded SIM technology. Our analysis indicates a substantial surge in eSIM adoption across various device categories, with smartphones leading the charge, followed by smartwatches and tablets. The historical period (2019-2024) saw steady but incremental adoption, largely fueled by early adopter enthusiasm and technological advancements that improved eSIM functionality and security. However, the estimated year (2025) marks a critical inflection point, with the market poised for significant expansion. The forecast period (2025-2033) projects continued robust growth, driven by factors such as increasing smartphone penetration, the rise of the Internet of Things (IoT), and the growing preference for flexible and convenient connectivity solutions. By 2033, we anticipate that the market will surpass several million units, significantly exceeding the figures recorded in 2025. Key players like Apple, Samsung, and Huawei are strategically investing in eSIM technology, contributing to its broader acceptance and integration across their product lines. The increasing availability of eSIM profiles from mobile network operators further simplifies the adoption process for end-users. This report will delve into the detailed market segmentation, analysing the application-based user demographics (18-24, 25-30, 30-35, 35-40, and above 40 years old) and the device type-based segments (eSIM Smart Watches, eSIM Tablets & Notebooks, and eSIM Smartphones) to provide a comprehensive understanding of the market dynamics and future prospects. The growth isn't merely about numbers; it's about the fundamental shift in how consumers access and manage mobile connectivity, indicating a move towards a more streamlined and user-friendly experience.

Several key factors are accelerating the adoption of eSIM devices. Firstly, the enhanced convenience offered by eSIMs is a major driver. Users can easily switch mobile plans and carriers without physically changing SIM cards, leading to increased flexibility and reduced hassle. Secondly, the growing popularity of IoT devices, such as smartwatches and trackers, necessitates a smaller, more integrated SIM solution, making eSIMs an ideal choice. The space savings afforded by eSIMs are crucial for these compact devices. Thirdly, the increasing demand for multiple connections on a single device is also fueling the growth. Users often require both personal and professional mobile numbers, and eSIMs facilitate this seamlessly. Moreover, the growing penetration of smartphones, particularly in developing economies, is creating a massive potential market for eSIM technology. The simplification of the activation process and improved security features offered by eSIMs are also contributing to their widespread adoption. Finally, the rising adoption of cloud-based SIM management platforms is making it easier for network operators to manage eSIM profiles remotely, further boosting the market's growth trajectory. These combined factors indicate a sustained and significant upswing in the eSIM device market throughout the forecast period, with millions of units projected to be shipped annually.

Despite the promising growth outlook, several challenges and restraints hinder the widespread adoption of eSIM devices. One major challenge is the lack of widespread eSIM support among mobile network operators globally. While adoption is rapidly increasing, some regions still lack robust eSIM infrastructure, limiting market penetration. The initial higher cost of eSIM-enabled devices compared to traditional SIM-based devices also presents a barrier, particularly in price-sensitive markets. Furthermore, security concerns surrounding eSIM technology remain a point of concern for some users and require thorough addressing by industry stakeholders. Technical complexities in the implementation and management of eSIM profiles can also pose challenges for both operators and manufacturers. Lastly, the need for consumer education and awareness about the benefits and functionalities of eSIMs remains crucial for driving broader acceptance and overcoming initial hesitancy. Addressing these challenges effectively will be critical in unlocking the full market potential of eSIM devices and ensuring sustained growth in the coming years.

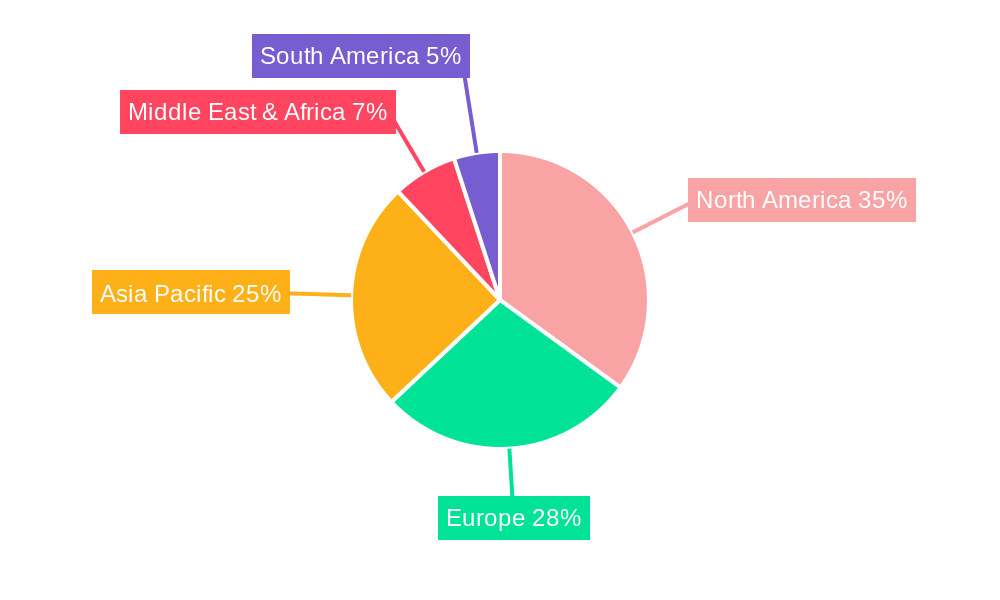

The eSIM device market is expected to be dominated by several key regions and segments in the forecast period.

North America and Western Europe: These regions are anticipated to lead the market due to high smartphone penetration, strong technological infrastructure, and early adoption of eSIM technology. The mature economies, combined with a high disposable income, contribute significantly to eSIM's appeal.

Asia-Pacific: This region is projected to experience significant growth, driven by the rapidly expanding smartphone market in countries like India and China. While initial adoption may be slower compared to developed markets, the sheer scale of the market presents tremendous growth opportunities.

Segment Dominance: The eSIM Smartphone segment will undeniably dominate the market. Smartphones are the most ubiquitous type of eSIM-enabled device, and their continued growth directly fuels the expansion of the overall eSIM market. The 25-30 year-old age demographic represents a significant portion of smartphone users, showing a higher tech adoption rate and contributing heavily to this segment's dominance.

In summary: While numerous markets will experience growth, the combination of high smartphone penetration, advanced infrastructure, and a technologically savvy population makes North America and Western Europe frontrunners. The sheer scale of the Asian market, however, presents massive growth potential. The overall market leadership belongs to the eSIM Smartphone segment and is largely influenced by the 25-30 age group's significant contribution to the market's growth. The interplay of regional and demographic factors will shape the market landscape throughout the forecast period. We project that the growth within each of these segments will be in the millions of units annually.

The eSIM industry's growth is fueled by a confluence of factors. The increasing demand for flexible and convenient connectivity solutions, coupled with the growing proliferation of IoT devices requiring smaller and more efficient SIM technology, is significantly accelerating adoption. Furthermore, technological advancements in eSIM management platforms are simplifying profile activation and management, easing the process for both consumers and mobile network operators. The cost reduction of eSIM-enabled devices also plays a role, making them more accessible to a wider range of consumers. These factors, acting in synergy, are creating a powerful catalyst for sustained and substantial growth in the eSIM device market throughout the forecast period.

This report provides a comprehensive overview of the eSIM device market, including detailed market sizing, segmentation, growth drivers, challenges, and competitive landscape analysis. It offers valuable insights into the dynamics of the market and helps to identify opportunities for growth and investment. The detailed analysis covers historical data, current market estimates, and future projections for the forecast period. This information is critical for businesses and investors seeking to understand and navigate this rapidly expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.1% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 8.1%.

Key companies in the market include Apple, Samsung Electronics, Huawei, Microsoft, ASUS, Lenovo, Google, .

The market segments include Application, Type.

The market size is estimated to be USD 7549.4 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "eSIM Device," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the eSIM Device, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.