1. What is the projected Compound Annual Growth Rate (CAGR) of the ESG Wealth Management Product?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

ESG Wealth Management Product

ESG Wealth Management ProductESG Wealth Management Product by Type (/> ESG Index Funds, ESG Project Fund, ESG-themed Etfs, ESG Bond Funds, ESG Equity Funds, Other Derivatives), by Application (/> Risk Management, Invest and Manage Finances, Corporate Governance, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

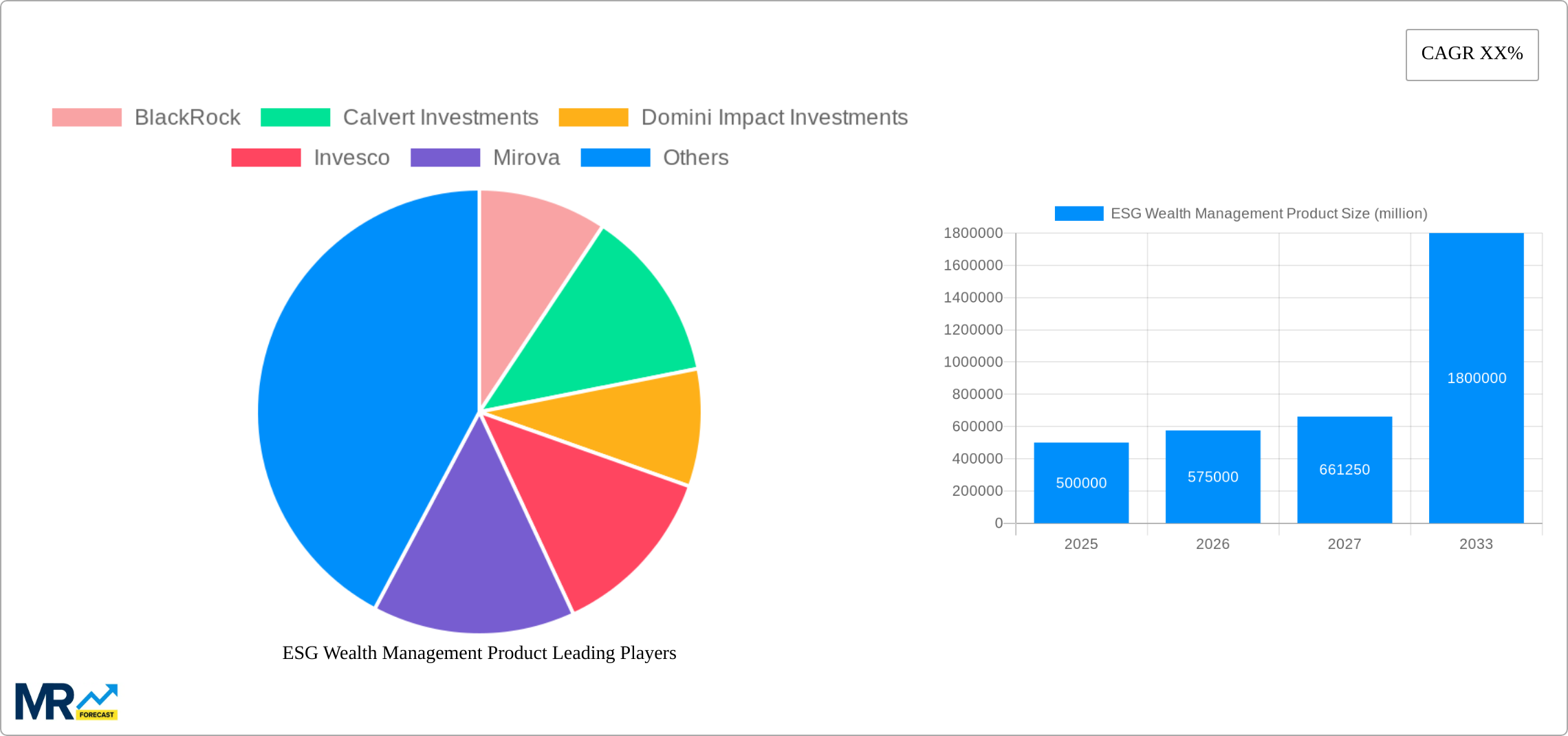

The ESG Wealth Management Product market is projected to experience robust growth, with an estimated market size of $850 million in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 15% through 2033. This significant expansion is driven by increasing investor demand for sustainable and ethical investment options, coupled with a growing awareness of the financial benefits associated with Environmental, Social, and Governance (ESG) integration. Key growth drivers include evolving regulatory landscapes that encourage ESG adoption, a heightened focus on corporate social responsibility, and the demonstrable resilience of ESG-focused portfolios during market volatility. Furthermore, the rising prominence of ESG factors in investment decision-making, alongside the increasing availability of sophisticated ESG data and analytics, are empowering investors to align their financial goals with their personal values.

The market is segmented into various product types, with ESG Equity Funds and ESG Index Funds anticipated to lead in terms of adoption and market share due to their accessibility and broad appeal. ESG Bond Funds are also showing considerable promise as investors seek to finance projects with positive social and environmental impacts. In terms of application, Risk Management and Invest and Manage Finances are primary drivers, highlighting how ESG principles are being integrated not only for ethical reasons but also for enhancing portfolio performance and mitigating long-term risks. Leading companies such as BlackRock, Calvert Investments, and Vanguard are at the forefront of this market, offering innovative ESG solutions and shaping investment strategies. Geographically, North America and Europe are expected to dominate the market, driven by strong investor education, supportive regulatory frameworks, and a mature wealth management ecosystem.

Here is a unique report description for an ESG Wealth Management Product report, incorporating your specified requirements:

The ESG Wealth Management Product market is poised for significant expansion, with projections indicating a robust Compound Annual Growth Rate (CAGR) throughout the study period. From a historical baseline in 2019, the market has witnessed a paradigm shift, moving from niche ethical investing to mainstream financial consideration. By the base year of 2025, the market is estimated to reach a substantial valuation, driven by increasing investor awareness and a growing demand for sustainable and socially responsible investment options. The forecast period, 2025-2033, anticipates sustained growth, fueled by evolving regulatory landscapes, corporate commitment to ESG principles, and the demonstrable financial performance of ESG-aligned assets. Key trends observed include a pronounced shift towards ESG-themed ETFs and ESG Index Funds, offering accessible and diversified exposure to sustainable themes. Furthermore, the rise of ESG Bond Funds reflects a growing appetite for fixed-income instruments that prioritize environmental and social impact alongside financial returns. The integration of ESG factors into traditional wealth management strategies is no longer an outlier but a fundamental component, as investors increasingly seek to align their financial goals with their values. This evolution is reshaping investment portfolios, with a notable increase in the allocation of assets towards products that demonstrably contribute to a more sustainable future. The market's trajectory suggests a future where ESG considerations are intrinsically linked to prudent financial management, with an estimated market size exceeding several hundred million dollars by the close of the forecast period.

Several powerful forces are converging to propel the ESG Wealth Management Product market forward. Primarily, growing investor consciousness plays a pivotal role. Across demographic segments, individuals are increasingly scrutinizing the societal and environmental impact of their investments, seeking to generate positive change alongside financial returns. This heightened awareness is complemented by regulatory tailwinds. Governments worldwide are introducing policies and disclosure requirements that encourage or mandate ESG integration, thereby standardizing practices and fostering greater transparency within the industry. Financial institutions, recognizing this shift in investor sentiment and the potential for long-term value creation, are actively developing and promoting ESG-centric wealth management products. This includes offering a wider array of ESG Index Funds, ESG Equity Funds, and ESG Bond Funds to cater to diverse investor needs. Furthermore, the improving financial performance of ESG-focused companies and funds is a significant catalyst. Evidence suggests that companies with strong ESG credentials often exhibit better operational efficiency, lower risk profiles, and greater resilience, leading to attractive returns for investors. This empirical data is dismantling previous perceptions of ESG as a performance trade-off, solidifying its position as a driver of sustainable financial growth. The demand for ESG Project Funds, aimed at specific impact-driven initiatives, also highlights a maturing market that seeks tangible environmental and social outcomes.

Despite the burgeoning growth, the ESG Wealth Management Product market faces several significant challenges and restraints. A primary concern is the issue of greenwashing, where companies or funds may misrepresent their ESG credentials to attract investors. This lack of standardized and robust ESG data verification can lead to investor skepticism and erode trust in ESG products. The complexity of ESG metrics and reporting standards also presents a hurdle. Investors and advisors may struggle to navigate the myriad of frameworks and data points, making it difficult to accurately assess the true ESG impact of an investment. Furthermore, the nascent stage of some ESG-specific asset classes, such as certain ESG Project Funds or specialized ESG-themed ETFs, may lead to liquidity concerns or higher management fees compared to more established investment vehicles. The current market dynamics also present a challenge, where an over-reliance on certain ESG themes might lead to concentrated portfolios and increased volatility, particularly during market downturns. While ESG Equity Funds and ESG Bond Funds are becoming more mainstream, the development of more sophisticated ESG products, like "Other Derivatives" with embedded ESG features, is still in its early stages, requiring further innovation and market education. Finally, the perceived trade-off between ESG performance and financial returns, although increasingly being debunked, still lingers in the minds of some conservative investors, acting as a restraint on broader adoption.

Several regions and segments are set to dominate the ESG Wealth Management Product market, driven by a confluence of regulatory support, investor demand, and industry innovation.

Key Regions/Countries:

Dominant Segments:

The interplay between these regions and segments, supported by a robust study period from 2019-2033 and an estimated market size in the hundreds of millions of dollars by 2025, indicates a future where ESG wealth management is intrinsically linked to prudent financial decision-making.

The ESG Wealth Management Product industry is experiencing significant growth catalysts. Investor demand for sustainable and ethical investments continues to rise, driven by a growing awareness of global environmental and social challenges. Regulatory frameworks are evolving to encourage ESG integration, promoting transparency and accountability among financial institutions. Furthermore, the demonstrable financial outperformance of many ESG-aligned companies and funds is increasingly attracting mainstream investors, dispelling notions of a performance trade-off. This positive feedback loop, where successful ESG investments encourage further adoption, is a key driver for the market's expansion.

This report offers comprehensive coverage of the ESG Wealth Management Product market, delving into its historical trajectory from 2019 through the estimated base year of 2025 and projecting its growth through 2033. It meticulously analyzes the driving forces behind its expansion, including investor demand and regulatory tailwinds. The report also addresses the critical challenges and restraints such as greenwashing and data complexity. Key market insights are provided, highlighting trends in ESG Index Funds, ESG-themed ETFs, and ESG Bond Funds. Furthermore, the report details the dominant regions and segments, underscoring the importance of applications like Invest and Manage Finances and Corporate Governance. Leading players, significant developments, and the overall estimated market valuation provide a complete picture for stakeholders.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include BlackRock, Calvert Investments, Domini Impact Investments, Invesco, Mirova, Neuberger Berman, Parnassus Investments, Pax World Funds, RobecoSAM, State Street Global Advisors, Trillium Asset Management, UBS Asset Management, Vanguard, Walden Asset Management, WHEB Asset Management, Hamiton Lane, Sumitomo Mitsui DS Asset Management, Pwc, Deloitte, Smart Pension.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "ESG Wealth Management Product," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the ESG Wealth Management Product, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.