1. What is the projected Compound Annual Growth Rate (CAGR) of the ESG Advisory Service?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

ESG Advisory Service

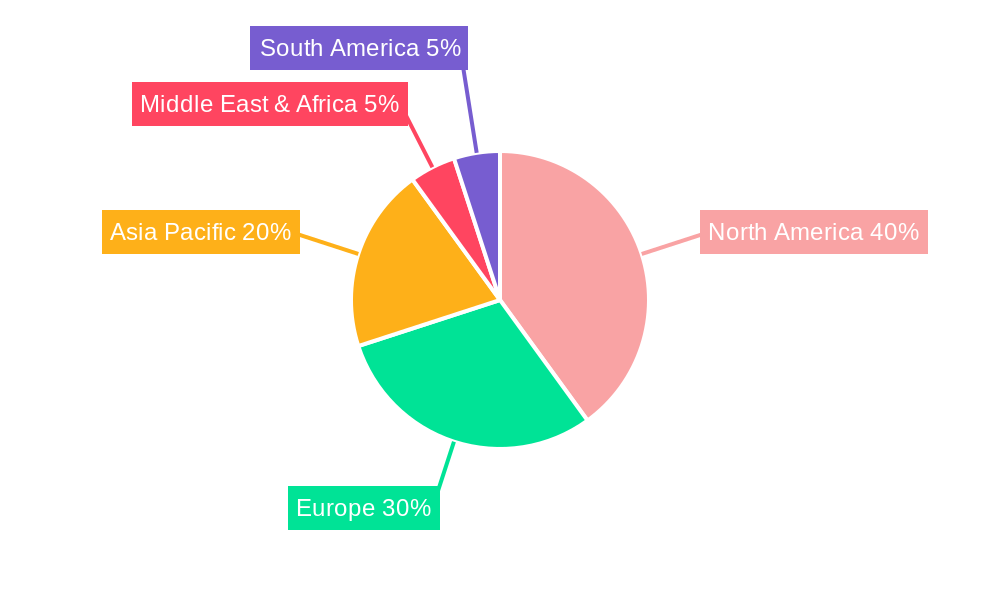

ESG Advisory ServiceESG Advisory Service by Type (Strategy Formulation, Risk Assessment, Performance Measurement, Due Diligence, Others), by Application (Energy and Utilities, Financial Services, Consumer Goods and Retail, Real Estate and Construction, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

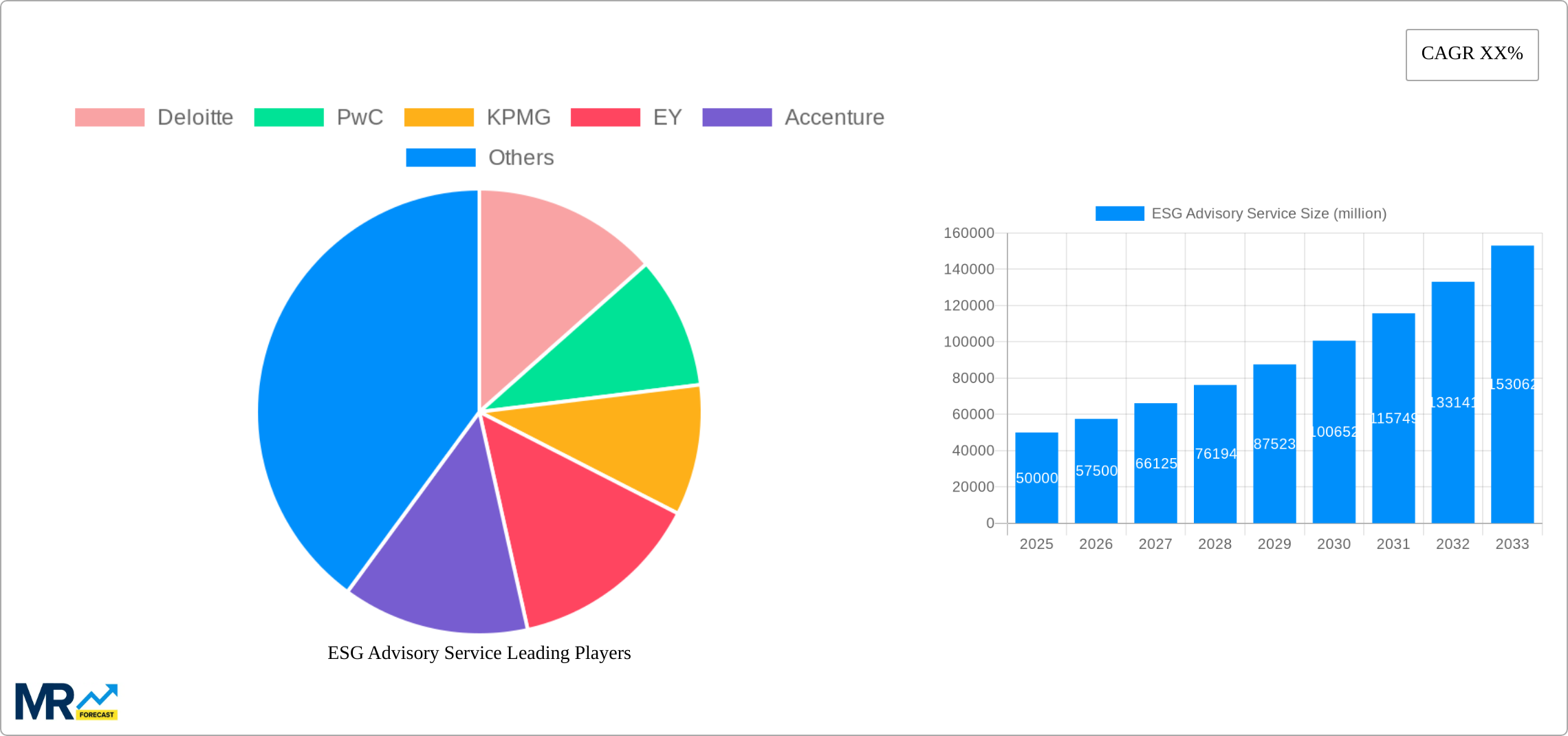

The ESG (Environmental, Social, and Governance) advisory services market is experiencing robust growth, driven by increasing regulatory scrutiny, investor demand for sustainable investments, and heightened consumer awareness of environmental and social issues. The market's expansion is fueled by a rising need for companies to demonstrate their commitment to ESG principles, manage related risks, and improve their overall sustainability performance. This demand is particularly strong across sectors like energy and utilities, financial services, and consumer goods and retail, where ESG considerations are becoming increasingly critical for operational efficiency and brand reputation. The market is characterized by a diverse range of service offerings, including strategy formulation, risk assessment, performance measurement, and due diligence. While large consulting firms like Deloitte, PwC, KPMG, EY, and Accenture dominate the market, a significant number of specialized ESG consultancies and technology providers are also contributing to its growth. The geographical distribution of the market is broad, with North America and Europe currently holding the largest market shares, but significant growth potential exists in Asia-Pacific and other emerging economies. Competitive dynamics are shaped by factors including the breadth of services offered, technological capabilities, industry expertise, and global reach.

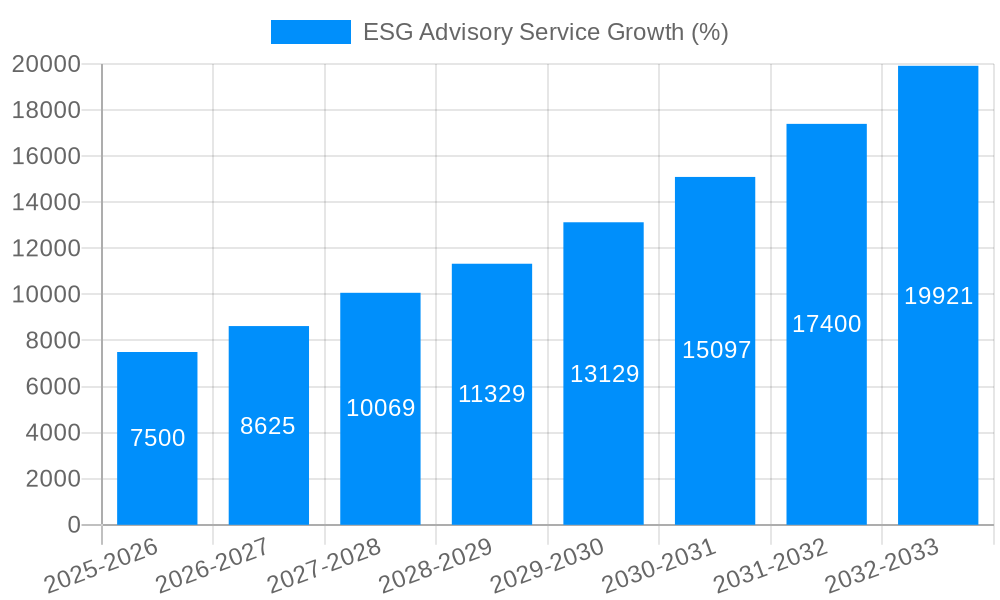

The projected CAGR, although not explicitly provided, can be reasonably estimated based on the current market dynamics and industry reports, suggesting a healthy growth trajectory for the foreseeable future. While precise figures remain confidential to market research providers, a cautious yet optimistic estimate would position the CAGR in the high single-digits to low double-digits. Several factors contribute to this growth including stricter regulations regarding ESG disclosures (e.g., SFDR in Europe, SEC regulations in the US), increased investor pressure to incorporate ESG into investment decisions, and the growing recognition of ESG's contribution to long-term business value. The market faces challenges including the complexity of ESG reporting standards, the need for skilled professionals, and the potential for greenwashing. However, ongoing developments in technology and standardization are poised to mitigate these challenges, further fueling market growth and maturity.

The global ESG advisory services market is experiencing explosive growth, projected to reach \$XXX million by 2033 from \$XXX million in 2025, exhibiting a robust CAGR of XX% during the forecast period (2025-2033). This surge is driven by heightened investor interest in sustainable investments, increasing regulatory scrutiny of ESG performance, and growing consumer demand for ethical and responsible products and services. The historical period (2019-2024) already showcased significant expansion, laying the groundwork for the projected future growth. Key market insights reveal a strong preference for integrated ESG strategies, moving beyond mere compliance to incorporate ESG factors into core business operations. The demand is particularly pronounced across sectors like Energy and Utilities, Financial Services, and Consumer Goods and Retail, where companies are facing pressure to demonstrate their commitment to sustainability. Furthermore, the market is witnessing a shift towards holistic solutions that encompass strategy formulation, risk assessment, performance measurement, and due diligence. This integrated approach underscores the increasing complexity of ESG reporting and the need for comprehensive advisory support. This trend is further fueled by the growing availability of sophisticated ESG data analytics tools and the increasing sophistication of ESG regulations and frameworks globally. The market is also witnessing a rise in the use of technology-driven solutions for ESG data management and reporting which contributes to efficiency and accuracy in ESG performance tracking. The increasing availability of sophisticated ESG data analytics tools and software solutions supports this trend. Finally, the increasing number of specialized ESG consultancies is further driving competition and innovation within the industry, creating a more dynamic and responsive market.

Several key factors are propelling the growth of the ESG advisory services market. Firstly, the escalating pressure from investors and stakeholders for greater transparency and accountability on ESG performance is a dominant driver. Investors are increasingly integrating ESG factors into their investment decisions, rewarding companies with strong ESG profiles and penalizing those with poor performance. This has created a significant demand for expert advice on how to improve ESG ratings and disclosures. Secondly, the tightening regulatory environment globally is forcing companies to comply with more stringent ESG reporting requirements. Governments worldwide are implementing new regulations and frameworks aimed at promoting sustainable business practices and increasing corporate transparency, driving a need for professional guidance to navigate these complex rules. Thirdly, the rise of conscious consumerism is another crucial factor. Consumers are becoming more aware of the environmental and social impacts of their purchasing decisions, leading them to favor companies with robust ESG credentials. This growing consumer demand pushes companies to enhance their ESG performance and seek external support to demonstrate their commitments. Lastly, the increasing availability of sophisticated data analytics and technology solutions is enabling companies to better measure and manage their ESG risks and opportunities. These tools empower companies to make more informed decisions, further increasing demand for the services of skilled ESG advisors who can interpret this data and guide strategic decisions.

Despite the significant growth potential, the ESG advisory services market faces several challenges. One major hurdle is the lack of standardization and harmonization in ESG reporting frameworks. The multitude of different standards and guidelines can create confusion and complexity for companies, making it difficult to compare their performance against others. This also makes it challenging for advisory firms to provide consistent and comparable services across different jurisdictions. Another challenge is the difficulty in measuring and quantifying the impact of ESG initiatives. While qualitative assessments are crucial, translating ESG efforts into tangible, measurable results can be complex, particularly in areas like social impact. This lack of clear metrics can hamper investment decisions and make it difficult to demonstrate the return on investment in ESG initiatives. The scarcity of skilled professionals with expertise in ESG issues is another considerable constraint. The rapid growth of the market has created a demand for experienced advisors that exceeds the current supply. This skills gap contributes to high costs and potentially limits the availability of quality services for smaller companies. Finally, concerns around the credibility and accuracy of ESG data and ratings pose a significant challenge. The lack of robust validation processes and inconsistencies in methodologies can lead to misinterpretations and potentially inaccurate assessments of company performance.

The Financial Services segment is poised to dominate the ESG advisory services market.

In addition, the Energy and Utilities segment displays strong potential, driven by the global transition towards renewable energy sources and increasing sustainability concerns within the sector. The need to navigate evolving regulations around carbon emissions, environmental remediation, and social responsibility within communities heavily impacts these organizations, boosting demand for ESG advisory services.

The ESG advisory service industry's growth is significantly propelled by the increasing focus on sustainable business practices, stricter government regulations mandating ESG disclosures, and heightened investor interest in responsible investments. These factors are collectively driving the demand for specialized advisory support, facilitating strategic planning, risk management, and performance reporting to align with ESG standards.

This report offers a comprehensive analysis of the ESG advisory services market, covering market size, growth trends, key drivers, and challenges. The report also provides detailed insights into key market segments and leading players, along with a forecast for future growth. The information within is designed to offer valuable insights to businesses and investors involved in or interested in this rapidly expanding market.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Deloitte, PwC, KPMG, EY, Accenture, BSR, Sustainalytics, ISS ESG, MSCI ESG Research, GRI, CDP Worldwide, Trucost, DNV GL, RobecoSAM, Corporate Citizenship, ERM, South Pole, BDO, Grant Thornton, Bureau Veritas, SGS, ERM CVS, EcoVadis, Vigeo Eiris, FirstCarbon Solutions, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "ESG Advisory Service," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the ESG Advisory Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.