1. What is the projected Compound Annual Growth Rate (CAGR) of the Equity Management Software?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Equity Management Software

Equity Management SoftwareEquity Management Software by Type (Basic($Under 50/Month), Standard($50-100/Month), Senior(Above $100/Month)), by Application (Start-Ups, Private Corporation, Listed Company, Financial Team, Other), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

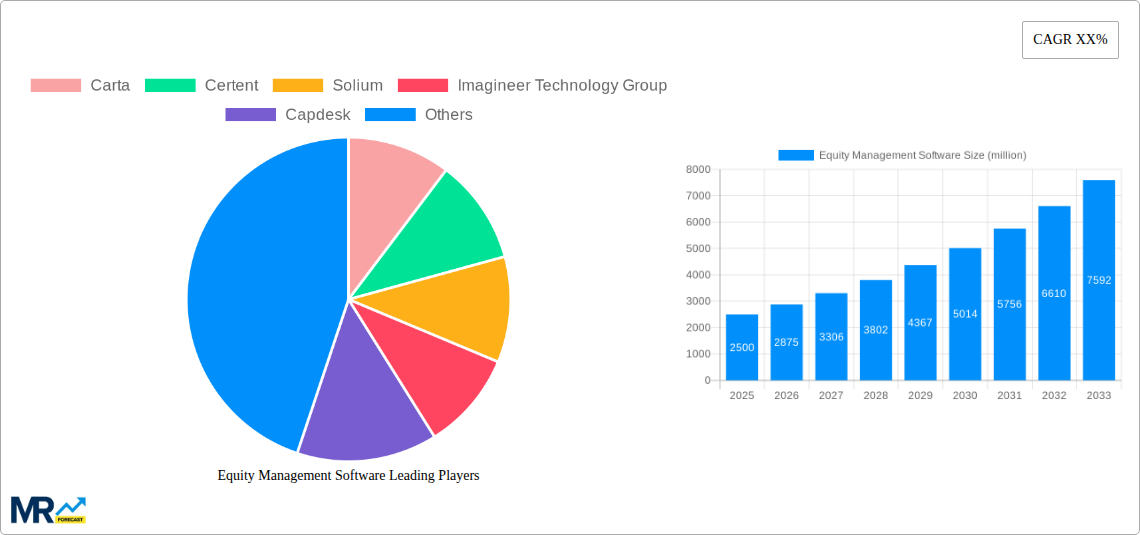

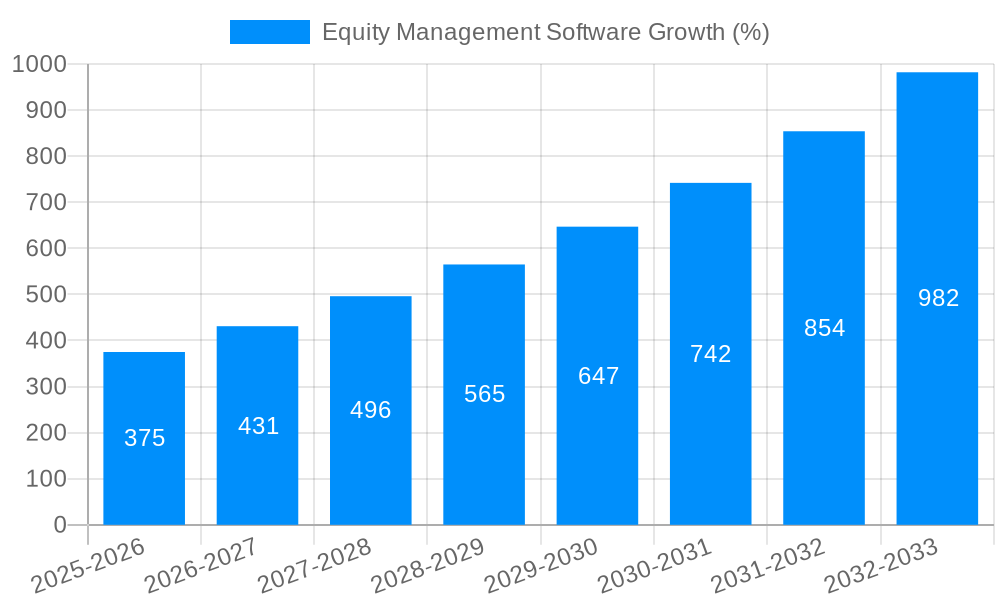

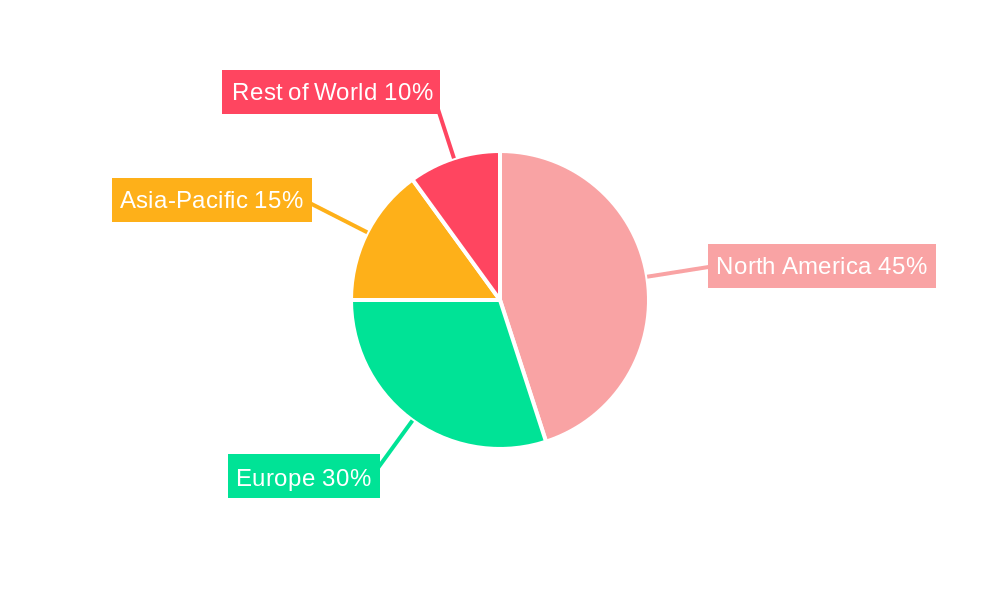

The Equity Management Software market is experiencing robust growth, driven by increasing regulatory compliance needs, the expanding private equity and venture capital landscape, and a rising demand for efficient capitalization table management among startups and established corporations. The market, segmented by pricing tiers (Basic, Standard, Senior) and user type (Start-ups, Private Corporations, Listed Companies, Financial Teams, and Others), shows significant potential across all segments. While precise figures for market size and CAGR are unavailable in the provided data, a reasonable estimation, considering typical SaaS growth rates and the market's inherent dynamics, suggests a 2025 market size in the range of $2.5 billion to $3 billion USD, with a Compound Annual Growth Rate (CAGR) projected between 15% and 20% for the forecast period (2025-2033). The higher-priced "Senior" solutions, catering to larger enterprises and complex equity structures, are likely to demonstrate the fastest growth, fueled by the need for advanced features and robust security. Geographic segmentation reveals a strong presence in North America and Europe, although significant growth opportunities exist in Asia-Pacific and other emerging markets, reflecting the global expansion of venture capital and private equity activities. Competitive forces are intense, with established players like Carta and Computershare vying for market share alongside rapidly growing technology firms. Future growth hinges on continuous innovation in areas such as AI-driven analytics, integration with other financial software, and enhanced security features.

The market's restraining factors are primarily linked to the cost of implementation and ongoing maintenance, particularly for smaller businesses, and the potential integration complexities with existing financial systems. However, the benefits of streamlined equity management—improved operational efficiency, enhanced investor relations, and minimized compliance risks—are increasingly outweighing these challenges. The ongoing evolution of regulatory landscapes will further contribute to the market's growth trajectory, necessitating the adoption of robust and compliant equity management software across various industry sectors. The increasing use of cloud-based solutions is also impacting the market by reducing upfront costs and improving accessibility, thus contributing to its expansion in diverse regions.

The global equity management software market is experiencing robust growth, projected to reach multi-billion dollar valuations by 2033. This surge is driven by several converging factors, including the increasing complexity of equity ownership structures, particularly in rapidly growing startups and privately held corporations. The historical period (2019-2024) witnessed significant adoption, especially among companies seeking streamlined capitalization table management, efficient investor relations, and improved compliance processes. The base year (2025) showcases a market already consolidated, with major players like Carta and Computershare establishing strong positions. However, the forecast period (2025-2033) indicates continued expansion, fueled by technological advancements, expanding regulatory requirements, and the rise of alternative investment strategies. While the basic segment ($Under 50/Month) caters to smaller startups, the standard and senior tiers ($50-100/Month and Above $100/Month respectively) are witnessing the most significant revenue growth as more complex organizations seek advanced features and enhanced security. The market's evolution is marked by a shift towards cloud-based solutions, offering scalability, accessibility, and cost-effectiveness, a trend expected to persist throughout the study period (2019-2033). The increasing demand for integrated platforms that combine equity management with other financial functions, such as accounting and reporting, will also shape the market's future. Furthermore, the expanding use of AI and machine learning in equity management will drive efficiency and accuracy. Overall, the market’s trajectory reflects a clear need for sophisticated solutions to manage the intricacies of modern equity ownership, guaranteeing significant growth opportunities in the coming years.

Several key factors are propelling the growth of the equity management software market. The increasing number of startups and private companies necessitates efficient tools for managing complex cap tables and investor relations. The rising complexity of equity structures, involving various classes of shares and intricate ownership arrangements, requires robust software to ensure accurate record-keeping and compliance. Furthermore, stringent regulatory requirements regarding transparency and reporting drive the demand for sophisticated equity management solutions capable of handling complex compliance needs. The global nature of many businesses, coupled with the increasing use of cross-border investments, necessitates software that can manage equity in multiple jurisdictions. Finally, the ongoing technological advancements, particularly in cloud computing and artificial intelligence, are improving the functionalities and accessibility of equity management software, making it more user-friendly and efficient for companies of all sizes. These factors are collectively creating a strong and sustained demand for advanced equity management software, leading to substantial market expansion.

Despite the significant growth potential, the equity management software market faces certain challenges. The high initial investment cost for implementing sophisticated software can be a barrier for smaller companies. The need for continuous software updates and maintenance to adapt to changing regulations and technological advancements can also pose a considerable financial burden. Data security and privacy concerns are critical, especially considering the sensitive financial and ownership information handled by these systems. Integration with existing financial systems and legacy technologies can also present challenges, requiring significant effort and expertise. Finally, the market is becoming increasingly competitive, with new players entering the space regularly, forcing existing players to continually innovate and improve their offerings to maintain their market share. Overcoming these hurdles will be crucial for sustained market growth and ensuring the long-term success of equity management software providers.

The North American region is expected to dominate the equity management software market throughout the forecast period (2025-2033), driven by a high concentration of startups and venture capital activity. Within the market segmentation, the "Standard" ($50-100/Month) segment is projected to exhibit the fastest growth. This is because it strikes a balance between affordability and functionality, catering to the needs of a broad spectrum of businesses, from rapidly growing startups to established private corporations. While the "Basic" segment will hold a sizable market share, it is the "Standard" tier that's experiencing the most substantial growth as companies scale and require more advanced features.

North America: High concentration of venture capital and private equity firms, leading to a large demand for robust equity management solutions.

Europe: Increasing adoption of cloud-based software and rising regulatory compliance requirements.

Asia-Pacific: Rapid growth of startup ecosystems and increasing foreign investments are driving market expansion.

Standard Segment ($50-100/Month): This segment offers a sweet spot of functionality and cost-effectiveness, appealing to a wide range of businesses in various growth stages. This balanced approach makes it the fastest-growing segment of the market. This contrasts with the Basic segment which attracts smaller companies, and the Senior segment which is more expensive and has lower adoption rates. The Standard segment represents a strong growth catalyst for the entire market, as it captures the majority of companies seeking to improve their equity management processes.

The increasing adoption of cloud-based solutions, the growing demand for enhanced security features, and the integration of artificial intelligence (AI) and machine learning (ML) are key catalysts driving the growth of the equity management software industry. These advancements enhance efficiency, improve accuracy, and ensure compliance, attracting a wider range of businesses to adopt such solutions.

This report provides a comprehensive analysis of the equity management software market, covering historical trends, current market dynamics, and future growth projections. It offers detailed insights into market segmentation, key players, and emerging technologies, providing valuable information for businesses and investors seeking to understand and participate in this rapidly evolving sector. The report incorporates extensive data analysis, including revenue projections and market share estimates, creating a complete picture of the industry landscape for the period 2019-2033.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Carta, Certent, Solium, Imagineer Technology Group, Capdesk, Computershare, Koger, Altvia Solutions, Preqin Solutions, Gust, Global Shares, TruEquity, Eqvista, Euronext, .

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Equity Management Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Equity Management Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.