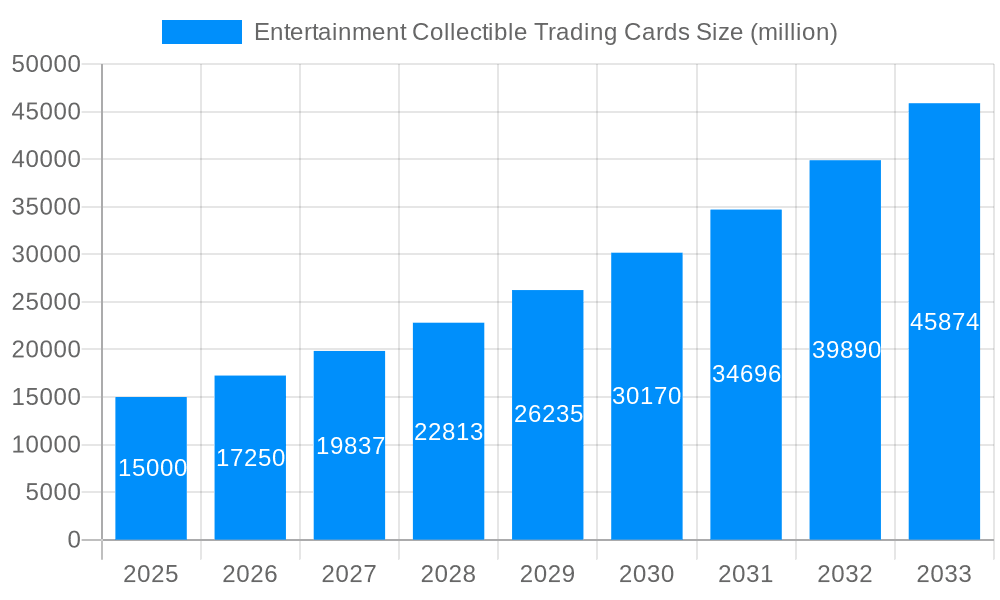

1. What is the projected Compound Annual Growth Rate (CAGR) of the Entertainment Collectible Trading Cards?

The projected CAGR is approximately 7.2%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Entertainment Collectible Trading Cards

Entertainment Collectible Trading CardsEntertainment Collectible Trading Cards by Application (Collector, Game Lover, Others), by Type (Game Card, Sports Card, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

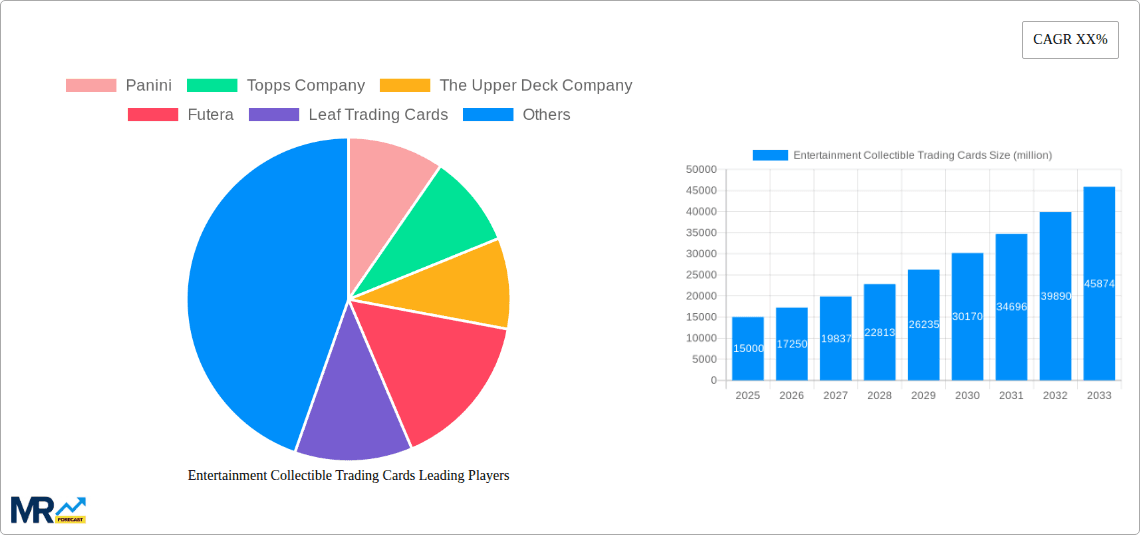

The global entertainment collectible trading card market is experiencing significant expansion, propelled by the sustained passion for collecting, the proliferation of online trading platforms, and the growing interest in associated digital assets. The market is projected to reach $464.2 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.2% from 2025 to 2033. Key growth drivers include the advancement of digital collectibles and the integration of blockchain technology, opening new engagement and investment channels. Strategic marketing by industry leaders such as Panini, Topps, and Upper Deck, alongside the consistent release of coveted cards from popular franchises, sustains robust demand. The market is segmented by application (collectors, gamers, others) and type (game cards, sports cards, others), with sports cards currently dominating. North America and Europe exhibit strong market performance, while the Asia-Pacific region is emerging as a fast-growing area. Potential restraints include the prevalence of counterfeiting and the volatility of collectible values.

Despite these challenges, the market outlook is optimistic. Enhanced accessibility via online marketplaces and the expanding digital collectible ecosystem, including NFTs, are creating new revenue streams and attracting younger consumer segments. Sustained success will depend on strategic collaborations between card manufacturers and entertainment properties to ensure a steady supply of high-demand products and cultivate ongoing community involvement. Future growth is anticipated from increased marketing investment and the development of innovative physical and digital collectible hybrids, balancing traditional collecting with the dynamic potential of the digital landscape.

The entertainment collectible trading card market, valued at millions of units in 2025, exhibits dynamic trends driven by evolving consumer preferences and technological advancements. The historical period (2019-2024) witnessed significant growth fueled by the resurgence of nostalgic properties and the expansion of digital collectibles. The forecast period (2025-2033) projects continued expansion, particularly within specific segments. While traditional sports cards remain a mainstay, the gaming card segment is experiencing explosive growth, driven by the popularity of collectible card games (CCGs) and trading card games (TCGs) like Pokémon and Magic: The Gathering. The collector segment continues to be a dominant force, with dedicated individuals investing heavily in rare and valuable cards. However, the market is witnessing a shift towards younger demographics, who engage with cards through online platforms, social media communities, and integrated digital experiences. This integration of physical and digital aspects creates new avenues for engagement and monetization. The rise of e-commerce and online marketplaces has significantly impacted distribution and access to cards, creating a globalized market with increased liquidity. Furthermore, the market is responding to changing demands by producing cards with enhanced features, such as augmented reality (AR) integration, limited-edition releases, and exclusive artwork. This trend contributes to increased collectibility and value. The market is also seeing an increasing focus on ethical sourcing and sustainability within its production processes. Overall, the market is characterized by a dynamic interplay of nostalgia, digital innovation, and evolving consumer behavior, promising substantial growth in the years to come.

Several key factors are propelling the growth of the entertainment collectible trading card market. The enduring appeal of nostalgia plays a significant role, with established franchises like Pokémon and Yu-Gi-Oh! continuing to attract new generations of collectors and players. Furthermore, the rise of digital collectibles and NFTs is blurring the lines between physical and virtual ownership, creating new opportunities for engagement and investment. The increasing popularity of collectible card games (CCGs) and trading card games (TCGs), both online and offline, is another crucial driver. These games foster strong communities and provide continuous opportunities for engagement, with new card releases and events constantly creating demand. The accessibility of these games and the ease of joining online communities further enhance the market's appeal. Additionally, the robust secondary market for trading cards allows collectors to buy, sell, and trade cards, increasing liquidity and further boosting demand. Finally, strategic marketing campaigns by major players, leveraging social media and influencer collaborations, play a significant part in generating interest and driving sales among younger demographics. The combination of these factors ensures that the market maintains considerable momentum.

Despite its considerable growth, the entertainment collectible trading card market faces certain challenges and restraints. The industry is susceptible to market fluctuations and speculative bubbles, with potential price volatility impacting both collectors and investors. Counterfeit cards remain a persistent problem, eroding consumer trust and potentially damaging the market's integrity. Furthermore, the cost of production, particularly for high-end cards with intricate artwork and rare materials, can be substantial, impacting profitability margins. Maintaining consumer engagement and attracting new demographics in the face of competing entertainment options requires constant innovation and marketing investment. Additionally, environmental concerns surrounding the production and disposal of cards are increasingly relevant and require the industry to adapt towards more sustainable practices. Lastly, the increasing complexity of regulations around the global trade of collectibles poses a logistical and legal challenge to companies. Addressing these challenges is essential to ensure the long-term health and sustainability of the market.

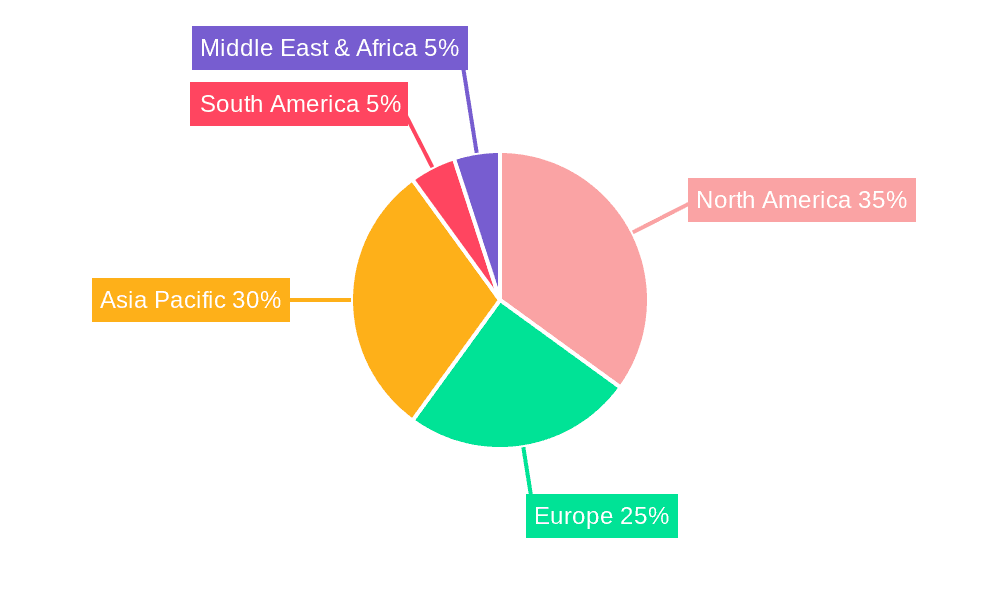

The North American market, particularly the United States, is expected to dominate the entertainment collectible trading card market throughout the forecast period (2025-2033). This dominance stems from a strong established collector base, a robust secondary market, and a high level of engagement with TCGs and CCGs. The substantial revenue generated from the sale of both new and used cards contributes significantly to overall market value.

North America's Dominance: High disposable income, a strong culture of collecting, and a high degree of access to online platforms contribute to this region's significant market share. The presence of major players headquartered within the region also supports robust market activity.

Asia-Pacific's Growth Potential: While North America currently leads, the Asia-Pacific region presents significant growth potential, driven by a large population, expanding middle class, and rising interest in gaming culture. Countries like Japan and South Korea, with well-established trading card gaming communities, demonstrate significant market vitality.

Europe's Stable Market: Europe maintains a relatively stable and sizable market share, driven by mature collecting traditions and a diverse range of card types and franchises.

Dominant Segment: Game Card

The game card segment is poised for significant growth, surpassing other segments in market value. The popularity of TCGs and CCGs like Magic: The Gathering and Pokémon, which offer continuous engagement through expansion sets, tournaments, and online platforms, drives this growth.

Game Card's Appeal: The interactive nature of these cards, offering strategic gameplay and opportunities for social interaction, fuels strong consumer demand, regardless of age range.

Expansion Sets and Tournaments: Continuous releases of new sets and organized tournaments further stimulate demand by creating a sense of scarcity and competition, influencing collector behavior.

Digital Integration: The integration of digital elements, such as online card games and NFT integration, expands the market's reach and appeal to younger generations.

Several factors are acting as catalysts for growth in the entertainment collectible trading card market. The increasing popularity of e-sports and online gaming directly fuels the demand for gaming-related cards. The ongoing integration of digital technologies, such as AR and NFTs, significantly enhances the collector experience, expanding market reach and value. Strategic partnerships between card manufacturers and popular entertainment franchises create highly sought-after collectibles. Finally, the robust secondary market, fueled by online marketplaces and auction houses, provides liquidity and access for a wider range of collectors and investors.

This report provides a comprehensive analysis of the entertainment collectible trading card market, covering historical performance (2019-2024), current estimates (2025), and future projections (2025-2033). It delves into market trends, driving forces, challenges, and key players, providing valuable insights for investors, industry stakeholders, and collectors. The report segments the market based on application (collector, game lover, others), type (game card, sports card, others), and key geographic regions, offering a granular understanding of market dynamics. The in-depth analysis helps to identify growth opportunities and potential risks within this dynamic and evolving market.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.2%.

Key companies in the market include Panini, Topps Company, The Upper Deck Company, Futera, Leaf Trading Cards, Hasbro Inc., Konami Holdings Corporation, Bandai, The Pokémon Company, Blizzard Entertainment, Upper Deck Company, Bushiroad, .

The market segments include Application, Type.

The market size is estimated to be USD 464.2 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion and volume, measured in K.

Yes, the market keyword associated with the report is "Entertainment Collectible Trading Cards," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Entertainment Collectible Trading Cards, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.