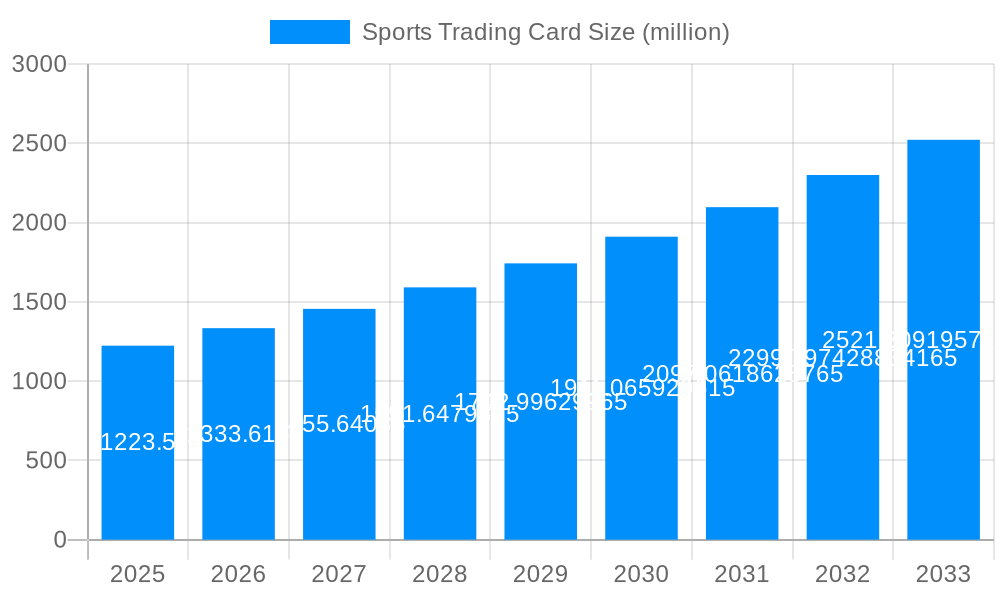

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sports Trading Card?

The projected CAGR is approximately 7.9%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Sports Trading Card

Sports Trading CardSports Trading Card by Type (Physical Sport Trading Card, Digital Sport Trading Card), by Application (American Football, Baseball, Basketball, Association Football, Hockey, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

The global sports trading card market is poised for significant expansion, projected to reach $7.8 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.9% from 2025 to 2033. This growth is propelled by the burgeoning popularity of fantasy sports and the inherent collectibility of trading cards, particularly among younger demographics. The advent of digital trading cards, leveraging blockchain and NFTs, is unlocking new engagement and investment avenues. Strategic alliances between sports entities and card publishers are amplifying brand awareness and collector appeal. Furthermore, market penetration into emerging economies with rising disposable incomes is a key growth driver. While challenges like counterfeiting and secondary market volatility persist, the market outlook remains optimistic. Physical cards currently lead, but digital counterparts are rapidly gaining momentum. American Football, Baseball, and Basketball remain dominant application segments due to established fan bases and robust collector ecosystems.

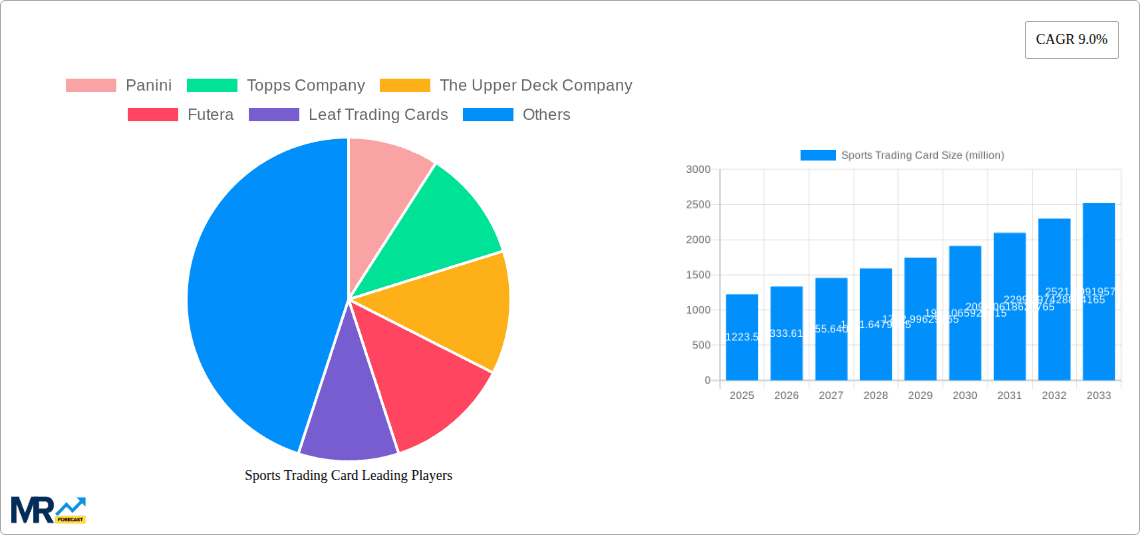

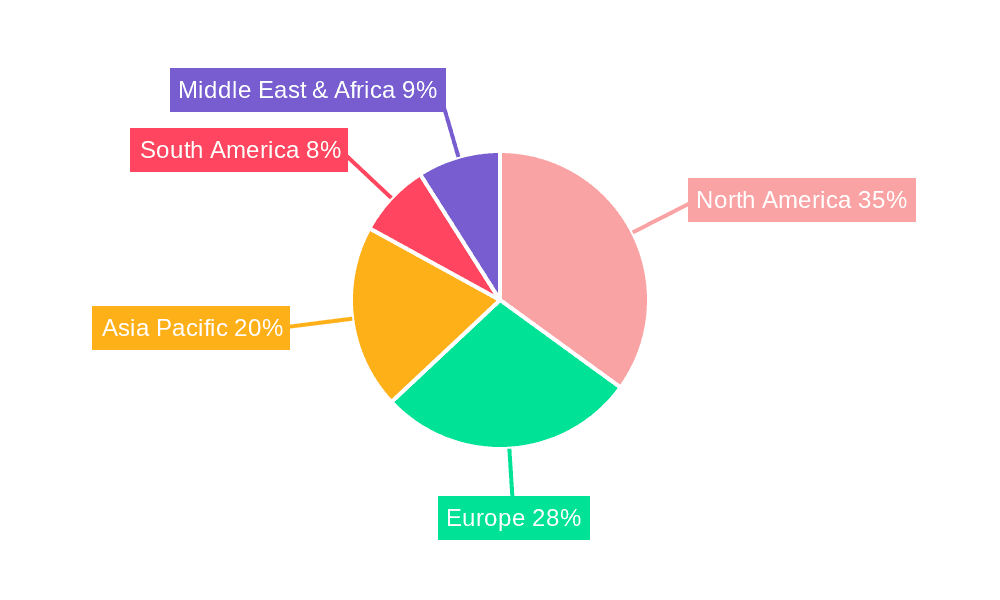

North America leads regional market share, attributed to major sports leagues and a mature collector culture. Europe and Asia-Pacific present substantial growth potential, fueled by increasing interest in both physical and digital sports collectibles. Leading players including Panini, Topps, Upper Deck, Futera, and Leaf Trading Cards are driving market dynamics through innovation, strategic collaborations, and targeted marketing. Key considerations for market participants include intensifying competition and the necessity of agile inventory management to navigate market fluctuations. Sustained growth hinges on embracing digital technologies, forging effective partnerships, and developing innovative products aligned with evolving consumer demands.

The sports trading card market, valued at approximately $XX billion in 2024, is experiencing explosive growth, projected to reach over $XXX billion by 2033. This surge is driven by a confluence of factors, including the increasing popularity of digital trading cards, the resurgence of interest in physical collectibles among millennials and Gen Z, and the strategic investments made by major players in the industry. The market is witnessing a fascinating interplay between traditional physical cards and the burgeoning digital realm, leading to innovative hybrid models that blur the lines between tangible and virtual ownership. The appeal extends beyond mere collecting; cards have become investment vehicles, with rare and highly sought-after cards fetching millions of dollars at auctions. This trend is further fueled by the growing influence of social media and online communities, where collectors connect, share their finds, and fuel the market's enthusiasm. Furthermore, the successful integration of blockchain technology and NFTs (Non-Fungible Tokens) has introduced a new level of authenticity and ownership verification, enhancing the value and appeal of digital cards and, to some extent, influencing the physical card market. The market's segmentation into various sports—American football, basketball, baseball, soccer (association football), and hockey—reflects the diverse preferences of collectors, with some sports consistently driving higher demand and value than others. This dynamic landscape promises continued growth, with potential disruption from new technologies and ever-evolving collector interests shaping the future of this vibrant market. The shift in collecting from a primarily child-centric hobby to a more broadly appealing investment and passion project is a crucial element of this growth trajectory.

Several key factors are propelling the growth of the sports trading card market. The rise of digital trading cards, offering accessibility, lower entry costs, and unique digital features, has broadened the collector base significantly. The nostalgia associated with physical cards, coupled with their perceived tangible value and potential for appreciation, continues to draw in collectors of all ages. The increasing integration of NFTs and blockchain technology provides a new level of authenticity and ownership verification, enhancing trust and increasing the perceived value of digital assets. Successful marketing and partnerships between trading card companies and sports leagues/teams, particularly leveraging celebrity endorsements, have effectively fueled increased interest and demand. Moreover, the flourishing online communities and social media platforms dedicated to trading cards create a strong sense of community, fostering engagement, information sharing, and market liquidity. The investment potential of rare and valuable cards, with prices reaching millions, draws both seasoned investors and hobbyists, further fueling the market’s expansion. The strategic acquisitions and mergers within the industry signal a consolidation of market share and further investment in innovation and marketing, consolidating market power and driving growth.

Despite its significant growth, the sports trading card market faces several challenges. The volatility of the market, susceptible to speculative bubbles and sudden price fluctuations, poses risks for investors. Counterfeit cards represent a considerable threat to the authenticity and integrity of the market, potentially eroding consumer confidence. Regulatory uncertainty surrounding digital trading cards and NFTs, particularly concerning taxation and intellectual property rights, creates complexities for businesses and collectors alike. The accessibility of digital trading cards, while expanding the market, also presents challenges in terms of managing and securing digital assets. Furthermore, environmental concerns associated with the production of physical cards and their packaging are increasingly important considerations, potentially leading to stricter regulations and consumer preference shifts. Finally, the inherent dependence on the performance and popularity of individual athletes and teams can impact demand for specific cards, creating uncertainty and potential market downturns.

The United States is currently the dominant market for sports trading cards, accounting for a significant portion of global sales. This dominance is primarily due to the immense popularity of major American sports leagues (NFL, NBA, MLB) and the strong collector culture within the country.

Physical Sport Trading Cards: This segment maintains a significant share of the market. The tangible nature of physical cards, the potential for grading and certification, and the thrill of the hunt continue to appeal to a large segment of collectors. Within the physical card market, cards associated with popular American sports like basketball and baseball command the highest prices and attract significant collector interest.

Digital Sport Trading Cards: The digital segment is experiencing rapid growth. Its lower barrier to entry, accessibility through mobile apps, and the integration of NFTs are expanding the collector base, with significant potential for future dominance. While digital trading cards are becoming increasingly popular globally, the U.S market currently leads in both adoption rates and overall value.

The North American market exhibits robust growth, driven largely by the US. However, Asian markets, particularly Japan and China, are showing a significant increase in interest and participation, fueled by growing disposable incomes and the increasing popularity of sports and digital collectibles. Europe, especially the UK and Germany, also demonstrates promising growth potential, although the market remains slightly smaller compared to North America. The future likely holds a continued dominant role for the US market in both physical and digital segments, however, the global market's expansion is significant, especially with Asian markets showing increasingly strong growth potential.

Several factors are actively accelerating the growth of the sports trading card market. The continued rise in popularity of digital trading cards, driven by technological advancements and broader adoption, is a crucial catalyst. Strategic partnerships between trading card companies and sports leagues create mutually beneficial marketing and distribution channels, expanding the reach and appeal of trading cards. The evolving investment potential of rare and valuable cards attracts new collectors and investors, boosting market volume. Furthermore, an expansion of the digital collectibles space and the rise of new platforms for buying and selling, both digital and physical cards. These various factors combine to create a powerful synergy that ensures continued market expansion.

This report provides a comprehensive overview of the sports trading card market, covering market size and segmentation, key growth drivers and challenges, leading players, and significant industry developments. The detailed analysis within this report offers a detailed understanding of current market dynamics and future growth potential. This report includes forecasts for the next decade, allowing investors and industry stakeholders to make informed strategic decisions. It combines historical data with future projections, providing a holistic view of the ever-evolving sports trading card market. The report meticulously dissects the significant shift from a niche hobby to a major collectible market, incorporating the influence of digital innovation and investment potential.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 7.9%.

Key companies in the market include Panini, Topps Company, The Upper Deck Company, Futera, Leaf Trading Cards, .

The market segments include Type, Application.

The market size is estimated to be USD 7.8 billion as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in billion.

Yes, the market keyword associated with the report is "Sports Trading Card," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Sports Trading Card, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.