1. What is the projected Compound Annual Growth Rate (CAGR) of the Entertainment and Media?

The projected CAGR is approximately 5.6%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Entertainment and Media

Entertainment and MediaEntertainment and Media by Application (Wire, Wireless, Others), by Type (Film, Music, Social Media, Video & Animation, Video Games, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2026-2034

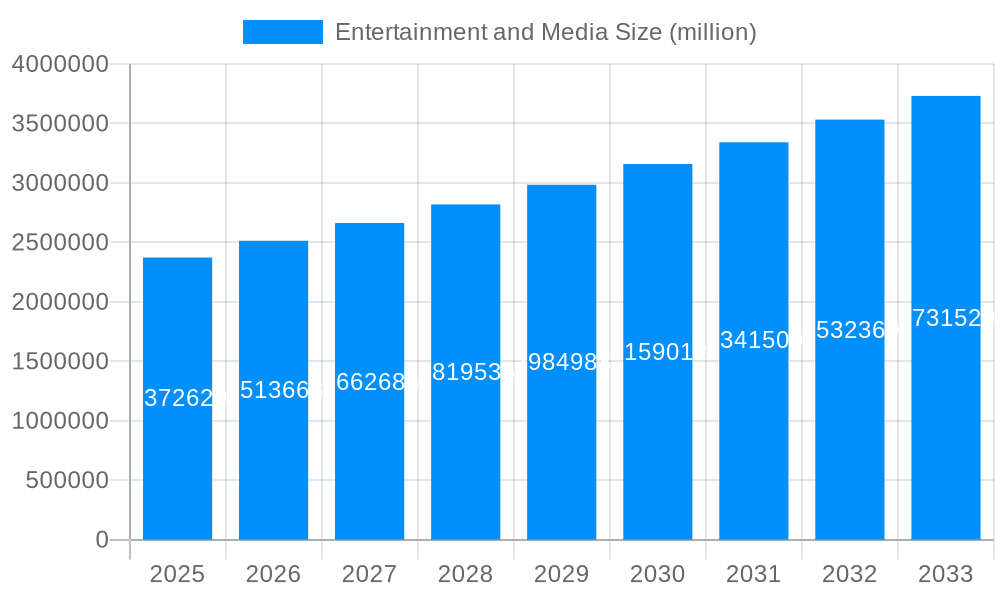

The global entertainment and media market, valued at $2,372,620 million in 2025, is projected to experience robust growth, driven by several key factors. The increasing adoption of streaming services across diverse platforms (Film, Music, Social Media, Video & Animation, Video Games) fuels this expansion, particularly among younger demographics. Technological advancements, such as enhanced virtual reality (VR) and augmented reality (AR) experiences within video games and entertainment applications, are further catalyzing market growth. The rise of mobile gaming and the proliferation of mobile-first content consumption significantly contribute to the market's expansion, particularly in emerging markets. Growth is also propelled by rising disposable incomes in developing economies, enabling greater access to premium entertainment content and experiences. However, challenges such as piracy, regulatory hurdles in certain regions, and fluctuating advertising revenues pose potential restraints on market growth. Segment-wise, the wireless application segment is expected to dominate due to increased smartphone penetration and improved internet connectivity globally. Within content types, the video & animation segment shows high potential due to increasing demand for high-quality streaming content and the expansion of over-the-top (OTT) platforms. Key players such as Comcast, Disney, and Netflix (implied based on industry knowledge) continue to invest heavily in content creation and distribution to maintain their market leadership.

Geographic distribution shows North America and Europe holding significant market share currently, owing to high levels of disposable income and technological infrastructure. However, rapid growth is expected in Asia-Pacific regions, particularly China and India, driven by burgeoning middle classes and increasing internet penetration. The forecast period (2025-2033) anticipates a continued upward trajectory, albeit at a potentially moderating CAGR, as the market matures and saturation in certain segments becomes more apparent. Competition will remain fierce, with established players and new entrants vying for market share through innovative content, technological advancements, and strategic partnerships. Sustained growth hinges on successful content diversification, agile adaptation to evolving consumer preferences, and effective management of piracy and regulatory complexities. Successful navigation of these factors will be crucial in ensuring the entertainment and media market maintains its trajectory of growth and profitability over the next decade.

The global entertainment and media industry, valued at $2.3 trillion in 2024, is undergoing a period of rapid transformation fueled by technological advancements, shifting consumer preferences, and evolving business models. The study period of 2019-2033 reveals a dynamic landscape where digital platforms are disrupting traditional media, fostering unprecedented levels of content consumption and competition. Streaming services like Netflix, YouTube, and emerging platforms like Bilibili have reshaped viewing habits, while social media platforms like Facebook, Instagram, and TikTok have become integral to content creation and distribution. The increasing convergence of technology and entertainment has led to the rise of immersive experiences like virtual reality (VR) and augmented reality (AR), expanding the possibilities for storytelling and interaction. The historical period (2019-2024) saw significant growth in online video and gaming, while the forecast period (2025-2033) projects continued expansion, albeit at a potentially slower rate due to market saturation in certain segments. By 2033, we anticipate further consolidation within the industry, with large conglomerates like Comcast, Disney, and Bertelsmann leveraging their diverse portfolios to maintain dominance. The estimated value for 2025 shows a significant jump from previous years, fueled by increased adoption of streaming services and continued growth in the gaming sector. However, challenges remain, particularly concerning the monetization of digital content and navigating evolving regulatory landscapes. The key market insight here is the persistent need for adaptation and innovation to thrive in this rapidly changing environment. Successful players will be those that can effectively leverage data analytics to understand consumer preferences, invest in high-quality content, and strategically navigate the complexities of the digital ecosystem. This report's analysis of the market from 2019 to 2033, with a focus on the base year 2025, provides a comprehensive view of these trends and their implications. This growth is not uniform across all segments; certain niche areas, particularly within video games and specialized streaming services, show exceptional promise. The overall picture points to a continued rise in the market's value, but with the expectation of a more nuanced and differentiated market landscape in the years to come.

Several key factors are driving the growth of the entertainment and media industry. Firstly, the proliferation of affordable and readily accessible internet and mobile devices has dramatically increased content consumption across all segments. This accessibility has fueled the rise of streaming services and online gaming, creating new avenues for content creation and distribution. Secondly, the increasing demand for personalized and immersive content experiences is driving innovation in areas like VR and AR, pushing the boundaries of storytelling and engagement. The personalization features offered by streaming platforms cater to individual tastes, further driving user engagement. Thirdly, the rise of social media has transformed the way content is created, shared, and consumed, turning everyday users into content creators and influencers. This user-generated content adds to the overall volume and diversity of available entertainment. Finally, technological advancements in areas like artificial intelligence (AI) and machine learning are enhancing content creation, personalization, and distribution efficiency. AI powers recommendation engines on streaming services and improves the efficiency of content production pipelines. These factors collectively contribute to the industry's robust growth, creating new opportunities and challenges for existing and emerging players alike. The interplay of these factors creates a dynamic environment that will continue to reshape the entertainment and media landscape in the coming years.

Despite its robust growth, the entertainment and media industry faces several challenges. Firstly, increasing competition, particularly from new streaming services and digital platforms, puts pressure on margins and forces established players to innovate and adapt constantly. The high cost of content production, coupled with the need to secure exclusive rights, poses a significant hurdle for many companies. Secondly, the evolving regulatory landscape, particularly concerning data privacy, content regulation, and intellectual property rights, creates uncertainty and compliance costs. Navigating differing regulations across various jurisdictions presents a complex challenge. Thirdly, the issue of content piracy continues to threaten revenue streams, particularly for film and music companies. Combating piracy requires ongoing investment in anti-piracy technologies and legal actions. Fourthly, maintaining a sustainable business model in a digital world where users are increasingly accustomed to free or low-cost content is a key challenge. Balancing user expectations with the need for profitability necessitates creative monetization strategies. Finally, attracting and retaining top talent in a competitive environment, especially in creative fields, requires significant investment in human capital and benefits. Overcoming these challenges requires a strategic approach focusing on innovation, diversification, and effective adaptation to the ever-changing digital environment.

The North American and Asia-Pacific regions are poised to dominate the entertainment and media market during the forecast period (2025-2033). Within these regions, the video & animation segment shows exceptional growth potential.

North America: The mature and technologically advanced market in North America provides fertile ground for the expansion of streaming services and the adoption of new technologies like VR and AR. High internet penetration rates and a strong consumer spending power fuel this growth. The US, specifically, continues to be a major content producer and consumer, significantly influencing global trends. The high disposable income contributes to the widespread adoption of premium streaming services and gaming subscriptions.

Asia-Pacific: The explosive growth of internet users in this region, particularly in countries like China and India, has created a massive market for online entertainment. The emergence of local streaming platforms and the increasing popularity of mobile gaming significantly contribute to the segment's expansion. China's rapidly evolving digital landscape and India's burgeoning middle class are key drivers of this expansion.

Video & Animation: The video & animation segment, encompassing film, television, animation, and streaming video, experiences consistent high growth. This is driven by factors like increased demand for high-quality content across multiple platforms, technological advances in animation and visual effects, and the proliferation of streaming services offering diverse genres and formats. The growth is further fueled by an increasingly globalized audience and the availability of high-speed internet that allows access to high-quality streaming video content.

The dominance of these regions and segments is expected to continue, fueled by ongoing technological advancements and evolving consumer preferences. However, other regions, such as Europe and Latin America, are also witnessing significant growth, albeit at a slower pace compared to North America and Asia-Pacific. The specific dynamics within each segment vary across regions, making a nuanced understanding of local market characteristics vital for success.

Several factors will continue to fuel growth in the entertainment and media industry. The increasing adoption of 5G technology will enable seamless streaming of high-quality content, enhancing user experience. Advancements in Artificial Intelligence (AI) will personalize content recommendations and improve content production efficiency. Finally, the continued expansion of the global middle class will create new markets and opportunities for content producers and distributors. These catalysts, coupled with the ongoing innovation in content formats and technologies, will further drive the industry's expansion in the coming years.

This report provides a detailed analysis of the entertainment and media industry, covering historical trends, current market dynamics, and future growth projections. It offers key insights into the factors driving industry growth, the challenges faced by industry players, and the leading companies shaping the future of entertainment. The report's focus on key segments and geographic regions provides a nuanced understanding of the industry's complex landscape, valuable for strategic planning and informed decision-making.

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.6%.

Key companies in the market include Comcast, Walt Disney, Bertelsmann, Viacom, Vivendi, Lagardère, News Corporation, BBC, Televisa, The New York Times, HBO, Yotube, Bilibili, .

The market segments include Application, Type.

The market size is estimated to be USD 2372620 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Entertainment and Media," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Entertainment and Media, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.