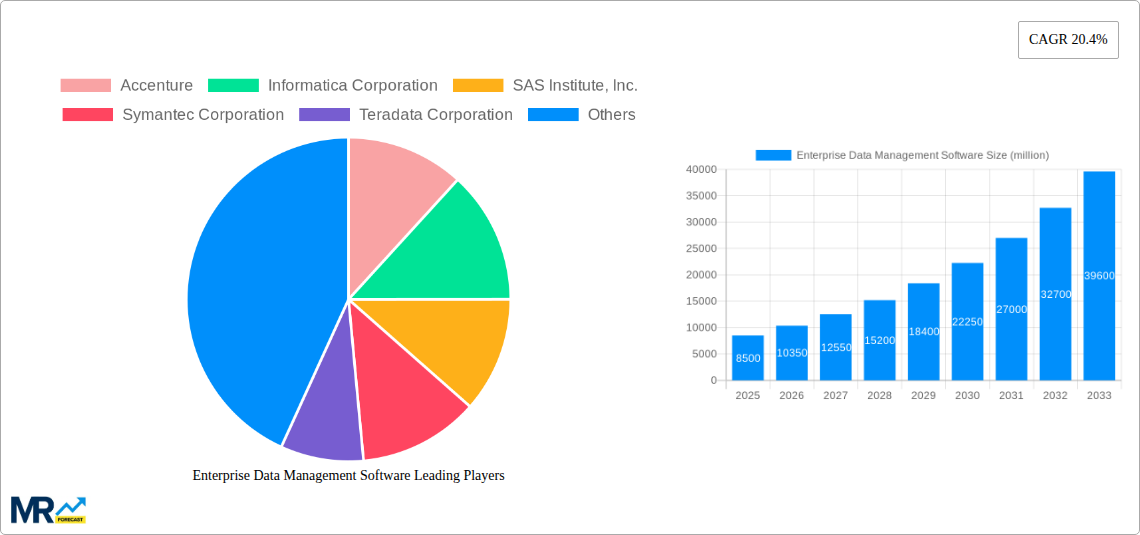

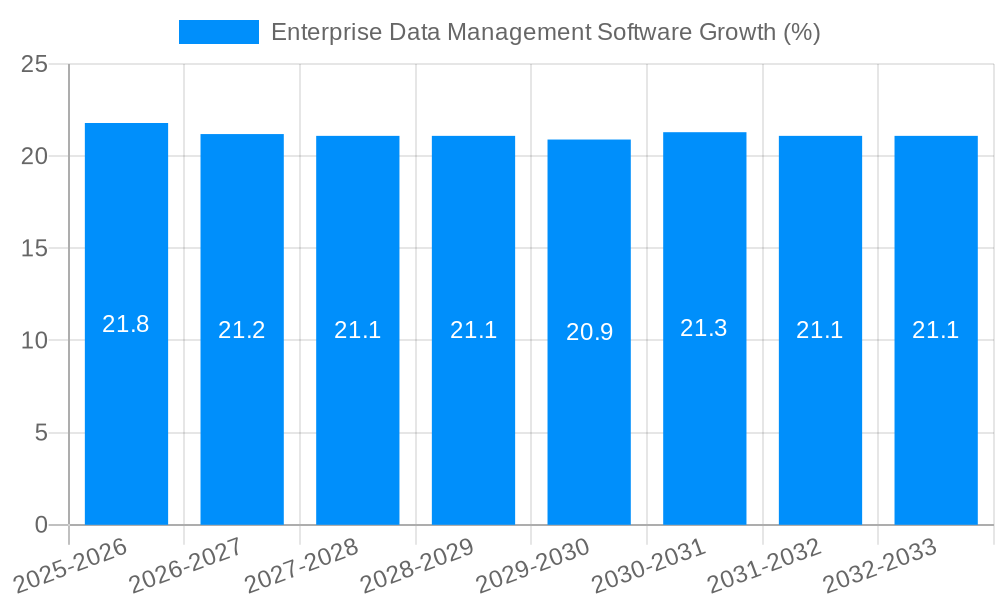

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise Data Management Software?

The projected CAGR is approximately 20.4%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Enterprise Data Management Software

Enterprise Data Management SoftwareEnterprise Data Management Software by Application (Small and medium-sized Business, Large Enterprises), by Type (On-premise, Hosted), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Enterprise Data Management (EDM) software market is poised for substantial growth, projected to reach approximately \$32020 million by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 20.4% from 2025 to 2033. This surge is fueled by the escalating need for organizations to effectively manage, govern, and derive value from their ever-increasing data volumes. Key drivers include the digital transformation initiatives across industries, the growing adoption of big data analytics and AI/ML, and the stringent regulatory compliance requirements that necessitate robust data governance and quality. Businesses are increasingly recognizing EDM software as a critical component for optimizing operations, enhancing customer experiences, and gaining a competitive edge. The market is experiencing a significant shift towards sophisticated solutions that offer capabilities like data integration, data quality management, master data management, data security, and data cataloging.

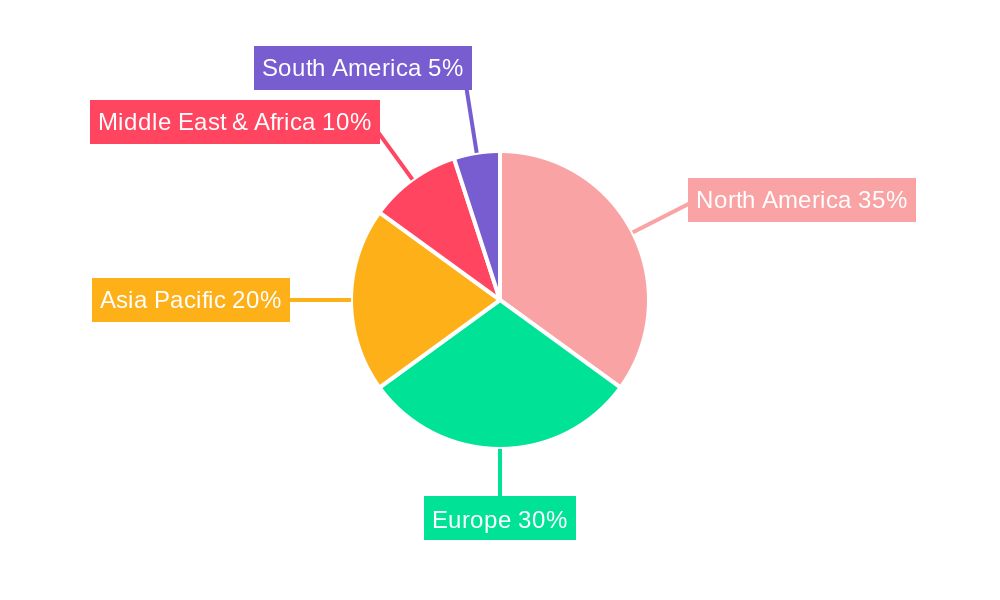

The EDM market segmentation reveals a strong demand from both Small and Medium-sized Businesses (SMBs) and Large Enterprises, indicating a broad appeal of data management solutions across organizational sizes. While on-premise solutions retain a presence, the market is leaning towards hosted or cloud-based EDM solutions due to their scalability, flexibility, and cost-effectiveness. Geographically, North America and Europe are expected to lead the market, owing to the early adoption of advanced technologies and established data governance frameworks. However, the Asia Pacific region, particularly China and India, is anticipated to witness the fastest growth, propelled by rapid digitization, increasing data generation, and a burgeoning IT sector. Leading companies such as IBM, Oracle, SAP SE, and Informatica Corporation are at the forefront, investing in innovation and strategic partnerships to cater to evolving market demands and capitalize on the high growth trajectory.

This comprehensive report delves into the dynamic and rapidly evolving global Enterprise Data Management (EDM) software market, providing an in-depth analysis of its trajectory from the historical period of 2019-2024, through the base year of 2025, and projecting its growth through the forecast period of 2025-2033. With an estimated market size of $XX,XXX million in 2025, the EDM software landscape is poised for significant expansion, driven by increasing data volumes, the imperative for data-driven decision-making, and the growing adoption of advanced analytics and AI. The report offers granular insights into market trends, key drivers, prevalent challenges, dominant market segments, and influential industry players.

The Enterprise Data Management software market is currently experiencing a significant paradigm shift, moving beyond traditional data warehousing and master data management towards more holistic and intelligent solutions. XXX indicates that the core of this transformation lies in the increasing demand for unified data governance and compliance, especially in light of stringent global data privacy regulations. Companies are no longer content with siloed data management tools; they seek integrated platforms that can ensure data quality, security, and lineage across the entire data lifecycle. The rise of data fabric and data mesh architectures is a prominent trend, offering decentralized yet interconnected approaches to data management that empower business units while maintaining organizational control. Furthermore, the integration of AI and machine learning (ML) into EDM solutions is accelerating, enabling automated data cleansing, metadata discovery, and predictive analytics capabilities. This intelligent automation is crucial for handling the exponential growth in unstructured and semi-structured data prevalent in areas like IoT and social media.

The market is also witnessing a growing emphasis on self-service data access and analytics. As data democratization becomes a strategic priority, EDM platforms are evolving to provide business users with intuitive tools to discover, access, and analyze data without relying heavily on IT departments. This shift necessitates robust data catalogs, business glossaries, and simplified data preparation functionalities. The growing adoption of cloud-native EDM solutions is another significant trend, offering scalability, flexibility, and cost-efficiency that traditional on-premise solutions struggle to match. Hybrid cloud deployments are also gaining traction, allowing organizations to leverage the best of both worlds. Finally, the increasing focus on ethical data usage and bias detection within AI models is shaping the development of EDM tools that can identify and mitigate potential data biases, ensuring responsible and fair data utilization. This multifaceted evolution highlights the critical role of EDM software in enabling organizations to unlock the full potential of their data assets in an increasingly complex digital ecosystem.

Several powerful forces are collectively propelling the growth of the Enterprise Data Management software market. The relentless explosion of data volumes across all industries, fueled by digital transformation initiatives, the Internet of Things (IoT), and the proliferation of digital channels, is the foundational driver. Organizations are drowning in data and recognize the urgent need for effective tools to manage, organize, and derive value from it. This is closely followed by the increasingly stringent regulatory landscape surrounding data privacy and governance. Regulations such as GDPR, CCPA, and others necessitate robust data management capabilities to ensure compliance, avoid hefty fines, and maintain customer trust. Companies are actively investing in EDM solutions to achieve auditable data lineage, secure data handling, and controlled access.

Furthermore, the growing adoption of advanced analytics, Artificial Intelligence (AI), and Machine Learning (ML) is a critical catalyst. These technologies require high-quality, well-governed, and accessible data to function effectively. EDM software provides the bedrock for these advanced capabilities by ensuring data accuracy, consistency, and readiness for analytical workloads. The pursuit of enhanced business agility and competitive advantage is another significant motivator. Businesses that can effectively leverage their data can make faster, more informed decisions, identify new market opportunities, and optimize operational efficiency. EDM solutions empower organizations to achieve this by providing a single, trusted source of truth and facilitating data-driven insights. Finally, the evolution of cloud computing and hybrid cloud strategies has made sophisticated data management solutions more accessible and scalable, enabling even smaller enterprises to adopt advanced EDM capabilities.

Despite the robust growth trajectory, the Enterprise Data Management software market faces several significant challenges and restraints that can impede widespread adoption and market expansion. A primary challenge is the complexity of data integration and migration. Organizations often grapple with integrating disparate data sources, legacy systems, and diverse data formats, which can be a time-consuming and resource-intensive undertaking. The sheer volume and variety of data, coupled with inconsistent data quality, further exacerbate this challenge. Another major restraint is the high cost of implementation and ongoing maintenance associated with comprehensive EDM solutions. Acquiring, deploying, and sustaining these platforms, especially for large enterprises with extensive data landscapes, can represent a substantial financial investment.

The shortage of skilled data management professionals poses a significant bottleneck. There is a growing demand for individuals with expertise in data governance, data architecture, data stewardship, and data security, and the available talent pool often struggles to meet this demand. This can lead to implementation delays and suboptimal utilization of EDM software. Resistance to change and organizational inertia within enterprises can also act as a restraint. Employees may be accustomed to existing data handling practices, and the introduction of new, rigorous data management processes can face pushback. Furthermore, ensuring data security and privacy in an increasingly distributed environment remains a constant concern. While EDM solutions aim to enhance security, the evolving threat landscape and the complexities of managing data across on-premise, cloud, and hybrid environments present ongoing security challenges. Finally, vendor lock-in concerns and the interoperability of different EDM tools can also create hesitation for organizations looking for flexible and future-proof solutions.

The Enterprise Data Management software market is poised for significant dominance in certain regions and segments, driven by a confluence of technological adoption, regulatory frameworks, and economic factors.

Large Enterprises (Application): This segment is expected to continue its dominance due to several inherent characteristics. Large enterprises typically possess vast and complex data ecosystems, encompassing multiple departments, business units, and legacy systems. The sheer volume and diversity of data generated by these organizations necessitate robust EDM solutions to ensure data quality, consistency, and accessibility for informed decision-making. Furthermore, large enterprises are often at the forefront of adopting advanced technologies like AI and ML, which are heavily reliant on well-managed data. The imperative for data governance and compliance, driven by stringent regulatory requirements and the need to mitigate reputational risk, is also more pronounced in larger organizations. The significant financial resources available to large enterprises also enable them to invest in comprehensive EDM platforms and the specialized talent required for their implementation and management. Examples of applications include master data management for customer and product information, data cataloging for discoverability, and data lineage tracking for regulatory audits, all of which are critical for their operational scale and complexity. The presence of companies like IBM Corporation, Oracle Corporation, SAP SE, and Informatica Corporation with strong offerings tailored for enterprise-scale deployments further solidifies this dominance.

Hosted (Type): The hosted or cloud-based deployment model is set to witness substantial growth and potentially rival or surpass on-premise solutions in market share over the forecast period. The inherent scalability, flexibility, and cost-effectiveness of cloud-based EDM solutions are major drivers. Businesses, regardless of size, can leverage cloud infrastructure to provision and de-provision resources as needed, avoiding the significant upfront capital expenditure associated with on-premise hardware and software. This agility is crucial for adapting to fluctuating data demands and embracing new analytical capabilities. Moreover, cloud providers often handle much of the underlying infrastructure management, freeing up IT resources to focus on strategic data initiatives. For Large Enterprises, hosted solutions offer the ability to scale their data management capabilities without being constrained by physical infrastructure limitations. For Small and Medium-sized Businesses, the hosted model democratizes access to sophisticated EDM tools that might otherwise be prohibitively expensive. The ease of access, automatic updates, and disaster recovery capabilities offered by hosted solutions further enhance their appeal. Companies like Talend, with its strong cloud-native offerings, are well-positioned to capitalize on this trend. The ability to integrate with other cloud-based services and applications also makes hosted EDM a natural choice for organizations embracing a cloud-first strategy.

North America: North America, particularly the United States, is expected to remain a dominant region in the Enterprise Data Management software market. This leadership is attributed to several factors, including a highly developed technological infrastructure, a strong presence of leading technology companies, and a proactive approach to data-driven innovation. The region boasts a robust ecosystem of enterprises across various sectors, including finance, healthcare, technology, and retail, all of which are heavily investing in data management to gain competitive advantages. The high adoption rate of advanced analytics, AI, and ML technologies in North America directly translates into a greater demand for sophisticated EDM solutions to support these initiatives. Furthermore, the regulatory landscape in North America, while evolving, is characterized by a strong emphasis on data privacy and security, prompting organizations to invest in robust data governance and compliance tools. The significant presence of venture capital and funding for technology startups also fuels innovation and the development of cutting-edge EDM solutions in the region. Companies like Informatica Corporation, SAS Institute, Inc., and Oracle Corporation have a strong historical presence and market share in North America, further cementing its dominance.

Europe: Europe is also a significant and rapidly growing market for Enterprise Data Management software. The region's strong regulatory framework, particularly the General Data Protection Regulation (GDPR), has been a primary catalyst, forcing organizations to adopt stringent data governance and privacy practices. This regulatory push has led to increased investment in EDM solutions that facilitate compliance, data anonymization, and consent management. Furthermore, European enterprises are increasingly recognizing the strategic value of data for innovation and operational efficiency. The growing adoption of AI and IoT technologies across various industries, including manufacturing, automotive, and healthcare, is driving the need for comprehensive data management capabilities. Countries like Germany, the UK, and France are leading the charge in adopting advanced data management solutions. The focus on data sovereignty and the desire to maintain control over data within the region also contributes to the demand for both on-premise and hybrid EDM solutions. The presence of global players and a growing number of regional EDM vendors catering to specific European market needs further strengthens the region's position.

The Enterprise Data Management software industry is experiencing robust growth fueled by several key catalysts. The escalating volume and complexity of data across all sectors, driven by digital transformation and IoT, necessitate effective management solutions. The increasing adoption of advanced analytics, AI, and machine learning, which rely heavily on high-quality, governed data, is a significant driver. Furthermore, the stringent global regulatory environment around data privacy and governance compels organizations to invest in EDM software for compliance and risk mitigation. The pursuit of enhanced business agility, improved decision-making, and a competitive edge through data-driven insights also propels market growth. Finally, the increasing accessibility and scalability offered by cloud-based and hybrid deployment models are democratizing access to sophisticated EDM capabilities, further accelerating industry expansion.

This Enterprise Data Management Software report provides a holistic view of the market, encompassing a detailed analysis of its current state and future trajectory. It meticulously examines market dynamics, including key trends, driving forces, and prevailing challenges, offering strategic insights for stakeholders. The report leverages quantitative data and qualitative analysis to project market growth from the historical period of 2019-2024, through the base year of 2025, and into the forecast period of 2025-2033. It identifies dominant market segments, such as Large Enterprises and Hosted deployment types, and key geographical regions like North America and Europe. Furthermore, the report highlights significant developments and lists the leading players that are shaping the EDM software landscape. The comprehensive coverage ensures that readers gain a deep understanding of the market's intricacies, enabling informed strategic planning and investment decisions.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 20.4% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 20.4%.

Key companies in the market include Accenture, Informatica Corporation, SAS Institute, Inc., Symantec Corporation, Teradata Corporation, IBM Corporation, Intel Security, Oracle Corporation, SAP SE, Talend, .

The market segments include Application, Type.

The market size is estimated to be USD 32020 million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3480.00, USD 5220.00, and USD 6960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Enterprise Data Management Software," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Enterprise Data Management Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.