1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise 2.0 Technologies?

The projected CAGR is approximately XX%.

MR Forecast provides premium market intelligence on deep technologies that can cause a high level of disruption in the market within the next few years. When it comes to doing market viability analyses for technologies at very early phases of development, MR Forecast is second to none. What sets us apart is our set of market estimates based on secondary research data, which in turn gets validated through primary research by key companies in the target market and other stakeholders. It only covers technologies pertaining to Healthcare, IT, big data analysis, block chain technology, Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), Energy & Power, Automobile, Agriculture, Electronics, Chemical & Materials, Machinery & Equipment's, Consumer Goods, and many others at MR Forecast. Market: The market section introduces the industry to readers, including an overview, business dynamics, competitive benchmarking, and firms' profiles. This enables readers to make decisions on market entry, expansion, and exit in certain nations, regions, or worldwide. Application: We give painstaking attention to the study of every product and technology, along with its use case and user categories, under our research solutions. From here on, the process delivers accurate market estimates and forecasts apart from the best and most meaningful insights.

Products generically come under this phrase and may imply any number of goods, components, materials, technology, or any combination thereof. Any business that wants to push an innovative agenda needs data on product definitions, pricing analysis, benchmarking and roadmaps on technology, demand analysis, and patents. Our research papers contain all that and much more in a depth that makes them incredibly actionable. Products broadly encompass a wide range of goods, components, materials, technologies, or any combination thereof. For businesses aiming to advance an innovative agenda, access to comprehensive data on product definitions, pricing analysis, benchmarking, technological roadmaps, demand analysis, and patents is essential. Our research papers provide in-depth insights into these areas and more, equipping organizations with actionable information that can drive strategic decision-making and enhance competitive positioning in the market.

Enterprise 2.0 Technologies

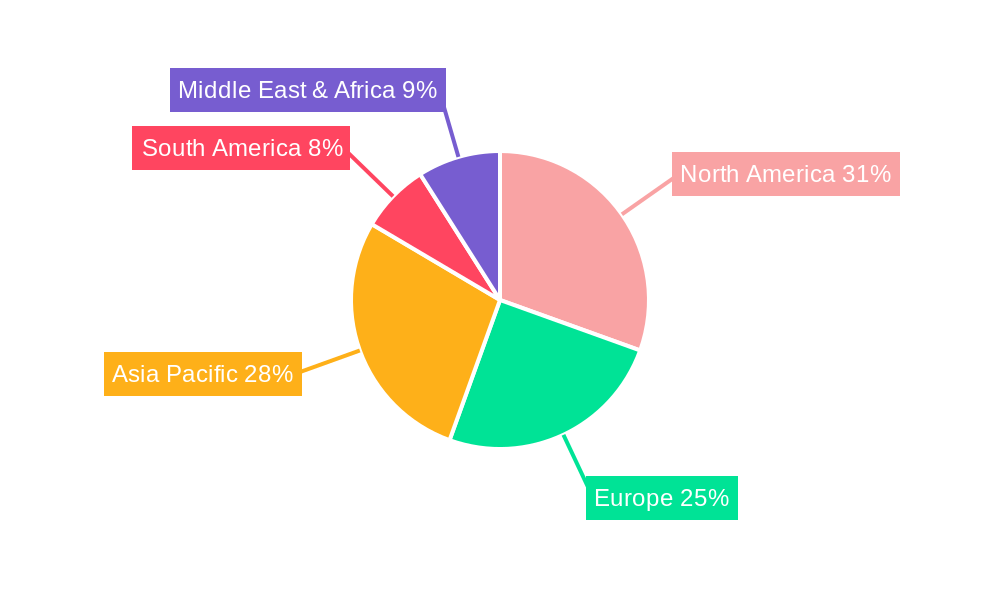

Enterprise 2.0 TechnologiesEnterprise 2.0 Technologies by Type (/> Free, Purchased), by Application (/> Electronics, Industrial, Media, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

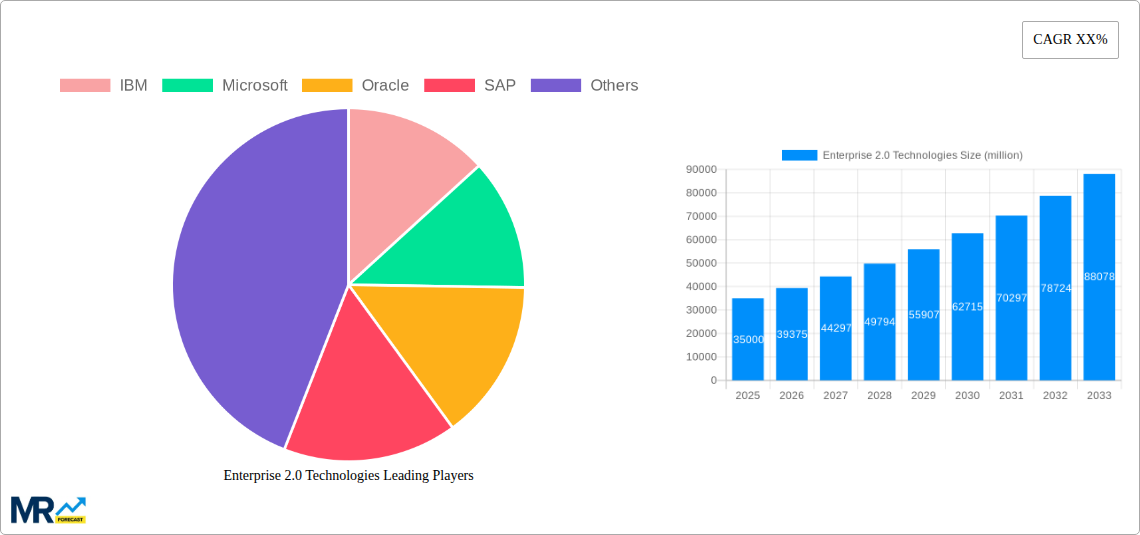

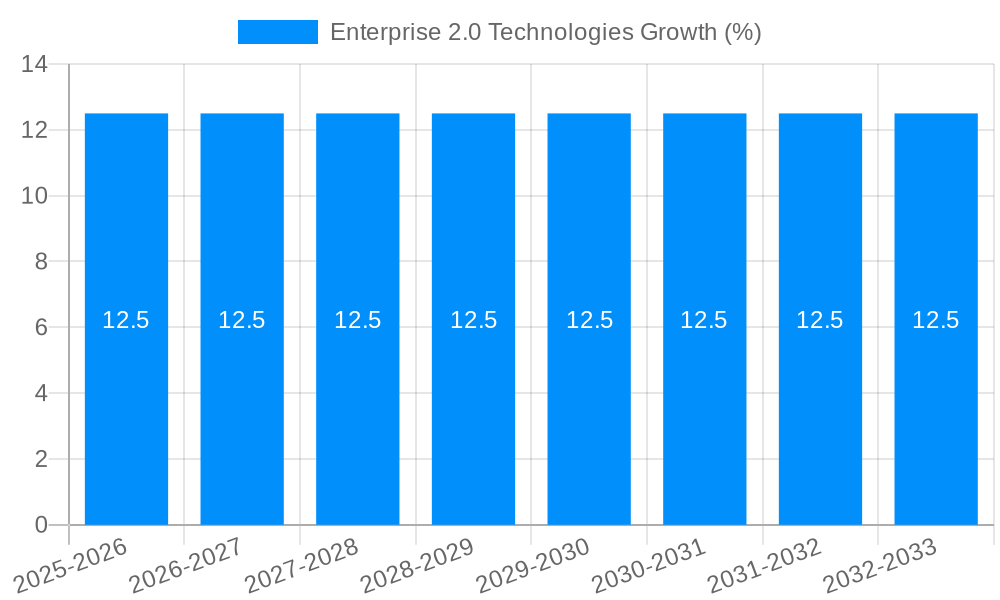

The Enterprise 2.0 Technologies market is poised for significant expansion, estimated to reach approximately $35,000 million by 2025, with a projected Compound Annual Growth Rate (CAGR) of 12.5% through 2033. This robust growth is fueled by the increasing demand for collaborative platforms, enhanced internal communication, and efficient knowledge management within organizations of all sizes. Key drivers include the widespread adoption of cloud-based solutions, the growing emphasis on employee engagement, and the need for agile business processes to adapt to dynamic market conditions. The integration of social networking principles into enterprise workflows, alongside advanced analytics and AI-driven insights, is further accelerating market penetration. This evolution signifies a paradigm shift from traditional hierarchical structures to more interconnected and participatory work environments, empowering employees and fostering innovation.

The market is segmented into Free and Purchased models for technology types, with Purchased solutions expected to dominate due to their comprehensive features and dedicated support, although Free options will continue to attract smaller businesses and specific departmental use cases. In terms of application, the Electronics and Industrial sectors are anticipated to be major adopters, leveraging these technologies for streamlining complex operations, supply chain management, and product development lifecycles. The Media sector will also see substantial growth, utilizing Enterprise 2.0 tools for content creation, collaboration, and audience engagement. Restraints, such as data security concerns and the initial cost of implementation for some advanced solutions, are being mitigated by robust security protocols and the demonstrable return on investment. Leading companies like IBM, Microsoft, Oracle, and SAP are actively shaping this landscape with innovative offerings, driving the market towards a more connected and productive future.

This report delves into the dynamic world of Enterprise 2.0 technologies, a transformative wave of digital tools and platforms reshaping how businesses operate, collaborate, and innovate. Spanning a comprehensive study period from 2019-2033, with a Base Year of 2025 and a Forecast Period of 2025-2033, this analysis provides deep insights into market trends, driving forces, challenges, and future growth trajectories. The report focuses on key players such as IBM, Microsoft, Oracle, and SAP, examining their strategic contributions and market positioning. We also dissect the market across various segments, including Type: Free, Purchased, and Application: Electronics, Industrial, Media, Others, to offer a granular understanding of adoption patterns. Crucially, the report will highlight significant Industry Developments and provide actionable intelligence for stakeholders navigating this rapidly evolving landscape. The historical context from 2019-2024 sets the stage for understanding the current market dynamics and projecting future advancements.

XXX The Enterprise 2.0 technologies market is on an unprecedented ascent, projected to reach multi-million dollar valuations across its diverse segments. This growth is fueled by a fundamental shift in organizational paradigms, moving away from rigid, top-down structures towards more agile, collaborative, and knowledge-sharing environments. Cloud-native architectures, artificial intelligence (AI) integration, and the burgeoning adoption of blockchain technologies are the defining pillars of this evolution. The report forecasts a compound annual growth rate (CAGR) exceeding 15% for the overall market from 2025-2033. Within the Application segment, the Industrial sector is anticipated to witness the most significant uptake, driven by the demand for enhanced supply chain visibility, predictive maintenance, and smart manufacturing capabilities, with an estimated market size of over $850 million by 2033. The Electronics segment, closely following, is expected to leverage Enterprise 2.0 for faster product development cycles, collaborative design, and improved customer engagement, projecting a market value surpassing $720 million in the same period. The Media segment, while perhaps seeing slower initial adoption, is poised for substantial growth as it embraces platforms for content creation, distribution, and audience interaction, with an estimated market of over $550 million by the end of the forecast period. The Others segment, encompassing a wide array of industries, will also contribute significantly, demonstrating the pervasive nature of these technologies. The increasing integration of AI and machine learning into Enterprise 2.0 platforms is creating intelligent systems capable of automating tasks, providing predictive insights, and personalizing user experiences, a trend that will continue to accelerate throughout the forecast period. Furthermore, the rise of decentralized applications (dApps) and the exploration of Web3 principles within enterprise contexts are opening up new avenues for secure data management, transparent workflows, and enhanced employee empowerment, albeit with a longer-term growth trajectory. The market for purchased Enterprise 2.0 solutions will continue to dominate, driven by the need for robust security, advanced features, and dedicated support, while free and open-source solutions will serve as crucial innovation incubators and entry points for smaller organizations.

The relentless march of Enterprise 2.0 technologies is being propelled by a confluence of critical business imperatives and technological advancements. The fundamental driver is the escalating demand for enhanced collaboration and communication across geographically dispersed teams and organizational silos. As businesses embrace hybrid and remote work models, Enterprise 2.0 platforms become indispensable for fostering a sense of unity and facilitating seamless knowledge exchange. The report identifies increased operational efficiency and productivity as a paramount driving force, with organizations seeking to streamline workflows, automate repetitive tasks, and empower employees with intuitive tools that reduce friction and enhance output. The rise of data-driven decision-making is another significant catalyst. Enterprise 2.0 technologies provide the infrastructure and analytical capabilities necessary to collect, process, and derive actionable insights from vast amounts of organizational data, leading to more informed strategic planning and improved business outcomes. Furthermore, the imperative to foster innovation and agility in a rapidly changing market environment compels organizations to adopt platforms that encourage experimentation, idea generation, and rapid prototyping. The report highlights the increasing importance of employee engagement and retention, as modern workforces expect modern, engaging, and user-friendly digital tools that support their productivity and well-being. The competitive landscape also plays a crucial role, pushing companies to adopt advanced technologies to gain a competitive edge, improve customer experiences, and optimize their internal processes.

Despite the immense potential, the widespread adoption of Enterprise 2.0 technologies is not without its hurdles. A primary challenge lies in cultural resistance to change. Many established organizations grapple with ingrained traditional work practices, making it difficult to foster the collaborative and open communication ethos that underpins Enterprise 2.0. The fear of data security and privacy breaches remains a significant restraint, especially as sensitive corporate information is shared and processed on cloud-based platforms. Robust security protocols and transparent data governance policies are crucial but often require substantial investment and ongoing vigilance. Another considerable challenge is the complexity of integration with existing legacy systems. Seamlessly weaving new Enterprise 2.0 tools into established IT infrastructures can be technically demanding and resource-intensive. Lack of clear ROI and measurable benefits can also hinder adoption, as organizations seek concrete evidence of how these technologies will translate into tangible business improvements. The initial cost of implementation, including software licensing, customization, and training, can also be a significant barrier, particularly for small and medium-sized enterprises. Furthermore, employee training and skill gaps can impede the effective utilization of these sophisticated tools, necessitating substantial investment in workforce development. The ever-evolving nature of technology also presents a challenge, requiring continuous updates and adaptation to remain competitive.

The dominance within the Enterprise 2.0 Technologies market is expected to be a multifaceted phenomenon, driven by a combination of regional innovation hubs and specific segment adoption patterns.

Key Dominating Regions/Countries:

Dominating Segments:

Application: Industrial: This segment is set to be a powerhouse, driven by the profound need for modernization within manufacturing, logistics, and supply chain operations. The adoption of Enterprise 2.0 here is directly linked to the pursuit of Industry 4.0, enabling:

Type: Purchased: While free and open-source solutions offer entry points, the purchased segment will continue to command the largest market share due to the critical requirements of enterprise-grade solutions. This includes:

Application: Electronics: The Electronics segment is another key area of growth, fueled by the fast-paced nature of product development and the need for agile innovation. Enterprise 2.0 adoption here facilitates:

The interplay between these dominant regions and segments will shape the overall trajectory of the Enterprise 2.0 technologies market, creating significant opportunities for solution providers and businesses alike.

The Enterprise 2.0 technologies industry is experiencing robust growth fueled by several key catalysts. The pervasive adoption of cloud computing infrastructure provides a scalable and accessible foundation for deploying these advanced tools. Furthermore, the increasing demand for remote and hybrid work solutions, accelerated by recent global events, necessitates collaborative platforms that enhance communication and productivity regardless of location. The continuous evolution of Artificial Intelligence (AI) and Machine Learning (ML) is empowering Enterprise 2.0 tools with enhanced analytical capabilities, automation, and personalized user experiences, driving greater efficiency and insights. Finally, the growing recognition among businesses of the importance of employee engagement and internal knowledge sharing is a significant driver, pushing organizations to invest in platforms that foster a more connected and empowered workforce.

This comprehensive report provides an in-depth analysis of the Enterprise 2.0 technologies market, covering its historical evolution from 2019-2024 and projecting its future trajectory through 2033. With a Base Year of 2025, the report offers meticulous insights into market dynamics, segmentation, and key growth drivers. It meticulously examines the competitive landscape, highlighting the strategic contributions of industry giants such as IBM, Microsoft, Oracle, and SAP. The report dissects market trends across Type: Free, Purchased, and Application: Electronics, Industrial, Media, Others, providing valuable data and forecasts for each. Furthermore, it explores the critical Industry Developments and the various Growth Catalysts propelling the sector forward, alongside the inherent Challenges and Restraints that organizations must navigate. This report serves as an indispensable resource for stakeholders seeking to understand and capitalize on the transformative potential of Enterprise 2.0 technologies.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note*: In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include IBM, Microsoft, Oracle, SAP.

The market segments include Type, Application.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4480.00, USD 6720.00, and USD 8960.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Enterprise 2.0 Technologies," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Enterprise 2.0 Technologies, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.